Summary

On October 10, 2018, the US Department of the Treasury launched a significant pilot program to implement part of the Foreign Investment Risk Review Modernization Act (FIRRMA) while final rules are being crafted.1 The pilot goes into effect on November 10, 2018, and makes two important changes to the Committee on Foreign Investment in the United States (CFIUS):

First, with some exceptions for investment funds, the pilot program expands the jurisdiction of CFIUS to capture any foreign investment (direct or indirect) in a specially defined category of US companies called a "pilot program U.S. business" where a foreign investor obtains any material nonpublic technical information, access to the board of the business, or the ability to influence the production or development of critical technologies.

Second, the pilot program mandates notification to CFIUS of any investment in a pilot program US business. CFIUS will have 30 days to respond to such notifications, potentially requiring a full CFIUS filing. CFIUS will also have the power to impose civil penalties for noncompliance.

The pilot program will end no later than March 5, 2020, after the Treasury Department enacts permanent regulations. The Treasury Department also promulgated additional technical amendments to federal regulations to implement certain immediately effective provisions of FIRRMA and to make other updates to regulations consistent with the new law.2

Background

On August 3, 2018, President Trump signed the National Defense Authorization Act for Fiscal Year 2019.3 The bill included FIRRMA, which significantly modifies the rules for foreign investments in the United States. The new law reflected growing bipartisan concern that certain foreign transactions are diminishing US technological superiority and that CFIUS lacked sufficient authority and resources to account for the complex deal mechanisms foreign investors may employ to acquire valuable stakes in US companies that are important for US security.

FIRRMA allows CFIUS to analyze a greater range of transactions than before, empowers CFIUS to require certain foreign investors to make mandatory filings, permits CFIUS for the first time to charge filing fees and requires the secretary of Commerce to oversee the creation of new export control restrictions for emerging critical technologies.

The secretary of the Treasury is charged through FIRRMA with crafting new regulations to implement many provisions of the law. The rule-making process is likely to play out over the next year. In the interim, the law empowers CFIUS to enact pilot programs to implement on a temporary basis the authorities provided in two sections of FIRRMA that did not take effect upon the statute's enactment. The interim rules issued on October 10 were promulgated under that authority.

Critical Technology Pilot Program Expands CFIUS Jurisdiction

Under the pilot program, and subject to important exceptions for investment funds described below, CFIUS will have jurisdiction over even very small foreign investments in certain critical technology companies.

The new regulations give CFIUS jurisdiction to review any "pilot program covered investment," which is defined as any direct or indirect investment by a foreign person in a pilot program US business that does not result in control of the US business but affords the foreign person access to any material nonpublic technical information, or membership or observer rights on the board of the US business, or any other involvement in the operation of the US business's use of critical technologies (other than voting shares). Key aspects of this new rule are described below:

- Pilot Program US

Business: Under the new regulations, a pilot program US

business is any business that produces, designs, tests,

manufactures, fabricates or develops a critical

technology that is:

- utilized in connection with the US business's activity in one or more pilot program industries; or

- designed by the US business specifically for use in one or more pilot program industries.

- Critical Technology:

Pursuant to FIRRMA and the new regulations, critical technologies

are: defense articles included in the International Traffic in Arms

Regulations (ITAR);

- civilian-military dual-use technologies subject to Export Administration Regulations export controls;

- certain nuclear technologies identified by the Code of Federal Regulations (CFR);

- select agents and toxins defined by the CFR; or

- emerging and foundational technologies specially controlled pursuant to the Export Control Reform Act of 2018.

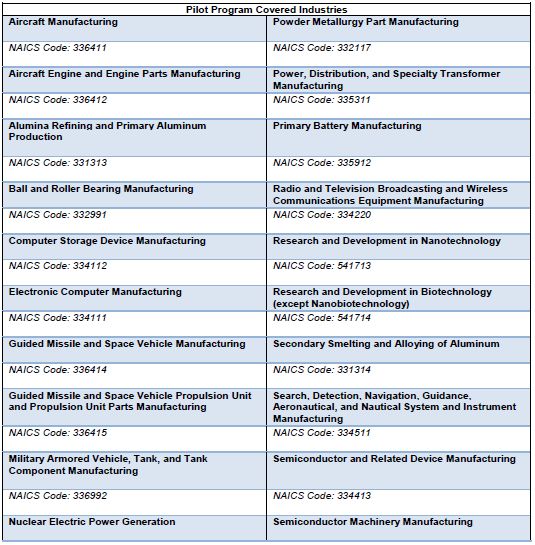

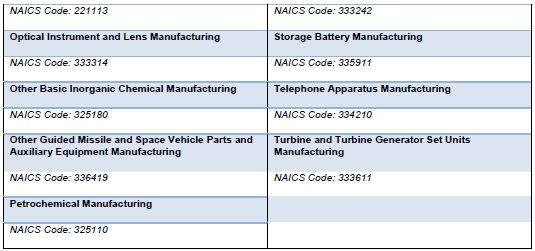

- Pilot Program Industries: The pilot program covers over two dozen targeted industries in an Annex to the regulations, which is reproduced below. These industries include aircraft manufacturing, electronic computer manufacturing, telephone apparatus manufacturing and many others. The Treasury Department chose them out of concern that foreign investment in those industries could pose a threat to US technological superiority and national security.

- Investments Triggering

Jurisdiction: Under FIRRMA, covered transactions include

not just any merger, acquisition or takeover by a foreign person

that could result in foreign control of a US

business—including those carried out through a joint

venture—but also "any other investment" by a

foreign person in any US business involved in critical

infrastructure or the production of critical technologies or that

maintains sensitive personal data that, if exploited, could

threaten national security.

For a noncontrolling foreign investment to be covered under the pilot program, it must give the foreign investor

- access to material nonpublic technical information in the possession of the target US business;

- membership or observer rights on the board of directors or equivalent governing body of the US business;

- the right to nominate an individual to a position on the board of directors or equivalent governing body of the US business; or

- any involvement, other than through voting of shares, in substantive decision-making of the US business regarding the use, development, acquisition or release of critical technology.

The pilot program states explicitly that it applies to joint ventures. - Applicable to All Foreign

Investment: The pilot program applies to foreign

investment from any country and does not single out any specific

country. " Limited Partner Exception for Investment

Funds. There is a carve-out of the pilot program rules for

certain investment funds. A foreign party may invest indirectly in

a pilot program US business via a US-managed investment fund and

participate as a member of the fund's advisory board without

triggering CFIUS jurisdiction, if the fund is managed exclusively

by a general partner, a managing member or an equivalent;

- the foreign person is not the general partner, managing member or equivalent;

- the advisory board or committee does not have the ability to approve, disapprove or otherwise control the fund's investment decisions or decisions of the fund manager relating to the fund's portfolio companies;

- the foreign investor does not otherwise have the ability to control the investment fund, including the authority to approve, disapprove or otherwise control investment decisions of the investment fund; control decisions made by the general partner or equivalent; or unilaterally dismiss, prevent the dismissal of, select or determine the compensation of the general partner or equivalent; and

- the foreign investor does not have access to material nonpublic technical information of the pilot program US business due to its participation on the advisory board or committee.

The interim rule includes two examples that illuminate the reach of the limited partner exception for investment funds:

"Example 1. Corporation A, a foreign person, makes an investment in an investment fund as a limited partner. The investment confers membership on an advisory board of the investment fund. The investment fund holds 100 percent of the ownership interests in a pilot program U.S. business. Corporation A will have the right to approve decisions made by the general partner with respect to the use and development of the critical technologies produced by the pilot program U.S. business. This transaction is a pilot program covered transaction."

"Example 2. Corporation A, a foreign person, makes an investment in an investment fund as a limited partner. The investment confers membership on an advisory board of the investment fund. The investment fund holds 100 percent of the ownership interests in a pilot program U.S. business. Corporation A is not the general partner that wholly manages the investment fund. Corporation A lacks any ability to control the investment fund or its decisions. As a member of the advisory board, Corporation A has the right to vote on the compensation of the general partner and the right to vote on the dismissal of the general partner for cause, but does not have the power to determine either of these matters unilaterally. Assuming no other relevant facts, this transaction is not a pilot program covered transaction with respect to Corporation A." (emphasis added)

Mandatory CFIUS Notifications

The pilot program also requires submission of mandatory declarations for all pilot program covered transactions, which include both (i) a pilot program covered investment and (ii) an investment in which a foreign person acquires "control" of a pilot program US business. These mandatory filings will trigger a new type of CFIUS review period that could impact M&A timelines:

- Declarations must be filed at least 45 days prior to a transaction's expected completion date. The committee will have 30 days to act on the declarations, and it may require parties to file a complete CFIUS notification in response. Such a notification would then begin a separate CFIUS review process.

- Parties may choose to file a notice under CFIUS' standard procedures rather than a declaration.

- Parties that are required to file with CFIUS and do not do so can be assessed a civil monetary penalty up to the value of the transaction.

- Declarations must include, among

other things,

- a brief description of the nature of the transaction, including what will be acquired;

- information on the ownership of the foreign investor and its activities;

- an explanation of how the pilot program US business is subject to the pilot program;

- a statement about the pilot program US business's previous US government contracts, grants and funding;

- a description of the parties' prior history with CFIUS;

- a statement as to whether the parties stipulate that the transaction is covered by CFIUS' jurisdiction, including through the pilot program; and

- a statement about which critical technology or technologies the pilot program US business and its subsidiaries produce, design, test, manufacture, fabricate or develop.

Conclusion

After the passage of FIRRMA, navigating deal risks associated with CFIUS has grown more complex for both US businesses and foreign investors. Now, under the pilot program, CFIUS jurisdiction has expanded to include noncontrolling investments in critical technologies. The categories of transactions subject to the filing requirement have also expanded, and parties failing to make a required declaration may be assessed a civil monetary penalty up to the value of the transaction. Therefore, foreign investors and US businesses should carefully assess the applicability of this pilot program and further regulations on investments.

Footnotes

1 Determination and Temporary Provisions Pertaining to a Pilot Program to Review Certain Transactions Involving Foreign Persons and Critical Technologies, RIN 1505-AC61, Department of the Treasury, https://home.treasury.gov/system/files/206/FR-2018-22182_1786904.pdf.

2 Provisions Pertaining to Certain Investments in the United States By Foreign Persons, RIN 1505-AC60, Department of the Treasury, https://home.treasury.gov/system/files/206/FR-2018-22187_1786944.pdf.

3 See Amb. Robert M. Kimmitt, Benjamin A. Powell, et al., Congress Expands US Government Review of Foreign Investments, WilmerHale Client Alert, Aug. 2, 2018, https://www.wilmerhale.com/en/insights/client-alerts/20180802-congress-expands-us-government-review-of-foreign-investments.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.