The 'perfect storm' which faces mobile operators round the world is well documented. Its elements can be summarised as:

- Exploding data and signaling volumes overloading networks

- Declining revenue from traditional sources, notably voice and messaging, because of changing consumer behaviour and competition from over-the-top providers like WhatsApp/Facebook

- Stagnant or declining ARPU (average revenue per user) for all consumer services

- Declining revenue per megabyte of data.

Just to stand still, operators need to invest in networks which can support the data volumes and user experience demanded by users, including new voice and messaging technologies to try to keep some of that business alive (for instance, Voice over LTE or HD Voice). They face significant capex investments to support the new data volumes and applications, but cannot be certain these will guarantee higher ARPUs and profits, when much of the usage is over-the-top.

The clear conclusion is that a business case which rests entirely on mobile consumers will fail, perhaps quickly, perhaps after a decade of painful decline. The only way to be profitable when focused on consumer services alone will be to operate over-the-top or as an MVNO (a mobile virtual network operator, which rides on a third party network and so does not incur the costs of building and maintaining its own infrastructure).

For the companies which still own their own mobile networks, the priorities will be to slash the cost of expanding capacity (with new, more efficient technologies and with options like network sharing), and to generate additional revenue streams from the same capacity.

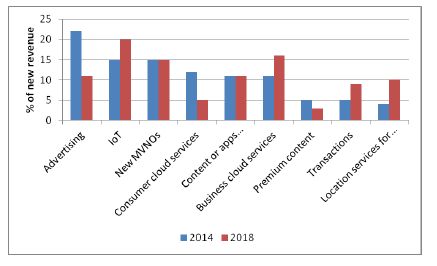

In a survey conducted by Rethink Technology Research in late 2013, 65 mobile operators were asked what percentage of new revenues, driven by their upgrade to LTE or fourth generation technology, would fall into various categories. Between 2014 and 2018, it was clear that their plans and expectations were shifting away from consumer services and towards two new areas of growth – charging the content or application provider, rather than the consumer, for popular services (for instance, revenue sharing); and focusing on enterprise services. In the second group, the most important areas of new revenue are the 'internet of things' (IoT), in which all kinds of everyday devices are connected to the internet, often wirelessly; and cloud-based services for enterprises. By 2018, these are expected to be the biggest generators of new revenues for LTE networks, with the IoT contributing about one-fifth.

Figure 1. Most important sources of additional revenue driven by LTE Source: Rethink Technology Research mobile operator survey 2013

Of course, there is a consumer angle to the IoT (services to 'wearables' like smart watches or Google Glasses, for instance, as well as home security and monitoring systems). However, many of these will be supported by WiFi, which does not provide revenue for the mobile operator. By contrast, most IoT growth will come from industrial or vertical market sources – an expansion of the established business in mobile M2M (machine-to-machine) connectivity in segments like vehicle tracking and factory automation.

It is both threatening and reassuring for service providers to wake up to the low importance of consumers in the profitable mobile model. They know that enterprise customers have higher ARPU (double in many countries), lower churn and greater predictability of usage. But they also know that they have less control over the enterprise and vertical bases, which have treated operators as providers of connectivity not added value. Mobile operators, in particular, have a deep one-to-one relationship with consumers, but they should beware of seeing that market as the low hanging fruit for IoT services, on the basis that it extends that consumer relationship to embrace many more home and mobile gadgets. There will increasing unwillingness among users to pay very much extra to attach larger numbers of gadgets, with most of the expenditure going to providers of value added services, not connectivity.

The real source of mobile operator riches in the LTE-based IoT will be the enterprise, particularly where a carrier can provide more than just connectivity, but can also offer cloud-based management of all those devices, or big data services. It is important that they make this adjustment if they are to increase revenues but also profitability – otherwise there will be a glaring disparity between what the mobile operators believe they will make from IoT services over the next few years, and the probable reality.

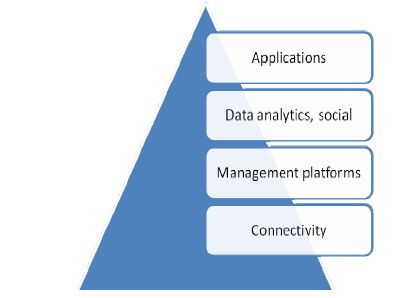

Figure 2. The mobile enterprise and IoT revenue hierarchy

There are four very broad layers of revenues in mobile enterprise services in general and the IoT in particular, each with its own technology platforms, ecosystems and standards. As we ascend the pyramid, each layer becomes less generic, more sector- or use case-specific, but more valuable. Mobile operators can play at all four levels, and will need to, to take a good share of a prize worth about $60bn in revenues to service providers of all kinds by 2018.

But the mobile operators will have to battle with many different types of provider for a share of this $60bn pie – making their fights with the over-the-top and Wi-Fi players in the 3G/4G mobile data era look like playground tussles. Rethink predicts that, despite competition from Wi-Fi and others, mobile operators will command the largest share of IoT access revenues in 2018, at 35%. This figure will have shrunk significantly however, partly because cellcos will be sharing more access revenue, even over 4G, with third parties than they do in the human internet. In the complex web of IoT providers, integrators, specialized MVNOs and others will ride on cellular networks, but will add much of the value, squeezing the amount the network owners can charge.

And by 2018, access will represent only about 10% of total IoT service revenues. In the far larger area of end-to-end management and service delivery, mobile operators will only seize an estimated 20% of the total, overtaken by specialized cloud-based providers. This will be despite the creation of some very large and successful platforms by a few multinationals, such as Deutsche Telekom and Vodafone. The situation will look even worse at the analytics and applications layers.

Figure 3. Forecast market share for different types of service provider in two key IoT areas – access and end-to-end management services.

These market pressures mean many mobile operators will be forced to reduce their expectations over the coming years. Nonetheless, a sharp focus on business sector revenues will yield rewards in the shape of increased margins and a healthier ratio of network capital expenditure to incremental revenues. As direct-to-consumer models wither in the face of over-the-top services, WiFi and ever lower willingness to pay for data, the mobile operators still have some strong weapons when they address the enterprise sectors, where there is still growth to be had – in many cases, businesses and public sector organisations have only just started down the route of mobilising their processes, and many are also embarking on mobile cloud projects.

Mobile networks – as opposed to WiFi – can provide security, deep knowledge of customer behaviour, guaranteed quality of service, and other features which are far more important to enterprises than most consumers. New services, such as analytics and mobile device management can be built on top of those foundations to improve value and margins. And the wise mobile carrier will increase its capacity and flexibility in order to support a wider variety of MVNOs, some of them dedicated to particular enterprise segments.

Such strategies will improve the likelihood of the investment in new LTE networks proving to be a profitable exercise, rather than a protracted losing battle against the data deluge.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.