The macroeconomic backdrop to the Deloitte CFO Survey Q4 2012

Investors' worst fears about the European single currency continued to ease in the fourth quarter. European finance ministers agreed on steps to create a common banking supervisor, Greece successfully agreed terms on a third bailout and the Portuguese government passed an austerity budget for 2013. Spreads on peripheral euro area bonds fell steadily and measures of financial market stress eased. Despite these developments the economic outlook deteriorated. The International Monetary Fund (IMF) downgraded its forecasts for global growth in 2012 and 2013 and consensus forecasts are for a further contraction in euro area activity in 2013. UK growth forecasts for 2013 were revised down to 1.2% from 2.0% by the Office for Budget Responsibility, citing weak productivity growth and the weakness of net exports. The UK double dip recession ended in the third quarter and UK employment has remained unexpectedly strong. The recovery in the United States maintained momentum with Q3 2012 growth revised upwards to an annual rate of 2.7%, and the unemployment rate steadily falling to a four-year low in December. The global equity market zig‑zagged through 2012, gaining 16% for the year as a whole and rallying strongly from mid‑November.

See Page 9 for charts describing the economic and financial context for this survey.

About the survey

This is the 22nd quarterly survey of Chief Financial Officers and Group Finance Directors of major companies in the UK. The 2012 third quarter survey took place between 25th November and 11th December. 112 CFOs participated, including the CFOs of 36 FTSE 100 and 38 FTSE 250 companies. The rest were CFOs of other UK listed companies, large private companies and UK subsidiaries of major companies listed overseas. The combined market value of the 84 UK listed companies surveyed is £672 billion, or approximately 35% of the UK quoted equity market.

The Deloitte CFO Survey is written and produced by Ian Stewart, Chief Economist and Debapratim De, Assistant Manager, Economics & Markets Research at Deloitte. It is the only survey of major corporate users of capital that gauges attitudes to valuations, risk and financing. To join our panel of CFO respondents and for additional copies of this report, please contact Tulaine Trimble on 020 7007 1684 or email ttrimble@deloitte.co.uk Please visit www.deloitte.co.uk/cfosurvey for current and past copies of the survey, historical data and coverage of the survey in the media and elsewhere.

The Deloitte CFO Survey

2013 outlook: Cash, costs and the search for opportunity

Key points

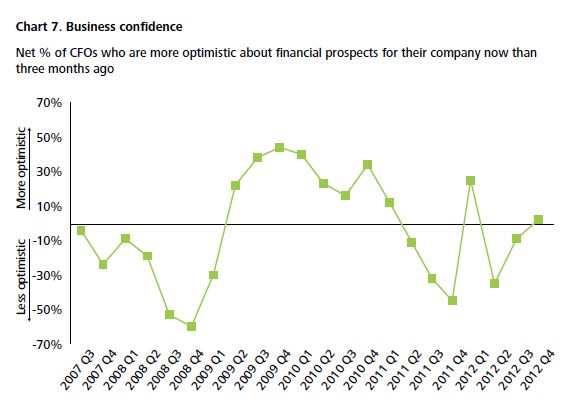

CFOs enter 2013 in a more optimistic mood than they entered 2012. The dominant concern for corporates a year ago was that the single currency could break up. Such fears have receded. Better news from the euro area and an end to the UK double dip recession have boosted spirits with CFO optimism up sharply from the lows seen at the end of 2011.

Alongside these signs of confidence, CFOs continue to worry that growth will be in short supply this year. Weak growth prospects for the euro area and the UK rate as the greatest worries for CFOs in 2013. Perceptions of financial and economic uncertainty remain high. The central concern for CFOs today is the economy, just as it was at the start of the last four years.

CFOs sem less worried about company-specific issues such as margins, cash flow and credit availability. Indeed, large companies enter 2013 with healthy balance sheets and benefiting from benign financing conditions. In the fourth quarter of 2012, CFOs reported a sharp decline in credit costs and now rate credit as being cheaper than at any time in the last five years. The economic outlook remains murky, but the cost and availability of debt finance, at least for the large businesses in our sample, have improved significantly in the last four years.

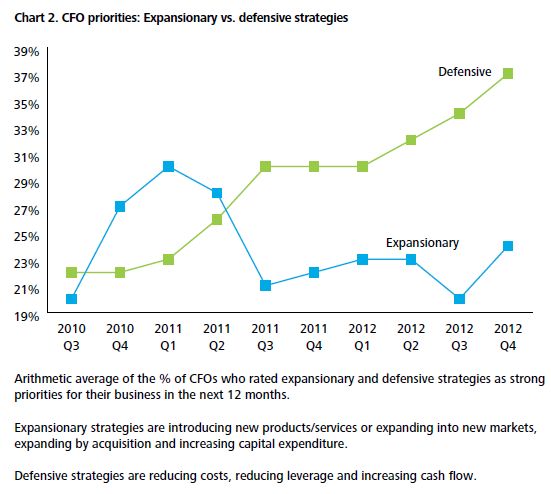

The picture that emerges is of businesses which are constrained by low growth and uncertainty rather than access to capital. CFOs' balance sheet strategies have become increasingly defensive not for want of capital but for scarcity of opportunity. Large companies enter 2013 with a stronger focus on cutting costs and bolstering cash flow than at any time in the last two years.

Yet CFOs have not closed the door to growth. About half of CFOs think that troubled times create opportunities to take market share and expand capacity, or to implement overdue change within the business. Big businesses are also more positive about undertaking capital expenditure than they were a year ago. The difference now is that such opportunities are more selective. CFOs cannot rely on steady growth to lift revenues. They have to work harder for, and carefully judge the risks of, expansion.

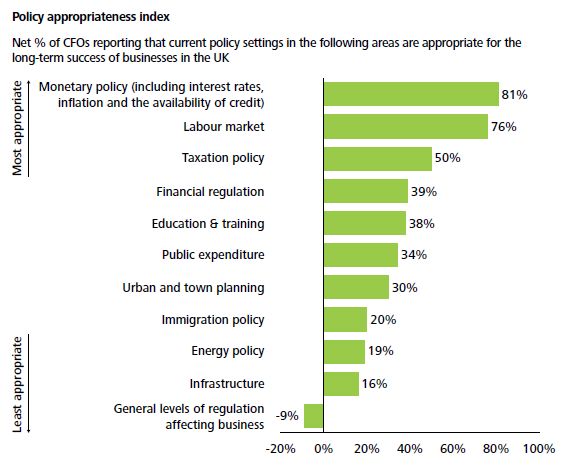

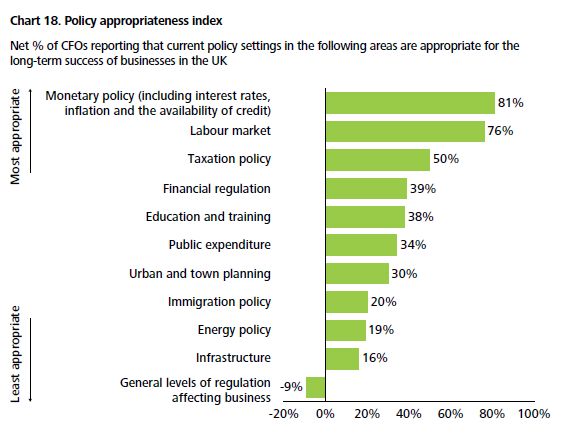

Our special question (see chart below) this quarter asked CFOs about the appropriateness of UK government policy for business. Monetary policy, which includes interest rates, inflation and the availability of credit, is seen by CFOs as being most appropriate. By and large major companies think the Bank of England has got monetary policy right. CFOs are also positive about UK labour market policies. The areas of greatest concern relate to micro, rather than macroeconomic policy – regulation, infrastructure, energy and immigration. For CFOs it is the micro side of the economy, rather than monetary policy, that needs attention.

CFO sentiment see-sawed through 2012, largely in response to the bad and the good news from the euro area. Through these ups and downs corporate strategies have become steadily more defensive over the last year. By and large big corporates have the firepower to hire and invest. Five years on from the onset of the financial crisis the missing ingredient, and one which holds the key to corporate behaviour, is confidence about future growth.

CFOs remain defensive

The dominant concern for CFOs as they enter 2013 is the weakness of growth in the euro area and the UK. Worries about the external environment loom larger than worries about margins, cash flow and costs. And just 4% of the 112 CFOs we surveyed cite the cost of and difficulty in raising finance as being major worries for their businesses.

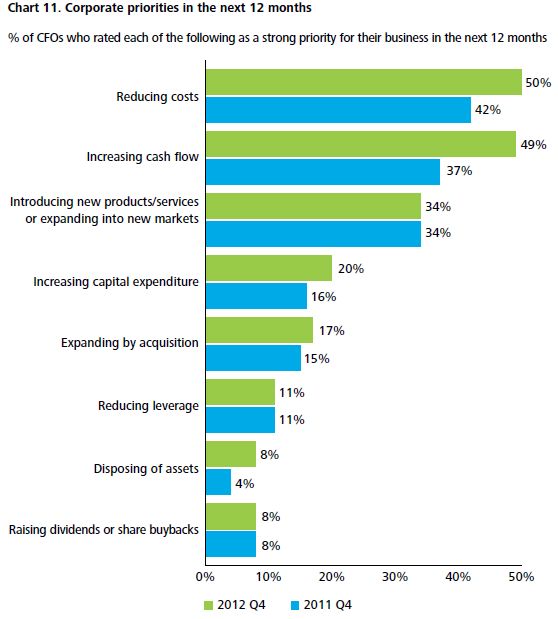

Defensive balance sheet strategies are the order of the day for big corporates. In the fourth quarter corporates became still more defensive, with an increased focus on cost control and building cash.

But, in addition, capital spending has also edged up the priority list for CFOs and this generated an uptick in expansionary strategies.

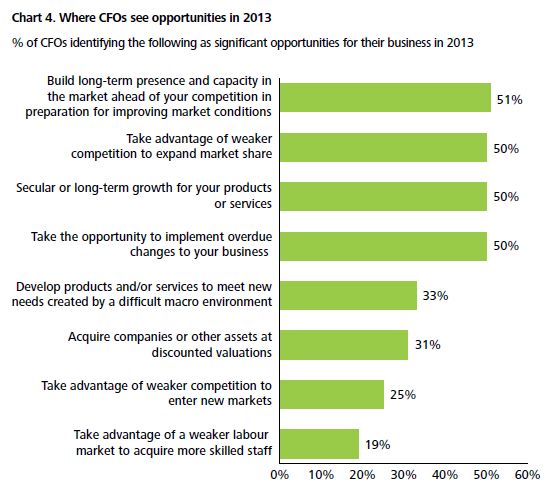

Opportunities in difficult markets

In late 2008, in the wake of the collapse of Lehman Brothers, we asked CFOs if they felt that a difficult economic environment would create new opportunities for their businesses. 83% said yes. Four years on the proportion who are as positive has fallen to 47%, a similar level to that in late 2011.

Prolonged economic weakness may have reduced optimism, but around half of CFOs still see opportunities in the current economic weakness.

The most widely cited opportunities relate to expanding capacity, market share and output – and implementing overdue change within the business.

The paradox is that a low growth environment is seen by about half of our panel as creating an opportunity to expand their business.

Optimism rises

Fears that the euro area could break up have continued to ease. On average CFOs assign a 22% probability to one or more countries leaving the single currency in the next 12 months. This is the lowest reading since we started asking this question a year ago.

Recessionary concerns have also eased slightly, though they remain elevated. On average CFOs see a 40% probability that the UK economy will fall back into recession in the next two years.

Less bad news from Europe and an easing of recessionary concerns have helped bolster CFO sentiment. CFOs enter 2013 in a far more optimistic mood than they entered 2012.

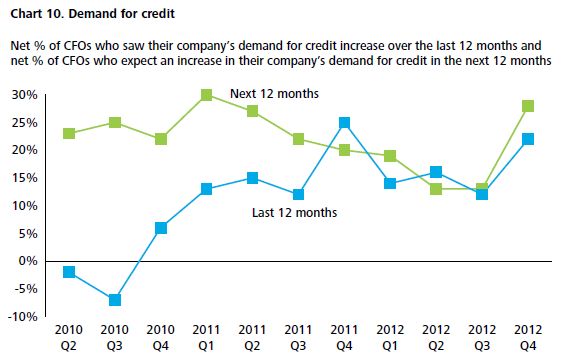

Rising demand for credit

Credit conditions improved markedly in the fourth quarter for our sample of large companies. The decline in the cost of credit was the largest on record and CFOs now rate credit as being cheaper than at any time in the last five years. Credit is seen as being more available than at any time in the last two years.

Low interest rates on corporate bonds have helped make bond issuance the most attractive form of finance for CFOs. Bank borrowing has also increased in popularity. Equity continues to be out of favour with CFOs.

Low interest rates and improving credit availability seem to be stimulating demand for credit from large corporates. CFOs say their demand for credit has risen and they expect it to continue rising through 2013.

Focus on costs and cash flow

CFOs are more optimistic today than they were a year ago, but corporates enter 2013 with a increased focus on defensive balance sheet strategies. CFOs are placing a greater emphasis on defensive strategies such as cost reduction and increasing cash flow than they did a year ago. However, they are rather more positive today about expansionary strategies such as capital spending.

This focus on defensive strategies is reflected in a marked slowdown in business investment since the credit crunch. However, the independent Office for Budget Responsibility is forecasting a significant recovery in the next five years.

Uncertainty reigns

Despite rising levels of business optimism CFOs believe they are operating in an uncertain world. 93% of CFOs rate the level of financial and economic uncertainty facing their business as being above normal, high or very high.

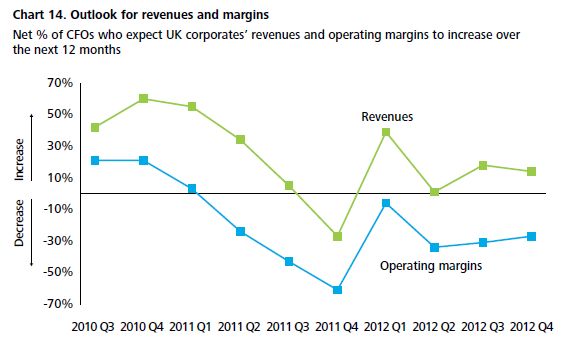

Expectations for corporate revenues and margins have improved since the end of 2011.

Expectations for corporate spending have also edged higher from their lows in late 2011.

The international view

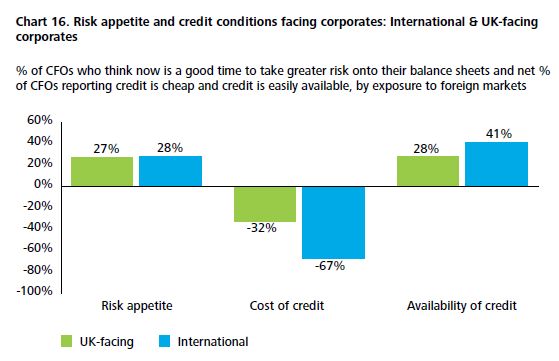

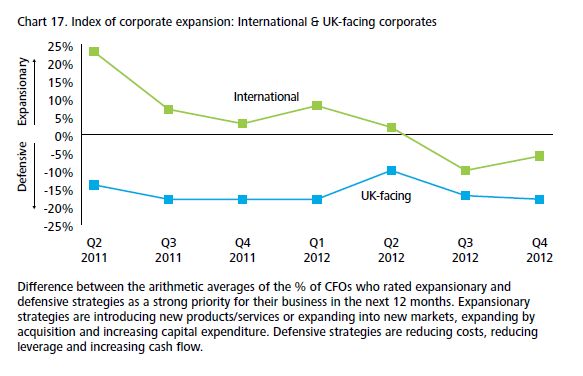

We also segment our panel of respondents by their exposure to geographical markets.

While international companies – those that derive 70-100% of their revenues from outside the UK – enjoy much better credit conditions, their appetite for risk is roughly the same as that of their UK-facing peers.

UK‑focussed companies have been consistently defensive in terms of their balance sheet policies over the last 18 months. International companies have had a more expansionary approach, though the gap has narrowed in the last year, perhaps reflecting the slowdown in the euro area and in emerging markets.

This quarter we asked CFOs to rate the appropriateness of UK policy in areas which are vital to the long‑term success of business.

CFOs rate monetary policy and the labour market as being most appropriate.

CFOs were least impressed with general levels of regulation, infrastructure, energy and immigration policy.

CFO Survey: Economic and financial context

Our top four charts from the 2012 Q4 Survey

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.