- within Transport topic(s)

- in Canada

- with readers working within the Technology industries

Vessels cannot sail without fuel. This industry truth is recognized in contracts and under U.S. maritime law. In fact, enabling ship operators to efficiently obtain fuel is so important that U.S. maritime law purports to grant fuel suppliers a maritime lien over the vessels to which fuel is supplied. However, a recent series of cases demonstrates that the U.S. maritime laws establishing fuel suppliers' rights are uncertain, creating risks for fuel suppliers, ship operators and shipowners. An analysis of these cases dictates better contractual practices to mitigate the legal (and consequent market) uncertainties.

Based in Denmark, O.W. Bunker & Trading A/S and its many global subsidiaries and affiliates (collectively, "O.W. Bunker"), supplied shipping fuel, known as bunkers, to ocean-going vessels. In November 2014, after disclosure of fraud at a Singapore subsidiary as well as significant losses stemming from the declining price of petroleum, O.W. Bunker sought bankruptcy protection in Denmark. When O.W. Bunker's reorganization failed in Denmark, its U.S. subsidiaries filed voluntary chapter 11 petitions in Connecticut, where a liquidating chapter 11 plan was confirmed in December 2015.1

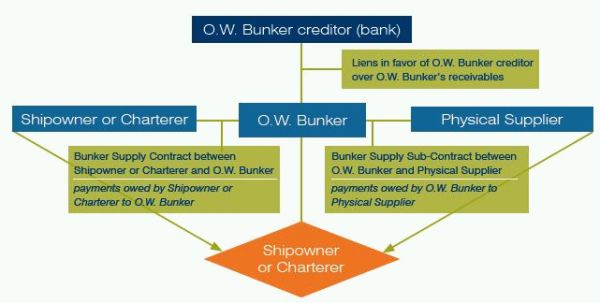

The facts of the O.W. Bunker case are not unusual in the bunker supply sector. A shipowner or charterer contracted with O.W. Bunker for the supply of bunkers for its vessels. O.W. Bunker in turn selected and contracted with physical bunker suppliers (Physical Suppliers), who actually delivered the fuel to the vessels. O.W. Bunker also assigned its rights under certain bunker supply contracts, as security, in favor of its creditor, ING Bank N.V. (ING). For ease of review, the diagram below highlights in very simple and condensed terms the various persons and contractual relationships in a typical supply of bunkers scenario involving O.W. Bunker:

While this article is not intended to be an analysis of maritime liens under U.S. maritime law, in order to appreciate the issues presented to (i) the shipowners/ charterers, (ii) O.W. Bunker (and its creditor, ING) and (iii) the Physical Suppliers upon O.W. Bunker's filing for bankruptcy protection, a brief explanation here would be appropriate.

- Under U.S. maritime law, a maritime lien "is a non-possessory property right of a non-owner in a vessel, its earned freight, cargo or other maritime property giving the lienholder the right in admiralty courts to have the property sold and the proceeds distributed to the lienholder to satisfy an in rem debt of the property."2

- A person providing "necessaries" to any vessel on the order of the shipowner (or another person authorized by the shipowner) has a maritime lien on that vessel.3

- The term "necessaries" is broadly construed and generally understood to mean essential supplies and services provided to a vessel, including bunkers.

In layman's terms, a bunker supplier who delivers shipping fuel to a vessel on the order of the shipowner (or another person authorized by the shipowner) has a maritime lien on that vessel.

There was no dispute that the Physical Suppliers delivered the bunkers to the vessels. When O.W. Bunker's financial conditions became public (and payments were not being made to the Physical Suppliers), the Physical Suppliers demanded payments against the shipowners/charterers for amounts owed under their bunker supply subcontracts with O.W. Bunker. Concurrently, O.W. Bunker (and ING, as its creditor) also made payment claims from the shipowners/ charterers for amounts owed under O.W. Bunker's bunker supply contracts with the shipowners/charterers for the same bunkers.

The conundrum for the shipowners/charterers was that they did not know to whom payments should be made for the fuel.

- If they paid O.W. Bunker (that is, the party with whom they contracted for the supply of bunkers) or ING, as its creditor, the Physical Suppliers would arrest their vessels by asserting maritime liens for the value of the fuel actually provided by the Physical Suppliers under the bunker supply subcontracts.

- In order to release their vessels from arrest, the shipowners/charterers would have had to pay the Physical Suppliers.

- In effect, the shipowners/charterers would have had to pay twice for the same fuel (first to O.W. Bunker (or ING) as obliged under their bunker supply contracts and second, to the Physical Suppliers for the release of their vessels from arrest).

Consequently, the shipowners/charterers refused to pay anyone and instituted interpleader actions in the U.S. where they placed the price of the bunkers with the courts and asked the courts to decide which party should be entitled to the payments.

Much has already been written analyzing the various U.S. court decisions since these interpleader actions were instituted in the U.S., and those analyses are beyond the scope of this article. However, in short summary, some courts narrowly and strictly construed what constituted maritime liens as a matter of policy and held that the Physical Suppliers did not have maritime liens as the bunkers supplied by the Physical Suppliers were not provided on the order of the shipowners (that is, the Physical Suppliers' contractual relationships were with O.W. Bunker and not with the shipowners/charterers). This narrow and strict construction of maritime liens led these courts to conclude that O.W. Bunker possessed the maritime liens and were entitled to the payments from the shipowners/charterers. The Physical Suppliers were left with merely a contractual claim against O.W. Bunker for payments owed to them under their bunker supply subcontracts with no recourse against the vessels.4

Other courts took a more lenient view and held that awarding the maritime liens and, consequently, the payments to O.W. Bunker, would amount to a windfall in favor of O.W. Bunker and ING. These courts took a more equitable approach and reached the same results as if there had been no bankruptcy.5 These rulings suggested that the parties should receive the contractual rights for which they originally bargained. O.W. Bunker certainly was earning a margin on its subcontracts with the Physical Suppliers. Therefore, the Physical Suppliers should be entitled to their payments under the subcontracts with O.W. Bunker and O.W. Bunker should be entitled to just the margins. In this case, the shipowners/charterers would make one payment equal to the aggregate amounts paid to the Physical Suppliers and O.W. Bunker.

The divergent outcomes of the U.S. courts in the O.W. Bunker case highlight the problematic state of play as the courts have failed to provide clear and consistent guidance for shipowners/charterers involved. Until the courts can provide better guidance, pre-contractual due diligence and negotiations are more important than ever and should be emphasized more than usual for shipowners/charterers to better protect themselves against multiple claims for payments for the same bunkers supplied to their vessels.

Below are some modest suggestions for shipowners/charterers to consider during the pre-contractual due diligence and negotiations stage:

- A more thorough due diligence and review of (i) the bunker supply contracts between the shipowners/charterers and the intermediate bunker suppliers and (ii) the bunker supply subcontracts between the intermediate bunker suppliers and the physical suppliers.

- Written agreement by the physical suppliers for the benefit of the shipowners/ charterers not to assert any claims against the shipowners/charterers or the vessels, in effect preventing the physical suppliers from treating the vessels as a form of credit enhancement.

- Written confirmation in the bunker supply subcontracts that the selection of the physical suppliers under the bunker supply subcontracts is not to be construed to be a selection by shipowners/charterers but solely by the intermediate bunker suppliers.

- Written confirmation in the bunker supply subcontracts by the physical suppliers that the bunkers are being delivered at the direction of the intermediate bunker suppliers.

- Written confirmation in the bunker supply subcontracts by the physical suppliers that they are not looking to the credit of the vessels for payments under the bunker supply subcontracts.

- Written agreement by the physical suppliers for the benefit of the shipowners/ charterers that the bunkers are being ordered and supplied for the intermediate bunker suppliers' accounts and that no claims or maritime liens may be placed on the vessels.

- Written agreement by the intermediate bunker suppliers that either (i) they have already paid the physical suppliers the payments owed by them under the bunker supply subcontracts or (ii) if payments have not been made, that the intermediate bunker suppliers will exercise no claim over the bunkers or the vessels until payments are made to the physical suppliers. In the event the intermediate bunker suppliers breach this undertaking, the shipowners/ charterers would seek to withhold payments.

- Written indemnity by the intermediate bunker suppliers for the benefit of the shipowners/charterers for any losses and costs (including litigation costs) incurred by the shipowners/charterers for claims made by the physical suppliers against the shipowners/charterers or the vessels in the event of nonpayment under the bunker supply subcontracts.

- Upon the occurrence of nonpayment by the intermediate bunker suppliers of amounts owed by them under the bunker supply subcontracts, shipowners/ charterers would seek to terminate the bunker supply contracts.

- Written agreement with intermediate bunker suppliers to utilize an escrow account, and payments under the bunker supply contracts will be deposited into that escrow account and released upon (i) payments under the bunker supply subcontracts have been fully made and/or (ii) in the case of any disputes with the physical suppliers, upon resolution of such disputes. The intermediate bunker suppliers would forego any claims to such payments in the escrow account if the physical suppliers were to arrest the vessels for nonpayment under the bunker supply subcontracts.

Whether a shipowner/charterer would be successful in obtaining any of the above suggestions from its counterpart intermediate bunker supplier and/or physical supplier may be open to debate and subject to the negotiating positions of the parties involved. However, even a failed negotiation will help define the parties' expectations in terms of their rights and obligations in a subsequent dispute. Furthermore, the above list of suggestions should not be construed to be exhaustive. However, in light of the divergent decisions in the O.W. Bunker case by the U.S. courts, it behooves shipowners/charterers to raise these types of points during the pre-contractual due diligence and negotiations stage to seek better protections against potential multiple claims for payments for the same bunker.

Click below to download the complete newsletter featuring this article.

Global Transportation Finance Newlsetter - June 2017

Footnotes

1 The history relating to O.W. Bunker is generally taken

from UPT Pool Ltd. v. Dynamic Oil Trading (Singapore) PTE Ltd.

(O.W.I.), No. 14-CV-9262 (VEC), 2015 WL 4005527 (S.D.N.Y. July 1,

2015).

2 Charles M. Davis, Maritime Law Deskbook (2016 Edition, Compass

Publishing Company), 499.

3 Commercial Instruments and Maritime Lien Act, 46 U.S.C.

§31342.

4 See, e.g., Clearlake Shipping Pte Ltd v. O.W. Bunker

(Switzerland) SA, 14-9287 (S.D.N.Y. Jan. 9, 2017).

5 See, e.g., Martin Energy Services LLC v. M/V Bravante IX, 14-322

(N.D. Fla. Jan. 26, 2017).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.