Private Credit Defaults Increase from 1.41% in Q3

NEW YORK, January 18, 2024 – Proskauer, a leading international law firm, today announced the results of its quarterly Private Credit Default Index (the "Index") for Q4 2023, revealing an overall default rate of 1.6%. The rate is a slight increase from Q3's default rate of 1.41%, though still lower than Q1 and Q2, which were 2.15% and 1.64%, respectively.

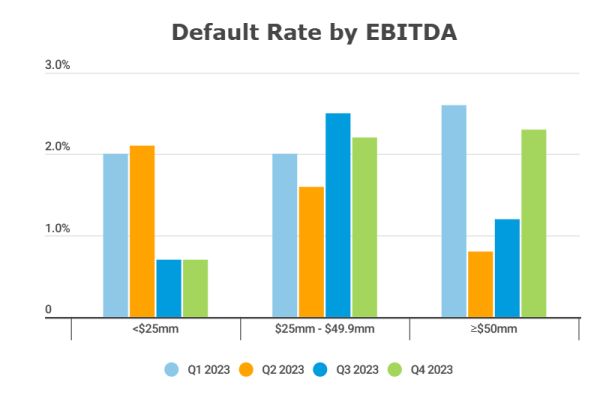

The default rate for companies with greater than $50 million of EBITDA increased from 1.2% in Q3 to 2.3% in Q4. Core middle market companies, those with EBITDA between $25-$49.9 million, had a default rate of 2.2% in Q4, a modest decrease from the prior quarter's rate of 2.5%. Companies with EBITDA under $25 million remained steady between Q3 and Q4, with default rates at 0.7% in each quarter. For the third consecutive quarter, the default rate for all EBITDA bands was below the default rate reported by Fitch Ratings.

The Firm's Private Credit Default Index tracks senior-secured and unitranche loans in the United States and breaks down default rates by EBITDA and industry as well as default type (payment, bankruptcy, financial covenant, other material default, etc.). The Q4 2023 Private Credit Default Index included more than 1,000 active loans, representing $148.9 billion in original principal amount.

The full report is available only to the Firm's direct lending clients and contains a comparison to the default rates published by the rating agencies, historical trends by industry and EBITDA bands, defaults by default type, defaults in cov-lite loans and defaults by year of origination.

Proskauer's Private Credit Default Index Reveals Rate Of 1.6% For Fourth Quarter Of 2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.