Case Numbers Are on the Rise

Based on our informal survey and analysis of patent lawsuits, energy companies will see both an increase in lawsuits filed by "patent trolls" and will find that a decreasing percentage of their defensive patent litigations are against competitors. To date, the complaints about patent trolls—also known as non-practicing entities (NPEs) and patent assertion entities, among other names—have primarily come from technology and retail companies that have been embroiled in patent litigation against patent trolls. Retailers are relatively new to the debate. In fact, in 2010, we predicted an uptick in patent cases filed in the retail industry because of an increase in cases filed by NPEs.1 We now predict that energy and oil and gas companies will join that debate as they deal with the significant costs associated with defending against patent cases filed by NPEs (which we define as entities, other than universities, that do not manufacture anything or provide any services) without the opportunity for crosslicensing that cases against competitors present.

Energy companies should therefore take this possible trend into account when revising and implementing their risk mitigation plans and their patent litigation strategies and budgets.

The Morgan Lewis Survey

Overall, patent cases have nearly doubled in the past decade, from about 2,500 in 2003 to more than 5,000 cases filed in 2013.2 The energy industry constitutes about 20% of the total patent cases.3 Our survey first sought to quantify, within the patent cases filed against energy companies, whether the number of cases filed has increased or decreased in recent years.

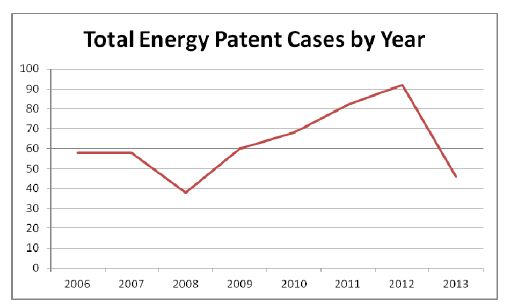

Based on an analysis of patent cases from 2006 to 2013 in the LexMachina database, we reviewed each case where LexMachina categorized one of the defendant parties as an "energy" company, which includes oil and gas and power-generation companies, and then manually reviewed each case to determine whether the plaintiff was an NPE. The results are reflected on the following graphs, which show the relationship between the total patent cases filed in the energy industry, the total NPE cases, and the percentage of cases that were NPE cases, respectively.

Observations

The total number of industry-specific patent cases filed is increasing slowly in the energy sector, albeit with a dip in 2013, possibly because not all data was entered into the database at the time of this survey. However, the clear trend is that the percentage of cases brought by NPEs against energy companies is increasing at a meaningful rate.

For energy companies, NPE cases have increased from 10% of all cases to nearly 30% from 2006 to 2013. This trend alone likely means that (a) more NPE suits will be filed against energy companies and (b) a larger portion of energy companies' patent litigation dockets will be composed of NPE lawsuits (as opposed to competitor lawsuits).

However, other trends in the industry also appear to be driving factors behind this push by NPEs to target energy and oil and gas companies. These trends include the following:

- An increased reliance on and use of computer-based technologies in the energy industry (e.g., downhole exploration).

- More energy companies selling their patents to monetize their investments in research and development.

- NPEs continuing to look for untapped licensing (and litigation) targets.

Whatever the underlying reason for the increased attention, at least one well-known NPE, Acacia Research Corporation, has unambiguously stated its intent to acquire and assert a portfolio of patents against those companies that call the "energy corridor" their headquarters.4 Combined with an uptick in the percentage of patent cases filed against energy companies, these factors likely point to a new patent litigation trend for the industry.

Practical Considerations

With NPEs targeting the energy industry, oil and gas and power companies should take practical steps to prepare for the possibility of claims being filed against them. A majority of NPEs seek to maximize their investment returns and minimize their exposure by settling early and by asserting broad claims against as many defendants as possible.

As most NPEs aim to extract a quick settlement, some of the most practical steps that companies can take when being sued or threatened by an NPE include the following:

- Explore indemnity and insurance options and sources.

- Assess (with experienced counsel) the merits and exposure of the case in its early stages, and develop a litigation roadmap/risk management plan based on that early case assessment.

- Consider filing a declaratory judgment action to declare the claims invalid and/or not infringed.

- Consider filing a reexamination, inter partes review, or post-grant review with the USPTO's Patent Trial and Appeal Board.5

- Do not ignore threat letters, but discuss them with counsel before responding.

- Consider obtaining an opinion letter from counsel on invalidity or non-infringement.

- Investigate the NPE and its litigation history.

- Form joint defense groups early, and share information with other NPE targets (and possibly share counsel as a way to save litigation costs).

- Take the steps necessary to preserve relevant data, and be prepared to comply with any early disclosure rules on discovery and invalidity contentions (to ensure that the case is decided on the merits and not through sanctions motions).

Many other practical considerations—like seeking broad contract language for all IP licenses, considering intellectual property insurance, seeking broad indemnification language from suppliers and contractors, planning for litigation in budgets, and even considering cross-licensing patents—can be long-term strategies to stay ahead of any patent litigation efforts brought by NPEs. The overall strategy should be tailored for the specific business needs and should consider the risk that the company is willing to accept.

Conclusion

Our survey points to an increase in the number of cases filed by NPEs in the energy industry. In fact, our survey (and the other data points discussed above) suggests that energy companies should expect upward of 30% of all patent cases filed in the energy industry in 2014 to be brought by NPEs. Although the total number of patent cases has not yet increased substantially, it appears that the volume and percentage of cases that the industry will face against NPEs will increase over the near term. Companies should therefore prepare for this shift in the mix of patent cases and implement practical and strategic considerations to ensure they are prepared for suits filed by NPEs.

Footnotes

1. For more information, see our September 2010 White Paper, "Patent Claims Against Retailers," available at: http://www.morganlewis.com/pubs/IP_PatentClaimsAgainstRetailers_WP_Sept2010.pdf.

2. Chris Barry, Ronen Arad, Landan Ansell, & Evan Clark, "2013 Patent Litigation Study: Big cases make headlines, while patent cases proliferate", PricewaterhouseCoopers LLP (June 2013), available at http://www.pwc.com/us/en/forensic-services/publications/2013-patentlitigation-study.jhtml .

4. Press Release, Acacia Research Corp., Acacia Research Launches Houston Office and Energy Practice (Dec. 9, 2013), available at http://acaciaresearch.com/wp-content/uploads/2013/12/120913-Acacia-Houston-Office-Release.pdf.

5. For more information on post-grant proceedings, visit www.morganlewis.com/topics/patenttrials.

This article is provided as a general informational service and it should not be construed as imparting legal advice on any specific matter.