- within Law Department Performance, Accounting and Audit and Law Practice Management topic(s)

Roth IRAs have been popular since their introduction in 1998 because the earnings on funds invested in such accounts build up tax free, as opposed to merely tax deferred as in traditional IRAs. However, many people do not have Roth IRAs, either because their income is above the Roth IRA contribution limit (which generally ranges from $110,000 to $160,000, depending on filing status) or because they do not have any funds available to make Roth IRA contributions after funding their 401(k) or other retirement plans. Fortunately, this accessibility issue has dramatically improved.

The Economic Growth and Tax Relief Reconciliation Act of 2001 provides that beginning in 2006 employees who participate in a 401(k) plan are allowed to designate part (or all) of their contributions to the plan as Roth 401(k) contributions as long as the plan has been amended to accept such contributions. Note, however, that qualified plans are not required to do this. Unlike an employee’s traditional 401(k) elective contributions, Roth 401(k) elective contributions are fully subject to tax in the year in which they are made (i.e., contributions are post-tax). However, the earnings on such contributions escape being taxed if they are not withdrawn from the 401(k) plan before the later of (a) when the account owner reaches age 59½, becomes disabled, or dies; or (b) five years after the Roth 401(k) account is first funded.

For 401(k) plans that have been amended to allow Roth contributions, the plan must track these contributions and their related earnings in an account that is separate from: (1) the employee’s regular 401(k) contributions, (2) any employer matching contributions, (3) any forfeitures allocated to the employee, and (4) the earnings thereon. Accordingly, all that will be in an employee’s Roth 401(k) account will be the employee’s own after-tax Roth contributions and the related earnings (any matching contributions made by an employer would be part of the employee’s regular 401(k) account). Unfortunately, there is currently no provision for converting existing regular 401(k) accounts into Roth 401(k) accounts. Keep in mind that this separate accounting requirement adds another layer of complexity to the qualified plan, and also increases the recordkeeping and compliance costs of the employer. Furthermore, and subject to a plan allowing it, employees may split their annual 401(k) contribution limit between regular (pretax) and Roth (post-tax) contributions, in any manner they choose, or they may make only regular or only Roth contributions.

Observation

In general, traditional 401(k) pretax contributions tend to make more sense for employees who expect their marginal tax bracket to fall in the future. Roth 401(k) post-tax contributions are more likely to be the right choice for employees who expect their marginal tax bracket to increase, or at least stay the same, in the future.

A significant advantage of Roth 401(k) accounts over Roth IRAs is that the annual contribution limit is higher for Roth 401(k) accounts ($15,000 for 2006, increased to $20,000 for individuals who will be at least 50 by the end of 2006) than for Roth IRAs ($4,000 for 2006, increased to $5,000 for individuals who will be at least 50 by the end of 2006). Also, there is no income phaseout limitation for making Roth 401(k) contributions (although the annual limits on employee contributions to 401(k) plans, including Roth 401(k) plans, apply, and the standard 401(k) nondiscrimination rules also apply, which can limit certain higher-income taxpayers’ ability to make contributions – just as the rules currently do for regular contributions). However, Roth 401(k) contributions are post-tax, so adjusted gross income is not reduced, which may cause the reduction of deductions or credits. As the saying goes, you may want to "crunch the numbers."

We have developed a comprehensive proprietary model that allows us to quantify the difference in value between traditional 401(k) and Roth 401(k) accounts. This model allows us to determine, for virtually any person, at any age, in any current (or retirement) federal tax bracket, and for any amount of annual 401(k) contributions, the projected difference in the two types of 401(k) accounts. Whether you are 25 and just getting started making 401(k) contributions, or 55 and contemplating making contributions for just a few years, our model can quantify the financial difference between the two alternatives. The difference may be much greater (or far smaller) than you envision, but having information on which to make an informed decision is the key.

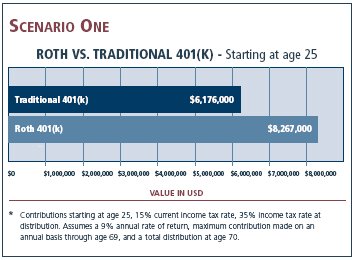

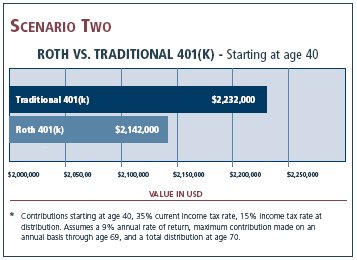

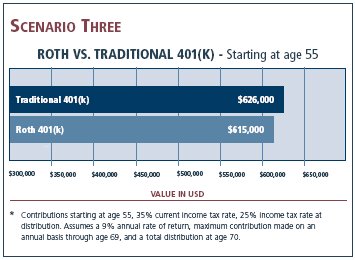

The accompanying graphs illustrate the after-tax differences between making Roth 401(k) and traditional 401(k) contributions under three different scenarios.

The graphs are not intended to cover every possible pattern of contributions or distributions, changes in current or retirement marginal federal income tax rates, or changes in the rate of return on the amounts contributed, and they are not intended to provide legal or tax advice. They are intended to be used as a guide in illustrating the range of potential differences in the net values of Roth 401(k) and traditional 401(k) accounts.

As the graphs illustrate, in the first scenario the Roth 401(k) net value is significantly higher than the traditional 401(k) net value; in the second scenario the traditional 401(k) net value is significantly higher than the Roth 401(k) net value; and in the third scenario the two net values are not significantly different.

Since there is no crystal ball to look into to determine what will happen to federal income tax rates in the future, the most prudent approach is to view your alternatives using current federal law and to modify any decision you make based on future changes in the law.

We would be delighted to perform the Roth 401(k) vs. traditional 401(k) analysis for you. Feel free to contact us for an analysis specific to your own situation.

For more information, please contact Michael A. Gillen, director of the Duane Morris Tax Accounting Group.

As required by United States Treasury Regulations, you should be aware that this communication is not intended to be used, and it cannot be used, for the purpose of avoiding penalties under United States federal tax laws.

This newsletter is for general information and does not include full legal analysis of the matters presented. It should not be construed or relied upon as legal advice or legal opinion on any specific facts or circumstances. The invitation to contact the authors or attorneys in our firm is not a solicitation to provide professional services and should not be construed as a statement as to any availability to perform legal services in any jurisdiction in which such attorney is not permitted to practice.

Duane Morris is a registered service mark of Duane Morris LLP.