Patent litigation in Q1 2022 remained consistent with long-term trends. In particular, NPE assertion was down compared to an unseasonably active first quarter last year, but NPE plaintiffs still had their second-busiest first quarter since 2015. Operating company litigation was up this past quarter compared to the prior year, but filings were flat when excluding litigation targeting generic drugs, which increased substantially from a slow Q1 2021.

Beyond district court, data indicate that defendants continue to shift from America Invents Act (AIA) reviews to reexaminations as a result of the NHK-Fintiv rule, while the Federal Circuit issued a series of noteworthy rulings impacting the Patent Trial and Appeal Board (PTAB) during the first quarter. Courts have also been active on issues related to standard essential patent (SEP) disputes, with three of the world's top patent jurisdictions releasing significant new decisions on fair, reasonable, and nondiscriminatory (FRAND) licensing issues affecting the automotive industry, patent pools, and SEP negotiations.

Meanwhile, the steady flow of operating company patents to NPEs continues, with several notable patent deals coming to light in Q1. In January, BlackBerry announced that it had entered into a conditional agreement to divest "substantially all its non-core patent assets" for $600M, with the buyer reportedly linked to a group of assertion entities. Also in Q1, USPTO data made public during the quarter revealed the assignment of another large operating company portfolio to Dominion Harbor Enterprises, LLC, as the monetization firm filed more litigation asserting previously acquired patents.

Finally, the role of third-party funding in NPE litigation appears to be expanding: a recently published report claims that a significant portion of capital committed by litigation funders in 2021 was trained on patent litigation, and RPX research has confirmed third-party funding of a rash of new NPE campaigns launched during the first quarter.

RPX members also have exclusive access to an on-demand RPX Community webinar covering highlights from this post; CLE credit may be available. Members can view the webinar on RPX Insight.

Litigation Update: NPE Litigation Dips from Busy Q1 2021 as Spike in ANDA Activity Drives Operating Company Increase

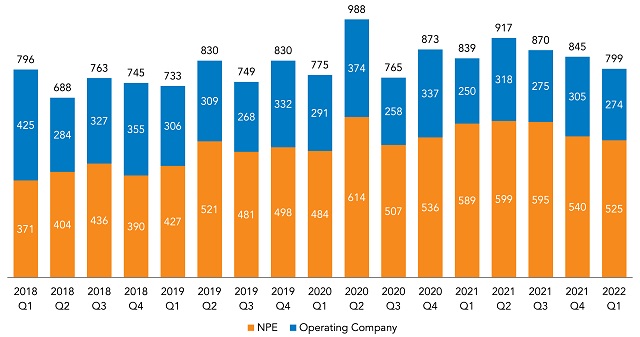

NPEs added 525 defendants to patent litigation campaigns in the first quarter of 2022—11% below Q1 2021, which at 589 defendants was uncharacteristically active. However, NPEs still had their second busiest first quarter since 2015 and exceeded the trailing Q1 three-quarter average by 23%.

The most litigious NPE plaintiff in Q1 2022 was once again patent monetization firm IP Edge LLC. For the past two years, plaintiffs controlled by IP Edge have added around 150 defendants per quarter. Excluding IP Edge, NPEs added 381 defendants, down 13% from the first quarter of last year but almost exactly in line with the Q1 average from 2016-2021.

NPE and Operating Company Litigation (Defendants Added)

Operating company litigation, meanwhile, was up in Q1 2022 compared to a slow quarter one year ago, with 274 defendants added (versus 250 in Q1 2021). Nearly all of that increase is attributable to Abbreviated New Drug Application (ANDA) litigation targeting generic drugs, which saw unusually low activity in the first quarter last year—with 22 defendants added—compared to 47 this year.

Excluding ANDA litigation, operating company litigation was essentially unchanged in Q1 2022 compared to both the year-ago quarter and Q1 2020, as shown below.

ANDA and Other Operating Company Litigation (Defendants Added)

Overall, plaintiffs added 799 defendants to patent litigation campaigns in Q1, slightly below the first quarter of 2021 and slightly above the trailing Q1 average.

| Defendants Added | Change Compared to: | ||||

| Q1 2022 | Q1 2021 | Q1 2018-2020 Average | Q4 2021 | ||

| NPE | 525 | -10.9% | 22.9% | -2.8% | |

| Operating Company | 274 | 9.6% | -19.6% | -10.2% | |

| Total | 799 | -4.8% | 4.0% | -5.4% | |

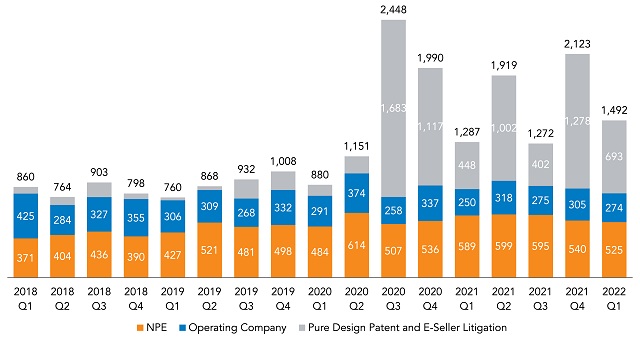

The operating company data above exclude another distinct category of litigation filed by a small group of design and utility patent owners targeting copycats and counterfeiters selling products online. RPX excludes such "e-seller" cases from analyses of district court litigation because they tend to follow a different dynamic compared to a typical patent suit: These e-seller cases sometimes name hundreds of defendant entities, many of which may be merely online storefronts for the same ultimate parent. Additionally, plaintiffs mainly seek injunctive relief instead of damages, and their cases often end with the e-seller defendant's failure to answer, followed by a default judgment.

This category of litigation, which began to spike in Q3 2020, is shown in grey below to illustrate its magnitude.

Please note that apart from the graph below, the remaining analyses in this report exclude pure design patent and e-seller litigation.

All Patent Litigation Including Design Patent and E-Seller Litigation (Defendants Added)

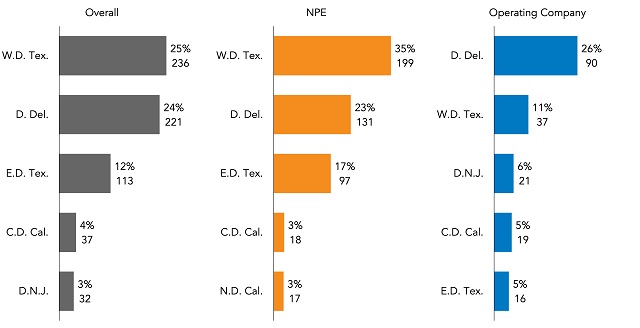

Venue Update: West Texas Keeps the Top Spot as Judge Albright Gets Reversed on Automaker Ruling

In Q1 2022, the Western District of Texas was once again the most popular district for all patent litigation and for litigation filed by NPEs. Delaware held a close second place in both of those categories, taking the number-one spot for operating company litigation. The Eastern District of Texas was the third most popular for NPE litigation and litigation overall, but dropped to fifth place for operating company plaintiffs.

Top Patent Litigation Districts in Q1 2022 (Defendants Added and Percentage of Total)

On March 11, the District of Delaware lost its most experienced active district judge when Leonard P. Stark was elevated to the Federal Circuit, replacing retiring Circuit Judge Kathleen M. O'Malley. Judge Stark is now the only active judge on the Federal Circuit bench with experience as a trial judge, a status previously held by Judge O'Malley: As highlighted during his Senate confirmation hearing, Judge Stark has presided over 63 trials held in patent infringement cases, of which he has overseen more than 2,400 in the nearly 14 years he served in Delaware. Judge Stark stated at his hearing that his experience presiding over so many patent cases will inform future work on the Federal Circuit: "The technology is always complex, the facts are very challenging. Patent litigators often disagree with each other, so I estimate that in a typical patent case that goes to trial I make many hundreds of decisions, or even more than 1,000, and typically only a handful of those issues get appealed to the Federal Circuit, so I'll bring an understanding of the context in which those issues arise".

Judge Stark is President Joseph R. Biden Jr.'s second nominee to the Federal Circuit—and the second with experience in patent law—following the July 2021 confirmation of Circuit Judge Tiffany P. Cunningham, an experienced patent litigator and former Perkins Coie partner. President Biden has not nominated a replacement for Judge Stark in the District of Delaware as of the date of this report.

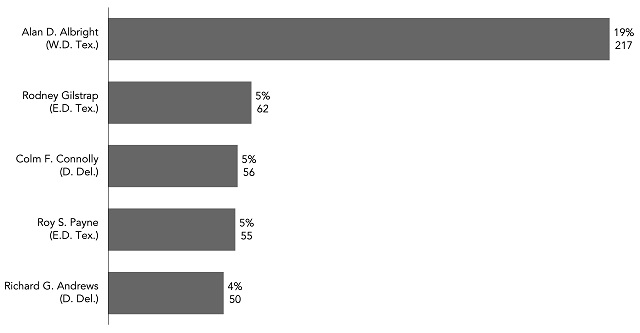

The top judge in Q1 2022 was Western District of Texas Judge Alan D. Albright, with 19% of new litigation filed in his courtroom. As noted in RPX's review of the fourth quarter and 2021, Judge Albright has attracted so much litigation in part by actively seeking out patent cases, a practice that has led to Congressional scrutiny—and, in turn, a study by the federal judiciary's Committee on Court Administration and Case Management.

Top District Judges in Q1 2022 (Defendants Added and Percentage of Total)

Judge Albright has become well known for his restrictive posture toward various defensive motions commonly brought in patent suits. These include motions to stay pending the outcome of PTAB trials as well as patent eligibility motions under Alice, which he has previously stated he is inclined against granting early in the course of litigation. Judge Albright has also lamented the difficulty of applying Section 101 caselaw consistently, remarking in a February ruling that "[a]t this point, it is trite to comment on the confusing abyss of patent eligibility law".

That said, Judge Albright's best-known tendency has arguably become his idiosyncratic approach to motions to transfer for convenience. As also detailed in RPX's fourth-quarter review, the Federal Circuit has frequently reversed his decisions on mandamus, taking issue with the way he has applied various substantive factors and flagging a variety of repeated legal errors. In 2021, the Federal Circuit issued 18 writs of mandamus against Judge Albright on that issue, including nine in the prior quarter alone.

While the appellate court did so just once in the first quarter of 2022, that ruling—in In re: Volkswagen—overturned a notable decision by Judge Albright that venue can be proper against an automaker based in the activity of in-district dealerships. In that September 2021 opinion, Judge Albright concluded that the dealerships' relationships with automakers, governed mainly by franchise agreements, make those dealerships the agents of the respective automakers; that the automakers ratify the in-district dealerships as their own places of business; and that the dealerships are conducting the business of the automakers in West Texas.

However, the Federal Circuit cut through each of those determinations, ruling instead that plaintiff StratosAudio, Inc. "failed to carry its burden to show that the dealerships are agents of Volkswagen or Hyundai under a proper application of established agency law". For that reason, the appellate court determined that the in-district dealerships "do not constitute regular and established places of business of Volkswagen and Hyundai under [Section] 1400(b)", taking instruction from its February 2020 holding in In re: Google.

See here for more details on the Federal Circuit's decision and its potential impact.

Finally, Judge Albright has since taken additional steps to place limits on transfers—in particular, through an updated standing order designed to make it harder to file motions to transfers in the first place. That new standing order, issued on March 7, requires that motions for transfer be filed within eight weeks of receiving or waiving service of the complaint or within three weeks of the case management conference, whichever is later. After that, leave from the court is required. Parties must also repeatedly check in with the court about transfer motions, as Judge Albright now asks parties to file multiple status reports on pending motions—including one advising him when motions are ready for resolution, another when a case is four weeks away from the first Markman hearing (or, if there are more than one such hearing, six weeks before the first one), and yet another one week before the hearing if the motion still has not been decided.

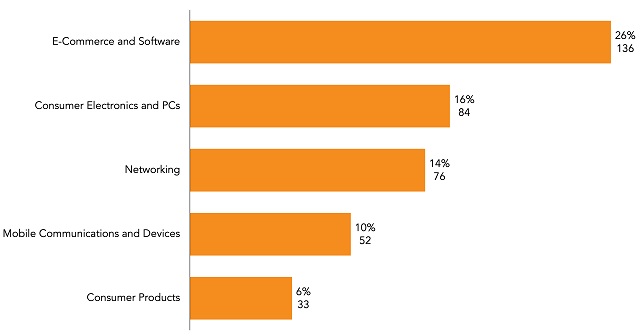

Market Sector Update: E-Commerce and Software Saw the Most NPE Activity, with Familiar Plaintiffs and Patents

The top market sector for NPE litigation in Q1 2022 was E-Commerce and Software, accounting for more than a quarter of all NPE activity. Networking saw the second most NPE assertions in the first quarter, followed closely by Consumer Electronics and PCs and trailed by Mobile Communications and Devices as well as Consumer Products.

Top NPE Market Sectors in Q1 2022 (Defendants Added)

E-Commerce and Software litigation filed by NPEs in Q1 included activity from a variety of notable plaintiffs, with some of those cases asserting patents from familiar sources. Among those plaintiffs were Advanced Transactions, LLC and Alto Dynamics, LLC, two Georgia LLCs with ties to patent monetization firm IPInvestments Group LLC (d/b/a IPinvestments Group), both of which launched campaigns focusing on this sector in February over patents acquired from Intellectual Ventures LLC (IV) earlier that month via other IPinvestments entities. Those campaigns respectively target online payment systems, e-commerce websites, and shopping services (Advanced Transactions) and data collection, user login, and search technologies (Alto Dynamics).

Another monetization firm hitting the same sector in February was prolific monetization firm IP Edge LLC, which, through Savannah Licensing LLC, launched a campaign that hit a host of app developers, service providers, and mobile device makers over software that incorporates certain user feedback features. The patents came from another familiar source: In May 2021, fellow IP Edge entity Vibrant Licensing LLC acquired them from Empire Technology Development LLC—itself a subsidiary of Allied Inventors Management, LLC, which was reportedly founded in 2015 to monetize patents received from IV. IP Edge also continued to litigate patents acquired from Xerox via Bassfield IP LLC, which in January and March filed more cases in the QR code campaign that it launched in December.

Additionally, monetization firm Dynamic IP Deals, LLC (d/b/a DynaIP) launched two new E-Commerce and Software campaigns this past quarter. In March, its subsidiary AK Meeting IP LLC filed its first litigation over screen and content sharing features included in various online collaboration products. Another entity linked to DynaIP is Silent Communication, LLC, which apparently attempted to sue BlackBerry in March over its Hub+ communications suite, targeting features related to aggregating contact data and messages from multiple sources—though corporate identity issues could undercut that case (as detailed here). The patent at issue was previously litigated by Mobile Synergy Solutions, LLC, an NPE associated with Texas monetization firm Dominion Harbor Enterprises, LLC.

Other recent campaigns hitting this sector have focused more on products and services related to enterprise infrastructure. In March, Desktopsites Inc. (f/k/a CityCites.com Corp.), a former cloud computing company that has since turned to patent assertion, sued Dell (VMware) over virtualization software with certain remote access and authentication features. The month before, Isix IP LLC, a subsidiary of monetization firm Aequitas Technologies LLC, kicked off a campaign targeting systems integration products, which allow the integration of different computing systems such as cloud-based and on-premises applications.

Even more campaigns targeted more consumer-facing features this past quarter. Among them were two initiated by inventor-controlled NPEs: In February, Zentian Limited accused Amazon and Apple of infringing five speech recognition patents through the provision of devices respectively supporting the Amazon and Siri voice assistants, including wake word support ("Alexa" and "Hey Siri"), text dictation, and on-device speech processing. Weeks later, M4siz Limited added more retailers to its ongoing campaign targeting the search features offered by their e-commerce websites—in particular, features related to correcting misspelled search terms.

PTAB Update: NHK-Fintiv Supreme Court Appeals Dismissed as Federal Circuit Focuses on Estoppel

In the first quarter of 2022, 336 petitions for America Invents Act (AIA) review were filed with the PTAB, including 328 petitions for inter partes review (IPR) and eight petitions for post-grant review (PGR). Filings in Q1 were essentially unchanged from both the prior quarter (when 339 petitions were filed) and Q1 2021 (which saw 337 petitions).

AIA Review Petitions Filed

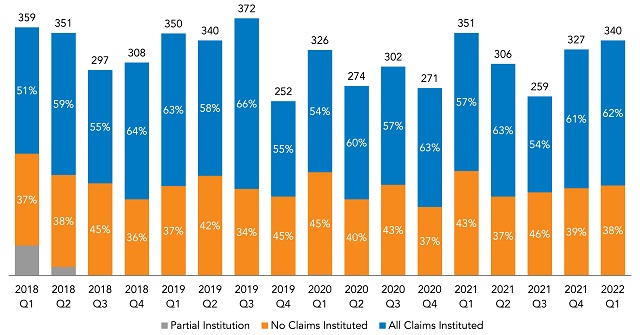

Additionally, the PTAB instituted trial in 62% of the AIA review petitions addressed in Q1. The institution rate for 2021 was 58.7%, a slight increase from 2020's 58.2% but still down from 2019's 61%.

AIA Review Institution Rates

That prior decline can be attributed partly to a pair of precedential PTAB decisions known together as the NHK-Fintiv rule, which allows the board to use its discretion to deny institution in AIA reviews based on several factors related to the status of parallel district court litigation. The most hotly debated of those factors has been one that allows the PTAB to deny institution when its final decision would be due close to the district court's scheduled trial date. This practice has been especially problematic from a strategic perspective because it forces petitioners to file as early as possible—effectively, further compressing the one-year window defendants already have to file an IPR—based on an aspect of litigation, trial scheduling, that is inherently outside of a petitioner's control and is subject to change.

That said, additional decisions from the PTAB have allowed petitioners to stipulate around other NHK-Fintiv factors, which may be contributing to the leveling-out of year-over-year institution rates. In Sand Revolution II v. Continental Intermodal Group – Trucking (issued May 2020; designated as informative that July), the PTAB granted institution after the petitioner agreed not to assert the same invalidity grounds in district court that it did in its IPR petition. That same December, the Board accepted an even broader type of stipulation in its Sotera Wireless v. Masimo decision (designated as precedential two weeks later), after the petitioner informed the district court that it would not pursue "any ground raised or that could have been reasonably raised in an IPR" after institution. Some practitioners have indicated that the PTAB has been more amenable to the latter, broader type of stipulation.

NHK-Fintiv Has Led to an Upswing in Reexam Requests

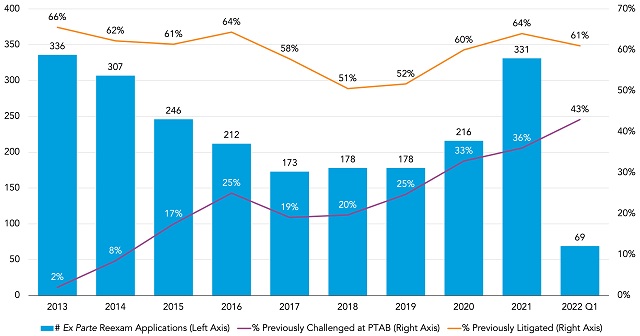

Apart from the use of such stipulations, data show that a key result of NHK-Fintiv has been that would-be petitioners are instead filing more ex parte reexaminations, which are not subject to the same level of discretionary denials and offer a variety of other advantages (such as lower cost and lack of estoppel).

Indeed, reexam requests went up markedly last year: parties filed 331 such requests, or 53.2% more than in 2020 (during which 216 requests were filed). Early data for 2022 suggests that this trend is holding, with about the same number of reexam requests filed in Q1 (69) as in the first quarter last year (72). Moreover, the share of those patents that have been previously litigated in district court increased in 2021 as well, accounting for 64% of the patents with reexam requests (up from 60% in 2020 and 52% in 2019), although that dipped slightly to 61% in Q1 2022. In addition, the share of patents with reexam requests that were also previously challenged via AIA review also continued to increase last year, reaching 36% in 2021—up from 33% in 2020 and 25% in 2019. That AIA review overlap was even higher in Q1 2022 at 43%.

Taken together, these datapoints suggest that NHK-Fintiv is the reason that defendants are filing more ex parte reexams.

Ex Parte Reexam Filings and the Share of Challenged Patents with Prior Litigation and PTAB Reviews

Note: Data as of April 4, 2022. Due to the delayed availability of filing dates and related data from the USPTO, this analysis is subject to change.

Supreme Court Denies NHK-Fintiv Challenge, but Federal Circuit Appeal Proceeds

The NHK-Fintiv rule has spawned several appellate challenges since its inception, including three Supreme Court appeals of decisions directly denying institution in AIA reviews that were rejected in the first quarter. Two of those certiorari petitions were denied at the start of Q1: one filed by Apple, after a court ruled that its direct appeal was barred under the Supreme Court's Cuozzo decision; and a second from Mylan, which had challenged a denial based on a related ruling (Mylan v. Janssen) providing that mandamus review for such decisions is only available based on "colorable constitutional claims". The third petition, filed by Intel based on a ruling citing Mylan, was denied by the Court on March 21.

However, an overlapping appeal remains active before the Federal Circuit, over the dismissal of a California lawsuit challenging the rule itself. That case, filed by Apple, Cisco, Google, and Intel, later joined by Edwards Lifesciences, asserted that NHK-Fintiv has reduced the availability of IPR and alleged that the rule conflicts with the AIA, that it is arbitrary and capricious, and that it violates the Administrative Procedure Act (APA) because it had not been "adopted through notice-and-comment rulemaking". The appellants filed their opening brief in February. Since then, the court has received amicus briefs in support from stakeholders spanning a variety of industries: Mylan; Honda and Tesla; and a group of nine tech and telecom companies and industry associations, including the Computer and Communication Industry Association, Micron, Juniper Networks, Verizon, VMware, and TSMC. The government's brief in response is due on April 29.

Vidal Takes the Reins at the USPTO

The ongoing NHK-Fintiv debate will likely be top-of-mind for new USPTO Director Kathi Vidal, who was confirmed by the Senate on April 5 after more than a year in which the agency lacked a permanent head. Unsurprisingly, the rule was among the most frequent topics of questioning during Vidal's confirmation process last year, with Senator Thom Tillis (R-NC) taking particular issue with the NHK-Fintiv factor tying institution to district court trial dates—a practice that Vidal, at his request, agreed to study and review.

Vidal also detailed her views on a variety of additional patent issues in her capacity as a nominee, including other topics related to the PTAB—among them, APA challenges to discretionary denial practices, concerns over PTAB filing practices, and the compensation of PTAB administrative patent judges—as well as so-called "judge shopping", SEP licensing issues, and patent eligibility. See here for more on Vidal's views as shared with the Senate Judiciary Committee.

Federal Circuit Decisions on IPR Estoppel in District Court and Reexams; Forum Selection Clauses

The Federal Circuit also issued several significant decisions that dealt with the PTAB throughout the first quarter. Among the most notable was its February 4 opinion in Caltech v. Apple and Broadcom. That ruling vacated and remanded a $1.1B damages award against the defendants but also significantly expanded IPR estoppel—the statutory requirement that restricts petitioners from raising certain IPR validity arguments in subsequent district court challenges.

In Caltech, the Federal Circuit resolved a district court split over the application of that requirement by overruling its 2016 Shaw Industries Group v. Creel Automated Systems decision, now holding that a petitioner is estopped not just from later asserting arguments actually raised in a successful petition, but also from including those arguments that they "reasonably could have" included. The decision's original wording was interpreted by some stakeholders as establishing that an IPR against even one claim of a patent could lead to estoppel as to all claims of that patent. However, the court subsequently modified the opinion to clarify that Caltech extends estoppel to grounds that "reasonably could have" been included but not to all claims.

On February 24, the Federal Circuit additionally held that appellate review is available for USPTO decisions not to initiate reexaminations based on IPR estoppel, which in this context bars reexam requests by petitioners whose IPRs against the same claims have reached final written decisions. In Alarm.com v. Hirshfeld, the court ruled that the Eastern District of Virginia was wrong to reject an APA lawsuit challenging a reexam denial on that basis. The Federal Circuit instead concluded, contrary to the district court, that the relevant statutory scheme does not preclude appeals of IPR estoppel decisions with respect to reexams.

Another decision of particular commercial relevance was the Federal Circuit's ruling that forum selection clauses can bar parties from filing IPRs. On February 8, the court held in Nippon Shinyaku v. Sarepta Therapeutics that parties are free to contract around IPRs should they choose to do so, confirming a series of prior rulings in its first precedential opinion addressing the issue. The decision places even greater importance on the careful review of forum selection clauses for potential defendants that wish to preserve their options for validity challenges.

FRAND Update: Top SEP Jurisdictions Issue Notable Rulings on Patent Pools and SEP Negotiations

In the first quarter of 2022, courts in three of the world's top standard essential patent (SEP) jurisdictions issued notable decisions on fair, reasonable, and nondiscriminatory (FRAND) patent licensing, including rulings related to patent pools and SEP negotiations.

US: Fifth Circuit Dismisses Auto Supplier Lawsuit Against Avanci and Licensors

In late February, the Fifth Circuit ordered the dismissal of a lawsuit filed by automotive component supplier Continental against Internet of Things (IoT) licensing platform Avanci, LLC and several licensing partners, in a suit that challenged the licensors' policy to only offer licenses to OEMs (i.e., makers of finished vehicles). The appellate court determined that the plaintiff was not an "intended beneficiary" of the Avanci patent owners' contractual commitments to license their SEPs on FRAND terms. As a result, the Fifth Circuit ruled that the company had not suffered a sufficient injury from the defendants' refusal to grant it a license, which in turn deprived it of Article III standing. The court further held that because the licensors were offering licenses to the OEMs, this meant that they were also "making SEP licenses available to Continental on FRAND terms". While the decision was somewhat fact-specific, it could limit the extent to which some SEP licensors are required to license component suppliers going forward.

The decision is also notable because of the posture of the US Department of Justice (DOJ), which essentially distanced itself from the case on appeal after its prior involvement. When the case was before the district court, past DOJ leadership filed an amicus brief that argued against the application of antitrust law to FRAND disputes (an issue not revisited by the Fifth Circuit). Yet the DOJ mostly did not participate in the appeal, apart from a brief filing that suggested the amicus brief no longer represented its current views.

The government largely ceased its involvement in that litigation around the same time that the Biden administration began to pursue a new policy toward SEP licensing. That new policy, detailed in draft form late last year, seeks to balance the interests of both licensors and licensees—returning to the view that injunctions should not be granted in SEP cases when monetary damages are available but retaining some focus on alleged implementer misconduct. The policy has yet to be finalized, and it received significant attention from stakeholders in the meantime during the official public comment period. Numerous public comments were received as of the early February deadline, including 167 comments published as of the date of this report and over 1,000 comments in total.

See here for more details on Continental v. Avanci and the DOJ's policy shift.

Germany:

– Düsseldorf Court Rules Against Patent Pool, Leading to Changes in Licensing Policy

German courts are typically seen as relatively friendly to patent plaintiffs, but the District Court of Düsseldorf bucked that trend with its recent ruling that a patent pool's licensing terms were non-FRAND—the first time that one of the country's courts has done so. That December 2021 decision, issued in litigation brought by four members of Access Advance's video pool HEVC Advance, held that Turkish device manufacturer Vestel had infringed six patents covering the HEVC codec, but denied injunctive relief and granted damages for Vestel, both as a result of the non-FRAND holding.

The decision has not yet been released by the court, so the specific grounds for its non-FRAND determination were not revealed until early March—when Access Advance detailed the ruling in a press release that also announced changes in response. According to that summary, the court took issue with with the HEVC Advance Duplicate Royalty Policy, in light of the "substantial number of overlapping patents" between the HEVC Advance and MPEG LA patent pools covering the HEVC codec—which was an issue since Vestel had taken a license to MPEG LA's pool prior to the departure of certain licensors. The court held that the license offered to Vestel under that policy was non-FRAND for two reasons: it did not grant Vestel a "direct legal obligation" that the pool's licensors would ensure that no duplicate royalties were paid due to the MPEG LA overlap, and it did not detail the steps licensors would take to prevent duplicate royalty payments.

The changes announced by Access Advance in response put the onus on implementers: while the old Duplicate Royalty Policy let each HEVC Advance licensor to identify the pool or joint licensing programs that would qualify for a duplicate royalty deduction, the revised version allows current and prospective licensees "that qualify" to request deductions based on a license with another pool or program.

– Munich Court Updates SEP Guidelines Following Higher Court Ruling

Meanwhile, in late March, the Munich District Court—reportedly Germany's busiest patent venue—issued new guidelines concerning SEP negotiations during active litigation. The guidelines are designed to implement the German Federal Court of Justice's two landmark decisions in Sisvel v. Haier (Sisvel I and Sisvel II), which held that both SEP owners and implementers must show their willingness to arrive at a FRAND license under the Court of Justice of the European Union's Huawei v. ZTE opinion. The Sisvel rulings imposed particularly stringent requirements on implementers hoping to make such a showing, mandating that they "clearly and unambiguously" demonstrate their willingness consistently and continuously throughout negotiations. The court also held that SEP owners are not required to offer the same rates to all licensees, and that an initial non-FRAND offer is not necessarily abusive—but rather, that it is the starting point of a good-faith negotiation to navigate the complexities of determining a FRAND result.

The new guidelines, as revealed by Juve Patent, place a similar emphasis on the negotiation process for disputes that lead to litigation—treating the initial offer as the starting point for the FRAND negotiation, and requiring the parties to show the "court that they are actively seeking a licence until the end of the oral hearing". Presiding Judge Georg Werner, announcing the new guidelines in open court, explained that they assume that the "court cannot prescribe a good licence agreement", as summarized by Juve Patent, and that it is the parties themselves that should decide the licensing terms. Werner further proclaimed that there is no "general rule" for determining a FRAND rate, for which there will always be a "certain range" based on conditions related to specific industries, markets, and disputes.

Netherlands: Dutch Supreme Court Affirms Rulings Favoring SEP Owners

Finally, another significant decision came in the Netherlands, which as noted by IAM has become an increasingly important patent venue in pan-European patent disputes. In February, that country's Supreme Court summarily affirmed a set of 2019 Court of Appeal decisions in Philips v. Wiko that largely interpreted certain requirements of Huawei v. ZTE as favoring SEP owners. In those earlier decisions, the court ruled that SEP owners have no obligation to explain why offered rates are FRAND under Huawei; they must merely state "what the royalty will be" and how it "must be calculated". Nor, held the court, is there a requirement under Huawei to share existing agreements, which are often confidential, in order to justify alleged FRAND rates. Additionally, the court argued in favor of a less rigid application of Huawei's rules on abusive conduct that considers the totality of the SEP owner's actions—concluding, as a result, that the SEP owner making a licensing offer after the start of litigation does not make the filing of the lawsuit an abuse of dominant position after the fact.

The Supreme Court's rulings on appeal came shortly after another key SEP development: the District Court of the Hague's decision to exercise international and territorial jurisdiction over a FRAND case, in another of the cases between Access Advance and Vestel. This could ultimately end with the court setting the terms of a global FRAND license, and marks the third time that a national court has determined that it has the authority to do so following similar rulings in the UK (Unwired Planet v. Huawei) and China (Sharp v. Oppo).

Marketplace Update: BlackBerry Announces $600M Patent Deal; Churn of OpCo Patents Continues; and More Third-Party Backed Campaigns Crop Up in Q1

Notable Patent Deals Revealed During the Quarter

In late January, BlackBerry announced that it had entered into a conditional agreement to sell "substantially all of its non-core patent assets" to Catapult IP Innovations Inc. for $600M. Formed in Delaware in June of last year, Catapult IP has been linked by IAM to York Eggleston, an individual that RPX has tied, via public records, to more than a dozen assertion entities—including six litigating NPEs, most asserting former operating company patents. A visual summary of those campaigns is available to RPX members here.

Catapult's principal funding for the deal, according to BlackBerry's press release, "will be a $450 million senior secured term loan, for which it has received $400 million of conditional commitments from a lending syndicate led by Toronto-based Third Eye Capital that includes a Canadian pension fund". BlackBerry further reported that at closing, the company will receive $450M in cash and a promissory note in the principal amount of $150M.

According to BlackBerry's announcement, the transaction could take up to 210 days to complete and is conditional upon "among other things, satisfaction of all regulatory conditions under the Hart–Scott–Rodino Antitrust Improvements Act in the United States and the Investment Canada Act". In its March 31 earnings call, BlackBerry announced that the deal had cleared regulatory review, with certain details related to financing still being finalized: CEO John Chen stated during the call that "[c]ompletion of the remaining closing conditions—including financing—is on target for the end of this quarter". According to BlackBerry's 8-K announcing the conditional sale agreement, "BlackBerry may terminate the Patent Sale Agreement if Catapult has not secured the required financing commitments within 90 days of the date of the Patent Sale Agreement." That gives the buyer until May 1 to line up the financing absent an extension from BlackBerry based on the January 31 date of the announcement.

Additional RPX reporting on the deal is available here.

Dominion Harbor Acquires Hundreds of Seiko Epson Patents

Over the years, Texas-based monetization firm Dominion Harbor Enterprises, LLC has made headlines through its acquisition and assertion of relatively large portfolios of operating company patents. That trend continued in 2021, which saw former Honeywell, Panasonic, Sony, and TCL Technology Group portfolios sail into Dominion Harbor—as well as hundreds of Seiko Epson patents, according to assignment data made public by the USPTO during the first quarter of 2022.

Meanwhile, Dominion-controlled plaintiffs filed more than a handful of new infringement suits during Q1, all asserting former operating company patents: In February, Dominon's Sovereign Peak Ventures, LLC brought three separate suits against ASUSTek, each asserting patents developed by Panasonic. That same month, Dominion's Redwood Technologies, LLC filed its inaugural cases—one each against Fortinet and Sonim. The original development work for Redwood's nine patents-in-campaign was conducted at either Panasonic or Sony; the patents are a small subset of the over 240 US assets that the NPE received from Wi-Fi One, LLC—a litigating subsidiary of Inception Holdings, LLC—in November 2021. Finally, in March, Dominion's Liberty Peak Ventures, LLC hit Comerica over former American Express patents—again a small subset of assets from a larger transaction, this one with Intellectual Ventures LLC in 2018.

For more information about Dominion's recent acquisition and litigation activities, as well as signs of a capital injection in 2021, see here.

Following Suit Against Google, Valtrus Receives More Patents

Throughout 2021, Valtrus Innovations Limited (f/k/a Dolya Holdco 9 Limited), an Irish NPE controlled by Key Patent Innovations Limited, received hundreds of former HP Enterprise (HPE) patents—most via Ocean Tomo, LLC (OT Patent Escrow LLC), and at least once directly from HPE. The first quarter of 2022 saw the NPE file its first US litigation to date—hitting Google over a subset of those patents—and subsequently acquire yet more former HPE patents. Currently available USPTO records indicate that the NPE now holds over 1,100 US patent assets.

Filed in January, Valtrus's case against Google asserts patents originating with HPE through various predecessor companies (e.g., Compaq, Verity, etc.); Google has filed a motion challenging the asserted patents under Alice.

A closer look at Valtrus's campaign, as well as background on the NPE's formation, control, and possible capital source, is available here.

Fortress Tied to New NPE Asserting Former MaxLinear Patents

In March, Entropic Communications, LLC filed its first lawsuits to date, hitting AT&T (with DirectTV) and DISH Network over patents received from a subsidiary of MaxLinear, the publicly traded operating company that acquired Entropic Communications in 2015 for a reported $245M. The asserted patents generally relate to satellite and cable technology and moved from MaxLinear to the plaintiff last year in a transaction that hinted at the involvement of Fortress Investment Group LLC—a relationship since confirmed by public records.

Having acquired more than 300 former MaxLinear patent assets to date, the plaintiff looks ready to expand its campaign beyond its current targets. RPX members can access more information about the NPE's patent holdings and ties to Fortress here.

At Least Seven Third-Party Funded NPE Campaigns Launched in Q1

The 2021 Litigation Finance Market Report released in Q1 by Westfleet Advisors reports that a pool of 47 litigation funders active in the US have combined assets under management of $12.4B. Of course, not all of that capital is funding patent litigation; however, according to Westfleet's study, "patent litigation attracted a significantly higher percentage of new commitments in 2021, comprising 29% of all capital commitments". In an earlier version of its annual report, published in January of this year, the firm proclaimed that in the context of commercial litigation finance, "patent litigation is king".

Indeed, a steady stream of new third-party backed campaigns suggests continued investor interest in patent litigation. If counting only those funding relationships proven by RPX via publicly available records, more than 30 new third-party backed NPE campaigns were launched in 2021. In Q1 2022 alone, RPX confirmed—again, via publicly available records—the involvement of third-party funders (including multiple litigation finance firms and hedge funds) in at least seven new NPE campaigns launched during the quarter.

RPX members can get an exclusive look at some of those campaigns and their funders here. Additional reporting on even more third-party backed campaigns will be available via the members-only webinar that will soon be offered alongside this report. That webinar will also discuss RPX research and analysis that indicate that the combined AUM of litigation funders active in the US market could be higher than what Westfleet has estimated.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.