Overview

Within the last week, Congress passed the Jumpstart Our Business Startups Act (the "JOBS Act" or the "Act"), adopting measures designed to facilitate both public and private capital formation and it is expected to be signed by the President on Thursday, April 5, 2012. The legislation is intended to (i) ease certain restrictions to encourage "emerging growth companies" (companies with less than $1 billion in revenue) ("EGCs") to go public and (ii) provide private companies with additional avenues to raise capital without registration with the SEC. As enacted, the JOBS Act represents a significant liberalization of requirements under the federal securities laws for both public and private capital raising. The Act also directs the SEC to conduct a comprehensive review of Regulation S-K to determine whether its disclosure requirements should be further simplified to minimize the costs and burdens imposed on EGCs during the registration process.

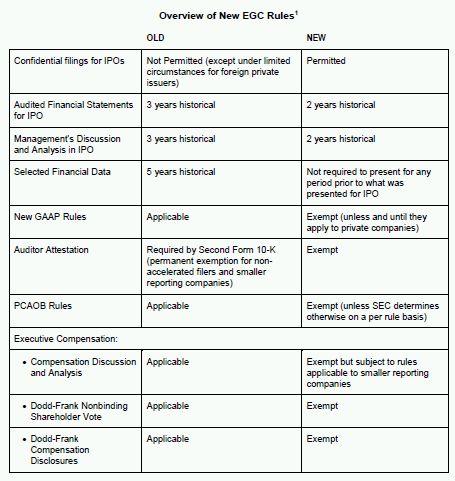

Under the Act, EGCs will benefit from a streamlined IPO process and scaled-back disclosure and other requirements, including:

- Initiating the IPO registration process through confidential review by the SEC;

- Permitting the presentation of only two years of audited financial statements in an IPO registration statement (compared to the three years currently required);

- Limiting the presentation of selected financial data to the earliest audited period presented in an IPO registration statement (compared to the five years currently required);

- Exempting EGCs from certain executive compensation disclosure requirements, such as the compensation discussion and analysis ("CD&A");

- Exempting EGCs from the auditor attestation report required by Section 404(b) of the Sarbanes- Oxley Act of 2002 (the "Sarbanes-Oxley Act");

- Easing the restrictions on communications with institutional investors;

- Reducing restrictions with respect to the publication of analyst reports (including allowing the issuance of research by underwriters during the post-IPO blackout period and before expiration of an IPO lock-up agreement); and

- Exempting auditors of EGCs from certain rules that the PCAOB may adopt in the future.

The Act's reforms also expand capital raising opportunities for companies by:

- Permitting general solicitation in certain Rule 506 and Rule 144A offerings, so long as the only purchasers in such offerings are accredited investors or qualified institutional buyers, respectively;

- Increasing the shareholder threshold that triggers registration with the SEC under the Securities Exchange Act of 1934, as amended (the "Exchange Act") from 500 to 2,000 record holders (or 500 record holders who are not accredited investors);

- Adopting a new "crowdfunding" exemption for offerings of up to $1 million; and

- Raising the cap on Regulation A offerings from $5 million to $50 million.

For your reference, we have attached a chart summarizing the public capital reforms.

Public Capital Reforms

What is an Emerging Growth Company?

The JOBS Act creates a new class of issuers referred to as "emerging growth companies." An EGC is a company that had total annual gross revenues of less than $1.0 billion for its most recently completed fiscal year. An EGC will retain its status until the earlier of: (i) the last day of the fiscal year during which the company had total annual gross revenues of $1.0 billion or more, (ii) the last day of the fiscal year following the fifth anniversary of the date of the company's initial public offering, (iii) the date on which the EGC has issued more than $1 billion in non-convertible debt during the previous three-year period, or (iv) the date on which the company qualifies as a "large accelerated filer" (a company that has been reporting for at least a year, has a public float of at least $700 million and has filed at least one annual report).

If a company's IPO occurred on or before December 8, 2011, then the issuer would not qualify as an EGC. A company can determine not to avail itself of the benefits conferred on EGCs under the Act.

How does the JOBS Act ease restrictions for emerging growth companies and facilitate IPOs?

The legislation adopts several measures to streamline the IPO process for EGCs and provides for scaled disclosure and financial reporting requirements, allowing companies to gradually assume the regulatory burdens of a public company over a one to five-year period.

1) Scaled Financial Statement Disclosure Requirements and Transition Period for Auditing Standards

EGCs are permitted to present only two years of audited financial statements in their IPO registration statements, rather than three years. EGCs also enjoy the corresponding relief in their management's discussion and analysis of financial condition and results of operations disclosure. In addition, for any other registration statement, periodic report or other report they file with the SEC, they are only required to present selected financial data as of the earliest audited period presented in their IPO registration statement. As a result, whereas selected financial data today must be presented for five years, EGCs could present this data for as little as two years.

An EGC is not required to comply with any new or revised financial accounting standard unless and until the standard is generally applicable to companies that are not "issuers" under the Sarbanes-Oxley Act. It may voluntarily choose to do so, but the Act requires an EGC to elect whether it intends to comply with the financial accounting standards that apply to non-EGCs at the time it is first required to file a registration statement, periodic report or other report with the SEC under Section 13 of the Exchange Act. The EGC must continue to follow that approach for the duration of its status as an EGC. Conversely, the Act does not permit an EGC to "cherry pick" individual accounting standards it would prefer to follow.

The Act also exempts EGCs from any rules that the Public Company Accounting Oversight Board ("PCAOB") might establish to require either mandatory audit firm rotation or an "auditor discussion and analysis" that would supplement the auditor's report. These initiatives were the subject of separate "concept releases" issued by the PCAOB last year, but the PCAOB has not yet proposed or adopted such rules for auditors of public companies. The Act further provides that any other rules adopted by the PCAOB in the future shall not apply to auditors of EGCs, unless the SEC specifically determines that they are in the public interest, after considering such factors as investor protection, efficiency, competition and capital formation. While Sarbanes-Oxley already requires the SEC to review most PCAOB rules before they can take effect, the Act effectively subjects future PCAOB rules that would apply to auditors of EGCs to heightened scrutiny.

2) Internal Controls - Auditor Attestation Requirement Relief

The JOBS Act exempts EGCs from the Section 404(b) auditor attestation requirement regarding the adequacy of a company's internal controls. Under existing rules, newly public companies must comply with the auditor attestation requirements upon filing their second annual report, except non-accelerated filers and smaller reporting companies that are exempt from the requirement entirely.

3) Executive Compensation Disclosure Relief

The Act exempts EGCs from providing a comprehensive overview of certain material elements of compensation disclosure, specifically:

- An EGC is treated as a smaller reporting company (generally, a company with a public float of less than $75 million). In this regard, an EGC is exempt from many of the standard executive compensation requirements (including a CD&A section in its SEC filings) and benefits from scaled down executive compensation disclosure, including compensation disclosure for only three (as opposed to five) named executive officers and limited narrative disclosure;

- An EGC is exempt from certain compensation disclosure requirements set forth in the Dodd-Frank Wall Street Reform and Consumer Protection Act (the "Dodd-Frank Act") such as the requirement to hold non-binding shareholder votes on (i) the approval of the compensation of named executive officers (say-on-pay votes), (ii) the frequency of such votes, and (iii) golden parachutes (payments triggered by a merger or acquisition transaction), until no later than one year after they cease to be an EGC or three years after an IPO if the company was an EGC for less than two years; and

- An EGC is also exempt from other Dodd-Frank compensation provisions regarding CEO pay ratio disclosure and a comparison of pay versus financial performance.

4) Confidential SEC Filings

The Act provides that an issuer that qualifies as an EGC can submit its registration statement for its initial public offering confidentially for SEC review. This would also include a qualifying foreign private issuer. However, the company must publicly file all draft registration statements no later than 21 days prior to the commencement of its IPO roadshow.

5) Easing the Restrictions on Communications

The Act gives EGCs and persons authorized to act on their behalf more freedom to communicate (orally or in writing) with potential investors that are qualified institutional buyers or institutional accredited investors to gauge interest in a contemplated securities offering, including an IPO, either before or after the filing of a registration statement. Any such pre-filing and post-filing communications would not be subject to the SEC's current "gun-jumping" restrictions.

6) Expanding the Availability of Research Reports

The Act expands upon the principles of the existing safe harbor of Rule 139 and excludes from the definition of offer under Section 5 of the Securities Act, any research (including during the pre-filing, post-filing and post-effective periods) about an EGC that facilitates its public equity offerings, even if the broker-dealer publishing the research is participating in the offering. The Act also prohibits the SEC or any national securities association from adopting or maintaining any rule that restricts broker-dealers from publishing research about an EGC during the post-IPO blackout period and before expiration of an IPO lock-up agreement. In addition, the Act further expands the scope of "research report" to encompass both oral communications and written communications.

Although the new rules permit the publication or distribution of research reports prior to pricing, they do not explicitly prohibit the SEC or a national securities association from restricting research reports about an EGC prior to pricing (as it does with respect to post offering communications). Although broker-dealers would not be subject to liability under Section 5 of the Securities Act for any pre-offering research, investors could still bring an action under Rule 10b-5, which would require showing that the broker-dealer acted recklessly or with an intention to mislead. Given how Congress approached the treatment of pre-offering and post offering research reports, it warrants watching to see whether the SEC issues guidance with respect to research coverage initiated prior to pricing an IPO.

7) Easing Restrictions on Meetings with Research Analysts

The JOBS Act eases current restrictions on the communications between analysts, investors, companies and investment bankers. Specifically, the Act prohibits the SEC or any national securities association from adopting or maintaining any rule that either restricts research analysts from participating in any communications with an EGC's management, where investment bankers are also present, or restricts who may arrange for communications between a securities analyst and a potential investor in connection with an EGC's IPO.

Other than as described above, the existing rules under the antifraud provisions of the securities laws, Section 501 of the Sarbanes-Oxley Act, SEC Regulation AC and the Global Research Analyst Settlement of 2003 continue to apply to analyst research and communications.

Private Capital Reforms

How does the JOBS Act ease restrictions on private capital formation?

In an effort to facilitate private capital raising, Congress relaxed various existing restrictions. Unlike the self-executing provisions discussed above with respect to IPOs, the legislation directs the SEC to take action to effect certain changes.

1) Permitting General Solicitation in Certain Transactions

The Act directs the SEC to adopt rules within 90 days of enactment of the Act to lift the prohibition against general solicitation and general advertising for certain private placements made pursuant to Rule 506 of Regulation D and Rule 144A. The rules must permit general solicitation or general advertising in connection with private placements pursuant to Rule 506, provided that all of the purchasers of the securities are accredited investors. In addition, issuers relying on Rule 506 must take reasonable steps to verify that purchasers are accredited investors, with the verification methods to be determined by the SEC. It remains to be seen if the SEC will require more than the customary representations issuers typically require from investors in a Regulation D offering.

With respect to Rule 144A offerings, the rules must provide that offers can be made to persons other than qualified institutional buyers by means of a general solicitation or general advertising, as long as the securities are sold only to persons that the seller and any person acting on behalf of the seller reasonably believe are qualified institutional buyers.

Loosening these restrictions should make it easier for companies to undertake private and public offerings simultaneously, since there will be less of a concern that private investors were solicited by the public offering. This additional flexibility is important during difficult market conditions.

2) Increasing the Section 12(g) Threshold

Prior to the passage of the JOBS Act, under Section 12(g) of the Exchange Act, an issuer that had total assets exceeding $10 million and a class of equity securities (other than an exempted security) held of record by 500 or more persons generally had to register its securities under the Exchange Act. The JOBS Act provides that only issuers having total assets exceeding $10 million and a class of equity securities (other than an exempted security) held of record by either 2,000 persons, or 500 persons who are not accredited investors, are required to register the securities under the Exchange Act. Accordingly, private companies will need to keep track of their non-accredited investors. Notably, any employees who receive securities pursuant to an employee compensation plan are not counted toward this shareholder limit. One benefit of these changes is that a company can stay private longer and still raise capital. In addition, companies taking advantage of the new rule may benefit from increased trading activity in private secondary markets.

3) Lifting the Cap on Regulation A Offerings and the Crowdfunding Exemption

Prior to the enactment of the JOBS Act, Regulation A provided an exemption from registration for offerings of up to $5 million per year. The Act directs the SEC to amend Regulation A to increase the offering cap of all securities offered and sold during the prior 12 months to $50 million. Issuers offering securities under the exemption would be required to file audited financial statements and may be subject to the SEC's periodic reporting requirements.

The Act also creates a new exemption for "crowdfunding," which is the process of raising money through a private placement from multiple supporters. Under this new method of raising capital, companies may, subject to meeting other conditions, issue up to $1 million of securities during the prior 12 months provided that sales to any one investor within the prior 12 months may not exceed (i) the greater of $2,000 or 5% of the investor's annual income or net worth if either the annual income or net worth of the investor is less than $100,000 and (ii) 10% of the investor's annual income or net worth up to a maximum aggregate investment of $100,000 if either the annual income or net worth of the investor is equal to or more than $100,000.

Potential Additional Changes

The SEC is required to conduct a comprehensive review of Regulation S-K to analyze whether the disclosure requirements should be modernized and simplified to reduce the costs and other burdens associated with compliance by EGCs during the registration process. A report is due within 180 days of enactment of the Act.

In addition, the SEC is required to report to Congress no later than 90 days after enactment of the Act on the impact that trading and quoting securities in one penny increments (decimalization) has had on the number of initial public offerings since its implementation relative to the period prior to its implementation. The SEC is also required to examine the impact of this change on liquidity for small and mid-cap companies in this study, and whether there is sufficient economic incentive to support trading operations in these securities in penny increments. If the SEC determines that the securities of EGCs should be quoted and traded using a minimum increment of greater than $.01, the SEC can designate a different minimum for EGCs, up to less than $.10, within 180 days of the Act.

Conclusion

Unlike new regulatory reforms such as the Sarbanes-Oxley Act and the Dodd-Frank Act, which continued the trend of increasing disclosure requirements and tougher governance standards, the JOBS Act mandates changes that are deregulatory in nature and seek to loosen certain rules governing access to and regulation of the capital markets. The changes are meant to modernize the capital formation process, allowing for faster and more predictable deal execution with the ultimate goal of providing easier access to the U.S. markets. We expect that the SEC may follow up with specific guidance in certain of the areas covered in the Act, as questions inevitably are raised regarding implementation.

Footnotes

1. An emerging growth company ("EGC") is a company that had total annual gross revenues of less than $1.0 billion for its most recently completed fiscal year. Once an EGC loses its status, it will no longer be permitted to rely on the EGC exemptions. The Act should be consulted for the date when compliance to full public company status will be required for each item. An EGC will retain its status until the earlier of: (i) the last day of the fiscal year during which the company had total annual gross revenues of $1.0 billion or more, (ii) the last day of the fiscal year following the fifth anniversary of the date of the company's initial public offering, (iii) the date on which the EGC has issued more than $1 billion in non-convertible debt during the previous three-year period, or (iv) the date on which the company qualifies as a "large accelerated filer,

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.