Default Rate Decreases from Q1 Rate of 2.15%

NEW YORK, July 19, 2023 – Leading international law firm Proskauer today released the results of its proprietary Private Credit Default Index (the "Index") for the second quarter of 2023, revealing an overall default rate of 1.64%. The default rate reflects a decrease from the previous quarter's default rate of 2.15%. The drop was the first decrease following two consecutive quarters of increasing default rates.

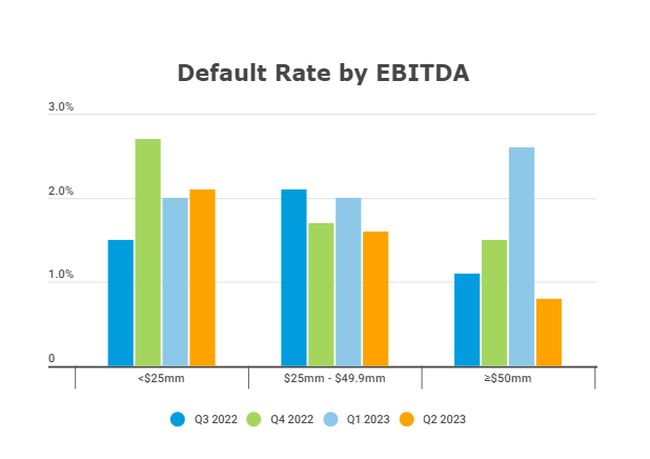

The Index shows that companies with EBITDA at the time of origination greater than $50mm had a default rate of 0.8%, a significant decrease from 2.6% in Q1 2023. Those with $25-$49.9 million of EBITDA had a 1.6% default rate, a decrease from 2.0% in Q1 2023. Those with less than $25 million of EBITDA had a 2.1% default rate, which was a slight increase from 2.0% in Q1 2023.

As noted previously, the higher default rate for smaller companies likely reflects the fact that on average these companies have a greater number of financial covenants than loans to larger companies.

The Index also revealed a drop in defaults for consumer goods/services for the first time since Q2 2022, ending at 5.3% in Q2 2023. The previous quarter's rate was 8.0%. Other industries saw significant decreases in default rates from Q1 2023 to Q2 2023. Health care/life sciences fell by 1.1%; business services by 0.7%; and manufacturing by 1.3%.

Proskauer's Private Credit Default Index tracks senior-secured and unitranche loans in the United States. The Q2 2023 Index includes 977 active loans, representing $144.9 billion in original principal amount. In addition to default rates by EBIDTA and industry, the Index also refines its analysis by default type (payment, bankruptcy, financial covenant, other material default, etc.) and by comparison to the publicly reported default rates for leveraged loans as reported by the rating agencies.

The full report, which is only available to the Firm's direct lending clients, also contains an apples-to-apples comparison to the default rates published by the rating agencies, historical trends by industry and EBITDA bands, defaults by default type, defaults in cov-lite loans and defaults by year of origination.

Methodology

Our Index is based on U.S. dollar denominated senior secured and unitranche loans. Default rates are calculated by dividing the number of defaulted loans by the aggregate number of loans in the Index.

While there are varying conventions of what is considered a default for purposes of calculating a default rate, the Index includes loans that have a payment, financial covenant or bankruptcy default, loans that are otherwise in default if the default is expected to continue for more than 30 days (excludes immaterial defaults) and loans that were amended in anticipation of a default. A default is assumed to take place on the earliest of:

- The date a debt payment was missed

- The date a distressed restructuring occurs

- The date the borrower filed for, or was forced into, bankruptcy

- The date a financial covenant default occurs

- The date that a default occurs if that default is expected to continue for more than 30 days (excludes immaterial defaults)

- The date the loan is modified in anticipation of a default

For the purposes of this study, if a borrower re-emerges from bankruptcy, or otherwise restructures its defaulted debt and, reestablishes regular, timely payment of all its debts, we reclassify the borrower as a non-defaulted borrower, as of the date of emergence or restructure.

Proskauer's Q2 2023 Private Credit Default Index Reveals Default Rate Of 1.64%

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.