On November 15, 2022, the U.S. Securities and Exchange Commission's Division of Enforcement (the "Division") announced its enforcement results for fiscal year 2022 ("FY 2022").1 While there was only a modest increase in the overall number of enforcement actions brought by the agency, 6.5% over fiscal year 2021 ("FY 2021"), monetary sanctions increased sharply, to a record $6.4 billion, a 67% increase over FY 2021.

The actions highlighted by the SEC in its press release continue to provide valuable insights into evolving trends and areas of continued enforcement focus. Digital assets remained in the spotlight in FY 2022, while the focus on Special Purpose Acquisition Companies ("SPACs") in FY 2021 has been replaced by a growing trend of actions involving recordkeeping violations, environmental, social, and governance ("ESG") issues, cybersecurity, and private funds.

The results for this second year under the Biden administration, and the first full fiscal year under Chair Gary Gensler, return to near pre-COVID-19 pandemic levels, although the number of actions continues to be relatively low overall by recent historical standards.

FY 2022 Statistics

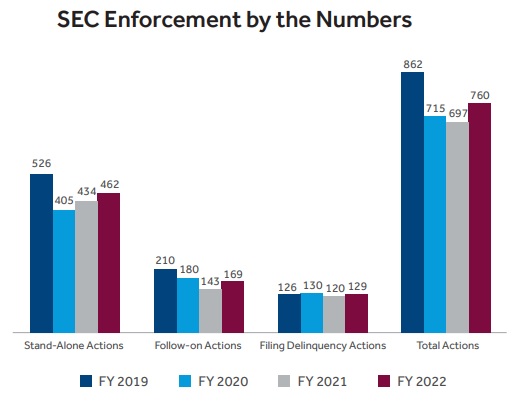

The SEC brought 462 new stand-alone enforcement actions in FY 2022, a 6.5% increase over FY 2021. New actions remain below pre-pandemic levels, but there have been increases of similar magnitude for two years in a row, potentially signaling a return to Obama-era enforcement levels. The numbers of "follow-on" administrative proceedings and actions against issuers who were delinquent in making required filings with the SEC, as well as total actions, have all increased for the first time in three years.

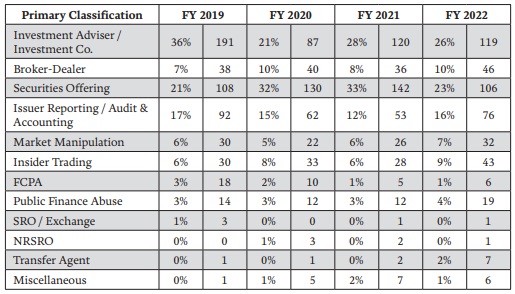

Three types of actions continued to constitute the majority of stand-alone actions brought during FY 2022:

- Investment adviser and investment company matters (26% of the total);

- Securities offering matters (23% of the total); and

- Issuer reporting/accounting and auditing matters (16% of the total).

There were, however, some significant year-over-year increases involving several types of actions, including issuer reporting/accounting and auditing matters (43% increase), insider trading (54% increase), and broker-dealer matters (28% increase). On the other hand, securities offering matters decreased 34% year-over-year, likely reflecting the reduced focus on retail fraud as compared to the Clayton administration. There were six FCPA matters brought in FY 2022, which continued to trend lower than recent averages.

Standalone Enforcement Actions by Primary Classification

"The results for this second year under the Biden administration, and the first full year under Chair Gary Gensler, return to near pre-COVID-19 pandemic levels, although the number of actions continues to be relatively low overall by recent historical standards."

The increased level of activity in insider trading and issuer reporting/accounting and auditing matters aligns with some of the recent high-profile cases brought by the SEC, including the first-ever insider trading case involving cryptocurrencies,2 an insider trading case charging a former member of Congress,3 and the largest-ever penalty imposed by the SEC against an accounting firm.4

The Division's Trial Unit conducted 15 trials during FY 2022, a high for the last ten years. The Commission won favorable verdicts in 12 of those cases, a record suggesting that the Commission can be beaten at trial in certain cases.

Largest Penalty Total by Far in SEC History

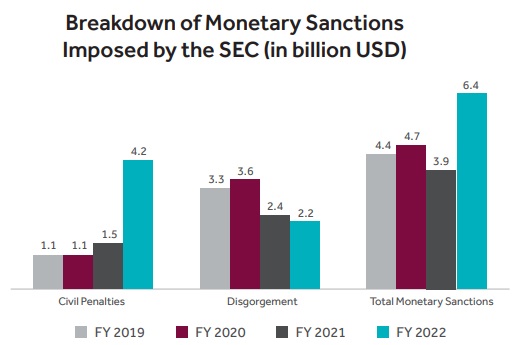

Although the total number of actions increased only modestly, the Commission imposed a record $6.4 billion in monetary sanctions in FY 2022, the most in the SEC's history, including $4.2 billion in penalties and $2.2 billion in disgorgement. As shown below, while disgorgement continued to decline, penalties increased almost threefold from FY 2021, setting another record for the Commission. Indeed, FY 2022 marks the first time in SEC history that penalties exceeded the amount of disgorgement imposed.

This marked increase in penalties and total monetary sanctions underscores the SEC's willingness to use "every tool in [its] toolkit," including "penalties that have a deterrent effect and are viewed as more than the cost of doing business."5 Perhaps in recognition of this, Enforcement Director Gurbir Grewal noted that the SEC may not break monetary relief records each year, because the Division expects "behaviors to change. [It] expects compliance."6

In addition, the SEC's press release highlighted that in several actions, the Commission "recalibrated" penalties and combined them with prophylactic remedies, such as retention of independent compliance consultants and admissions, to "deter future misconduct and enhance public accountability[.]"

While the total value of monetary sanctions imposed is significant, it must be noted that approximately $1.1 billion of the $4.2 billion total came in a single investigative sweep relating to recordkeeping violations at multiple Wall Street firms, with the resulting 11 settlements filed together during the last week of the agency's fiscal year.7

Focus Areas

As noted above, the SEC's press release highlighted the Commission's actions targeting broker-dealer (and one investment adviser) recordkeeping violations involving "off channel" business communications, as well as actions related to digital assets, ESG, cybersecurity, and private funds. For reasons discussed below, we expect to see continued activity in these areas in the new fiscal year.

Recordkeeping Violations by Regulated Entities

Recordkeeping violations received significant attention during FY 2022, primarily due to high-profile actions against many of the largest Wall Street firms following an investigative sweep relating to the preservation and supervision of business-related communications on personal devices.8 The SEC's FY 2022 announcement specifically called out actions against 16 broker-dealers and one investment adviser for "widespread and longstanding failures to maintain and preserve work-related text message communications conducted on employees' personal devices." The Commission imposed a $125 million penalty against one broker-dealer in December 2021,9 and during the last week of FY 2022 announced charges against 16 other prominent Wall Street firms, imposing combined penalties of more than $1.1 billion for similar recordkeeping violations.10 In each case, the respondents admitted to the violations and agreed to "undertakings designed to remediate past failures and prevent future misconduct." We expect continued enforcement attention in this area as companies increasingly integrate evolving technology into their communications in light of the remote work environment. Indeed, several large asset management firms recently disclosed that they are responding to another wave of SEC requests relating to electronic communications.11

Digital Assets

In May 2022, the SEC announced an addition of 20 positions to its Crypto Assets and Cyber Unit, which nearly doubled the unit's size.12 Notably, crypto assets have continued to garner significant enforcement attention in FY 2022. In February, the Commission settled an administrative proceeding against BlockFi, a cryptocurrency trading and lending platform, finding that BlockFi sold unregistered securities and failed to register as an investment company.13 Recent enforcement actions in the crypto area also included proceedings against several individuals responsible for a blockchain-based pyramid scheme,14 and the Commission's first insider trading case involving digital assets against Ishan Wahi and his associates, which was accompanied by a parallel criminal case by the Department of Justice.15

ESG

In parallel with multiple recent proposed rules addressing ESG concerns, the Commission brought several ESG-related actions in FY 2022. For example, the Commission imposed a $1.5 million penalty against BNY Mellon Investment Advisor, Inc. for ESG-related misstatements regarding investment quality review for mutual funds.16 The SEC also brought enforcement actions against Vale S.A., one of the world's largest iron ore producers for ESG misstatements,17 and Wahed Invest, LLC, a robo-adviser,18 for failing to adopt and implement adequate policies and procedures to monitor its ESG strategy. The press release for the year-end results highlighted that the Division has "focused attention on [ESG] issues with respect to public companies and investment products and strategies" and "applies time-tested principles concerning materiality, accuracy of disclosures, and fiduciary duty" in evaluating ESG claims. ESG is a quickly growing area of investment activity and one that the SEC will continue to be focused on in FY 2023.

Cybersecurity

Cybersecurity was another area of focus for the SEC in FY 2022. Again, in parallel with proposed rules, the Commission brought enforcement actions concerning failures to comply with recordkeeping and customer information safeguarding obligations. The SEC's year-end press release highlighted the agency's actions against several financial institutions concerning insufficient policies and procedures related to identity theft19 and failure to protect customers' personal identifying information.20

"Recordkeeping violations received significant attention during FY 2022, primarily due to high-profile actions against many of the largest Wall Street firms following an investigative sweep relating to the preservation and supervision of business-related communications on personal devices."

Private Funds

Consistent with Chair Gensler's stated emphasis on enforcement in the private fund space,21 the SEC brought a number of actions against private fund advisers in FY 2022 concerning fraudulent concealment of risks, misappropriation of investor funds, and misrepresentation of fund performance, fees, and expenses. These actions followed a January 2022 Risk Alert published by the Division of Examinations that identified four categories of deficiencies related to private fund adviser compliance issues.22 The Division also brought actions against an investment adviser and associated portfolio managers concerning an options trading strategy23 and against private fund advisers for violations of the Custody Rule, misrepresenting fund performance, and misusing investor funds. In addition, the SEC charged an investment adviser in a matter involving management fee offsets.24 In another example, the SEC filed a settled action against the Infinity Q Diversified Alpha Mutual Fund for mispricing its net asset value as part of an overvaluation scheme.25

Gatekeepers

In addition to the areas of focus discussed above, the SEC continued to target perennial areas of enforcement. The SEC brought a series of actions against so-called "gatekeepers"– i.e., auditors and lawyers – for "failing to live up to their heightened trust and responsibility." Specifically, the FY 2022 press release highlighted several significant actions against auditors, including, but not limited to, charges against the China-based affiliate of Deloitte for failure to comply with U.S. auditing requirements concerning audits of U.S. issuers and foreign companies listed on U.S. exchanges.26 The Deloitte action called out certain actions by the auditor, such as allowing clients to select their own samples for testing and prepare their own audit documentation. We expect the focus on auditors to be magnified in light of the newly revitalized Public Company Accounting Oversight Board, which is likely to be much more active in the enforcement space, not least because its current Chair is a former SEC enforcement trial attorney.

The FY 2022 press release also noted both settled and litigated proceedings against lawyers in fraudulent securities offerings,27 and it highlighted an action against a "recidivist" transfer agent for violating a previously imposed associational bar.28 While such enforcement actions are not new or unusual, the Commission appears to have highlighted them to send a broader message that this area remains a focus.

Individual Accountability

The SEC's press release identified "individual accountability" as a "pillar" of the SEC's enforcement program, and FY 2022 results seem to bear this out: more than two-thirds of the stand-alone enforcement actions during the fiscal year involved at least one individual, though this is down from levels in recent years.

In addition to highlighting actions against public company executives and senior personnel in the financial industry, the press release noted actions brought under Section 304 of the Sarbanes-Oxley Act of 2002 in which the SEC ordered a number of executives to return bonuses and compensation in light of misconduct at their firms, even though they were not charged in those actions or otherwise responsible for the misconduct. For example, in August 2022, the SEC ordered three former executives of an infrastructure company to return nearly $2 million in bonuses following their company's restatement of its financial results due to misconduct by another former official.29

Whistleblower Protections

Following a record-breaking year for whistleblower activity in FY 2021, the SEC in FY 2022 issued 103 whistleblower awards. These totaled approximately $229 million, a 59% decrease in amounts awarded. FY 2022 was nonetheless the SEC's second highest year in terms of both award amounts and the number of individual awards. The press release also highlighted that the Whistleblower Program received a record high number of tips – 12,300 – during the fiscal year. These results demonstrate the health of the Whistleblower Program and seem to indicate that the SEC has succeeded in its efforts to incentivize reporting.

Conclusion

While enforcement activity continued to increase in FY 2022, it still remains below pre-pandemic levels. On the other hand, the SEC is increasing its focus on a number of key industries, issues, and initiatives. The recent troubles in the crypto world may yield more enforcement actions in FY 2023, and it is already clear that the SEC is continuing to focus on the recordkeeping, ESG, and cybersecurity issues. Looking ahead to FY 2023, considering these priorities and the SEC's continued commitment to robust enforcement in more traditional cases concerning insider trading and financial reporting and accounting, we expect that the SEC's level of enforcement activity will grow, penalties will continue to be high, and the aggressive enforcement environment will continue.

Footnotes

1. Press Release, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022), https://www.sec.gov/news/press-release/2022-206.

2. See Debevoise FinTech Blog, New DOJ and SEC Insider Trading Actions Fail to Clarify Issue of Digital Assets as Securities (Aug. 3, 2022), https://www.debevoisefintechblog.com/2022/08/03/new-doj-and-sec-insider-trading-actions-fail-to-clarify-issue-of-digital-assets-as-securities/.

3. See Debevoise Insider Trading Disclosure Update, Vol. 8, Issue 1 (Sept. 29, 2022), https://www.debevoise.com/insights/ publications/2022/09/insider-trading-disclosure-update-volume-8.

4. Press Release, Ernst & Young to Pay $100 Million Penalty for Employees Cheating on CPA Ethics Exams and Misleading Investigation (June 28, 2022), https://www.sec.gov/news/press-release/2022-114.

5. Press Release, SEC Announces Enforcement Results for FY22 (Nov. 15, 2022), https://www.sec.gov/news/press-release/2022-206.

6. Id.

7. Press Release, SEC Charges 16 Wall Street Firms with Widespread Recordkeeping Failures (Sept. 27, 2022), https://www.sec.gov/news/ press-release/2022-174.

8. See Chris Prentice, SEC scrutiny into Wall Street communications shifts to investment funds – sources, Reuters (Oct. 11, 2022), https://www.reuters.com/business/sec-scrutiny-into-wall-street-communications-widens-investment-funds-sources-2022-10-11/.

9. Press Release, JPMorgan Admits to Widespread Recordkeeping Failures and Agrees to Pay $125 Million Penalty to Resolve SEC Charges (Dec. 17, 2021), https://www.sec.gov/news/press-release/2021-262.

10. Press Release, SEC Charges 16 Wall Street Firms with Widespread Recordkeeping Failures (Sept. 27, 2022), https://www.sec.gov/news/ press-release/2022-174.

11. See Chris Prentice, SEC scrutiny into Wall Street communications shifts to investment funds – sources, Reuters (Oct. 11, 2022), https://www.reuters.com/business/sec-scrutiny-into-wall-street-communications-widens-investment-funds-sources-2022-10-11/.

12. Press Release, SEC Nearly Doubles Size of Enforcement's Crypto Assets and Cyber Unit (May 3, 2022), https://www.sec.gov/news/press-release/2022-78.

13. Press Release, BlockFi Agrees to Pay $100 Million in Penalties and Pursue Registration of its Crypto Lending Product (Feb. 14, 2022), https://www.sec.gov/news/press-release/2022-26. See also Debevoise FinTech Blog, Will the SEC Let BlockFi Register Digital Asset Interest Accounts? (May 10, 2022), https://www.debevoisefintechblog.com/2022/05/10/digital-asset-interest-accounts-and-the-sec/.

14. Press Release, SEC Charges Eleven Individuals in $300 Million Crypto Pyramid Scheme (Aug. 1, 2022), https://www.sec.gov/news/press-release/2022-134.

15. See Debevoise FinTech Blog, New DOJ and SEC Insider Trading Actions Fail to Clarify Issue of Digital Assets as Securities (Aug. 3, 2022), https://www.debevoisefintechblog.com/2022/08/03/new-doj-and-sec-insider-trading-actions-fail-to-clarify-issue-of-digital-assets-as-securities/.

16. Press Release, SEC Charges BNY Mellon Investment Adviser for Misstatements and Omissions Concerning ESG Considerations (May 23, 2022), https://www.sec.gov/news/press-release/2022-86.

17. Press Release, SEC Charges Brazilian Mining Company with Misleading Investors about Safety Prior to Deadly Dam Collapse (Apr. 28, 2022), https://www.sec.gov/news/press-release/2022-72.

18. Press Release, SEC Charges Robo-Adviser With Misleading Clients (Feb. 10, 2022), https://www.sec.gov/news/press-release/2022-24.

19. Press Release, SEC Charges JPMorgan, UBS, and TradeStation for Deficiencies Relating to the Prevention of Customer Identity Theft (July 27, 2022), https://www.sec.gov/news/press-release/2022-131.

20. Press Release, Morgan Stanley Smith Barney to Pay $35 Million for Extensive Failures to Safeguard Personal Information of Millions of Customers (Sept. 20, 2022), https://www.sec.gov/news/press-release/2022-168.

21. Speech, Prepared Remarks at the Institutional Limited Partners Association Summit, Chair Gary Gensler (Nov. 10, 2021), https://www.sec.gov/news/speech/gensler-ilpa-20211110.

22. See Debevoise Update, SEC Continues Focus on Private Fund Adviser Disclosures and Other Topics (Feb. 4, 2022), https://www.debevoise.com/insights/publications/2022/02/sec-continues-focus-on.

23. Press Release, SEC Charges Allianz Global Investors and Three Former Senior Portfolio Managers with Multibillion Dollar Securities Fraud (May 17, 2022), https://www.sec.gov/news/press-release/2022-84.

24. Press Release, SEC Charges Private Equity Fund Adviser with Fee and Expense Disclosure Failures (Dec. 20, 2021), https://www.sec.gov/news/press-release/2021-266.

25. Press Release, SEC Seeks Special Master to Oversee Return of Remaining Funds to Harmed Investors of the Infinity Q Mutual Fund (Nov. 10, 2022), https://www.sec.gov/litigation/litreleases/2022/lr25575.htm.

26. Press Release, Deloitte's Chinese Affiliate to Pay $20 Million Penalty for Asking Audit Clients to Conduct Their Own Audit Work (Sept. 29, 2022), https://www.sec.gov/news/press-release/2022-176.

27. See, e.g., Press Release, SEC Charges Philadelphia Lawyer with Fraud (July 7, 2022), https://www.sec.gov/enforce/33-11080-s.

28. Press Release, SEC Charges Recidivists for Violations of a Previous Commission Order (Sept. 21, 2022), https://www.sec.gov/litigation/ litreleases/2022/lr25514.htm.

29. Press Release, SEC Charges Infrastructure Company Granite Construction and Former Executive with Financial Reporting Fraud (Aug. 25, 2022), https://www.sec.gov/news/press-release/2022-150.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.