Overview and Key Issues From 2023

During 2023, M&A activity in the United States showed some signs of rebounding from the post-pandemic cooldown. Meanwhile merger enforcement remained the subject of intense public and political focus. The Federal Trade Commission (FTC or Commission) and the Department of Justice (DOJ) continued to press an aggressive enforcement agenda, featuring envelope-pushing litigations and a decline in settlements. Yet, government enforcers continue to have an inconsistent record in front of the courts and appear willing to consider settlements to resolve already-filed litigations. The push and pull of 2023 provides several takeaways for parties considering strategic transactions in 2024:

- Revised Merger Guidelines. On December 18, 2023, DOJ and FTC published revised Merger Guidelines. These guidelines replace the 2010 Horizontal Merger Guidelines and the 2020 Vertical Merger Guidelines, which FTC (but not DOJ) had previously repealed. The guidelines reinforce the authorities' stated intention to aggressively investigate transactions they believe may substantially lessen competition, and unlike prior guidelines, offer no "safe harbors" or categories of transactions that are unlikely to raise competitive concerns (even, for example, in unconcentrated industries). The final guidelines reflect some changes from the draft guidelines released in mid-2023 — for example, while the draft guidelines set out the authorities' view that a merger should not "further a trend toward concentration," the final guidelines note that a trend towards consolidation is merely a "factor" that will be considered. The guidelines are not law and are not binding on courts; indeed, a number of ideas the guidelines advance draw upon theories that were tested and rejected by courts in prior merger challenges. It remains to be seen how courts will consider the new guidelines. In any event, the guidelines provide a picture into how the enforcers will analyze a merger and will remain important for parties wishing to avoid the cost and risk of federal litigation.

- The Authorities Saw Limited Success in Court and Accepted Settlements To Resolve Pending Litigation Challenges. FTC and DOJ saw a number of high-profile losses this year. Most notably, district courts rejected FTC and DOJ's challenges to the Meta/Within, Microsoft/ Activision, and UnitedHealthcare/Change transactions. Notably, however, both FTC and DOJ appeared to be willing to accept settlements to resolve ongoing litigations, as shown in DOJ's settlement to resolve Assa Abloy/Spectrum Brands and FTC's settlements to resolve Intercontinental Exchange/Black Knight and Amgen/Horizon, discussed below. The Assa Abloy/ Spectrum brands settlement was the first merger consent decree that the DOJ accepted since Assistant Attorney General Jonathan Kanter's January 2022 speech in which he expressed skepticism towards settlements to resolve competition issues. FTC did notch a high-profile win in a case filed before the beginning of this year when the Fifth Circuit agreed that the consummated Illumina/Grail merger substantially lessened competition — discussed in greater detail below.2

- Settlements in Advance of Litigation Continue To Be Limited. In prior administrations, most antitrust concerns with transactions were resolved through consent decrees and negotiated divestitures. However, current antitrust enforcers have publicly expressed skepticism of such resolutions. In Assistant Attorney General Jonathan Kanter's September 2023 speech, for example, the AAG claimed that "complex merger consent decrees ... often fail to protect the harm to competition from an otherwise anticompetitive merger."3 Since that time, DOJ has not resolved any merger challenges prior to litigation by consent decree. And this year, FTC only resolved one challenged transaction (Quantum/EQT) without litigation.

- New Proposed HSR Rules. This year, the authorities also announced proposed revisions to the Hart-Scott-Rodino merger notification filing process. These proposals have the potential to substantially expand the universe of ordinary course document submissions and analyses required for the filings.4 The HSR rules have not yet been finalized, although more details on the proposed rules can be found in our client Advisory.5

- FTC Leadership Changes. Several FTC staffing changes also took place this year. Commissioner Wilson stepped down from her position on March 31, 2023. When she announced her intent to resign on February 14, 2023, she expressed her concern about the direction of FTC and Chair Khan's participation in FTC's challenges involving Facebook, given Chair Khan's prior work and public statements.6 Since her resignation, FTC has been led by three Democratic Commissioners. The president nominated two Republican Commissioners, Melissa Holyoak and Andrew Ferguson, on July 3, 2023, but they have not been confirmed by the Senate. FTC Bureau of Competition Director Holly Vedova retired in August 2023. Shortly thereafter, FTC announced the appointment of its new Bureau of Competition Director, Henry Liu, a former partner at Covington & Burling LLP.7

- FTC's Ability To Bring Cases Was Under Attack on Multiple Fronts. This past year, the Supreme Court heard the Axon case and ruled, in a 9-0 decision, that parties may raise collateral attacks on FTC administrative procedures without exhausting that administrative procedure.8 The merits of Axon's challenge will not proceed in court, however, as FTC abandoned its challenge to the merger.9 Axon was not alone in raising constitutional challenges. The FTC scored a win in the Fifth Circuit, which rejected challenges to the FTC's structure and in-house proceedings, concluding that "Illumina's constitutional challenges to the FTC's authority are foreclosed by binding Supreme Court precedent."10 Other attacks remain pending in the district courts or were left unresolved. Meta challenged the constitutionality of FTC Commissioners' adjudication of a unilaterally reopened proceeding from 2020,11 and U.S. Anesthesia Partners filed a motion to dismiss in the District of Texas challenging the FTC's ability to bring a standalone enforcement action in federal court without first initiating an administrative proceeding.12 Intercontinental Exchange also raised constitutional challenges to FTC's structure and proceedings in its affirmative defenses when responding to FTC's motion for a preliminary injunction, and FTC moved to strike Intercontinental's "constitutional defenses" as "immaterial and impertinent." The FTC's challenge was settled before the court decided the motion to dismiss.13 Meanwhile, challenges to the structure of SEC's administrative forum, which are broadly similar, are proceeding before the Supreme Court, and oral arguments were held on November 29, 2023.14 Needless to say, if one or more of these actions are successful on the merits, FTC may be substantially hindered from enforcing the antitrust laws without legislative changes.

2023 by the Numbers

Industry sources have observed that merger and acquisition activity in 2023 was down globally, but showed some signs of a rebound in the United States, following a spike in 2021 and a subsequent drop in 2022.15 Overall, M&A activity translates imperfectly to merger review activity, but we know that the Premerger Notification Office has received about 152 HSR filings per month in 2023 through November.16 This is slightly lower than monthly figures in 2020 and 2021.

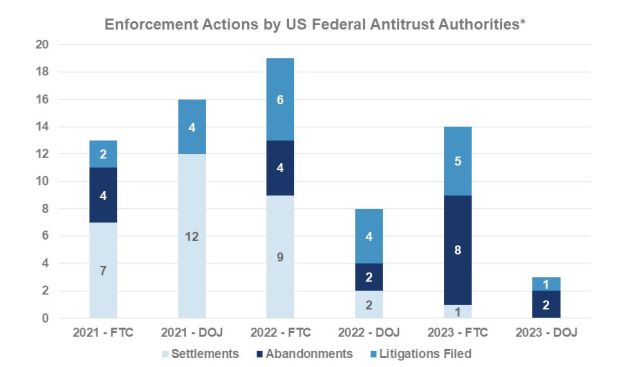

Merger enforcement actions (litigations, forced abandonments, and settlements by consent decree) have likewise continued to decrease year-over-year. This decrease in enforcement actions may be attributable to a number of causes including ordinary variance from year to year and the possibility that lengthier investigations are creating a "lag" between deal announcement and court challenge.

* Includes all merger-related actions taken by FTC and DOJ (including consent decrees, litigation in federal district court, and FTC administrative proceedings), as well as mergers abandoned due to agency concerns or abandoned non-public mergers which FTC credited to the agencies' investigations. Excludes matters pending from the prior year, HSR violation enforcement, enforcement of prior consent decree, CID enforcement, and challenges pursued by other enforcers or private parties.

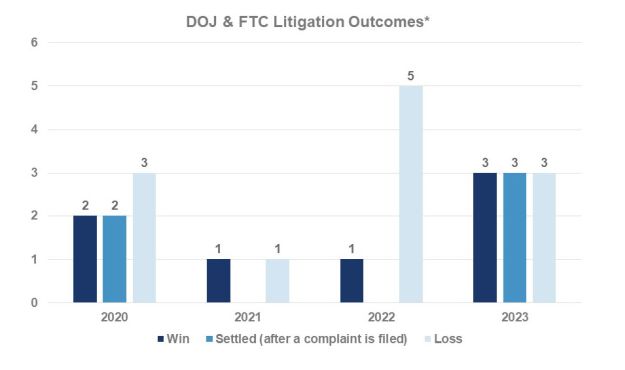

FTC and DOJ saw mixed results in court last year. Although a number of transactions were abandoned under the pressure of litigation (either before or after a complaint was filed), only a handful of cases were litigated. In 2023, courts issued six substantive decisions resulting in three victories and three losses for enforcers. A substantive decision by a court is, for example, the grant or denial of a temporary restraining order, preliminary injunction, or motion to dismiss. Three cases were settled without a substantive decision. Two cases were abandoned after a complaint was filed.

* Outcomes are tracked based on the date of a substantive decision by the district court or FTC administrative law judge; they are not based on the filing date of the complaint. A "win" includes decisions by district courts and administrative law judges favorable to the agencies such as the grant of a temporary restraining order or preliminary injunction, or a denial of a motion to dismiss. Decisions favorable to the parties are counted as "losses." "Settled" cases include cases resolved by the parties after litigation is underway; this number does not include cases in which a settlement is reached without litigation and is then filed contemporaneously with the complaint. Pending cases, abandonments before a substantive decision was made, and appeals are not included.

Last year underscored the authorities' willingness to pursue novel claims in merger challenges, and might also suggest that such an approach might simultaneously embolden parties to continue to litigate to defend their transactions. But, as you can see in the following tables, it is difficult to quantify this trend. The number of deals abandoned after a complaint appears to ebb and flow year-to-year, while the number of transactions settled has fallen, and the number of transactions abandoned has risen again after a two-year lull.

| Deals

Abandoned After a complaint is filed, as a percentage of all complaints filed |

|||

| 2020 | 2021 | 2022 | 2023 |

| 4 (33.33%) |

1 (16.67%) |

5 (50%) |

2 (33.33%) |

| Settlement

Timing As compared to complaint filing, as a percentage of all settlements that year |

||||

| 2020 | 2021 | 2022 | 2023 | |

| Before or contemporaneously with complaint | 22 (91.67%) |

19 (100%) |

11 (100%) |

1 (25%) |

| After complaint or arbitration filed | 2 (8.33% |

0 (0%) |

0 (0%) |

3 (75%) |

To read this article in full, please click here.

Footnotes

1. The authors thank Jennifer Chang and Alejandra Uria for their valuable contributions. Alejandra Uria is not admitted to the practice of law in any state.

2. Illumina Inc. v. FTC, 88 F.4th 1036 (5th Cir. Dec. 15, 2023).

3. Jonathan Kanter, Assistant Attorney General, Dep't of Justice, Remarks at the 2023 Georgetown Antitrust Law Symposium (Sept. 19, 2023).

4. Press Release, Fed. Trade Comm'n, FTC and DOJ Propose Changes to HSR Form for More Effective, Efficient Merger Review (June 27, 2023).

5. Debbie Feinstein, C. Scott Lent, & Peter G. Danias, "FTC Proposes Substantial Revisions to HSR Form as Part of Increasing Aggressiveness Against Transactions," Arnold & Porter LLP (July 5, 2023).

6. Christine Wilson, Opinion, "Why I'm Resigning as an FTC Commissioner," Wall St. J. (Feb. 14, 2023); Fed. Trade Comm'n, Letter of Resignation by Commission Christine S. Wilson (Mar. 2, 2023).

7. Press Release, Fed. Trade Comm'n, FTC Chair Khan Names Henry Liu as the Agency's Bureau of Competi- tion Director (Aug. 22, 2023).

8. Veronica E. Callahan, Ryan Hartman et al., "Supreme Court Deals Another Blow to SEC by Allowing Collateral Attacks on Administrative Proceedings to Proceed in Federal Court," Arnold & Porter LLP (Apr. 25, 2023); Sonia Kuester Pfaffenroth, Matthew Tabas, and Brian E. Auricchio, "Antitrust Agency Insights: Developments at the U.S. Antitrust Enforcement Agencies — Second Quarter 2023," Arnold & Porter LLP (July 6, 2023).

9. Order, Axon Enter. Inc. v. FTC, No. 2:20-cv-00014 (D. Ariz. Oct. 11, 2023), ECF No. 63.

10. Opinion, Illumina Inc. v. FTC, 88 F.4th 1036 (5th Cir. Dec. 15, 2023).

11. Complaint, Meta Platforms Inc. v. FTC, No. 1:23-cv-03562 (D.D.C. Nov. 29, 2023), ECF No. 1.

12. Motion to Dismiss, FTC v. U.S. Anesthesia Partners Inc., No. 4:23-cv-03560 (S.D. Tex. Nov. 20, 2023), ECF No. 99.

13. Plaintiff's Motion to Strike Defendants' Affirmative Defenses, FTC v. Intercontinental Exchange Inc., No. 3:23-cv-01710 (N.D. Cal. May 16, 2023).

14. See SEC v. Jarkesy, No. 22-859 (U.S. argued Nov. 29, 2023).

15. Anirban Sen & Anousha Sakoui, "Dealmakers See Rebound After US Activity Buoys Global M&A Volumes," Reuters (Sept. 29, 2023); Michael J. de la Merced, DealBook Newsletter: The State of Deals, N.Y. Times (Dec. 28, 2023).

16. Fed. Trade Comm'n, "Premerger Notification Program."

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.