As institutional investors and fund sponsors continue to navigate a challenging economic landscape, we have observed the following trends and opportunities in the U.S. private funds market.

1. Fundraising and the denominator effect

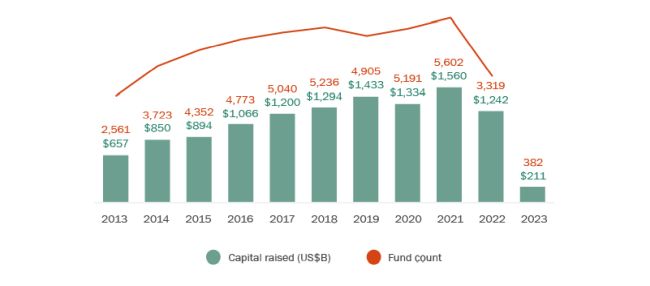

The decline in private capital fundraising observed at the tail end of 2022 shows no signs of slowing down in 2023. According to PitchBook's latest "Global Private Market Fundraising Report", through the first quarter of the year, fundraising is lagging significantly from the record-setting levels of recent years (see Figure 1). This is impacting fund strategies across the board, with the sole exception of secondaries funds which are off to a hot start (see Figure 2 below).

Figure 1 - Private capital fundraising activity

Source: PitchBook. Global fundraising activity as of March 31, 2023.

Figure 2 - YoY fundraising changes by strategy (trailing four quarters)

|

Strategy |

Capital raised ($B) |

YoY change |

|

Private equity |

$455.0 | -15.8% |

|

Venture capital |

$202.0 | -38.4% |

| Real estate | $92.3 | -42.0% |

| Real assets | $62.8 | -63.9% |

| Debt | $197.0 | -21.9% |

| Fund of funds | $19.9 | -50.6% |

| Secondaries | $62.4 | 39.6% |

| Private capital | $1091.4 | -29.1% |

Source: PitchBook. Global fundraising activity as of March 31,

2023.

While a host of factors are contributing to the overall trend (higher interest rates, inflationary pressures, shrinking deal volumes, more rigorous approval processes and general market uncertainty), many institutional investors are scaling back their commitments to private funds as their portfolio exposure to alternative assets has become overweighted due to the "denominator effect". Initially triggered primarily by the rapid decline in public market valuations in 2022, the denominator effect continues to impact investors despite the recent upswing in public market performance, as fund sponsors generally remain reluctant to correct the inflated valuations of certain assets held by their funds' portfolios. We expect institutional investors affected by these challenges will be more selective in deploying their commitments to private funds, focusing on their longer-term sponsor relationships as opposed to less established sponsors with unproven track records. As a result, some private fund sponsors are starting to look for new and alternative sources of capital, particularly from retail investors, and we are seeing a recent boom in the retail fund market.

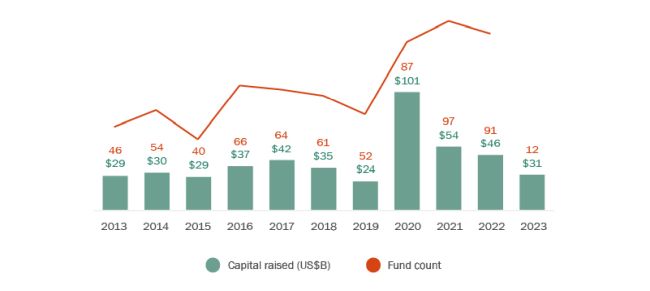

2. Secondaries funds

According to PitchBook (see Figure 3), the capital raised for secondaries funds in the first quarter of 2023 was the second highest on record for a quarter, reaching $30.7 billion. This represents approximately two-thirds of the total capital raised for secondaries funds in all of 2022, with four of the top five secondaries funds closing in the first quarter of 2023 coming out of the United States. We expect secondaries funds will continue to be a bright spot in the U.S. funds market throughout the year, as secondaries firms are able to take advantage of investors in need of liquidity that are selling their fund interests at a discount.

Figure 3 - Capital fundraising activity for secondaries

Source: PitchBook. Global fundraising as of March 31, 2023.

3. ESG and anti-ESG

Environmental, social and governance (ESG) considerations continue to be top of mind throughout the private funds space, as more and more institutional investors adopt internal ESG policies and pledges that they expect fund sponsors to take into account when managing their funds. While fund sponsors are trying to keep up with investors' growing requests for ESG-related diligence, investment restrictions, reporting and disclosure, they also face a conflicting challenge in the United States—the anti-ESG movement (watch our video to learn about common ESG requests from investors).

We expect fund sponsors will largely try to remain neutral on ESG issues and be sensitive to both sides' concerns in an effort to maximize their fundraising prospects.

As of March 2023, over half of U.S. jurisdictions have anti-ESG legislation that is being proposed or already on the books, including anti-boycott laws, ESG investment prohibitions and other anti-ESG policies. Such efforts are representative of the sharp political divide in the U.S. and are being driven by lawmakers in conservative-led states, in contrast to opposing legislation that supports ESG priorities in progressive-leaning states. As pro- and anti-ESG forces battle it out in the United States, we expect fund sponsors will largely try to remain neutral on the issue and be sensitive to both sides' concerns in an effort to maximize their fundraising prospects. We could also see the emergence of innovative fund structures that seek to balance these competing interests, such as distinct fund classes or parallel vehicles that address each side's ESG (or anti-ESG) related priorities.

At the same time, the Securities and Exchange Commission (SEC) is very focused on ESG issues related to disclosure and reporting and on combating "greenwashing". The SEC is sending clear signals that they are taking greenwashing claims seriously through its proposed rules1 (which are still pending), various risk alerts and enforcement actions charging investment advisers for failing to follow policies and procedures relating to ESG.

4. SEC proposed rules

Last year, the SEC proposed substantial new rules under the Investment Advisers Act of 1940, as amended, that, once implemented, are expected to have a significant impact on certain areas of the fundraising and ongoing compliance process for fund sponsors (read our previous discussions of the proposed rules and 2023 examination priorities).

The SEC's proposed rules could ultimately mean that fund sponsors will be required to provide enhanced quarterly reporting and more standardized performance disclosures, as well as be subject to mandatory audits and annual reviews.

The comment period drew a strong reaction from the market, from both fund sponsors and investors, with comments in both support of and opposition to the proposed rules. While the timing for finalization of the rules is uncertain, we generally expect that the final rules will mirror the SEC's initial proposals. This could ultimately mean that fund sponsors will be required to provide enhanced quarterly reporting and more standardized performance disclosures, as well as be subject to mandatory audits and annual reviews. Further, we expect an increased focus on preferential treatment of larger investors, which could lead to an uptick in funds-of-one or separately managed accounts for such investors, in an attempt to preserve their access to certain preferential terms.

Footnote

1. The proposed rules are available at: https://www.sec.gov/rules/proposed/2022/ia-6034.pdf.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.