In Short

The Situation: On December 14, 2022, the Securities and Exchange Commission ("SEC") adopted final rules that significantly alter the ways in which directors and officers adopt and utilize Rule 10b5-1 plans and enhance issuers' disclosure obligations with respect to these plans. The SEC's final rules adopt previously proposed amendments, which were discussed in our December 2021 Alert, but include several significant modifications.

The Result: The final rules institute additional Rule 10b5-1 trading plan conditions for an insider to benefit from the affirmative insider trading defense afforded by the rule, including mandatory cooling-off periods, prohibitions on overlapping plans, and single-trade plan limitations. The SEC did not extend the conditions to issuers, but indicated that this matter remains under consideration. The final rules also require new disclosure about issuers' insider trading policies, the use of trading plans, and stock option grant timing vis-à-vis corporate disclosures.

Looking Ahead: The final rules become effective 60 days after publication in the Federal Register, with compliance for Forms 4 and 5 amendments required for filings on or after April 1, 2023. New periodic report and proxy/information statement disclosure requirements will be effective in the first full fiscal period beginning on or after April 1, 2023. Smaller reporting companies are provided an additional six months to comply.

Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"), provides issuers and corporate insiders with an affirmative defense to insider trading claims if a person trades—subject to certain conditions—pursuant to a binding contract, an instruction to another to execute the trade for the person's account, or a written plan, in each case adopted in good faith and when the person is not aware of material nonpublic information ("MNPI"). Noting various constituencies' concerns that insiders may opportunistically trade on the basis of MNPI while benefitting from the protections of Rule 10b5-1, the SEC's final rules deploy new conditions for reliance on Rule 10b5-1. The final rules include several significant modifications to the SEC's original proposed rules in response to comments on the proposed rules, including those submitted by Jones Day.

New Conditions for Affirmative Defense for Rule 10b5-1 Plans

The final rules impose new conditions that must be met for use of the Rule 10b5-1 plan affirmative defense. Specifically:

- For directors and officers (defined as "officers" under Rule 16a-1(f) of the Exchange Act), the cooling-off period will be the later of (i) 90 days following plan adoption or modification and (ii) two business days following disclosure in a Form 10-Q, Form 10-K, and, for foreign private issuers, Form 20-F or Form 6-K, that discloses the issuer's final results for the fiscal quarter in which the Rule 10b5-1 plan was adopted (not exceeding 120 days) before any trading can commence under the plan. For persons other than directors and officers, the cooling-off period will be 30 days. Although the new cooling-off periods apply to both the adoption and modification of Rule 10b5-1 plans, the final rules clarify that a new cooling-off period is not triggered by a modification that does not change certain core terms—e.g., price or price ranges for sales or purchases, amount of securities to be sold or purchased, or the timing of the transactions (or formulae, algorithms, or programs that affect the core terms).

- Directors and officers must certify, at the time of adopting a new or modified Rule 10b5-1 plan, that (i) they are not aware of MNPI about the issuer or its securities and (ii) they are adopting the plan in good faith and not as part of a plan or scheme to evade the prohibitions of Exchange Act Section 10(b) or Rule 10b-5. This certification must be included in the Rule 10b5-1 plan itself rather than delivered as a separate certification to the issuer as originally proposed. In addition, the final rules condition the affirmative defense on insiders having "acted in good faith with respect to" their Rule 10b5-1 plans, which deviates from the requirement that plans be "operated in good faith" included in the proposing release. The adopting release for the final rules identifies a number of scenarios in which an insider may not have acted in good faith, including when the insider, while in possession of MNPI, induces the issuer to publicly disclose the MNPI in a manner that makes the insider's trades under Rule 10b5-1 more profitable (or less unprofitable). In addition, the final rules condition the affirmative defense on insiders having "acted in good faith with respect to" their Rule 10b5-1 plans, which modified the original proposal that plans be "operated in good faith."

- For all persons other than issuers, the final rules restrict the use of multiple overlapping Rule 10b5-1 plans, conditioning the affirmative defense on a person not having an outstanding, or subsequently entering into an additional, Rule 10b5-1 plan for open market trades that would qualify for the affirmative defense for transactions during the same period. Similarly, for all persons other than issuers, the final rules preclude reliance on the affirmative defense with respect to a plan designed to effect a purchase or sale in a single transaction (a "single-trade plan") if that person has, during the prior 12-month period, adopted another single-trade plan that was also eligible to receive the affirmative defense. In a deviation from the proposed rules, the final rules incorporate certain limited exceptions to these restrictions for transactions that the SEC identified as unlikely to raise manipulation concerns—most importantly, both restrictions exempt qualified "sell-to-cover" transactions to satisfy tax withholding obligations related to equity awards over which the person does not exercise timing control.

Impact on Existing Rule 10b5-1 Plans

The final rules will not affect the affirmative defense available under an existing Rule 10b5-1 plan entered into prior to the effective date of the final rules, except to the extent that the core terms of such a plan are subsequently modified or changed after the effective date.

New and Enhanced Disclosure Requirements

The final rules also adopt more frequent and comprehensive disclosure requirements with respect to directors' and officers' use of Rule 10b5-1 plans, issuer's insider trading policies, and issuers' granting of certain equity compensation awards. Specifically:

- Newly adopted Regulation S-K, Item 408(a) will require issuers to provide quarterly disclosure of the adoption or termination of any Rule 10b5-1 plan and/or any other "non-Rule 10b5-1 trading arrangement" (pre-planned trading contracts, instructions, or plans not intended to benefit from Rule 10b5-1's affirmative defense) by directors and officers, including whether any plan or arrangement is intended to qualify for the affirmative defense under Rule 10b5-1. In addition, issuers must disclose the material terms—other than price information—with respect to Rule 10b5-1 plans and non-Rule 10b5-1 trading arrangements, including the director's and officer's name and title, the date of adoption or termination, the duration of the plan or arrangement, and the aggregate number of securities to be purchased or sold. Because any modification or change to the core terms of a Rule 10b5-1 plan by a director or officer would be deemed to constitute a termination of an existing plan and the adoption of a new plan, any such modifications would also trigger Item 408(a) disclosure.

- Newly adopted Regulation S-K, Item 408(b) will require issuers to provide annual disclosure identifying whether the issuer has adopted insider trading policies or procedures and, if not, explaining why it has not. Pursuant to new amendments to Regulation S-K, Item 601, an issuer will also be required to file a copy of its insider trading policy as an exhibit to its Form 10-K or Form 20-F, as applicable.

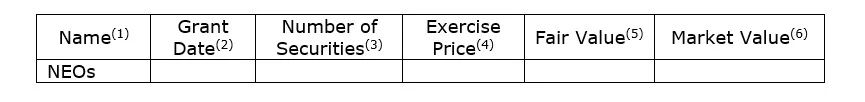

- In response to the SEC's long-standing concerns regarding "spring-loading" (the granting of stock options, stock appreciation rights, or similar awards in the lead-up to a positive announcement) and "bullet-dodging" (delaying the granting of stock options, stock appreciation rights, or similar awards until after a negative announcement), the final rules adopted new Regulation S-K, Item 402(x), which requires narrative disclosure in annual reports and proxy statements regarding policies and practices for the timing of stock option, stock appreciation right, or similar award grants relative to the release of MNPI as well as award-by-award tabular disclosure with respect to awards made to named executive officers in the four business days preceding or one business day following the filing of any periodic report or the filing or furnishing of any Form 8-K that discloses MNPI (other than a current report on Form 8-K disclosing a material new option award under Item 5.02(e) of the form). The tabular disclosure must include the percentage change in the market price of the securities underlying the awards between one trading day before and one trading day after the release of the MNPI. A template for this table is provided below:

(1) This column should list the names of the named executive officers receiving the award.

(2) This column represents the original grant date of the award to the named executive officer.

(3) This column represents the number of securities underlying the award to the named executive officer.

(4) This column represents the exercise price per share.

(5) This column represents the grant date fair value of each award computed using the same methodology as used for the issuer's financial statements under generally accepted accounting principles.

(6) This column represents the change in the stock price of the underlying securities between the closing market price of the security one business day before and one business day after disclosure of the MNPI.

- The new Item 408 and 402(x) disclosures must be iXBRL tagged and will be subject to the certifications made by an issuer's principal executive and financial officers under the Sarbanes-Oxley Act of 2002.

Changes to Form 4 and Form 5

- The final rules require directors and Section 16 officers to use new checkbox disclosure to identify on Forms 4 or 5 whether any reported transaction was executed pursuant to a Rule 10b5-1 plan and to disclose in the "Explanation of Responses" section the date of adoption of the plan.

- In addition, dispositions of bona fide gifts of securities that were previously reportable on a Form 5 (or voluntarily before the Form 5 deadline on a Form 4) must now be reported within two business days on a Form 4, but acquisitions of bona fide gifts of securities may still be reported on a Form 5. Further, the SEC clarified that the Rule 10b5-1 affirmative defense is available for bona fide gifts of securities, and that a gift of securities made with the knowledge that the donee will soon sell the securities should be viewed as in effect a sale of the securities for cash followed by a gift of the cash.

The full release detailing the new rules can be found on the SEC's website.

Five Key Takeaways

- The SEC's Division of Enforcement has conducted multiple investigative sweeps focused on Rule 10b5-1 plans, including as recently as this year following the initial rule proposal in December 2021. In light of the perceived abuses highlighted in the adopting release, issuers and individuals should expect additional enforcement attention in this area, including following the effectiveness of the final rules.

- Individuals planning to sell or gift securities pursuant to Rule 10b5-1 plans should consider how the new cooling-off periods will impact the timing of anticipated trading activity, including sales under Rule 10b5-1 and potential discretionary sales. Notably, for directors and officers, the cooling-off period extends to the later of (i) 90 days following plan adoption or modification and (ii) two business days following the filing of the Form 10-Q or Form 10-K (or Form 20-F or Form 6-K, in the case of foreign private issuers) disclosing the issuer's quarterly results.

- Issuers should review their current insider trading policies and consider what changes should be made in light of the final rules, including adding language regarding cooling-off periods applicable to Rule 10b5-1 plans and addressing the application of their policies to bona fide gifts by directors and officers.

- Issuers will need to prepare for enhanced disclosure requirements, including establishing robust additional policies and procedures related to Rule 10b5-1 plans of their directors and officers, and may reevaluate granting practices regarding option and option-like equity awards in light of the newly adopted disclosure requirements.

- It remains possible that additional rulemaking affecting issuers is on the horizon, in light of statements throughout the adopting release about the need for further evaluation of additional regulatory action applicable to issuer activities.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.