- within Energy and Natural Resources and Intellectual Property topic(s)

- with readers working within the Utilities industries

Chapter 12 of the Bankruptcy Code, enacted in 1987, provides relief to family farmers facing financial distress. Chapter 12 is available exclusively for family farmers that want to reorganize their financial affairs. While Chapter 12 was very popular in the first few years after its enactment, the number of Chapter 12 cases decreased after the farm economy stabilized. Nevertheless, hundreds of Chapter 12 cases are still filed every year in the United States.

Many agriculture experts predict increased distress for farmers in the near term, so it is natural to speculate whether Chapter 12 will play an increased role in the future. In fact, Chapter 12 filings nationwide were about 28% higher in the first six months of 2016 than in the comparable period in 2015. With this increase in agricultural distress and the increase in Chapter 12 filings, it is a good time to examine how Chapter 12 has worked in practice in Missouri.

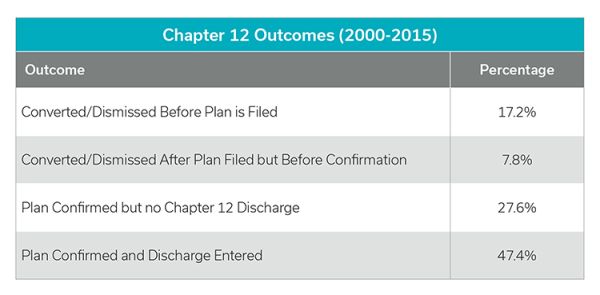

The methodology of this examination was simple. All Chapter 12 bankruptcy cases filed in Missouri between 2000 and 2015 were identified through online searches of the dockets for both the Eastern and Western districts. After adjusting for various anomalies, 126 unique Chapter 12 cases were filed in Missouri between 2000 and 2015. Ten of those cases are still pending and have been ignored for purposes of arriving at the percentages in Table 1.

Outcomes of Chapter 12 cases

There are four primary possible outcomes for a Chapter 12 case:

- Converted to Chapter 7 or dismissed before plan filed. If the Debtor fails to file a Plan, there are two possible dispositions of the case: (a) conversion of the case to one under Chapter 7, or (b) dismissal of the case. Because of the Bankruptcy Code's longstanding hostility to involuntary liquidations of farmers, the Court can convert a Chapter 12 case only if the Debtor consents or the Debtor commits fraud in connection with the case. A total of 20 cases were either converted to Chapter 7 or dismissed before a Plan was filed.

- Case converted or dismissed after a plan was filed but before confirmation. This occurs when the debtor files a Plan, but is unable to obtain confirmation of the Plan. If the Debtor does not voluntarily convert its case to Chapter 7, the Court will eventually dismiss the case. Nine cases were dismissed or converted after a Plan was filed but before confirmation.

- Plan confirmed but no Chapter 12 discharge. This occurs when a Plan is confirmed, but no discharge is entered. Unlike Chapter 11, where the discharge can be obtained on the Effective Date of the Plan, in Chapter 12 the discharge is normally not entered until all Plan payments have been made. Many Chapter 12 debtors are able to confirm a Plan but thereafter default in making the Plan payments. These cases are typically either dismissed at some point after the default or the Debtor voluntarily converts the case to Chapter 7. After subtracting, the ten cases that are still pending, a total of 32 cases fall into this category.

- Plan confirmed and discharge entered. This is the most desired outcome for a Chapter 12 debtor. Not only does this Chapter 12 debtor obtain a confirmed Plan, the debtor also completes payments under the confirmed Plan and receives a discharge. (It appears that no hardship discharges were approved in Missouri during the relevant period.) All data in this article excludes cases that resulted in a hardship discharge under Section 1228(b), which are very rare. A total of 55 cases fall into this category

There are several interesting conclusions that can be drawn from the data in Table 1. First, nearly one-half of Missouri debtors achieved the ultimate objective in a Chapter 12 case, i.e. confirmation of a Plan, followed by completion of Plan payments and receipt of a Chapter 12 discharge. The remaining Chapter 12 cases end in either conversion to a Chapter 7 liquidation or dismissal.

Second, most Chapter 12 debtors are able to at least file a repayment Plan. 83% of all Chapter 12 debtors propose a repayment Plan at some point in their cases. And over 91% of all debtors that are able to file a Plan eventually convince a court to confirm it.

Third, many debtors fail to perform under their confirmed Plans. Of the 87 closed cases where a Plan was confirmed, no Chapter 12 discharge was entered in 32 of them. Therefore, about 36.7% of all confirmed Plans result in a post-confirmation default that precludes entry of a discharge.

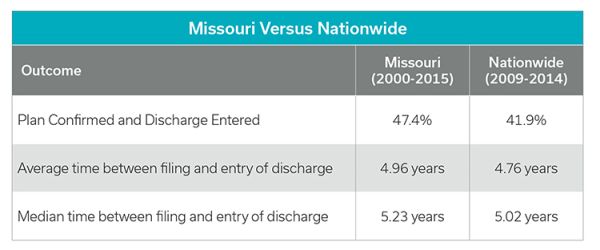

Another interesting metric is comparing Missouri Chapter 12 outcomes with Chapter 12 outcomes nationwide. While there is no readily available data for nationwide Chapter 12 outcomes for 2000 through 2015, the Executive Office of the United States Trustee (EOUST) does maintain a database that shows cases outcomes for 1,809 Chapter 12 cases that were closed nationwide in fiscal years 2009-2014. See generally, Flynn, Chapter 12: Outcomes for Family Farmers and Fishermen, American Bankruptcy Institute Journal (September 2015) at p. 36.

Therefore, Missouri debtors have on the average a slightly more positive set of outcomes than Chapter 12 debtors nationwide. Missouri debtors are slightly more likely to receive a Chapter 12 discharge, and they are slightly less likely to have their Chapter 12 cases dismissed or converted. Successful Missouri cases, however, proceed at a slightly slower pace than their counterparts nationwide.

Timing considerations

Under Section 1221, a Chapter 12 debtor must file a Plan within 90 days after the petition date. The court can extend the filing period if it concludes that the need for an extension is "attributable to circumstances for which the debtor should not justly be held accountable." For the most part, the Missouri Chapter 12 debtors filed their Plans on a timely basis as the median number of elapsed days between the petition date and the date of the first Plan was 92 days.

However, the data suggest that many farmers struggle to obtain confirmation of their Plans. The median number of days between the petition date and entry of a confirmation order is 196 days, which means that it typically takes over 100 days after filing a Plan to obtain confirmation. This is probably because most Chapter 12 debtors have to amend their original Plan in order to secure confirmation. In fact, of those Chapter 12 debtors that obtain a confirmed Plan, 70.6% of them file at least one amended Plan before confirmation. In fact, slightly over 30% of all debtors with confirmed Plans file at least three Plans before confirmation.

Conclusions

- While Chapter 12 is far from a cure-all, it does work a significant percentage of the time as evidenced by the 47.4% of Chapter 12 debtors that obtain a discharge.

- Chapter 12's liberal rules governing amendments, both pre- and post-confirmation, are frequently used. Farmers clearly need flexibility in proposing their Plans and pursuing confirmation. A debtor's need to file an amended Plan is not necessarily an omen that the Plan will ultimately fail. In many instances, a debtor was eventually be able to obtain a discharge in spite of filing one or more post-confirmation amendments. Both debtors and lenders should recognize at the outset that a substantial number of confirmed Plans require post-confirmation modification.

- Missouri's experience with Chapter 12 is very close to the nation as a whole.

- The influence of Chapter 12 is probably much more significant than the modest number of cases indicate. The results in Chapter 12 cases provide a spectrum of potential outcomes that influence both lenders and borrowers in out-of-court workout discussions.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.