With the extended filing dates for Forms 1094 and 1095, taxpayers may not receive a Form 1095-B or 1095-C from employers in time to help file taxes for 2015. However, individual taxpayers will generally not be affected by the extended deadline and should file their taxes as they normally would.

According to the IRS, "while the information on these forms may assist in preparing a return, they are not required. Like last year, taxpayers can prepare and file their returns using other information about their health insurance. Individuals do not have to wait for their Form 1095-B or 1095-C in order to file."

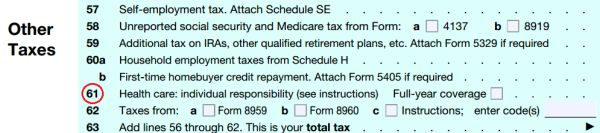

If an individual did not receive a subsidy from the exchange, there is no impact. The taxpayer can essentially check the box on line 61 of the return if he or she had insurance all year. However, if the taxpayer and family members did not have coverage for one or more months of the calendar year, they may claim an exemption or make an individual shared responsibility payment.

The forms used to help file personal taxes and who might receive them include the following:

- Form 1095-A, Health Insurance Marketplace Statement is provided by the Health Insurance Marketplace to individuals who enrolled or who have enrolled a family member in health coverage through the Marketplace. Only individuals who enroll in coverage through the Marketplace will get this form.

- Form 1095-B, Health Coverage is provided by insurance companies and other coverage providers. However, if the insurance coverage was purchased through the Marketplace or was a type of coverage referred to as "self-insured coverage" that was provided by an applicable large employer, the taxpayer will receive a different form. Individuals who have health coverage outside of the Marketplace will get this form (except for employees of applicable large employers that provide self-insured coverage, who will receive Form 1095-C instead).

- Form 1095-C, Employer-Provided Health Insurance Offer and Coverage is provided by applicable large employers to their full-time employees and, in some cases, to other employees. Individuals who work full-time for applicable large employers will get this form. Also, part-time employees will get this form if they enroll in self-insured coverage provided by an applicable large employer.

If a taxpayer is expecting to receive a Form 1095-A based upon the above description, the individual should wait to file the 2015 income tax return until that form is received. They will need the information on Form 1095-A to complete Form 8962 to reconcile any advance payments of the premium tax credit or claim the premium tax credit, and to file a complete and accurate tax return.

If you receive a Form 1095-A, Health Insurance Marketplace Statement showing that advance payments of the premium tax credit were paid for coverage for you or your family member, you generally must file an individual income tax return and submit a Form 8962 to reconcile those advance payments, even if you would not otherwise be required to file a tax return. You also must file an individual income tax return and submit a Form 8962 to claim the premium tax credit, even if no advance payments of the premium tax credit were made for your coverage.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.