In these times of budget austerity and acute market competition, corruption risks have received new attention, particularly at defense contractors. Keen management teams should pay close attention to corruption risks and activities that may raise concerns related to anti-corruption compliance. As we explain in this client memorandum, the risks and stakes are such that defense contractors should reexamine their anti-corruption compliance policies and procedures with a critical eye in light of the new market environment.

For defense contractors, there are three principal areas of potential corruption exposure: direct business with traditional government customers, their collaboration with intermediaries and other business partners, and their business with state-affiliated entities, including state-owned commercial aviation companies. This client memorandum discusses the corruption risks in those three areas.

New Market Environment, New Pressures

Historically, defense contracting has been an area of focus for anti-corruption enforcement. Defense contractors compete for high-stakes, long-term, and valuable contracts, which in some instances can be worth billions of dollars. The commercial need and pressure to win government contracts is great, and the related risk of corruption in many jurisdictions around the world is high, especially in countries where bribery may be a culturally accepted way of doing business or be perceived as being a necessary prerequisite to a deal.

This is particularly true as the budgets for the acquisition of new military equipment are under severe strain.1 In light of that pressure, many defense contractors have to compete more aggressively for business from new (and existing) customers, and to pursue business in countries outside the large traditional NATO and NATO-aligned countries that have been their historic focus.2

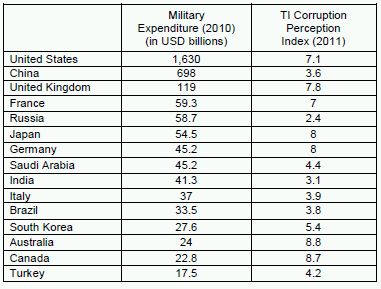

The corruption risks in this change in the market environment are substantial. Of the fifteen countries with the highest military expenditures in 20103 (according to the Stockholm International Peace Research Institute), the average Transparency International Corruption Perception Index score of the NATO and NATO-aligned countries4 is 7.05 out of 10 (where 0 is "highly corrupt" and 10 is "very clean"). The average score of the non-NATO and non-NATO-aligned countries5 in the same group of fifteen (excluding China and Russia) is 4.2. The following table provides additional detail.

Many defense contractors originally designed their anti-corruption policies and procedures around risks typical for business with the NATO and NATO-aligned countries. Accordingly, as defense contractors‟ customer bases have evolved, it would be prudent to reevaluate their anti-corruption policies to ensure that they sufficiently address the risks associated with their new operational reality. Such a reevaluation should entail not only making necessary revisions to the written policies and procedures, but also making corresponding upgrades to the compliance infrastructure to enforce them effectively, providing appropriate risk-based training to relevant personnel, and communicating the importance of compliance within the organization. These steps are necessary to manage the risks inherent in doing business with new types of customers in different parts of the world and to maximize the mitigation credit received from the regulators should violations occur.

Legal Landscape

The U.S. Foreign Corrupt Practices Act ("FCPA") and U.K. Bribery Act 2010 are significant components of the global anti-corruption regime, which also includes the OECD Convention on Combating Bribery of Foreign Public Officials in International Business Transactions (to which 39 countries have acceded), the UN Convention Against Corruption (which has 159 parties), and other national legislation.

The FCPA has two fundamental components. First, the anti-bribery provisions—which apply to issuers, domestic concerns, and persons acting on their behalf—make it unlawful to provide, offer, or promise anything of value to a foreign government official to obtain or retain a business advantage. Second, the FCPA‟s accounting provisions require issuers: (a) to maintain books and records that accurately and fairly reflect the transactions of the company, and (b) to devise and maintain an adequate system of internal accounting controls. The Bribery Act, in addition to prohibiting bribery of foreign officials, also criminalizes commercial bribery and creates a corporate offense for failing to prevent bribery. Although the FCPA itself does not prohibit commercial bribery, the Department of Justice has been charging such conduct under the Travel Act (often in connection with FCPA charges). The existence of a robust anti-corruption compliance program may be a defense to a Bribery Act charge of failing to prohibit bribery and may be a mitigating factor in an FCPA case (under the U.S. Sentencing Guidelines).

In recent years, the U.S. government has placed a greater emphasis on the enforcement of the FCPA generally and violations by defense contractors, in particular. For example, the government investigated BAE Systems for foreign bribery (ultimately resolving the case on other grounds) and United Industrial Corporation ("UIC") for bribes paid by a subsidiary in connection with work for the Egyptian Air Force. The U.K. Serious Fraud Office ("SFO") is just beginning to prosecute under the Bribery Act, but many expect the SFO to enforce the Act aggressively.

The U.S. and U.K. governments have the resources and willingness to investigate and bring these types of cases, despite a number of recent setbacks.6 The U.S. Department of Justice Criminal Division‟s Fraud Section has been expanding the number of its FCPA prosecutors; the SEC‟s Division of Enforcement created a specialized FCPA unit; the FBI established an International Contract Corruption Task Force; and, most recently in 2011, the FBI launched an initiative focusing on corruption in commercial aviation sales and maintenance contracts. In mid-2011, SFO Director Richard Alderman stated that the SFO has approximately 80 staff members working on corruption cases.7 Moreover, and unsurprisingly, the U.S. and U.K. authorities are cooperating with each other (and with other prosecutors around the world) on bribery investigations.

Some Practical Challenges

In order to penetrate emerging and nontraditional markets, defense contractors often choose—and, in some circumstances, are required—to use intermediaries and local business partners. The risks that accompany doing business with such persons and firms are myriad, although different arrangements entail different risk dynamics. Defense contractors‟ compliance policies and procedures should be sure to require and document thorough due diligence of all such persons. Although such diligence is a smart business practice, the authorities have come to expect it.8 At a minimum, the diligence should include determining the existence of relationships between the intermediary or business partner and government officials and state-owned enterprises, understanding the nature of those relationships, evaluating the intermediary‟s other client relationships, and learning about the intermediary‟s various financial arrangements with third parties. In the course of the diligence, defense contractors should be particularly attuned to red flags and should address them if they arise. If a company engages an intermediary or local business partner, the contract should include appropriate anti-corruption-related provisions to mitigate the risk further.

The risks associated with using intermediaries who subsequently engage in corrupt conduct are not theoretical or remote. Indeed, the government has proven itself willing to charge companies and their officers with violations of anti-corruption laws for their conduct in connection with intermediaries. For example, in 2009, the former president of ACL Technologies (which was a subsidiary of UIC) settled FCPA anti-bribery and accounting charges with the SEC and agreed to a civil penalty. The defendant allegedly authorized payments to an Egyptian-based agent while knowing or consciously disregarding the high probability that the agent would transfer at least a portion of those payments to Egyptian Air Force officials in order to win a contract related to a military aircraft depot in Cairo. Parallel to that, the SEC filed a settled administrative proceeding against UIC alleging violations of the books-and-records and internal-controls provisions; UIC agreed to disgorge its net profits from the contract.

A New Wrinkle: State-Owned Commercial Aviation

In September 2011, Reuters reported that the FBI had launched a new initiative focusing on commercial aviation sales and maintenance contracts.9 There has been speculation that this initiative may have been precipitated by self-disclosures by certain companies, whistleblower reports, or a combination of those factors.

Because many defense contractors manufacture both military and civilian versions of their aircraft, the expansion of the focus of FCPA enforcement from business with traditional government customers to business with foreign state-owned airlines is unsurprising. As noted above, many defense contractors are expanding their military-equipment customer base in order to offset declining business in their traditional geographic markets. They are doing the same for their sales and leases of civilian aircraft (and accompanying service contracts), and the corruption risks inherent in doing business with foreign state-owned airlines are as great as they are when doing business with foreign ministries of defense.

Depending on the circumstances, employees of state-owned enterprises may be foreign officials for purposes of the FCPA, and, therefore, the prohibition on corrupt payments will apply equally to them.10 Unfortunately, there is not a bright-line definition of what constitutes a state-owned enterprise or which employees of state-owned enterprises are considered foreign officials under the FCPA. To complicate matters, the Department of Justice and the SEC have been employing a broad interpretive approach in this area.11

The Stakes

The potential sanctions for an FCPA violation are not pleasant: high criminal and civil fines, disgorgement of profits attributable to the corrupt activity, independent compliance monitors, and charges against individual officers and employees (and possible imprisonment of those persons). The sanctions for violating the Bribery Act include an unlimited fine and imprisonment for up to ten years. Collaterally, individuals convicted under the Bribery Act may be disqualified from serving as a director of a public company for up to 15 years (under the Company Directors Disqualification Act 1986), and assets may be confiscated (under the Proceeds of Crime Act 2002). A bribery conviction may also impact a company‟s ability to access the U.S. capital markets by limiting its ability to rely on certain offering exemptions. Debarment is a discretionary sanction for a bribery conviction in both the United States and the United Kingdom, but is a very real possibility. Related to debarment, companies might also lose export licenses and other necessities to their business.

While companies face considerable sanctions if there is a determination that they have violated the FCPA or the Bribery Act, repercussions are often felt long before the charging documents have been drafted. The investigations, both an internal investigation by counsel and the official investigations by the U.S. and foreign authorities, can be extremely time consuming and often result in distractions within the company. The scope of those investigations can be staggering—multiple geographies, business units, languages, and accounting systems—and the costs of counsel, forensic accountants, and other consultants are not insignificant. Moreover, while government investigations are conducted non-publicly, leaks to the media are not uncommon, and, under certain circumstances, public companies may be required to disclose the existence of the investigation in their public filings.

In order to manage these issues, companies should work with their counsel routinely to determine whether there should be enhancements to their anticorruption policies, procedures, and controls.

Conclusion

The authorities have made clear that defense contractors are under scrutiny for corruption and have demonstrated by the cases they have brought to date that they are able and willing to extract considerable penalties. Given the potential risks for companies that operate in the military and civilian markets, particularly the enhanced risks inherent in doing business in new markets with reputations for a prevalence of corrupt behavior, defense contractors should ensure that their compliance policies and procedures effectively address those risks. The potential sanctions are too severe to simply think that a policy merely telling employees not to engage in bribery is sufficient.

Footnotes

1 For example, between 2008 to 2010, the aggregate European Union defense expenditure decreased from € 201 billion to € 194 billion. European Defence Agency, Europe and United States Defence Expenditure in 2010, at 5 (Jan. 12, 2012), available at http://www.eda.europa.eu/Libraries/Documents/EU-US_Defence_Data_2010.sflb.ashx . See also David Alexander and Sebastian Moffett, Panetta Reassures European Allies Over Defense Cuts, REUTERS, Feb. 4, 2012, available at http://www.reuters.com/article/2012/02/04/us-security-usa-panetta-idUSTRE81308520120204 .

2 To be sure, the Justice Department is still prosecuting conduct arising from contracts with the United States‟ traditional defense partners. In 2009, the former director of sales and marketing for Pacific Consolidated Industries LP ("PCI") pleaded guilty to conspiracy to violate the FCPA. He bribed a UK Ministry of Defence official by way of sham consulting contracts between PCI and a relative of the official in order to win Royal Air Force contracts.

3 In order of decreasing military expenditure: United States, China, United Kingdom, France, Russia, Japan, Germany, Saudi Arabia, India, Italy, Brazil, South Korea, Australia, Canada, and Turkey

4 United States, United Kingdom, France, Japan, Germany, Italy, Australia, Canada, and Turkey.

5 Saudi Arabia, India, Brazil, and South Korea.

6 For example, on February 21, 2012, a U.S. District Court dismissed all charges—on the Department of Justice‟s own motion—against the remaining 16 defendants in the so-called "SHOT Show" FCPA case, which arose from an FBI sting operation. The Department‟s motion seeking dismissal of the charges cited the Department‟s lack of courtroom success (in two trials, no defendants had been convicted, some had been acquitted, and others were granted mistrials following hung juries). See Del Quentin Wilber, Charges Dismissed Against 16 Accused of Bribing Foreign Official in Sting, WASH. POST, Feb. 21, 2012, available at http://www.washingtonpost.com/local/crime/charges-dismissed-against-16-accused-of-bribing-foreign-official-in-sting/2012/02/21/gIQAOhU5RR_story.html .

7 Richard Alderman, Director, Serious Fraud Office, Address to Int‟l Dev‟t Comm., Hrngs. on Fin. Crime and Dev‟t (July 13, 2011).

8 See, e.g., U.S. Dep‟t of Justice, Lay-Persons Guide to the Foreign Corrupt Practices Act, available at http://www.justice.gov/criminal/fraud/fcpa/docs/lay-persons-guide.pdf ("To avoid being held liable for corrupt third party payments, U.S. companies are encouraged to exercise due diligence and to take all necessary precautions to ensure that they have formed a business relationship with reputable and qualified partners and representatives. Such due diligence may include investigating potential foreign representatives and joint venture partners to determine if they are in fact qualified for the position, whether they have personal or professional ties to the government, the number and reputation of their clientele, and their reputation with the U.S. Embassy or Consulate and with local bankers, clients, and other business associates. In addition, in negotiating a business relationship, the U.S. firm should be aware of so-called red flags,‟ i.e., unusual payment patterns or financial arrangements, a history of corruption in the country, a refusal by the foreign joint venture partner or representative to provide a certification that it will not take any action in furtherance of an unlawful offer, promise, or payment to a foreign public official and not take any act that would cause the U.S. firm to be in violation of the FCPA, unusually high commissions, lack of transparency in expenses and accounting records, apparent lack of qualifications or resources on the part of the joint venture partner or representative to perform the services offered, and whether the joint venture partner or representative has been recommended by an official of the potential governmental customer.").

9 Andrea Shalal-Esa, FBI Eyes Possible Corruption in Aerospace, REUTERS, Sep. 9, 2011, available at http://www.reuters.com/article/2011/09/09/us-aero-arms-summit-bribery-idUSTRE78876G20110909 .

10 This distinction is irrelevant under the U.K. Bribery Act, which is not limited to bribery of foreign officials.

11 For example, they have asserted that employees of a steel mill and a construction company are "foreign officials" because of the foreign government‟s ownership interest in those businesses. See United States v. SSI Int'l Far East Ltd., 06 CR 398 (D. Or. 2006) (steel mill); SEC v. York Int'l Corp., 07 CV 1750 (D.D.C. 2007) (construction company).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.