With private equity transactions appearing to be on the increase, perhaps now is a good time to revisit what employers and employees need to consider when deciding whether or not to make a restricted securities regime election.

The underlying principle of the restricted securities regime is that if an employee acquires restricted securities (e.g. shares which are subject to transfer restrictions), income tax on the proportion of the unrestricted market value ("UMV") (i.e. the market value of the restricted securities ignoring the effects of the restrictions) which represents the difference between the actual market value of the securities, taking account of the restrictions ("AMV") and the UMV of the securities, is deferred. When a restriction is lifted or the securities are sold (a chargeable event), the proportion of the unrestricted market value which is released is then charged to income tax.

Without such a regime, when restrictions are lifted (and as such increasing the value of the employee's holding), the rise in value would not be taxed and any gain arising when the restricted securities are sold would only be taxed under the capital gains tax regime (which tends to be much more favourable to a tax payer than the income tax regime).

Restricted Securities

The restricted securities regime is contained in Chapter 2 of Part 7 of the Income Tax (Earnings and Pensions) Act 2003 ("ITEPA"). It applies to "securities" or "interests in securities" which are both "employment related securities" and "restricted securities" or "restricted interests in securities".

The above terms are defined in the legislation. Although the scope of this article does not extend to considering their meaning in detail, as Chapter 7 has been drafted with a pronounced anti-avoidance motive, it will be of no surprise that each term is given a wide meaning. In the context of private equity transactions, shares acquired by a manager, for example in a company incorporated to acquire a target, will be restricted securities if the shares are subject to "good/bad leaver" provisions and such provisions reduce the market value of the shares.

As mentioned above, the restricted securities regime is broadly designed to impose an income tax charge on any untaxed value of restricted securities owned by an employee when the restrictions on the securities are lifted or the restricted securities are sold.

It should be noted that where an income tax charge arises on the lifting of a restriction, the employee will have to find the money to pay the tax bill. The same is true if an income tax charge arises on making a restricted securities regime election at the time of acquisition (see below).

On the occurrence of a chargeable event, the taxable amount is calculated in accordance with the following formula:

(UMV x (IUP – PCP – OP)) - CE

where:

UMV is the unrestricted market value of the securities immediately after the chargeable event (i.e. their market value ignoring the effects of the restrictions).

IUP is the "initial uncharged proportion" and its value is calculated by using the formula:

(IUMV – DA) / IUMV

In this formula:

IUMV is the unrestricted market value of the securities at the time they were acquired.

DA is the total of the deductible amounts (basically the consideration paid to acquire the restricted securities, plus any amounts already treated as taxable income arising from the restricted securities).

PCP is the "previously charged proportion" and is the proportion which has already be charged to tax on previous taxable events under the restricted securities regime. If there have been no previous taxable events, PCP will be zero.

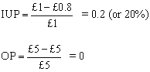

OP is the "outstanding proportion" and is the proportion that is not chargeable under the current taxable event, but may be charged on a future taxable event under the restricted securities regime. OP is calculated using the formula:

(UMV – AMV) / UMV

In this formula:

UMV is the unrestricted market value of the restricted securities immediately after the relevant chargeable event.

AMV is the actual market value of the restricted securities (taking all restrictions into account) immediately after the relevant chargeable event.

CE is any available costs and expenses (e.g. consideration given by the employee in connection with the lifting of restrictions).

An Excel spreadsheet to assist employees and employers to calculate the taxable amount under the restricted securities regime is available on request from HMRC.

Straightforward Example

An employee is invited to acquire a number of shares for 80p per share in his employer company, each with an initial unrestricted market value (IUMV) of £1, on terms that he is restricted from transferring the shares for four years (it is this restriction which has reduced the market value of each share from £1 to 80p). At the end of the four year period, the shares have an unrestricted market value (UMV) of £5 each.

After four years a charge to income tax will arise on:

UMV x (IUP – OP)

where:

UMV = £5

i.e. £5 x 0.2 = £1

As can be seen in a straightforward case, the taxable proportion of the unrestricted market value will equal the discount enjoyed by the employee when the restricted securities were acquired, expressed as a proportion of the unrestricted market value. In other words, as the amount paid by the employee for the shares (80p) represents a discount of 20%, when the restrictions expire in four years time and the shares are worth £5, income tax is chargeable on £1 (20% of £5).

It should be noted that if, for example, the employee had paid 50p per share (30p less than each share's actual market value) a liability to income tax equal to 30p per share would arise in respect of their acquisition under the general earnings charging provisions.

It should also be noted that if the employee had paid £1 per share (i.e. had paid the unrestricted market value for each share), no restricted securities tax charge would arise in the future. However the practical difficulty here in the context of shares in a private company is valuing the shares as such a valuation is more of an art than a science. It is, therefore, unlikely that HMRC's and an employee's unrestricted market value of shares in a private company would be the same.

To alleviate this practical difficulty HMRC and the British Venture Capital Association on 25 July 2003 jointly issued a memorandum of understanding which, amongst other things, describes the circumstances in which HMRC will normally (and in the absence of any tax avoidance) accept that managers acquiring restricted securities in a venture capital or private equity backed company do so for a price which is not less than their initial unrestricted market value (so that no charge to income tax will arise on acquisition nor subsequently upon the occurrence of a chargeable event).

The full text of the memorandum can be found by visiting the British Venture Capital Association's website (www.bvca.co.uk).

Unappealing Feature

One of the most unappealing features of the restricted securities regime is that tax can still be due if the value of the restricted securities declines between the date of acquisition and the chargeable event. This is the case even if the unrestricted market value at the time of the chargeable event is less than the amount the employee actually paid for the restricted securities.

In the above example, if the unrestricted market value of each share at the time of the chargeable event had fallen to 60p, the taxable amount per share would be:

60p x (0.2 – 0) = 12p

i.e. 20% of 60p.

Section 431(1) ITEPA Election

The employer and employee may elect for the securities to be taxed on acquisition as if all restrictions were disregarded. Such an election is often referred to as a "section 431(1) election" and is irrevocable. If such an election is made, the employee will be charged income tax (under the general earnings charging provisions) at the time of the acquisition by reference to the full initial unrestricted market value (IUMV) of the shares. This will normally increase the amount of tax payable at the time of acquisition, but the effect is to disapply the restricted securities regime altogether so that, going forward, all growth in value should be charged to tax under the capital gains tax regime.

It should be noted that the making of a section 431(1) election does not protect against future charges to income tax under the other chapters of Part 7 of ITEPA which deal, amongst other things, with convertible securities, securities with an artificially depressed market value, securities disposed of for more than the market value and post-acquisition benefits from securities. It should also be noted that other elections under the restricted securities regime can be made although a consideration of them is outside the scope of this article.

Section 431(1) Election Example

Taking the facts in the above example, the effect of a section 431(1) election would be an immediate charge to income tax on the employee of 20p (£1 (IUMV) – 80p (amount paid by employee)) per share. Typically, such a charge would be under the general earnings charging provisions and no further charge to income to tax would then arise under the restricted securities regime.

PAYE/NIC

If the restricted securities that are acquired are "readily convertible assets", any income tax payable either on acquisition or on the occurrence of a chargeable event, must be accounted for by the employee's employer under PAYE. Any tax due under PAYE should be recovered from the employee within 90 days. If it is not, a further charge to income tax may arise.

Likewise, if the restricted securities acquired are readily convertible assets, a liability to both employer and employee Class 1 NICs will normally arise on the same amount as that on which PAYE is to be accounted for.

Factors To Consider When Deciding Whether Or Not To Make A Section 431(1) Election

Typically an employee would want to make a section 431(1) election if he considers that the up-front tax charge is affordable. Obviously, if the restricted securities have a low unrestricted market value at the time of acquisition (but have the potential for significant growth in value), this may make an election more appealing. However, an employee also needs to be aware that he may not keep the restricted securities (even though he paid tax on acquiring them), the restricted securities may not increase in value as expected and he may pay more tax because of the election than he would have done without it. The employee will need to balance these risks against the potential advantages of avoiding a restricted securities regime charge on a much increased value at a later date and only having to pay capital gains tax on a disposal of the restricted securities.

Most employees make a section 431(1) election on a precautionary basis. This will be the case where the employee considers that he has paid at least the unrestricted market value of the restricted securities and as such it is expected that no restricted securities regime charge could arise. But, as confirmation of the unrestricted market value cannot be agreed with HMRC on acquisition, it is not possible for the employee to be absolutely sure that no restricted securities charge can arise (unless the conditions in HMRC/BVCA memorandum are satisfied). HMRC have confirmed that such a precautionary election will not make HMRC think that the employee and the employer believe that the employee paid less than the unrestricted market value.

In respect of an employer, although making a section 431(1) election may crystallise an immediate employer Class 1 NIC liability, the advantage of making the election is the avoidance of any future liability to account for any employer Class 1 NICs on an amount on which income tax might otherwise be charged on the occurrence of a chargeable event under the restricted securities regime. For this reason, it is not uncommon, in private equity transactions, for directors and employees offered an opportunity to acquire shares in a company with institutional investors to be obliged to make a section 431(1) election as a condition of acquiring shares.

Form And Timing Of Section 431(1) Election

The election must be made in the form specified by HMRC and must be made not later than 14 days after the acquisition. The election does not need to be filed with HMRC, although it must be retained by the employer as HMRC may want to see it to confirm the tax treatment of securities. The employer must, however, on its annual Form 42 return, indicate that an election has been made.

This publication is intended merely to highlight issues and not to be comprehensive nor to provide legal advice. Conor Brindley is an associate with Rosenblatt Solicitors and can be contacted at conorb@rosenblatt-law.co.uk.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.