On March 6, 2024, the US Securities and Exchange Commission (SEC or Commission) adopted final rules to require registrants to disclose certain climate-related information in registration statements and annual reports. The final rules reflect the culmination of a nearly two-year rulemaking effort at the SEC, which garnered an unprecedented level of public engagement and political attention, with more than 24,000 comments filed.

The 886-page final rules look very different than the March 2022 proposal. Many proposed requirements were either eliminated, qualified by the materiality standard, or streamlined in the final rule. To summarize the key highlights of the final rule:

- Scope 3 emissions are not required for any registrant.

- Scope 1 and 2 emissions are required for certain larger registrants when those emissions are material, and attestation reports will be required at different assurance levels, on a phased-in basis.

- Climate-related risks that have had or are reasonably likely to have a material impact on the registrant's business strategy, results of operations, or financial condition are required for all registrants.

- The actual and potential material impacts of any identified climate-related risks on the registrant's strategy, business model, and outlook are required for all registrants.

- Disclosure of oversight by the board of directors of climate-related risks and the role of management in assessing and managing such risks are required for all registrants.

- Financial statement footnote disclosure of capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions, subject to one percent and de minimis disclosure thresholds are required for all registrants.

SEC registrants should not be misled by the topline changes of eliminating Scope 3 emissions requirements and the addition of materiality qualifiers: the remaining disclosure obligations in the final rule represent a significant and complex expansion of disclosure requirements. Materiality determinations provide companies with flexibility, but also with the risk of being second-guessed by the SEC. Applying the materiality standard to the context of climate-related risk context will require careful consideration. Compliance with the final rule will require a commitment of time, money, and personnel, and there will be a steep learning curve for many companies.

The final rule continues to be modeled after the TCFD Framework and GHG Protocol. However, the final rules are not identical to these frameworks, or other internationally recognized reporting frameworks. Companies that report under multiple frameworks should note that their SEC-specific reporting obligations under the final rule stand-alone and will require their own controls and procedures.

This client alert provides a starting point for understanding the new disclosure obligations included in the final rule.

Legal and Political Context of Final Rule

Before diving into the details, it is important to understand the legal and political context of the final rule. A mere hours after the final rule was adopted, Attorneys General for ten states petitioned the Eleventh Circuit Court of Appeals to vacate the Commission's adoption of the rule for exceeding the Commission's statutory authority, as arbitrary and capricious, an abuse of discretion, and not in accordance with the law. It is likely that additional actors will seek to litigate the SEC's action and the rule will be evaluated by courts under the major questions doctrine and the Administrative Procedure Act (APA). The unpredictable nature of the timing and outcome of any litigation must be weighed against the final rules' compliance dates, which require some information to be collected starting in 2025 and disclosed in filings covering that fiscal year. In other words, pending litigation, absent express stay of the rule by a court, should not delay discussions at companies on how to comply with the rule.

Additionally, Senator Tim Scott (R-SC) and Representative Bill Huizenga (R-MI) immediately signaled that they will seek to rescind the rule pursuant to the Congressional Review Act. Democratic control of the Senate and White House suggests this will be a difficult hurdle.

These legal and political divisions were also observable at the Commission meeting, where the final rule was adopted 3-2. Commissioner Peirce questioned the agency's statutory authority to adopt the final rule, while Commissioner Uyeda directly questioned the Commission's action under both the major questions doctrine and the APA. Commissioner Crenshaw disagreed and asserted there is "clear legal authority" for the rule. These tensions will continue to drive actions as the final rule is litigated in courts, debated in Congress, and implemented at the SEC.

New Disclosure Obligations for SEC Registrants

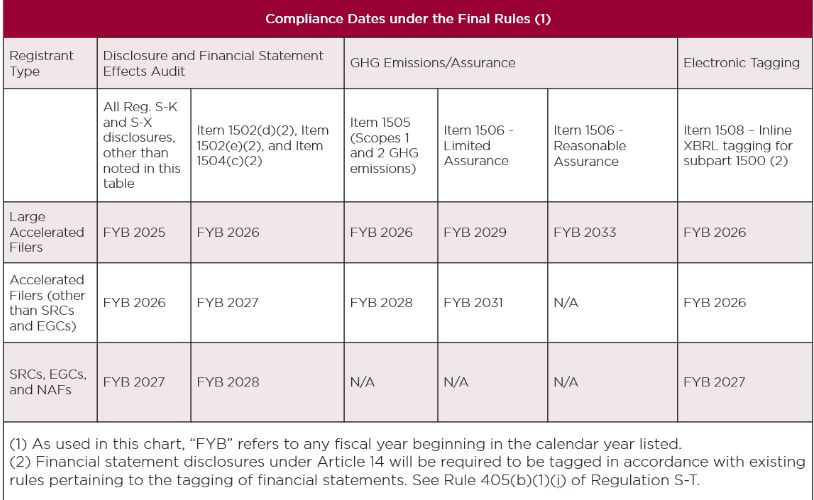

Sections 1-7 below describe many key aspects of each new disclosure obligation and highlight notable changes from the proposal. Section 8 includes a chart of important compliance dates, provided by the Commission in the final rule.

With the exception of the Scope 1 and Scope 2 emissions disclosure requirements, which are applicable to a subset of larger SEC registrants (and explained further below), the other disclosure obligations under the final rule are applicable to most SEC registrants.

Specifically, the final rule applies to all companies that file annual reports on Form 10-K or Form 20-F; or registration statements on Form 10, Form S-1, Form S-4, Form S-11, Form F-1, Form F-4, and Form 20-F. A limited exception applies to private companies that are parties to business combination transactions involving a securities offering on Form S-4 or Form F-4. Such entities will not have to comply with the rule.

Smaller reporting companies and emerging growth companies must comply with the final rule.

Foreign private issuers must also comply with the final rule, regardless of whether such issuers comply with climate-related reporting regimes in other jurisdictions. Notably, the Commission declined to adopt substituted compliance with other jurisdictions.

The final rules do not apply to asset-backed securities issuers and Canadian registrants who use the MJDS and file registration statements and annual reports on Form 40-F.

1. GHG Emissions Disclosure

Final Rule: Item 1505 of Regulation S-K requires disclosure of Scope 1 and Scope 2 emissions, if such emissions are material, for the most recently completed fiscal year, and to the extent previously disclosed in an SEC filing, for the historical years included in the consolidated financial statements in the filing. Large accelerated filers are required to include this disclosure in annual reports and registration statements covering information for fiscal year 2026. Except for smaller reporting companies and emerging growth companies, accelerated filers are required to include this disclosure in annual reports and registration statements covering information for fiscal year 2028.

Timing. To minimize difficulties in measuring and reporting GHG emissions as of fiscal year-end, the Commission permits flexibility in the timing requirements. Specifically, for disclosures in annual reports on Form 10-K, any GHG emissions metrics required to be disclosed may be incorporated by reference from the registrant's Form 10-Q for the second fiscal quarter in the fiscal year immediately following the year to which the GHG emissions metrics disclosure relates. Foreign private issuers reporting their annual report on Form 20-F, may amend their 20-F no later than 225 days after the end of the fiscal year to which the GHG emissions metrics disclosure relates. For registration statements, GHG emissions metrics must be provided as of the most recently completed fiscal year, which is at least 225 days prior to the date of effectiveness of the registration statement.

Disclosure. Disclosure should include separate Scope 1 and Scope 2 emissions, expressed in the aggregate, in terms of Co2e. If any constituent gas is individually material, disaggregated data of such constituent gas should be disclosed. Emissions should be disclosed in gross terms by excluding the impact of any purchased or generated offsets.

Item 1505(b) of Regulation S-K requires a description of the methodology, significant inputs, and significant assumptions used to calculate the registrant's disclosed GHG emissions. Specific disclosures are required to describe the organizational boundaries used by the registrant. Additionally, a brief description is required of whether the registrant calculated its GHG emissions using the GHG Protocol's Corporate Accounting and Reporting Standard, an EPA regulation, an applicable ISO standard, or another standard.

Materiality. In determining the materiality of Scope 1 and 2 emissions, the Commission states that the traditional concept of materiality under the federal securities laws applies: whether a reasonable investor would consider the disclosure important when making an investment or voting decision, or such reasonable investor would view the omission of the disclosure as having significantly altered the total mix of information made available. Notably, the Commission suggests that Scope 1 and 2 emissions may be material for a company if the registrant is exposed to a material transition risk that has manifested as a result of a requirement to report its GHG emissions metrics under foreign or state law, citing to the California laws relating to GHG emissions and the ISSB standards being adopted globally. Given the significant number of companies subject to reporting in jurisdictions that do, or soon will, require GHG emission reporting, companies should consider carefully their materiality determination under the Final Rule.

Attestation of GHG Emissions. Item 1506 requires registrants to disclose Scope 1 and/or Scope 2 emissions to include an attestation report in the filing that contains the emissions disclosure.

Large accelerated filers are required to obtain (i) limited assurance for emissions disclosed in filings covering fiscal year ending 2029; and (ii) reasonable assurance for emissions disclosed in filings covering fiscal year ending 2033.

As described above, accelerated filers, are required to obtain limited assurance for emissions disclosed in filings covering the fiscal year ending 2033. Such filers will not be required to obtain reasonable assurance.

Item 1506(b) requires that the GHG emissions attestation report must be prepared and signed by a GHG emissions attestation provider, defined as a person or firm that: (i) is an expert in GHG emissions by virtue of having significant experience in measuring, analyzing, reporting, or attesting to GHG emissions and (ii) is independent with respect to the registrant, and any of its affiliates, for whom it is providing the attestation report, during the attestation and professional engagement period. The report must be provided pursuant to standards that are established by a body or group that has followed due process procedures. The Commission views the PCAOB, AICPA, IAASB, and ISO standards meet this requirement. The final rule does not require a registrant to obtain an attestation report covering the effectiveness of internal control over GHG emissions disclosure.

If a filer that is not subject to Item 1505 of Regulation S-K voluntarily discloses emissions metrics and voluntarily receives assurance over such disclosure, Item 1506(e) requires disclosure describing the service provider, assurance standard used, level and scope of assurance services provided, results of assurance services, any material business relationships between the service provider and the registrant, and any oversight that exists of the service provider.

Notable Changes from the Proposal: The Commission determined not to require Scope 3 emissions due to concerns relating to costs, reliability, and robustness of Scope 3 emissions reporting. Accordingly, registrants are not required to disclose Scope 3 emissions under the final rule. Additionally, the Scope 1 and Scope 2 emissions disclosure requirements were streamlined from the proposal and, as opposed to being applicable to all reporting companies, are only required for large accelerated filers and certain accelerated filers as described above.

Applicability: The emissions disclosure requirements only apply to large accelerated filers and accelerated filers, other than smaller reporting companies or emerging growth companies.

Smaller reporting companies are generally operating companies that have a public float of less than $250 million; or annual revenues of less than $100 million and either no public float, or a public float of less than $700 million. Emerging growth companies are generally newly public companies with less than $1.235 billion in revenue.

2. Disclosure of Climate-Related Risks

Final Rule: Item 1502(a) of Regulation S-K requires companies to disclose any climate-related risks that have materially impacted or are reasonably likely to have a material impact on the registrant, including on its business strategy, results of operations, or financial condition. For each climate-related risk, registrants must disclose whether the risk is a physical or transition risk, providing information necessary to understand of the nature of the risk presented and the extent of the registrant's exposure to the risk. The rule provides a non-exclusive list of disclosures that must be provided, as applicable: (i) if a physical risk, whether it may be categorized as an acute or chronic risk, and the geographic location and nature of the properties, processes, or operations subject to the physical risk; and (ii) if a transition risk, whether it relates to regulatory, technological, market (including changing consumer, business counterparty, and investor preferences), or other transition related factors, and how those factors impact the registrant. Finally, for each identified risk, registrants must describe whether such risks are reasonably likely to manifest in the short-term (the next 12 months) and separately in the long-term (beyond the next 12 months).

Climate-related risks are defined as the actual or potential negative impacts of climate-related conditions and events on a registrant's business, results of operations, or financial conditions. The definition includes sub-definitions for four types of risks: physical, acute, chronic, and transition.

Physical risks include both acute and chronic risks to the registrant's business operations.

Acute risks are event-driven and may relate to shorter term severe weather events, such as hurricanes, floods, tornadoes, and wildfires, among other events.

Chronic risks relate to longer term weather patterns, such as sustained higher temperatures, sea level rise, and drought, as well as related effects such as decreased arability of farmland, decreased habitability of land, and decreased availability of fresh water.

Transition risks are the actual or potential negative impacts on a registrant's business, results of operations, or financial condition attributable to regulatory, technological, and market changes to address the mitigation of, or adaptation to, climate-related risks, including such non-exclusive examples as increased costs attributable to changes in law or policy, reduced market demand for carbon-intensive products leading to decreased prices or profits for such products, the devaluation or abandonment of assets, risk of legal liability and litigation defense costs, competitive pressures associated with the adoption of new technologies, and reputational impacts 851 (including those stemming from a registrant's customers or business counterparties) that might trigger changes to market behavior, consumer preferences or behavior, and registrant behavior.

Notable Changes from Proposal: First, the required disclosures fo rclimate-related risks are less prescriptive than the proposal. For example, while the proposal would have required the specific location of properties or operations subject to physical risk, including the zip code, the final rule provides flexibility in describing the "geographic location." The final rule does not require any specific metrics of properties located in flood hazard zones or water-stressed areas, as originally proposed. Additionally, the final rule no longer requires disclosure of climate-related opportunities. Second, the final rule requires disclosure of risks over a defined short-term and long-term horizon, contrasting with the proposal's undefined short-, medium-, and long-term time horizons.

3. Disclosure Regarding Impacts of Climate-Related Risks on Strategy, Business Model, and Outlook

Final Rule: Item 1502(b) of Regulation S-K requires companies to disclose the actual and potential material impacts of any identified climate-related risks on the registrant's strategy, business model, and outlook. The rule provides a non-exclusive list of disclosures that must be provided, as applicable: material impacts on the registrant's (i) business operations, including the types and locations of its operations, (ii) products or services, (iii) suppliers, purchasers, or counterparties to material contracts, (iv) activities to mitigate or adapt to climate-related risks, including adoption of new technologies or processes, and (v) expenditure for research and development.

Item 1502(c) of Regulation S-K requires discussion of whether and how the registrant considers any material impacts (described in response to Item 1502(b)) as part of its strategy, financial planning, and capital allocation. Disclosure must be provided, as applicable, as to (i) whether the impacts of identified climate-related risks have been integrated into the registrant's business model or strategy, including whether and how resources are being used to mitigate climate-related risks, and (ii) how any targets disclosed under the final rule relate to the registrant's business model or strategy.

Item 1502(d) of Regulation S-K requires two disclosures. First, registrants must disclose how any climate-related risks have materially impacted or are reasonably likely to materially impact the registrant's business, results of operations, or financial condition. Second, if as part of its strategy, a registrant has undertaken activities to mitigate or adapt to a material climate-related risk, a quantitative and qualitative description of material expenditures incurred and material impacts on financial estimates and assumptions that, in management's assessment, directly result from such mitigation or adaptation activities will need to be disclosed. The Commission indicates that the intent is to elicit a discussion of the financial effects of climate-related risks similar to the MD&A. There appears to be an overlap between this item requirement and Item 1502(a).

If a registrant has adopted a transition plan to manage a material transition risk, Item 1502(e) of Regulation S-K requires a description of the transition plan, and updated disclosures in the subsequent years describing the actions taken during the year under the plan, including how the actions have impacted the registrant's business, results of operations, or financial condition, and quantitative and qualitative disclosure of material expenditures incurred and material impacts on financial estimates and assumptions as a direct result of the disclosed actions. The final rule does not mandate that registrants adopt a transition plan.

If a registrant uses scenario analysis and, in doing so, determines that a climate-related risk is reasonably likely to have a material impact on its business, results of operations, orfinancial condition, Item 1502(f) of Regulation S-K requires certain disclosures regarding such use of scenario analysis. Specifically, registrants must describe each scenario, which should include a brief description of the parameters, assumptions, and analytical choices used, as well as the expected material impacts, including financial impacts, on the registrant under each such scenario.

If a registrant's use of an internal carbon price is material to how it evaluates and manages a material climate-related risk, Item 1502(g) of Regulation S-K will require disclosure in units of the registrant's reporting currency (i) the price per metric ton of CO2e and (ii) the total price, including how the total price is estimated to change over the short- and long-term. If a registrant uses more than one internal carbon price, it must provide the required disclosures for each internal carbon price, and disclose its reasons for using different prices. Further, if the scope of entities and operations involved in the use of an internal carbon price is materially different than the organizational boundaries used to calculate a registrant's GHG emissions, the registrant must briefly describe the difference.

Item 1507 of Regulation S-K provides a safe harbor for disclosures (other than historical facts) provided pursuant to the following requirements that will constitute "forward looking statements" for purposes of the PSLRA safe harbors: (i) Item 1502(e) (transition plans); (ii) Item 1502(f) (scenario analysis); (iii) Item 1502(g) (internal carbon pricing); and (iv) Item 1504 (targets and goals).

Notable Changes from Proposal: The Commission added a materiality qualifier to Item 1502(b) and removed a requirement to include material impacts on a registrant's value chain. Additionally, Final Item 1502(c) is less prescriptive than proposed and no longer requires both current and forward-looking disclosures (although both disclosures may still be necessary depending on the facts and circumstances) and eliminates the requirement to describe how any financial statement metrics or GHG emissions metrics relate to the registrant's business model or business strategy. Further, Final Rule 1502(d) no longer refers to the impact of risks on the consolidated financial statements and uses terms similar to existing MD&A requirements. Final Rule 1502(e) and 1502(f) include a materiality qualifier and less prescriptive requirements for transition plans and scenario analysis.

4. Governance Disclosure

Final Rule: Item 1501(a) of Regulation S-K requires disclosure of any oversight by the board of directors of climate-related risks. As applicable, any board committee or subcommittee responsible for the oversight of climate-related risks must be identified and the processes by which such committee or subcommittee is informed about such risks must be described. If a transition plan is disclosed pursuant to the final rule, the board must disclose whether and how it oversees progress against the target, goal or transition plan. If the board of directors does not exercise oversight of climate-related risks, no disclosure is required.

Item 1501(b) of Regulation S-K requires disclosure of management's role in assessing and managing material climate-related risks. The rule provides a non-exclusive list of disclosures that must be provided, as applicable: (i) whether and which management positions or committees are responsible for assessing and managing climate-related risks, and the relevant expertise of such persons in such detail as necessary to fully describe the nature of the expertise; (ii) the processes by which such positions or committees assess and manage climate-related risks; and (iii) whether such positions or committees report information about such risks to the board of directors or a committee or subcommittee of the board of directors.

Notable Changes from Proposal:Final Item 1501(a) eliminated proposed requirements relating to the identification of specific board members with expertise in climate-related risks, how frequently the board is informed of such risks, and information regarding how the board sets climate-related targets or goals.

5. Risk Management Disclosure

Final Rule: Item 1503 of Regulation S-K requires registrants to disclose any processes the registrant has for identifying, assessing, and managing material climate-related risks. The rule provides a non-exclusive list of disclosures that must be provided, as applicable, on how the registrant: (i) identifies whether it has incurred or is reasonably likely to incur a material physical or transition risk; (ii) decides whether to mitigate, accept, or adapt to the particular risk; and (ii) prioritizes whether to address the climate-related risk. Registrants must also disclose whether and how any process used to manage climate-related risk is integrated into the registrant's overall risk management system or processes.

Notable Changes from Proposal: Final Item 1503 includes a materiality qualifier and eliminated proposed disclosures that would have required descriptions of how the registrant determined the materiality of climate-related risks and how it weighed the relative significance of climate-related risks to other risks.

6. Targets and Goals

Final Rule: To the extent a registrant has set a climate-related target or goal that has materially affected or is reasonably likely to materially affect the registrant's business, results of operations, or financial condition, Item 1504 of Regulation S-K requires certain disclosures about such target or goal, including material expenditures and material impacts on financial estimates and assumptions as a direct result of the target, or goal or actions taken to make progress toward meeting such target or goal. Registrants will also be required to include, as applicable, a description of (i) the scope of activities included in the target; (ii) the unit of measurement; (iii) the defined time horizon by which the target is intended to be achieved, and whether the time horizon is based on one or more goals established by a climate-related treaty, law, regulation, policy, or organization; (iv) if the registrant has established a baseline for the target or goal, the defined baseline time period and the means by which progress will be tracked; and (v) a qualitative description of how the registrant intends to meet its climate-related targets or goals.

If carbon offsets or RECs have been used as a material component of a registrant's planto achieve climate-related targets or goals, then, Item 1504(d) of Regulation S-K requires the registrant to disclose (i) the amount of carbon avoidance, reduction or removal represented by the offsets or the amount of generated renewable energy represented by the RECs; (ii) the nature and source of the offsets or RECs; (iii) a description and location of the underlying projects; (iv) any registries or other authentication of the offsets or RECs; and (v) the cost of the offsets or RECs.

Notable Changes from Proposal: Final Item 1504 includes a materiality qualifier and streamlined certain requirements.

7. Financial Statement Effects

Final Rule: Rule 14-02(c) and (d) of Regulation S-X require financial statement footnote disclosure of (1) the aggregate amount of expenditures expensed as incurred and losses, excluding recoveries, incurred during the fiscal year as a result of severe weather events and other natural conditions; and (2) the aggregate amount of capitalized costs and charges, excluding recoveries, recognized during the fiscal year as a result of severe weather events and other natural conditions.

This requirement remains subject to a one percent disclosure threshold. However, Rule 14-02(b) of Regulation S-X now contains a de minimis threshold that exempts disclosure (i) if the aggregate amount of expenditures expensed as incurred and losses is less than $100,000 for the relevant fiscal year; and (ii) if the aggregate amount of the absolute value of capitalized costs and charges is less than $500,000 for the relevant fiscal year.

Rule 14-02(e) of Regulation S-X requires disclosure of the aggregate amounts of (1) carbon offsets and RECs expensed, (2) carbon offsets and RECs capitalized, and (3) losses incurred on the capitalized carbon offsets and RECs during the fiscal year. Disclosure is required if carbon offsets or RECs have been used as a material component of a registrant's plan to achieve disclosed climate-related targets or goals.

Rule 14-02(h) of Regulation S-X requires disclosure of financial estimates and assumptions used by the registrant to produce the consolidated financial statements materially impacted by severe weather events and other natural conditions or disclosed targets or transition plans.

This disclosure will be subject to the financial statement audit and registrant's internal controls over financial reporting. The Commission stated that it will work with the Public Company Accounting Oversight Board (PCAOB) to address any issues that arise.

Historical Periods. Rule 14-01(d) of Regulation S-X requires disclosure for historical fiscal year(s) included in a registrant's consolidated financial statements on a prospective basis only. Accordingly, depending on the relevant compliance date, a registrant will be required to provide disclosure for the registrant's most recently completed fiscal year for which audited financial statements are included in the filing in any filings to which the final rules apply; but registrants are not required to provide disclosure for historical fiscal years included in that filing.

Notable Changes from Proposal: The Commission significantly reduced the disclosure obligations with respect to the financial statements in the proposal. Specifically, it removed the requirement to disclose the impact of severe weather events, other natural conditions, and transition activities on each line item of a registrant's consolidated financial statements. Additionally, the final rule focuses on the required disclosure of financial statement's effects on capitalized costs, expenditures expensed, charges, and losses incurred as a result of severe weather events and other natural conditions in the notes to the financial statements. The final rule also shifted the disclosure of material expenditures directly related to climate-related activities to disclosure requirements under Regulation S-K, as opposed to Regulation S-X.

8. Compliance Dates

Below is the chart included in the final rule, explaining the relevant compliance dates.

Conclusion

SEC reporting companies must begin assessing how to comply with these rules. This primer merely scratches the surface of the number of nuanced and complex interpretive issues that will arise as companies, accountants, and lawyers process the 889 pages included in the final rule. While litigation and politics may ultimately alter the final rule's requirements, the timing and scope of any actions are too uncertain at this stage to justify the delay of compliance efforts.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.