By the Tax Accounting Group of Duane Morris

With tax law constantly changing, new tax-savings strategies are always emerging and this year is no exception. One wrinkle in planning for this year is that the much anticipated "extender package" has not yet been passed by Congress. Since many of the tax credits and deductions that expired at the end of 2005 may be retroactively extended by Congress, year-end planning may turn out to be more of a "lastminute" challenge this year.

So, while you can depend on us for cost-effective tax compliance, planning and consulting services, as well as for critical advocacy and prompt action in connection with your long-term personal and business objectives, we are also available for any immediate or last-minute needs you may have or Congress may create. Additionally, our one-of-a-kind platform also provides uncommon access to other valuable resources and services in legal and non-legal fields.

At the Tax Accounting Group (TAG), our goal is to provide highly personalized and uninterrupted service to maximize our ability to assist our clients in meeting their financial, tax and related goals. For our current clients, we sincerely appreciate the trust and confidence that you have bestowed upon us. We are both humbled and invigorated when our clients, both existing and new, tell us that our standards of personalized attention and sense of urgency are refreshing. We are not surprised to often hear from our clients that while our firm is big enough to serve their various needs, we take a remarkable personal interest in them and are intimately familiar with their activities. The number of referrals we receive from our clients, their families, friends and colleagues is simply incredible. To our clients, we sincerely appreciate your trust and confidence and continued referrals. As always, we will continue to work very hard to justify your trust in us and our firm.

To our friends who have not yet experienced our services, we invite you to evaluate our approach and look forward to working with you. We will be delighted to assist you. We hope you find this guide informative and useful, and encourage you to consult with us at your convenience. For additional information, please contact Michael A. Gillen, or the practitioner with whom you are in regular contact.

* * * * * * * * * * * * * * * * *

2006/2007 TAX PLANNING STRATEGIES

With tax year 2006 rapidly coming to an end, it’s time once again to consider, and where appropriate implement, year-end tax planning strategies available to you, your family and your business. Year-end tax planning techniques change each year due to changing tax rules, as well as changes in your own personal, financial and tax situations. And 2006 is no exception.

Two major pieces of tax legislation passed by Congress in 2006, the Tax Increase Prevention and Reconciliation Act of 2005 ("TIPRA") and the Pension Protection Act of 2006 ("PPA"), as well as certain provisions from previous tax legislation that became effective in 2006, have once again created new tax planning opportunities. The 2006 legislation contains provisions that provide significant incentives for workers, investors, retirees, homeowners and businesses.

With respect to TIPRA, getting past the unusual facts that (1) the first two words of the Act are "Tax Increase" and (2) although it was passed in 2006 it has the year 2005 in its title, the main features of TIPRA are alternative minimum tax (AMT) relief for individuals for 2006, two more years of low-tax treatment for capital gains and qualified dividends, and two more years of generous Section 179 expensing provisions for businesses.

On the flip side, to offset a portion of the reduction in revenue that will result from those provisions, TIPRA contains a number of provisions for raising revenue. For example, it removes the Adjusted Gross Income (AGI) ceiling for IRA-to-Roth-IRA conversions (but only after 2009) and changes the age at which the kiddie tax applies (from under age 14 to under age 18).

The PPA implements provisions that both strengthen existing pension plans and enhance retirement savings opportunities. Important new rules and tax incentives for charitable contributions are also reflected in the PPA.

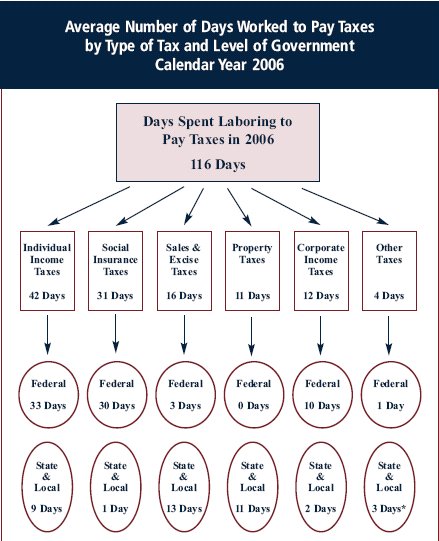

* Includes two days' worth of other business taxes.

Note: Due to rounding, components do not add up to total.

Sources: Bureau of Economic Analysius and Tax Foundation calculations.

Chart demonstrates the concept known as Tax Freedom Day", the first day of the year in which a nation as a whole has theoretically earned enough income to fund its annual tax burden. According to the Tax Foundation, Tax Freedom Day* fell on April 26 in 2006, three days later than it was in 2005 and 10 days later than it was in 2004.

Due to the extensive nature of the 2006 legislation, this guide includes specific tax-savings actions that you may consider, and implement where appropriate, to leverage the tax benefits created by the new legislation, as well as the phase-in of some provisions of prior-year legislation, including strategies that will help you set aside funds for retirement on a more favorable basis.

While the new legislation modifies the tax environment, no changes are scheduled in the income tax rates through 2010. Therefore, the tried-and-true tax planning strategies of accelerating deductions and deferring income, in general, will continue to be an effective method of minimizing your tax obligation.

To assist you in this effort, this complimentary guide focuses on select tax planning opportunities and strategies available for effective planning before year-end and includes, where appropriate, planning tips, illustrations and observations for the current year and subsequent years.

As always, we will be pleased to help you analyze the options and decide on the strategies that are most effective for you, your family and your business.

While examining this guide, please keep the following in mind:

- While this guide focuses on the tried-andtrue strategies of deferring taxable income and accelerating deductible expenses, with exceptions, you can sometimes achieve overall tax efficiency by reversing this technique. For example, you should consider accelerating income and deferring deductions if you expect to be in a higher tax bracket next year, your head-ofhousehold or surviving spouse filing status ends this year, you expect to be subject to the alternative minimum tax (AMT) this year, you have net operating loss or charitable contribution carryovers to absorb or if your marital status will change next year.

- If you choose to save taxes by accelerating income, you must consider the possibility that this means paying taxes early and foregoing the use of money that could have been otherwise invested. Accordingly, the time value of money can make a good decision better or, conversely, a bad decision worse.

- The strategies and tips reflected herein are designed to assist you in achieving your personal and business financial objectives in a "tax-efficient" manner. Consequently, a proposed transaction should make economic sense and save taxes. Furthermore, it is critical that you review your entire financial position before implementing any changes. There are a myriad of non-tax factors that can influence your year-end planning, including a change in employment, your spouse reentering or exiting the work force, the adoption or birth of a child, a death in the family or a change in your marital status.

- It usually makes sense to look at your tax situation over a two-year period, with the objective of reducing your tax liability for both years combined, not just for 2006 (or 2007).

- As we caution every year, due to the volatile nature of the stock market, economy and tax environments, we recommend the prudent approach of planning now, based on current law, and revising those plans as the need arises. Consequently, every edition of the Tax Accounting Review, which is published throughout the year, contains information on tax developments that are designed to keep you informed of significant changes in those environments.

- We urge you to examine your tax situation as soon and as often as possible and to consult with us as much as you wish. If you would like our assistance in determining or implementing a personal or business year-end tax plan or would like to discuss any of the new laws further, please do not hesitate to contact us.

With these words to our wise clients and friends in mind, the following are observations and specific suggestions that can be employed in the last 45 days of 2006 regarding income and deductions for 2006, where the basic principles of accelerating deductible expenses and deferring taxable income will result in maximum tax savings.

TAX PLANNING STRATEGIES CREATED BY TIPRA AND PPA

Below is a summary of the key provisions of the 2006 legislation affecting individuals and small businesses. Available upon your request are our Client Alerts that explain the new law in much greater detail.

1. Determine your exposure to the Alternative Minimum Tax (AMT). Since TIPRA eliminated the scheduled decrease in the 2006 AMT exemption amounts for individuals and actually provided for exemption amounts that are higher than they were for 2005, you may not be subject to this secret and costly tax in 2006. Contact us if you would like us to determine whether or not this is the case.

Without the TIPRA fix, the 2006 exemption amounts would have been $45,000 for married individuals filing jointly and surviving spouses, $33,750 for unmarried individuals, and $22,500 for married taxpayers filing separately. Under TIPRA, however, for tax years beginning in 2006, the exemption amounts for individuals increase to the following amounts: $62,550, $42,500 and $31,275, respectively.

Under pre-TIPRA law, for 2006, personal credits (other than the child credit, the adoption credit and the low-income saver’s credit) could not exceed the excess of regular tax liability over tentative minimum tax. In other words, if your AMT liability exceeded your regular tax liability, most personal credits were not allowed. With TIPRA, for tax years beginning in 2006, personal credits (including the dependent care credit, the credit for the elderly and permanently and totally disabled, the mortgage credit, the child credit, the Hope and Lifetime Learning credits, the adoption credit, the lowincome saver’s credit, the DC homebuyer credit and the new for 2006 residential and nonbusiness energy property credits) are allowed against the AMT.

|

Illustration: Assume that in 2006 the Rowands file a joint tax return reflecting taxable income of $300,000, regular tax of $79,000 and AMT of $98,000, resulting in an AMT liability of $19,000. They have $2,100 of dependent care credits and $10,000 of adoption credits. Under the Act, they may claim the full $12,100 of personal credits. Under pre-TIPRA law, they would not be able to claim any of their personal credits, since AMT exceeds their regular tax. |

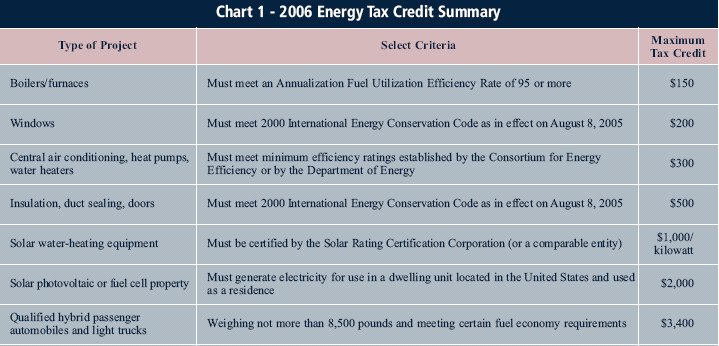

2. Make qualified home improvements by the end of 2006. Taxpayers considering making home improvements that qualify for the residential or nonbusiness energy property credits should do so in 2006 as opposed to 2007 if AMT is an issue, since these credits are allowed for AMT purposes in 2006, but not in 2007. Chart 1 highlights the available energy tax credits.

3. Revise your "kiddie tax" planning strategies. To offset a portion of the decrease in tax revenues that will result from TIPRA’s tax reduction provisions, TIPRA contains a number of provisions for raising revenue. One such provision is that the kiddie tax now applies to children under age 18; under prior law, it applied to children under age 14.

|

Planning Tip: To avoid or minimize the kiddie tax that this provision may create, consider investing a child’s funds in one or more of the following. Owners of Series EE and Series I bonds may defer reporting any interest (i.e., the bond’s increase in value) until the year of final maturity, redemption or other disposition. (If held in the parent’s name and used for qualified higher education expenses, and assuming certain adjusted gross income (AGI) requirements are met, the income is not taxed at all.)

|

A child subject to the kiddie tax pays tax at his or her parents’ highest marginal rate on the child’s unearned income (for example, interest and dividend income) over $1,700 (for 2006) if that tax is higher than the tax the child would otherwise pay on it. Alternatively, the parents can elect to include on their own return the child’s gross income in excess of $1,700.

If the strategies you employed, using prior kiddie tax rules, will result in taxable income subject to the kiddie tax this year (due to your child turning age 14 in 2003, 2004, 2005 or this year), consider investing the taxable income in investments that will not generate taxable income until your child turns age 18. You will bite the tax bullet this year, but, in a best-case scenario, the next three years should be kiddie-tax free.

College planning strategies employed under pre-TIPRA kiddie tax rules, such as the creation of custodial accounts or Crummey trusts, may also need to be changed, based on the change in the new kiddie tax rules, primarily because they tended to rely on strategies that resulted in taxable income to the beneficiary of the account or trust when he or she reached age 14. Consider, as alternatives, Section 529 college savings accounts (which have no AGI limitations) or Coverdell Education Savings Accounts (which have AGI limitations).

|

Observation: As a result of the change from age 14 to age 18, there is no longer an income tax benefit to establishing or maintaining Uniform Transfers to Minors Accounts (UTMAs) for college savings where the age of majority is 18. Earnings in accounts held under a UTMA will be subject to the parents’ highest marginal rate effective for 2006. |

|

Observation: As an added incentive for our Pennsylvania residents, you may now deduct on your Pennsylvania personal income tax return contributions to Section 529 plans, effective January 1, 2006. Currently more than 30 states allow a deduction for Section 529 plan contributions. Pennsylvania is the first state to allow a state income tax deduction for contributions to all 529 plans, not only those sponsored by the Commonwealth of Pennsylvania. |

Furthermore, appreciated stock held in a college student’s parent’s account can be gifted to the child after he or she reaches age 18. As long as the gifts are structured so that they are not taxable gifts, the student can then sell them and pay tax at a low rate (hopefully 5% or less). In addition, the child’s Roth IRA, funded by contributions that are based on the child’s earned income, may also be a source of college funding.

As you can see, effective college savings strategies are still available, even with the new and definitely un-improved kiddie tax rules. Contact us for details.

4. Defer sales or exchanges of self-created musical compositions or copyrights in musical works until 2007. If you were considering selling such assets this year, TIPRA gives you a reason to hold off until next year. Under prior law, literary, musical or artistic compositions, letters or memoranda, or similar property held by a taxpayer whose personal efforts created the property were not treated as capital assets.

|

Observation: When a taxpayer sold copyrights he owned in songs he created, gain from the sale was treated as high-taxed ordinary income rather than low-taxed capital gain. |

Under the new law, at the election of the taxpayer, the sale or exchange of musical compositions or copyrights in musical works created by the taxpayer’s personal efforts is treated as the sale or exchange of a capital asset. This change is effective for sales in tax years beginning after May 17, 2006 (January 1, 2007 for individuals) that occur before 2011.

5. Consider taking a "hardship" distribution in 2006. Under PPA, for purposes of the 401(k) hardship distribution rules, "hardship" includes hardship of a beneficiary under the plan, even if the beneficiary is not a spouse or dependent. This provision is effective August 17, 2006. The distribution will be subject to income tax, but, assuming certain requirements are met, will not be subject to the 10% penalty on early distributions.

6. Defer qualified plan distributions until 2007. PPA also provides that, for distributions after 2006, nonspouse beneficiaries may rollover, to an individual retirement account (IRA) structured for such purposes (in a trustee-to-trustee rollover), amounts inherited. Under pre-Act law, only participants and surviving spouses were able to rollover amounts from qualified plans, 403(b) annuities and IRAs to another plan or IRA; nonspouse beneficiaries were not eligible to rollover inherited amounts.

|

Planning Tip: Establish a new IRA to receive the inherited funds.They should not be commingled with an existing IRA as the new account will have different distribution rules. |

7. Diversify your employee contributions that have been invested in employer securities. Under PPA, participants must be allowed to immediately diversify any employee contributions or elective contributions invested in employer securities. For employer contributions, participants must be able to diversify out of employer stock after they have been in the plan for three years. The diversification requirement applies to plans with publicly traded employer securities.

8. Make charitable contributions of up to $100,000 of 2006 distributions from IRAs. PPA provides an exclusion from gross income for certain distributions of up to $100,000, per year, from a traditional IRA or a Roth IRA, where the distribution is contributed to a tax-exempt organization to which deductible contributions can be made. This provision is effective for 2006 and 2007, applies only to distributions made on or after the date the IRA owner attains age 70½, and must be made directly from the IRA trustee to the charitable organization. Distributions that are excluded from income under the new provision are not allowed as a deduction.

|

Observation: This provision can save taxes for those who itemize their deductions to the extent that AGI limitations would have otherwise reduced the amount of charitable contributions currently deductible. In addition, excluding the IRA distributions from AGI also results in a lower AGI, which may make deductions affected by AGI (such as medical deductions and miscellaneous itemized deductions) easier to deduct, and may also reduce the amount of Social Security benefits that are subject to tax. |

9. Take distributions from an IRA, as a member of the National Guard or the Reserves. Under PPA, distributions from an IRA or pension plan to members of the National Guard and Reserves called to active duty through 2007 are not subject to early withdrawal penalties. Perhaps more importantly, withdrawn amounts may be repaid to the IRA or pension plan within two years of the distribution without regard to the annual contribution limit.

10. Consider making qualified conservation contributions. PPA raises the charitable deduction limit from 30% of AGI to 50% of AGI for qualified conservation contributions. Furthermore, the charitable deduction limit is raised to 100% of AGI for eligible farmers and ranchers, provided that the contribution does not prevent use of the donated land for farming or ranching purposes. The Act also authorizes the carryover of unused deductions for up to 15 years. This provision is effective for 2006 and 2007.

11. Maximize certain cash contributions in 2006 before the enhanced substantiation requirements apply. With regard to charitable contributions of money, for tax years beginning after August 17, 2006, the donor must maintain a canceled check, bank record or receipt from the donee organization showing the name of the organization, the date of the contribution and the amount of the contribution. Previously, only contributions in excess of $250 required substantiation to this extent. Assuming you are a calendar-year taxpayer, your first tax year beginning after August 17, 2006, will start on January 1, 2007.

TAX PLANNING STRATEGIES FOR INDIVIDUALS

Assessing and Managing Your Alternative Minimum Tax (AMT) Exposure)

While we previously discussed the TIPRA effect on the burdensome AMT, it is such an important topic that it deserves a more in-depth discussion. The initial step in individual income tax planning is to assess your exposure to the AMT. A strategy that is effective for regular tax purposes can create an AMT liability because of differences in how certain deductions and income exclusions are handled. Having a basic understanding of your AMT position in order to properly assess your overall tax planning options is crucial.

Individuals actually compute their income tax liability under two systems – the regular tax system and the AMT system – and pay the higher of the two amounts. Although the AMT was originally intended to apply only to taxpayers who claimed certain (or too many) tax breaks, it has evolved into a system that affects many unsuspecting taxpayers. Although legislative measures have been taken to deal with the problem (such as the TIPRA measure noted above), they are neither significant enough nor last long enough to keep the AMT from creating an additional tax burden for many taxpayers.

Many taxpayers unknowingly fall into the AMT, but those who recognize substantial long-term capital gains, exercise incentive stock options during the year, pay large state and local income taxes and real estate taxes or deduct significant amounts of miscellaneous itemized deductions (like unreimbursed employee business expenses or investment advisory fees) are especially vulnerable.

If you have determined that you will be subject to the AMT, the next step is to effectively manage it. Consequently, you should try to control the timing of items that place you in an AMT position. Since the AMT rate (up to 28%) is generally lower than the effective maximum regular tax rate (35%), you may actually reduce your multiyear combined income tax liability by accelerating income into 2006 if you will otherwise be subject to the AMT this year and expect to be in the 33% or higher tax bracket next year. At the same time, since many itemized deductions are generally added back to taxable income to arrive at the AMT, they produce little or no tax savings in the year you are subject to the AMT. Therefore, you should defer such deductions until 2007 (assuming 2007 is a non-AMT year).

While the balance of this guide will focus on the time-honored strategies of deferring taxable income and accelerating deductible expenses to achieve maximum tax savings – that is, for the vast majority of taxpayers in a regular tax situation – you can sometimes achieve overall tax efficiency by reversing this technique if you are in an AMT situation.

PLANNING TIPS FOR CORPORATE EXECUTIVES

Corporate executives may need to select a new tax service provider in order to comply with a new rule that requires executives in a financial oversight role within their companies to utilize tax service providers other than the company audit firm. This rule was adopted by the Public Company Accounting Oversight Board (PCAOB) and requires that the auditor’s firm NOT prepare the tax returns or provide tax planning advice to the corporate executives of their public company audit clients. These rules became effective on October 31, 2006. It is anticipated that there will be increased scrutiny regarding the nature of services provided by CPA firms to private companies and it has been recommended that these companies also separate tax and audit service providers.

As corporate executives are interviewing and selecting new CPAs that they can trust to perform effective, efficient and confidential tax planning and preparation services, these executives should review with their new tax consultant year-end tax minimization strategies including:

- Considering a lump-sum distribution of employer stock from a retirement plan in order to preserve potential capital gain treatment.

- Considering filing an IRC Section 83(b) election with regard to year-end restricted stock grants in order for potential future growth to be taxed at preferential capital gains rates.

- Considering deferred compensation contributions to maximize the benefits of deferring income.

- Managing potential AMT exposure by exercising non-qualified stock options in the same year as an incentive stock option exercise or by making a disqualified disposition of incentive stock options in order to reduce your AMT exposure.

- Implementing strategies associated with international tax planning for executives on assignment in foreign countries, including the preparation of tax equalization calculations, in order to take full advantage of the new foreign earned income and housing exclusion provisions.

Being a successful executive in today’s fastpaced world leaves little time to properly investigate and achieve tax, financial and related objectives. In selecting a tax service provider, we suggest that the corporate executive look to a firm that:

- Administers a flexible executive tax assistance program designed specifically for corporate executives, providing highly personalized, comprehensive and confidential individual and business tax preparation, planning and consulting services.

- Offers a comprehensive and streamlined suite of accounting, finance and customized administrative services and tailors services to meet the unique needs of the corporate executive and/or sponsoring employer.

- Offers convenient, single-source access to other valuable resources and services such as legal, wealth management and financial planning.

- Maintains a national practice and platform.

- Deploys a coordinated, multidisciplined approach delivered by a primary core of CPAs intimately familiar with, and taking a personal interest in, the executive’s tax and related financial objectives.

- Avoids the conflict of interest risks presented by the dual activities of the employer company’s auditors performing tax services for company personnel.

- Streamlines interaction between the busy executive and advisors and assists the executive in achieving tax, financial and related objectives.

As always, should you have any questions or require assistance in analyzing and implementing related tax planning techniques, please feel free to contact us. We will be delighted to assist you.

Planning for Higher Education Costs

Education has been, and will continue to be, a high priority for every session of Congress. Consequently, many tax-savings opportunities exist for education-related expenses. If you or members of your family are incurring these types of expenses now or will be in the near future, it is worth examining them in some detail. Prior editions of the Tax Accounting Review focused on this issue in detail, so do not hesitate to contact us if you would like a copy of our education planning newsletters. Here, in summary, are some strategies to consider as year-end approaches.

12. Contribute to Section 529 qualified tuition plans. If you have not taken advantage of these plans to date, now is a good time to reconsider a 529 plan. Below we highlight the most important features of these plans and contribution opportunities that exist before year-end.

While plan contributions are not federally tax-deductible (although many states allow a deduction), contributions and earnings on contributions that are subsequently distributed for qualified higher education expenses (including tuition, room and board, and other expenses) at accredited postsecondary schools anywhere in the United States are free of federal income tax and may be free of state income tax. If distributions are not for qualified higher education expenses, the earnings are subject to regular income tax plus a 10% penalty.

|

Observation: As contrasted with the other education strategies discussed below, the AGI of the donor has no effect on contributions to the plan. |

The PPA made permanent the favorable federal income tax treatment of Section 529 plans; prior to PPA, qualified distributions from Section 529 plans made after 2010 were scheduled to be taxable; as a result of PPA, those distributions will not be taxable.

|

Planning Tip: Under the new law, student-owned 529 plans will not be included in the formula for determining federal financial aid. Under prior law, 30% of the student’s 529 (and other) assets were included. For parent-owned plans, parents are expected to contribute no more than 5.6% of the 529 account, while grandparent-owned accounts are excluded in their entirety from determining eligibility for federal financial aid. Consequently, under the new rules, increased amounts of financial aid are possible. |

|

Planning Tip: An election can be made to treat a contribution to a Section 529 plan as having been made over a five-year period; for example, for 2006, a married couple can make a $120,000 contribution to a Section 529 plan without incurring any gift tax liability, since the annual gift exclusion for 2006 is $12,000 per donor and the contribution can be split between spouses. As the allowable annual gift exclusion increased in 2006, you may now make an additional $1,000 per donee contribution for 2006 if you made a five-year election between 2002 and 2005. |

Finally, in general, if contributions to a Section 529 plan are not distributed for the benefit of the beneficiary, the account may be transferred to a member of the beneficiary’s family, penalty-free. Please do not hesitate to contact us with any questions you may have on Section 529 plans.

13. Be familiar with the education credit options. If you pay college or vocational school tuition and fees for yourself, your spouse or your children, you may be eligible for either the Hope

Scholarship Credit or the Lifetime Learning Credit. These credits reduce taxes dollar for dollar, but begin to phase out when 2006 AGI exceeds certain levels. Chart 2 provides a summary of the phase-outs.

|

Planning Tip: Parents also can shift an education credit from their return to the student’s return by simply forgoing a dependency exemption deduction for the student.This strategy is particularly appealing to high-income parents whose income prevents them from claiming the credit or from receiving any benefit from the dependency exemption. To benefit from this strategy, however, the student must have sufficient income, and therefore tax liability, to absorb the credit. It might be necessary to shift income to the student as well, perhaps through gifts of appreciated property (that the student then sells at a gain) or employment in a family business, as discussed in Item 33 below. However, unlike assets of a Section 529 plan, shifting income to a student can have a detrimental impact on a student’s receiving or being eligible for financial aid. |

14. Pay qualified education expenses if you qualify for the education credits. Because, as of press time, Congress had not extended the tuition deduction, no deduction is allowed for the payment of college tuition and related expenses for you, your spouse or your dependents. However, the education credits noted above are still available, provided your AGI does not exceed certain levels.

If you can benefit from the education credits, but your AGI is at or near the applicable limits, monitor your AGI level between now and year-end and, to the extent possible, take steps to keep it below the limit.

15. Remit additional student loan payments. An "above the line" deduction of up to $2,500 is allowed for interest due and paid in 2006. The deduction is phased out when AGI exceeds certain levels.

|

Observation: If your AGI exceeds the phase-out limits, consider a home equity loan to pay off your student loans since interest on home equity loans generally will create a deductible interest expense. |

Strategies for Your Investments

For 2006, as in prior years, long-term capital gains and qualifying dividend income continue to be subject to a tax rate of only 15% for taxpayers in a regular tax bracket of 25% or higher and 5% for taxpayers in the lower regular tax brackets. Since tax rates can be as high as 35% for other types of income, these rates can result in substantial tax savings. Here are some ways to capitalize on the lower rates as well as other tax planning strategies for investors.

16. Take advantage of the benefit of lower tax rates on capital gains. To be eligible for the lower 15% (or 5%) capital gain rate, a capital asset must be held for at least one year and a day. So, when disposing of your appreciated stocks, bonds, investment real estate and other capital assets, pay close attention to the holding period. If your holding period is less than one year and a day, consider deferring the sale so that you can meet the longer-than-one-year period (unless you have long-term or shortterm losses to offset). While we emphasize that it is generally not wise to let tax implications drive your investment decisions, you should not ignore them either. Remember also that realized capital gains may increase AGI, which in turn may reduce your AMT exemption and therefore increase your AMT exposure.

|

Planning Tip: To take maximum advantage of the spread between capital gains and individual income tax rates, consider receiving qualified employer stock options in lieu of salary to convert ordinary compensation income to capital gain income. However, as noted below in Item 32, ensure that this strategy does not reduce your tax savings from the deduction for production activities, if applicable, more than it reduces your income tax savings attributable to converting salary income to capital gain income. |

17. Consider purchasing dividendpaying stocks. The favorable tax rates (15% or 5%) on qualified dividends noted above continue to make dividend-paying stocks attractive. Consequently, you should once again review the composition of your investment portfolio. Keep in mind that to qualify for the lower tax rate on dividends, the shareholder must own the dividendpaying stock for more than 60 days during the 121-day period beginning 60 days before the stock’s ex-dividend date. For certain preferred stock, this period is 90 days during a 181-day period.

|

Observation: Dividends paid by domestic corporations generally qualify for the lower rate. Dividends paid by qualified foreign corporations, which include foreign corporations traded on an established U.S. securities market (including American Depository Receipts or ADRs), corporations organized in U.S. possessions and other foreign corporations eligible for certain income tax treaty benefits, will also be eligible for the lower rates. Dividends received on certain investments marketed as preferred stocks are really debt instruments (e.g., trust preferred securities) and are not qualified dividends eligible for the 15% tax rate. |

|

Planning Tip: To achieve even greater tax savings, consider holding bonds and other interest-yielding securities inside qualified plans and IRAs, while having stocks that produce capital gains and dividend income in taxable accounts. |

18. Do not get caught in the mutual fund investment pitfall. Before investing in a mutual fund prior to February 2007, first contact the fund manager to determine if year 2006 dividend payouts are expected. If such payouts take place, you may be taxed in 2006 on part of your investment. It makes sense to avoid such payouts, particularly if they include large capital gain distributions. Furthermore, certain dividends from mutual funds are not "qualified" dividend income and therefore are subject to tax at the taxpayer’s marginal income tax rate rather than at the preferential 15% (or 5%) rate.

|

Illustration: If you receive a payout of $7,500, the value of your original shares declines by $7,500, the dividend payment. If we assume that you are in the automatic dividend reinvestment plan (so that the dividend purchases new shares), then the value of your fund should now be about the same as your original investment. Assuming the dividend is qualified, it is subject to tax at 15%. If it is not a "qualified" dividend, it is subject to tax of up to 35%. If you had invested after the dividend date, you would own about the same shares, but would have paid no tax! |

19. Increase the recognized loss or reduce the recognized gain. When selling stock or mutual fund shares, the FIFO (first-in, first-out) rule generally applies, meaning that the shares you acquired first are the ones deemed sold first. However, if you choose, you can specifically identify the shares you are selling when you sell less than your entire holding of a stock or mutual fund. By notifying your broker of the shares you want sold at the time of the sale, your gain or loss from the sale is based on those identified shares. This sales strategy increases your control over the amount of your gain or loss and whether it is long-term or short-term. However, once the specific identification method is chosen, you may not use a different method (e.g., first-in, first-out method or average cost method) for the particular security you have specifically identified or throughout the life of the fund (unless you obtain permission from the IRS).

|

Planning Tip: As with many aspects of tax law, documentation is critical. Therefore, you must ask the broker or fund manager to sell the shares you identify and maintain records that include both dated copies of letters ordering your fund or broker to sell specific shares and written confirmations that your orders were carried out. |

20. Be a winner with capital losses. Periodically review your investment portfolio to see if there are any "losers" you should sell. This is especially true as year-end approaches, since the last day that you can offset capital gains recognized during the year or take advantage of the $3,000 ($1,500 for married separate filers) limit on deductible net capital losses is December 31. With the Dow Jones Industrial Average routinely setting record highs, you may not have these capital losses for long. But do not run afoul of the wash sale rule, discussed in the next item.

21. Avoid the wash sale rule. The wash sale rule, a statute that often catches investors by surprise, provides that no deduction is allowed for a loss if you acquire substantially identical securities within a 61-day period beginning 30 days before the sale and ending 30 days after the sale. Fortunately, there are ways to avoid this rule. For example, you could sell securities at a loss and use the proceeds to acquire similar, but not substantially identical, investments. If you wish to preserve an investment position and realize a tax loss, consider the following strategies:

- Sell the loss securities and then purchase the same securities no sooner than 31 days later. The risk of this strategy is that you will not benefit from any appreciation in the stock that occurs during the waiting period.

- Sell the loss securities and reinvest the proceeds in the stock of another company in the same industry or shares in a mutual fund that invests in securities similar to the security you sold. This approach considers an industry as a whole rather than a particular stock. After 30 days, you may wish to repurchase the original holding. This method may reduce the risk during the waiting period.

- Buy more of the same security (double up), wait 31 days and then sell the original lot, thereby recognizing the loss. This strategy allows you to maintain your position but also increases your downside risk.

| Observation: According to many brokerage firms, the last day that the 31-day period strategy will work is November 28, 2006. Buying securities after that date, taking consideration for the days that the firms are closed, will leave fewer than 31 trading days in the year. |

|

Planning Tip: The wash sale rule typically will not apply to sales of debt securities (such as bonds), since such securities usually are not considered substantially identical due to different issue dates, rates of interest paid and other terms. Consequently, bond swaps are an effective way to recognize a loss while maintaining your investment position. |

22. Increase your investment in municipal bonds. Today’s intermediate tax-free yields are about 4.3%, which translates into an equivalent taxable yield for high-income taxpayers in the 35% federal tax bracket and 5% state tax bracket of about 7.2%. Furthermore, taxexempt interest is not included in adjusted gross income, so deduction items based on AGI are not adversely affected. Assuming your investment portfolio is appropriately diversified, greater weight in municipal bonds may be advantageous.

|

Planning Tip: Be careful of the AMT impact on income from private activity bonds, which is a preference item for AMT purposes. In general, a municipal bond issued after August 7, 1986, that does not meet certain requirements (with regard to the use to which the proceeds are put) is a private activity bond. Consequently, it is important to review the prospectus of the municipal bond fund to determine if it invests in private activity bonds. If you are subject to the AMT, you should avoid these funds. |

23. Determine whether you are an investor or a trader. Discount brokers and online trading continue to have a huge effect on the way many people invest in the stock and securities markets. Consequently, many individuals spend a lot of time regularly trading stocks. If this describes you, please let us know as soon as possible since the tax treatment of your income and expenses from your trading activity can differ dramatically depending on whether, according to tax law, you are classified as a trader or an investor.

|

Observation: Your status as a trader or investor may not be as clear as you think, so an analysis of your situation should be done before year-end in order to determine your status and the tax planning opportunities that may exist. At the risk of oversimplification, an investor’s activities are limited to occasional transactions for his own account, while a trader’s activities must be continuous, frequent, regular and substantial. 24. Identify and dispose of worthless stock in your portfolio. Your basis in stock that becomes totally worthless is deductible (generally as a capital loss) in the year it becomes worthless, but documentation regarding its worthlessness from a professional appraiser’s report or other evidence is critical in securing the capital loss. Alternatively, consider selling the stock to an unrelated person for at least $1. You have now eliminated the need for an appraiser’s report and are almost guaranteed a loss deduction. |

25. Take advantage of your homerelated gain exclusion. Federal law provides that an individual may exclude, every two years, up to $250,000 ($500,000 for married couples filing jointly) of gain realized from the sale of a principal residence, provided certain residency and use requirements are satisfied. (Many, but not all, states also follow this rule.) Although the gain exclusion ordinarily does not apply to a vacation home, with careful planning you may be able to apply the exclusion to both of your homes.

|

Illustration: After selling your principal residence and claiming the allowable exclusion, convert your former vacation home into your new principal residence for at least two years. Establishing residency and use is critical to the success of this technique. Proper conversions result in an additional $250,000/$500,000 of tax-free gain. |

26. Directly deposit your tax refund to an IRA. As a result of the PPA, effective in 2007, you will be able to arrange to have all or part of your federal income tax refund directly deposited into your IRA (or your spouse’s IRA if you file jointly). This new provision creates another painless and convenient opportunity to maximize your contributions to an IRA.

To continue reading this article in its entirety please click here .

This article is for general information and does not include full legal analysis of the matters presented. It should not be construed or relied upon as legal advice or legal opinion on any specific facts or circumstances. The description of the results of any specific case or transaction contained herein does not mean or suggest that similar results can or could be obtained in any other matter. Each legal matter should be considered to be unique and subject to varying results. The invitation to contact the authors or attorneys in our firm is not a solicitation to provide professional services and should not be construed as a statement as to any availability to perform legal services in any jurisdiction in which such attorney is not permitted to practice.

Duane Morris LLP, among the 100 largest law firms in the world, is a full-service firm of more than 600 lawyers. In addition to legal services, Duane Morris has independent affiliates employing approximately 100 professionals engaged in other disciplines. With offices in major markets, and as part of an international network of independent law firms, Duane Morris represents clients across the United States and around the world.