SUMMARY

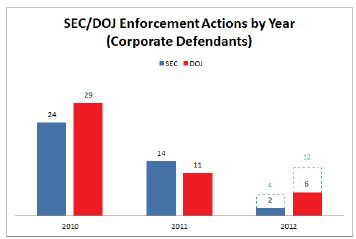

The number of Foreign Corrupt Practices Act ("FCPA") enforcement actions brought in the first half of 2012 is roughly on par with the number brought in the first half of 2011. Nonetheless, enforcement activity for both periods is down from a prolific 2010. If the numbers continue to trend as they did in 2011, 2012 should end with approximately 12 SEC and 14 DOJ enforcement actions.

Several trends from 2011 seem to be continuing through the first half of 2012, including the discounting of financial penalties by both DOJ and the SEC for companies that made swift, voluntary disclosures and continued to cooperate with the government. In at least one significant case (U.S. v. Peterson), DOJ and the SEC declined to bring an enforcement action against the individual defendant's corporate employer, financial services giant Morgan Stanley, noting Morgan Stanley's rigorous FCPA compliance program, voluntary disclosure, and ongoing cooperation.

After having declined to impose outside compliance monitors/consultants under recent deferred prosecution agreements, this trend has apparently been reversed somewhat. Already in 2012, DOJ and the SEC have required outside compliance consultants in at least four cases.

On the trial front, the setbacks that began for the government in 2011 continued into the first half of 2012. In the "SHOT Show" cases in Washington, D.C., the government dismissed the charges against the remaining defendants and dropped cases in which others had already been convicted. The judge noted that the dismissals closed a "long and sad chapter of white collar criminal enforcement." In O'Shea/ABB, at the close of the government's case-in-chief, the District Court in Houston granted the defendant's motion for a judgment of acquittal on the FCPA counts.

Subsequently, the government moved to dismiss the remaining counts of the indictment. And in May, the government dropped its Ninth Circuit appeal in the Lindsey Manufacturing Company FCPA case, in which Venable LLP's Jan Handzlik was counsel to Lindsey Manufacturing and its CEO, Dr. Keith Lindsey. Thus, the District Court's order overturning the convictions and dismissing the indictment with prejudice on grounds of prosecutorial misconduct was allowed to stand.

FCPA legislative reform efforts continued to gather steam in the first half of 2012. In February, the U.S. Chamber of Commerce and several members of Congress issued letters demanding "clear and concrete" guidance from DOJ on its enforcement positions, including the definition of "foreign official," requirements for adequate compliance programs, and the methodology for calculating fines and disgorgement, among other things. At the same time, other members of Congress continued to seek automatic debarment of government contractors convicted of FCPA violations and to make it easier for companies and individuals to bring private causes of action for FCPA violations. The implementation of Dodd-Frank, which monetarily rewards whistleblowers who provide information resulting in a successful SEC enforcement action, has also started to change the enforcement landscape.

Finally, in the first half of 2012, countries other than the United States continued to be active in policing global corruption. July 2012 marks the one-year anniversary of the U.K. Bribery Act's taking effect. China, India, Canada, Russia, and Greece revamped their anti-corruption efforts in 2011 and early 2012. This added another layer of complexity to anti-corruption compliance for multinational corporations.

STATISTICS

Corporate Defendants

In the first half of 2012:

- DOJ brought six enforcement actions against corporate defendants, the same number it brought in the first half of 2011.

- However, the SEC brought only two enforcement actions against corporate defendants, compared to nine for the same period in 2011 and eight in 2010.

Individual Defendants

In the first half of 2012:

- DOJ brought one new enforcement action against an individual defendant, compared with none during the same period in 2011 and two in 2010.

- At least four individuals pleaded guilty to FCPA violations and are currently awaiting sentencing.

- Meanwhile, the SEC brought four enforcement actions against individual defendants, compared to only one in the first half of 2011. By this time in 2010, the SEC had also initiated four enforcement actions against individuals.

Fines/Penalties

- In the first half of 2012, DOJ and the SEC together imposed approximately $124 million in sanctions, including disgorgement, in FCPA cases. In 2011, the total amount of these sanctions imposed was slightly more than $500 million. Penalties for these periods are significantly down from the cumulative DOJ/SEC total of approximately $1.7 billion in 2010.

- In probable reaction to long-running complaints, DOJ issued a series of press releases in 2011 and early 2012 asserting that it was difficult to quantify the value of voluntary disclosures and cooperation and stating that many sanctions had been substantially reduced because of the target's early selfreporting and continued cooperation.

Industry Targets

- As in 2011, most DOJ enforcement actions in 2012 involved

corporate and/or individual defendants in the following industries:

- Government Contracting, especially against contractors providing logistics, engineering and construction services; and

- Health Care and Life Sciences, especially medical device manufacturers.

- These same industries were targeted in 2010, with additional focus by DOJ on the energy, technology, telecommunications, logistics, manufacturing, and tobacco industries.

U.S.-Based Versus Non-U.S.-Based Defendants

As in 2011 and 2010, in the first half of 2012, roughly half of the enforcement actions were against non-U.S.-based companies and individuals, suggesting that DOJ and the SEC are continuing their publicized efforts to "level the playing field" with respect to non- U.S.-based entities.

RESOLUTIONS

- So far in 2012, DOJ has entered into more than 20

nonprosecution or deferred prosecution agreements with corporations

in various criminal enforcement areas. Of these, more than

one-quarter (six) were in the FCPA arena.

- Of the six companies that have entered into nonprosecution or deferred prosecution agreements with DOJ so far in 2012, all reportedly had their fines/penalties reduced because of early self reporting and ongoing cooperation. In some settlements, DOJ highlighted the companies' "extraordinary cooperation," including, among other things, an extensive internal investigation, following which the company made both U.S.- and non-U.S.-based employees available for interviews, and collected, analyzed, and organized voluminous evidence and information for DOJ.

- In what may be indicative of a trend, roughly half of the FCPA non-prosecution and deferred prosecution agreements in the first half of 2012 included provisions related to the companies' M&A activities, namely, specific requirements to conduct pre-transactional FCPA due diligence and to report any negative findings to DOJ, and to ensure that newly acquired/created entities are subject to the same rigorous anti-corruption compliance policies and training as the acquiring company. These provisions were foreshadowed by the increasing number of enforcement actions raising successor liability issues in previous years, such as Watts Water Technologies, Alliance One, and General Electric.

- Three of the six companies receiving deferred prosecution agreements in the first half of 2012 required the defendants to retain outside compliance consultants, compared with 2011, when only one deferred prosecution agreement required an outside compliance consultant (JGC Corporation). In Smith & Nephew and Biomet, Inc., DOJ adopted a "hybrid" approach to monitoring, whereby the defendants were required to retain outside compliance consultants for the first 18 months of their three-year deferred prosecution agreements and then to self-report to DOJ for the remaining 18 months.

U.S. v. Peterson (Morgan Stanley): In perhaps the most noteworthy resolution so far in 2012, individual defendant Garth Peterson, an American citizen and the former managing director of Morgan Stanley's real estate business in China, pleaded guilty to one count of conspiracy to circumvent internal controls. Mr. Peterson was alleged to have evaded Morgan Stanley's internal controls, by transferring a multi-million-dollar real estate ownership interest to himself and a Chinese government official, with whom Mr. Peterson had a personal friendship. Morgan Stanley discovered evidence of Mr. Peterson's illicit conduct through its system of internal accounting and anticorruption controls. It self-reported, conducted an internal investigation, and cooperated with DOJ and the SEC.

Ultimately, DOJ and the SEC declined to bring any enforcement action against Morgan Stanley, publicly citing Morgan Stanley's:

- Clear internal guidelines prohibiting bribery and other corrupt payments in the form of gifts, business entertainment, travel, lodging, meals, charitable contributions, and employment;

- Regular updating of internal policies to reflect recent regulatory developments and specific risks;

- Frequent training of employees and agents on internal policies, the FCPA, and other anticorruption laws. For instance, according to the DOJ press release, Morgan Stanley trained various groups of Asia-based personnel, including Mr. Peterson, on anti-corruption policies 54 times. Mr. Peterson himself had been trained seven times and reminded of his obligation to comply with the FCPA on at least 35 occasions;

- Close and regular monitoring of transactions posing corruption risks;

- Random audits of employees, transactions, and entire business units;

- Frequent testing to identify illicit payments;

- Extensive pre-transactional due diligence on all new business partners; and

- Even more stringent controls on any payments made to business partners.

Morgan Stanley was commended by DOJ for these business practices, which DOJ acknowledged were specifically calculated to eliminate bribery and corruption within the company. Mr. Peterson, who faces a maximum penalty of five years in prison, was deemed to be a "rogue" employee.

Lufthansa/BizJet: In March 2012, DOJ announced a settlement with BizJet International Sales & Support ("BizJet"), an Oklahoma-based aircraft maintenance, overhaul, and repair outfit accused of bribing Mexican and Panamanian government officials in exchange for aircraft services contracts. Under its deferred prosecution agreement, BizJet is obligated to pay approximately $11.8 million in criminal penalties and to implement significant FCPA compliance measures. Lufthansa, A.G., BizJet's parent company, also entered into a non prosecution agreement with DOJ, despite having no direct involvement in the underlying FCPA violations. Although no monetary penalty was imposed on Lufthansa, it admitted to and acknowledged responsibility for BizJet's conduct and committed to ongoing cooperation with DOJ while implementing its own set of rigorous FCPA compliance measures. According to some, the Lufthansa/BizJet case presents a new twist to FCPA successor liability: a parent company held to some measure of accountability for the conduct of its subsidiary, without any apparent discussion in the charging documents of the parent's role, if any, in the underlying FCPA violations.

To read this article in full please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.