Foreword

In a single lifetime we are in transition, looking back at our grandparents' generation and taking a forward look to the world our grandchildren may grow up in. We have changed our consumption habits and shopping patterns and now more than ever are re-evaluating our values and the search for value.

In this report we consider more than the outlook for Christmas 2009. There have been some profound and interesting changes over time and all have significant implications for the retail landscape.

We start by looking at the shopping basket and typical household expenditure over time reflecting on what our grandparents may have purchased and comparing this to where we spend our money now. We also explore the shift in the balance of power over what we buy and how we buy it during this time period.

There is considerable research and many reports published each year about the 'consumer' and some assertions of late about the 'new consumer'. However, there are some constant and undeniable forces that determine our ability to spend, as well as the need and desire to consume. These are examined and form the backdrop of our understanding of the 'smart shopper' today. Our view is that the 'smart shopper' has been with us for a while, influenced by globalisation, the digital age, the availability of shopping venues and more recently the recession, and we have mentioned some of this in our previous reports. The smart retailers have picked up on the trends that the recession has brought into sharper focus and these retailers are winning in these more challenging times.

We give our perspective on the 'golden quarter' but more importantly a prognosis of the future retail landscape and what retailers need to consider to 'breakout' of this downturn and establish strategies for adding value.

Our analysis shows that the health of the economy is underpinned by consumer spend which represents about 65% of GDP. We also know that the UK has world class retailers and suppliers to retail in this consumer business industry. This industry now needs greater economic and political certainty to give it confidence to plan for prosperity and the shopper needs similar certainty about the future so they can back Britain and return to spending with confidence.

To download our full report and access videos, regional summaries and further information about our retail services please log onto www.theretailreview.co.uk

Executive summary

What granny used to buy

In 50 years we have moved from post war austerity to current frugality in an age of superabundance. Our grandparents purchased tinned corned beef and now we buy frozen chicken nuggets! In our previous reports, notably in 2006, 2007 and 2008 we identified and highlighted some of the significant changes such as recent trends towards: value; provenance and heritage; the green agenda; and the digital age. Consumers have adapted their shopping habits and spending patterns over many years and will continue to be adaptive, like chameleons, in this recession and beyond.

Constant and undeniable forces

Although there are shifting patterns in the way we consume there are distinct overarching parameters that determine what we spend. These forces are grounded in people's income, wealth, demographic profile, 'lifestage' and shopping mission. All these forces come together for each individual to create a complex and discerning shopper. More wealth, affluence and diversity means that mainstream mass marketing is less effective than 40 years ago.

Push me pull you

The balance of power has shifted from government, to manufacturer to retailer in the last 50 years but now the customer has reclaimed the crown. Control is back with the 'smart shopper' and retailers will need to adjust the way they interact and serve this empowered person and the multi-dimensional communities that these people live in. Trust and transparency have become key drivers of the values required by the 'smart shopper'. These savvy people are demanding good corporate citizenship from the retailers they shop with and want to know that the retailer's values align with their own.

Digital age

The influence of technology and information is now 'mainstream' and affects consumer habits. The speed of innovation and change in the last 15 years has been pandemic. The communities that have been created transcend time zones and geographic boundaries and supply 'trusted' information to shape shopping habits. Retailers need to be mindful of how they interface with the 'smart shopper' be it in the market place or market space. Being on-line and always connected is a way of life and this is a permanent shift in behaviour.

Global village

We are now living in a global market place and the extent of how interdependent the developed western economies are, became self-evident with the financial crisis. There has been a surge in public awareness and pressure from many sources about climate change and the desire to reduce, reuse and recycle. The smart shopper will make choices underpinned by an awareness of green issues subject to their budgetary constraints. Sustainability is now on the agenda around the world and retailers are expected to conform and adapt their business.

Location, location, location

The retail landscape has gone through considerable growing pains. In the past ten years total retail capacity has increased by about 22%, on top of that more than 50 million square feet of selling has come from the internet, adding the equivalent of another 50 million square feet of space – yet demand has turned flat. Our analysis shows that the sales per square foot has been trending downwards and does not reflect well on return on investment metrics or adding value. A clear indicator that consumer insight rigour has not been applied in the rush for retail expansion. We are therefore now in an era of retail space abundance with consequences for retailers, property companies and local authorities.

Recession and recovery

The non-inflationary continued expansion (NICE) times have allowed the weaker retailers to survive. The recession has brought about a sharp focus on those without credible retail offers and robust balance sheets. Consumption is about 65% of gross domestic product (GDP) so any views about GDP are driven by what happens to UK consumption. The difficulty here is that consumers are struggling with: high debt levels; low savings; rising unemployment; and reduced access to credit. Overall it looks as if total household spending is unlikely to return to pre recession rates of growth before 2012. The spend trend looks flat.

Golden quarter 2009

Our survey of consumers this year shows that the trend of last year continues. Avarice and accumulation of products has lost its shine and the glow of frugality gets stronger. In every category, like last year, consumers tell us that they will be spending less on gifts, socialising and food and drink. In fact 40% of consumers, compared to 24% last year, said they will spend less. When asked about the state of the economy 80% stated that it is currently bad but on the question of future outlook 74% said it would stay the same or improve. From a customer perspective the forecast is careful and constrained spending over the golden quarter with many consumers focused on reducing their overall debt levels. From a retailer's perspective our survey indicates a cautious approach to the festive season with the majority expecting a flat trading period.

Winning in challenging times

The report sections all show an intensely competitive market place which is essentially saturated with retail offers both in-store and on-line. Demand has dropped off significantly brought to an abrupt halt by the financial crisis and consumer confidence, which until recently, was at an all time low. There is significant mistrust of politicians and financial institutions and a retrenchment to only trusting family and friends. Also there is a search by the 'smart shopper' for value and an evaluation of their values evidenced by a move to provenance and frugality in purchase decisions. Overall we expect further retail casualties.

In spite of the events of the last year there are still many retailers doing the same thing and expecting a different outcome! What is clear is that those retailers that are responding to five or six of the changing consumer dynamics noted in this report are winning in these challenging times. Those retailers that are doing one or two are being left behind. It is the scale and increase in the pace of change that will determine the winners that breakout of the recession and breakaway to be successful in the world of flat spend trend.

1. What granny used to buy

Post-war austerity to current frugality in an age of superabundance

In 50 years we have moved from post war austerity to current frugality in an age of superabundance having taken a detour to explore luxury and premium products and services on the way. Consumption patterns and habits of the post-war era were shaped by the restriction in the supply of goods, the use of ration books and a need to rebuild Britain. The inherent values our grandparents grew up with were to 'waste not, want not' and to make, mend and re-use. Growing your own vegetables to cooking from basic ingredients was part of the mainstream and majority lifestyle.

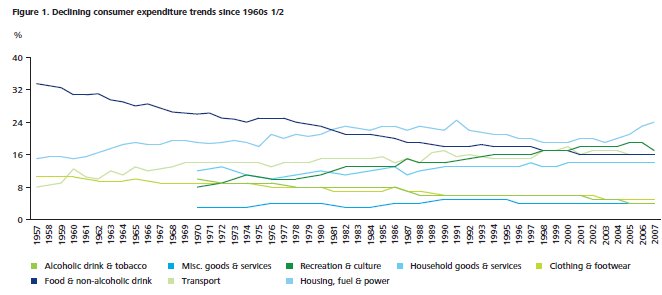

The National Statistics of the time show purchase patterns that focused on corned beef, condensed milk, soap flakes and a tin kettle. In 1957 a substantial part of the relative family spend, went on food (34%) with other categories such as housing, fuel, transport, clothing and footwear all adding up to less than 30%. It would appear that the fundamentals of feeding the family dominated daily life. The newspaper and wireless were the main mechanisms for getting information about world affairs with communication and entertainment centred on visiting friends and family in the local community.

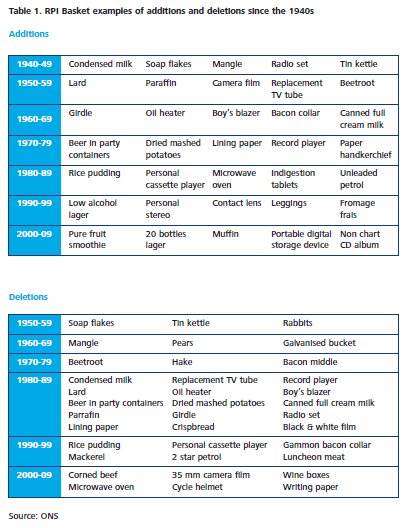

Looking at the history of the Retail Price Index (RPI) basket gives an insight into what became available and was considered a mainstream purchase. The RPI basket for the seventies included: beer in party containers, dried mashed potato; and record players and we were no longer interested in the price of beetroot. By the eighties we were monitoring the price of items such as: rice pudding, personal cassette players, microwave ovens, unleaded petrol, and indigestion tablets. Gone from the RPI basket were items like: condensed milk, lard, paraffin, a girdle and an oil heater. In the nineties we have added fromage frais, leggings and contact lenses to the basket and removed rice pudding, gammon and bacon collar. In this decade we have added items like: pure fruit smoothies, muffins, 20 bottles of lager, frozen chicken nuggets and portable digital storage devices and removed the microwave oven and camera film.

Although the sixties and seventies brought political and social change, it was the seventies and eighties where we saw a surge in new products, lifestyle shifts and spend pattern changes. In the eighties and nineties we saw a move towards luxury and premium products and services and their general availability to the mainstream shopper. We now have an abundance of choice and looking at the grocery shop, from what was once a simple own label product range has evolved into a multiple of private labels as illustrated in Table 2 (this does not include the sub-brands).

This has been driven by the ever changing consumer and the recession has emphasised this trend with 51% of consumers in our survey agreeing that they have changed their shopping habits now and buy cheaper or non branded products. Changes in behaviour like this has resulted in some grocers changing their strategies and even developing additional ranges to their portfolios, for example, Tesco's Discount Brands.

Today the relative spend on food has dropped to 9% and this is being topped by 23% spend on housing and 15% spend on transport with recreation and culture and restaurants and hotels at 11% and 10% respectively. Clothing and footwear account for 5% and alcohol & tobacco at 3%.

It is clear from the history of our spending patterns that as consumers we have been adjusting our shopping habits considerably over the years. In our 2006 report we noted the trends towards 'green' and sustainability desires such as social and ethical concerns. In 2007 we highlighted the digital age and talked of Christmas going electric. In 2008 we illustrated the trend towards 'in-tertainment', trading down, provenance and heritage.

So there is no 'new consumer'. Like chameleons we are adaptive and will change our colours depending on the shopping mission or recessionary times.

All these trends have continued to develop and as our research shows will continue to do so going forward with 52% of our sample agreeing that they have changed their shopping habits and will retain these habits for the longer term. Retailers are also noticing these shifts with 65% of retailers surveyed agreeing consumer purchasing habits have changed due to their increased awareness of health and wellbeing issues. Furthermore, half of consumers surveyed want both a wider range of ethical and environmentally friendly products and better labelling of products around the sustainability of goods.

2. Constant and undeniable forces

Shifting patterns

There has not been a year where some revised version or new twist on consumer classifications has not occurred. However, there are some constant and undeniable forces that determine the amount of money people spend and what they spend it on. These forces are grounded in people's income, wealth, demographic profile, lifestage and shopping mission. So let's look briefly at income in the UK. The graph below shows that real household disposable income has grown by 250% in the last 40 years.

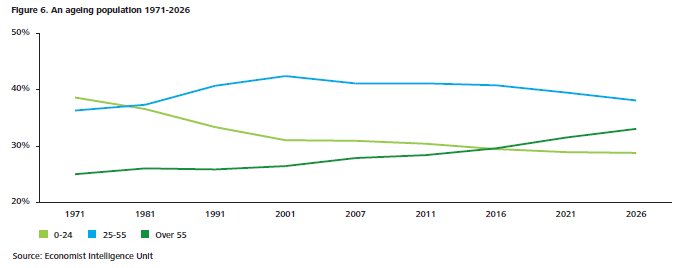

With an ageing population, more females in employment, more single person households, more educated, more travelled, more technology literate and more migration all impacting on shopping habits and spending patterns today. Single person households have increased from 18% in 1971 to 29% by 2008. Migration into the UK has also increased particularly with the expansion of the EU and the UK is now seen and frequently quoted as a multi-cultural society. This all has significant relevance for retailers.

Clearly, lifestage and lifestyle affect the spending patterns and our research shows that there is increasing complexity in all these dynamics. Overlay a trend towards shopping by mission for example, a birthday or anniversary or back to school need, then what is purchased changes as there is no longer a 'normal' shopping habit.

Given the layers of complexity, mass merchandising to middle England no longer works and trying to categorise consumers into a single linear dimension misses the opportunities.

So understanding who your best customers are and knowing how to engage with these changing consumers, although difficult is now paramount.

We have aspired to and given the increases in our income and wealth now live in the 'Martini lifestyle' with a twist, so we shop 'anytime, anyplace, anywhere', in many ways, driven by the way we consume media.

3. Push me pull you

The customer has reclaimed the crown

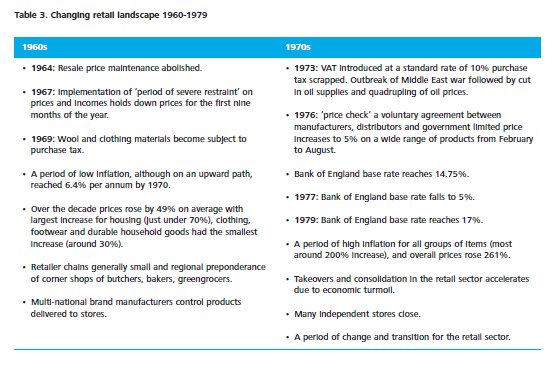

Although there seemed to be a view that the customer was always right in the fifties and sixties, the balance of power was actually with the government as a hangover from the post-war austerity restrictions such as rationing. The government set the rules and allowed resale price maintenance (RPM) whereby manufacturers could dictate the selling price to retailers.

The sixties and seventies enabled the large multi-national manufacturers to determine what products were sold as the retail sector was made up of independent shops and regional co-operatives, there were many butchers, bakers and greengrocers in the high street and the superstore and hypermarket concepts were in their infancy.

In 1964 RPM was abolished and enabled retailers to start establishing a direct relationship with consumers. In the mid-seventies the products were largely pushed at consumers.

Although checkout scanning started to be introduced in the eighties it was not until the nineties that the information was fully utilised to replenish what had been sold. During the seventies and eighties there had also been some consolidation in the retail sector with independent chains being taken over and a drive for large edge of town superstores. Added to centralised distribution to drive efficiency, the scale of the big chains allowed them to begin to dominate the retail landscape. The grocers introduced own label brands, ready meals and expanded their ranges with in-store butchers, bakers, produce, deli and by the nineties this expanded to petrol, pharmacy, photoshop etc., aiming to provide a 'one stop shop'. This was epitomised by the mission statement of ASDA in the early nineties as "satisfying the weekly shopping needs of ordinary working people and their families who demand value." At about the same time, two hundred miles south of Leeds, Tesco launched their loyalty card to get closer to their customer base.

Slowly over four decades the big 'grocers' have come to dominate the retail landscape. The power was then firmly in the hands of the retailers. This dominance has come from serving the customer and retail history is littered with the names of those retailers that did not serve the customer effectively.

The digital age has brought access to information to everyone with the internet. Furthermore the development of the mobile phone into a mobile media and communication device has enabled this access at any time in any place. The ability to research products, prices, opinions of others has created an unprecedented level of transparency and injected instant speed into 'word of mouth' recommendations or blogs.

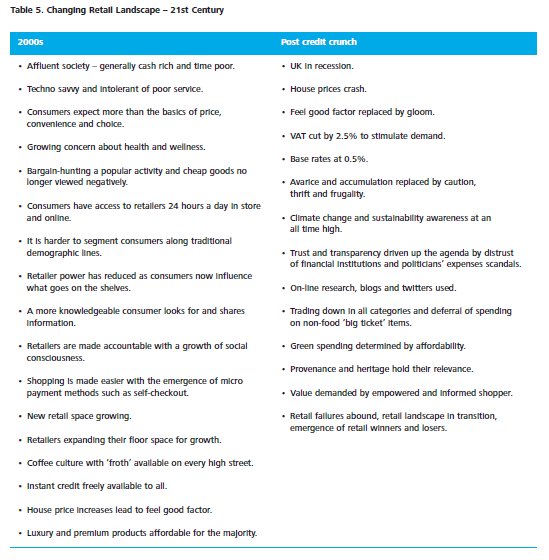

As can be seen in the post credit crunch column, two interesting points emerge which are expected to continue for the foreseeable future. One is the trend towards value being demanded by the empowered and informed shopper and the second is a desire for trust and transparency.

Control is back with the 'smart shopper' and retailers will need to adjust the way they interact and serve this empowered person and the multi-dimensional communities that these people live in because the customer has reclaimed the crown.

4. Digital age

The speed of technology innovation and change

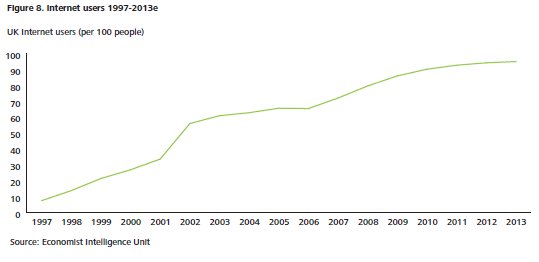

The influence of technology and information is now mainstream and affects consumer habits. The speed of innovation and change in the last 15 years has been pandemic. Almost every person has a mobile phone and access to the internet is available to most households.

The language used by today's consumers has changed and essential words unheard of by our parent's generation or did not exist or had different meanings such as Amazon, eBay, email, Google, Facebook, webcam, spam, Blackberry, bluetooth, Skype, text, mobile, broadband, iPhone, PS3, Wii, HD, plasma, Twitter, Blog, 3D and the list goes on. All of these words are now part of our 'digital dictionary' and for generations X, Y and Z they drive their consumption habits.

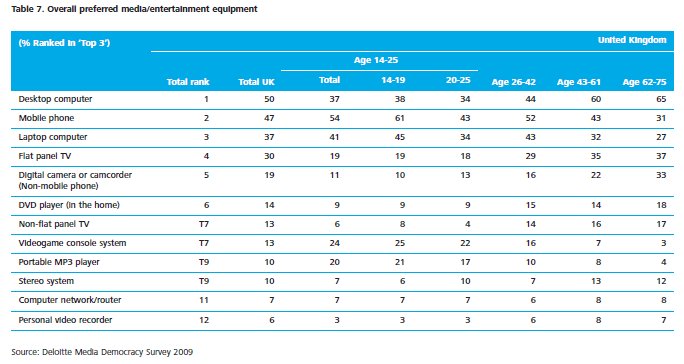

This digital age has firmly embedded itself into mainstream life. Mobile phones and/or laptops are now part of the standard equipment issue for most businesses. There are few people in the UK who have not sent or received a text message. The fastest growing part of Facebook right now is for SAGA members i.e. the 50+ age group. So the use of technology is not restricted to the 'young' as media reports may imply. Most businesses and working people use email and internet enabled searches for research or information and this is now the first port of call. Many use the internet for genealogy research and have memberships to on-line communities such as Friends Reunited.

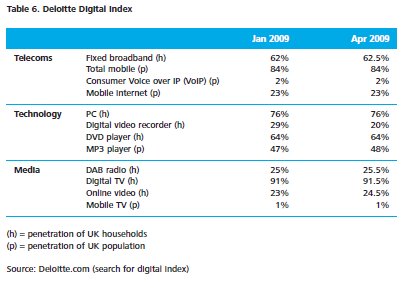

For further information please click here to view the Deloitte Digital Index.

Technology convergence has also led to changes in the way we consume media and entertainment. For further information view the State of the media democracy.

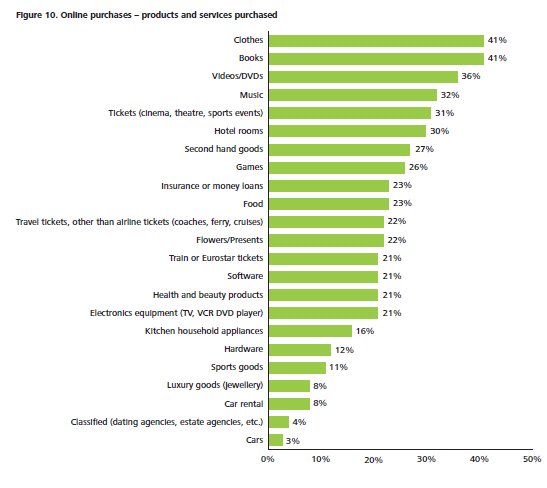

The proliferation in design and functionality coupled with the reduction in the cost of mobile phones and computers has revolutionised the way we work. Significant numbers of people do on-line research before they buy 'big ticket' items. Spending on-line continues to grow and is likely to be supplemented with the ability to purchase and transact via the mobile phone, with 15% of the population having purchased something via their mobile in the past 6 months.

The communities that have been created transcend time zones and geographic boundaries and supply 'trusted' information to shape shopping habits. Trust and transparency have become key drivers of the values required by the 'smart shopper' and this has moved up their values agenda driven by a backlash against failed financial institutions and political scandals over expenses.

Shoppers may be interested in a retailer's carbon footprint, ethical supply chains or simply local product, stocked at the local store and now demand this before they make a purchase decision.

These savvy people are demanding good corporate citizenship from the retailers they shop with and want to know that the retailer's values align with their own. Retailers need to be mindful of how they interface with the 'smart shopper' be it in the market place or market space.

Today, the savvy shopper is likely to have better information, about the product and the retailer, at their finger tips via the mobile digital media device compared to the sales staff in the store. Customer service and selling skills required now are in a different dimension to ten years ago. The digital age is here to stay, being on-line and always connected is a way of life, and this permanent shift in shopping behaviour is set to grow.

5. Global village

Beyond Britain – global village

We are now living in a global market place and the extent of how interdependent the developed western economies are, became self-evident with the financial crisis. As early as the nineties, the consumer mega trend to globalisation of products and services was noted and published. It's also easy to understand the influence of Hollywood and Bollywood on the changing tastes and demands of consumers in the UK.

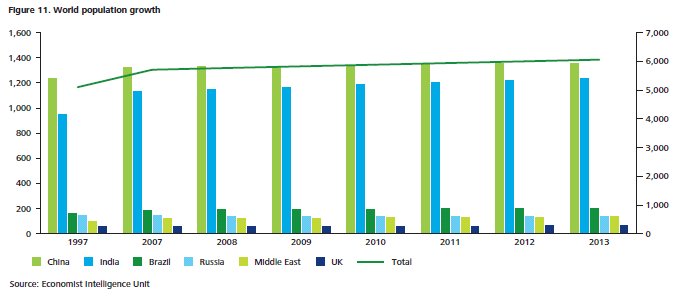

We also see the emergence of the developing economies and not just the 'BRIC' countries with the expected increase of about two billion middle class consumers worldwide before 2030 as noted in the World Economic Forum report (click here to view).

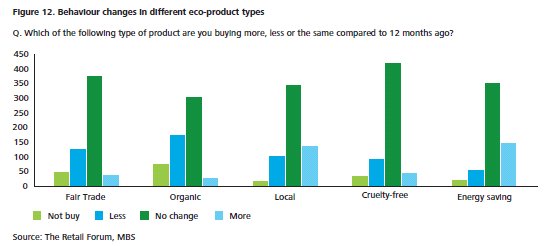

There has also been a surge in public awareness and pressure from many sources about climate change and the desire to reduce, reuse and recyle. The smart shopper will make choices underpinned by an awareness of green issues subject to their budgetary constraints. Recent research from The Retail Forum at Manchester Business School, shows that generally consumers have not changed their ethical shopping behaviour in spite of the 'credit crunch'. Although where there was some change, shoppers bought less fair trade, organic and cruelty free products but more local and energy saving products.

Sustainability is now on the agenda around the world and retailers are expected to conform and adapt their business, be it for product labelling, waste (weee) regulations or Carbon Reduction Commitment. In the EU and the UK there are Carbon Reduction Commitments mandated by the governments. UK consumers are separating their waste and packaging and are firmly on the recycling agenda.

Similalry, food wastage seems to have become an anathema and some retailers are adjusting their Buy One Get One Free (BOGOF) promotions. Most of the large retailers have embarked on building sustainable energy stores and almost everyone has something to say about their 'green' agenda. As consumers ponder the future, the green agenda is on their minds but the tangible changes in the shopping basket centre on provenance (e.g. healthy eating) and heritage (e.g. buying local).

The European Union has had a major impact on the movement of goods, people migration and regulation. The regulations have impacted everything from advertising products to children to chill chain integrity to weights and measures and waste and emissions directives. The global regulatory burden has increased over the years and this trend looks set to continue. Given that the cost to operate in the UK continues to rise and recently have been excaserbated by the value of sterling, it should not be a surprise that retailers are looking to overseas markets for better returns.

6. Location, location, location

Growing pains

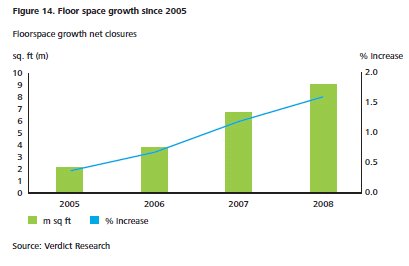

Most retail growth, excluding on-line sales which account for around 9% of total industry turnover, has essentially come from an increasing store base or an extension of floor space. With a massive drive in the last 20 years by retailers to increase their footage with relentless development of retail space – shopping centres, out of town malls, and re-workings of the high streets thereby adding additional sales.

More recently, in the past ten years retail capacity has increased by about 22% adding the equivalent of more than 100 million square feet to the total retail capacity.

There has been considerable investment in and growth of shopping venues around the UK in the last 10 years as shown in Figure 15. There are currently a total of 819 shopping centres in the UK, with 21% located in the South East and 12% located in the North West. A total of 1,340 retail parks exist in the UK, with 20% located in the South East, 11% located in the North West and a further 10% located in the West Midlands. Over 2.4 billion visits are made to shopping centres across the UK every year.

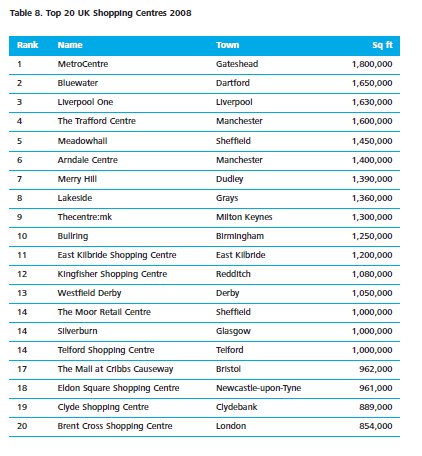

The top 20 shopping centre venues account for 24.8 million square feet of retail space.

We are therefore now in an era of retail space abundance. Where historically the landlords had a grip of the economics and rental prices, the market has shifted. Unfortunately, many retailers have long term lease obligations and may find themselves located in areas that no longer reflect their customer base. However, 52% of retailers surveyed say that they have approached their landlord and managed to negotiate better terms.

From our survey of retailers the following key points were noted:

- 76% agree that store closures are primarily a long-term structural issue, rather than solely a short-term cyclical effect of the recession.

- 75% agree that regional shopping centres (such as Westfield, Bluewater, Trafford) will increasingly monopolise expenditure at the expense of secondary and tertiary locations.

- 69% agree the recession is only the catalyst that is compelling the market to address fundamental retail oversupply.

Our analysis shows that the sales per square foot has been trending downwards and does not reflect well on return on investment metrics or adding value. A clear indicator that consumer insight rigour has not been applied in the rush for retail expansion.

There has been recent press reports about the impact of the recession on the high street and shopping centres with many empty shops being reported. This deterioration in the quality of shopping venue is expected to continue and in the longer term we may expect a convergence of operating models involving retailers, property companies and local government.

7. Recession and recovery

The non-inflationary continued expansion (NICE) times have allowed the weaker retailers to survive. The recession has brought about a sharp focus on those without creditable retail offers and robust balance sheets. So what do the economic indicators show? Below is an assessment from our UK Chief Economist, Ian Stewart:

"A slow recovery is the price the UK is likely to pay to rebalance its economy away from consumption and towards exports and investment. The years before the recession saw strong and sustained growth in consumer spending. Between 1995 and 2008 consumer spending grew faster than the overall economy 85% of the time. Between 1955 and 1995 consumer spending outpaced GDP growth just 55% of the time.

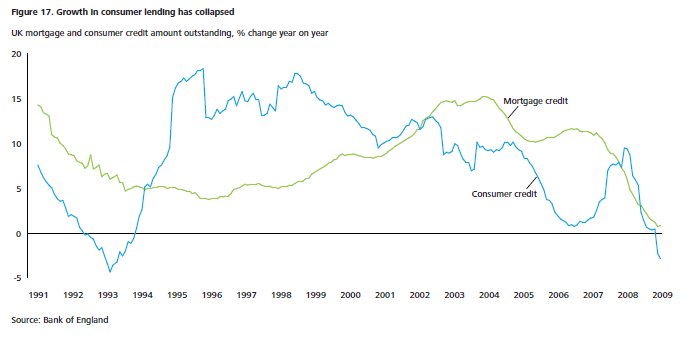

"The consumer faces a number of headwinds. Unemployment is set to rise well into 2010, albeit at a slower rate. Real spending power is likely to remain under pressure from corporate and public sector cost-cutting and from next year's rise in VAT. Other taxes may rise as an incoming government seeks to bring down the public sector deficit. And the supply of credit to the consumer sector, one of the drivers of the asset prices and spending, remains constrained. Banks are focussing on reducing risks on their balance sheet and raising capital, measures which probably mean that consumer credit will remain hard to get for some time.

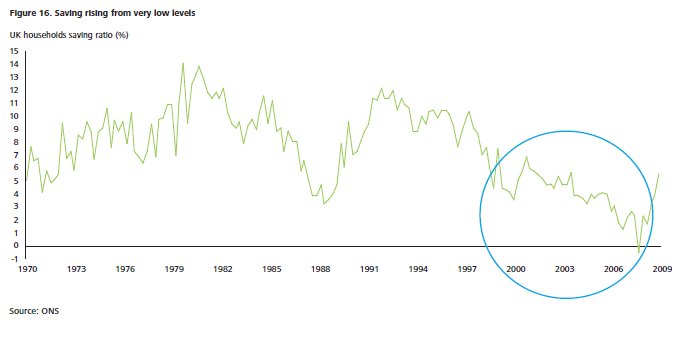

"Consumers entered the downturn with low savings and relatively high levels of debt. On the face of it consumer balance sheets are very stretched. During the good years financial innovation enabled more consumers to access credit more readily, fuelling house prices and spending. As a proportion of income, household debt increased from 100% to 165% in the 10 years to 2007. The savings ratio dropped from 4.5% to -0.5%.

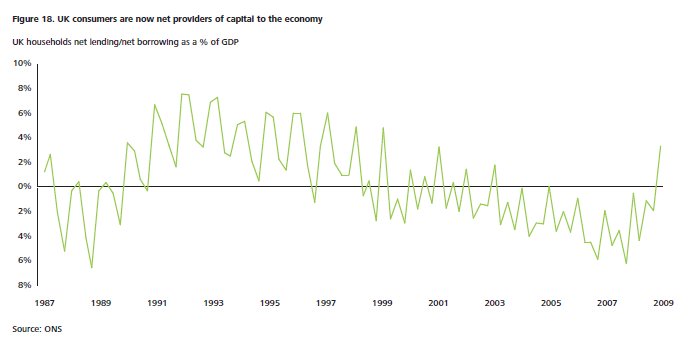

"In the last 18 months or so this process of running down savings and increasing debt has now gone into reverse. The savings ratio has risen sharply, to almost 5.0%. Meanwhile, growth in borrowing has collapsed and, in the case of consumer credit, has turned negative.

"The result is that UK consumers have gone from being net users of capital in the economy to net providers of capital to the rest of the economy.

"As consumers have switched from consuming to paying down debt and raising saving, spending has taken a major knock, falling for the past six consecutive quarters, the first time this has happened since records began in 1955. Overall consumer spending fell by 3.7% between 2007Q2 and 2008Q2. But the suffering has been unequally spread across different areas of consumer spending. Spending on housing, communication and clothing has grown through the downturn, while spending on services and 'big ticket' goods has been hard hit.

"The rise in the volume of spending on clothing and footwear, an increase of 9.0% in the deepest recession since the War, has been quite remarkable. In fact sales of clothing and footwear have been on a strong uptrend since the late 1990s. Our explanation is that volume has been driven in part by exceptional price deflation which, in turn, reflects the effects of globalisation in the production process. The sudden rise in sales volumes in the late 1990s coincided with the move to deflation in clothing and footwear prices.

"A necessary process of rebalancing within the consumer sector is happening and this has further to run. Yet this is not uncharted territory.

"After the recessions of the early 1990s the UK saw a similar process, with consumers raising savings and paying down debts, a process that lasted well beyond the recession. The lesson from this period is that the consumer sector does adjust, but it takes time.

"However, it is not all bad news for the UK consumer. In particular, focussing, as many commentators do, on the debt and savings position of consumers somewhat exaggerates the scale of the problem. While consumers have been borrowing heavily and not saving, they have also been acquiring assets, the value of which has risen over the last 10 years. These assets include pooled investments such as pensions, insurance policies and unit trusts, as well equities and housing.

"Part of what drove the housing market during the 1990s and the 2000s was older homeowners selling large homes, buying smaller ones and putting the extra cash into financial assets. UK households accumulated an additional £1 trillion of debt between 2000 and 2008 but also acquired over £750 billion of financial assets over the same period.

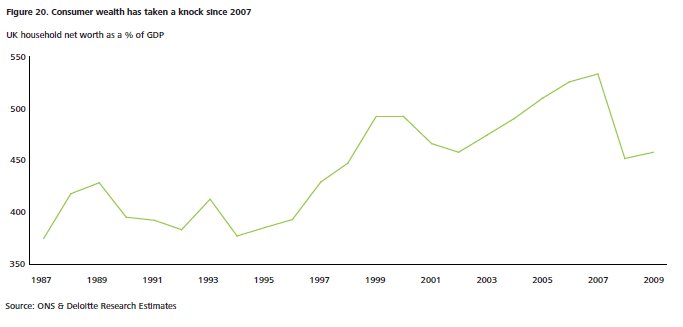

"The net wealth of the UK consumer sector has increased – measured as the total value of assets owned by UK consumers less the value of mortgage and other consumer debt. Since 2007 lower house prices and equity markets have depressed consumer wealth, taking it back to where it was in 2001. This represents a major loss of wealth. (The recent bounce in housing and equity prices has led to a slight recovery since 2009Q2). But focussing on net wealth paints a more complete – and marginally more reassuring – picture of the state of consumer balance sheets than the widely watched debt and savings numbers.

"For now it looks as if the process of strengthening consumer balance sheets has further to run. The general view, with which it is hard to disagree, is that this will be a slow process. The UK's economic recovery over the coming quarters is unlikely to come from the consumer.

"Rather the main drivers are likely to be investment, exports and a switch in demand from foreign to UK producers. The corollary is that growth in consumer spending will remain subdued through 2010 and into 2011 – and possibly beyond."

Hitherto the health of the economy was underpinned by consumer spend which made up about 65% of GDP. We know that the UK has world class retailers and suppliers to retail in this consumer business industry. So the industry now needs greater economic and political certainty to give it confidence to plan for prosperity and the shoppers need similar certainty about the future so they can back Britain and return to spending with confidence.

8. Golden quarter 2009

Our survey of consumers this year shows that the trend of last year continues. As consumers come to terms with the state of their balance sheet and the reality of lower long term disposable income growth, they will start to adopt a more cautious approach to spending and this will be particularly true this Christmas. So avarice and accumulation of products has lost its shine and the glow of frugality gets stronger.

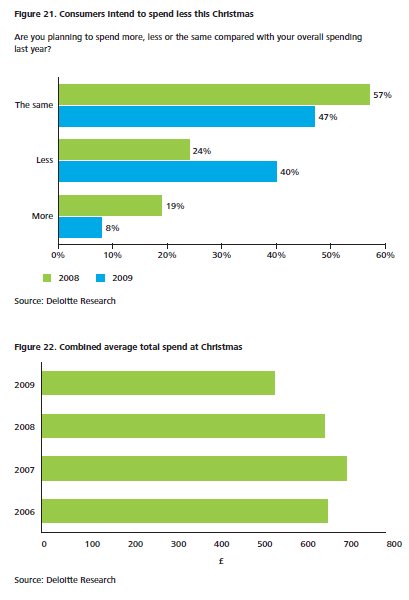

Therefore the forecast is a careful and constrained spending over the golden quarter with many consumers focused on reducing their overall debt levels. Our data shows a decline in consumers' anticipated Christmas spending.

The planned combined total average spend is of £541 in 2009 compared to £655 in 2008.

In every category, like last year, consumers tell us that they will be spending less on gifts, socialising and food and drink. In fact 40%, of consumers compared to 24% last year, said they will spend less.

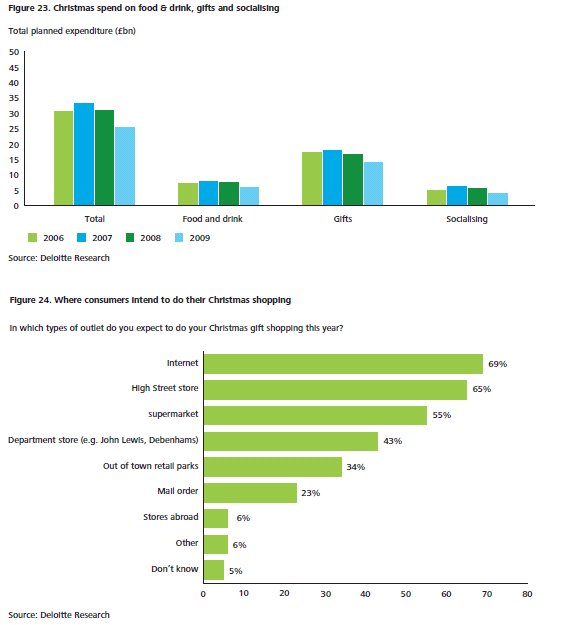

Consumers are cutting down on all the discretionary spend, as socialising is the hardest hit category with a 22% decline to under £100 per head on average. The decline in planned expenditure on food and drink is surprisingly pronounced with a 19% year-on-year drop, partly due to deflation but also to consumers consciously taking on promotional and special offers, consumers will certainly be more cautious on what will go on the Christmas dinner table retaining as much as possible all the traditions but giving up on anything superfluous. Similarly but to a lesser extent, gift spending is down by 15%, this is the category the least hit by the cut in spending. Accustomed to the recent months of special offers and promotions everywhere, consumers will be hunting for the best value for money gifts as they are determined to spend the biggest share of their Christmas budget on presents.

In terms of where consumers are planning to do their gift shopping and as they look into locating the best deals, 69% of consumers are planning to shop online this year, making the internet the most popular shopping channel for gift shopping this Christmas. High street stores will be the second most popular destination with 65% of consumers planning to take advantage of the discounts and special offers they have become accustomed to in the recent months as well as during the previous Christmas season.

Looking beyond Christmas, when asked about the state of the economy 80% of consumers stated that it is currently bad.

But consumers believe, the UK will soon have seen the worst of the downturn, as on the question of future outlook 74% think it will stay the same or improve.

Although there is some debate about consumer confidence improving it has yet to translate into actual increase in spending patterns. There still seems to be too much uncertainty in job prospects and economical and political environments to give consumers the full confidence needed to spend the way they did in 2007. In fact, our research shows that consumers have a low level of confidence regarding job security and future prospects. About 40% of the population are not anticipating a pay rise this year.

From a retailer's perspective, our survey indicates a cautious approach to the festive season with the majority expecting a flat trading period. But as retailers know, consumers behave differently during the festive season and with Christmas day falling on a Friday this year; the spending is likely to be even later than in prior years.

9. Breakthrough & breakaway

Winning in challenging times

The report sections all show an intensely competitive market place which is essentially saturated with retail offers both in-store and on-line. Demand has dropped off significantly brought to an abrupt halt by the financial crisis and consumer confidence has been at an all time low. There is significant mistrust of politicians and financial institutions and a retrenchment to only trusting family and friends.

There is a search by the 'smart shopper' for value and an evaluation of their values. As a result we have seen a permanent shift in four clear areas of values used by the smart shopper when making their purchasing decisions and also what we see as a medium term shift in the search for value.

Firstly, digital media consumption is pervasive and has changed the way we seek and use information. This leads directly to the way we now evaluate and make purchasing decisions. The speed at which we can check, validate and confirm our thoughts by on-line checks has enabled the smart shopper to become more promiscuous, discerning and demanding.

We have aspired to and now live the 'Martini' lifestyle with a twist – "anytime, anyplace, anywhere, in many ways" driven by the way we consume media.

Our research shows that the use of the internet and mobile technology is not just prevalent amongst the 'young' but the silver surfers are getting down with the kids! It is highly unlikely that as a nation we will give up using the technologies of the digital age. So this is a permanent shift in the way we behave.

Secondly, sustainability is in every person's conscience and varying shades of green behaviour can be seen throughout the nation such as separating and recycling waste to using energy saving light bulbs. There is also an underlying frustration with governments and industry for not doing enough, fast enough and with scientists for confusing messages about the impact and what can be done – is it really only about carbon reduction? The scale and complexity of the related issues are mind boggling and consumers are concerned about the future cost of energy and food and what world we will leave for our grandchildren.

The smart shopper is prepared to adjust shopping behaviour, for example, not using plastic bags, and even change the type of products purchased and shop responsibly subject to budgetary constraints. The criticality of this issue together with peer and upward pressure from younger generations suggests to us that this is a mind shift that is here to stay.

Thirdly, provenance and heritage are underlying themes where we have seen tangible changes in shopping behaviour over recent years. This could be due to healthy eating desires made popular by television programmes or government education initiatives or a better understanding of nutrition enabled by better labelling by retailers or simply a need to have certain products such as 'gluten free' due to personal health or life style. On heritage we have seen a big take up of local product perhaps due to retailers making this available and advertising localness. These themes are getting stronger and we consider they will continue.

Finally, trust and transparency is expected by the smart shopper from the retailers they patronise. With information at their finger tips or a phone call away to friends and family they want clarity and honesty about product specifications, country of origin, carbon footprint and so on. The smart shopper is now able to blog and twitter to their communities if they are delighted or disappointed in their shopping experience and also happy to tell the rest of the world.

Shoppers have been searching for value since time immemorial and more so in the recession. Value represents price and genuine affordable quality. The recession has, as in the previous downturn in the early nineties, resulted in shoppers trading down and searching for bargains and shopping around. Although value is top of mind, price is not the only determinant for making a purchase decision. Until the full recovery comes and consumers have the 'feel good' factor again, the search for value will be a key component in shopping behaviour and we think this is likely to be with us for the medium term. As we have shown, since our grandparents' generation, consumers are adaptive in their shopping habits and spend patterns.

So what can retailers do to win in these challenging times?

- In essence retailers need to improve selling and customer service skills in the front line. The past decade has been an invitation to treat and selling skills have not been needed. These are equally relevant to improving on-line and call centre experiences.

- The pursuit of floor space without rigorous evaluation underpinned by consumer insight has left many retailers with poor performing elements in their branch portfolios. This requires urgent attention not just to improve trading performance and sales per square foot metrics but also to strengthen the balance sheets.

- Product relevance and range proliferation needs attention. Do consumers really need a choice of 20 vacuum cleaners or 100 kettles? Simplify this by doing a range edit and do it with authority based on consumer insight and demand. Getting to the heart of what a customer wants and adding value to the product is more likely to increase sales than a strategy of reducing the specification to maintain margin.

- Extend your retail brand since it is currently stronger than the banks. Understand your customers better and leverage them with broader products and services and do this fast.

- Cross border retailing has always been difficult to do. But the growth of emerging economies is compelling and given the saturated competitive market place at home, internationalisation presents a great opportunity. Recognise the risks and complexities that come with this expansion approach.

- Take the game to the consumer and engage with them where they are when they are there. The media explosion of recent years means that traditional broadcasting is less effective so you need a structured approach to multi-channel retail. Investment in on-line and mobile will be a key differentiator.

- Do not underestimate the customer's desire to know about your 'green' credentials and your compliance with the rules and regulations. They want to know you are a good corporate citizen to feel comfortable spending with you. So retailers should create the transparency required.

- We believe that value is here to stay and the 'smart shopper' will continue to fine tune their values that influence their shopping habits and spending patterns and retailers should tune into that.

- Most retailers' business models were forged in the context of strong and growing demand and a consumer led boom. It is time to not just re-evaluate the business forecasts but to retune the business model.

In spite of the events of the last year there are still many retailers doing the same thing and expecting a different outcome! What is clear is that those retailers that are responding to five or six of the changing consumer dynamics noted above are winning in these challenging times. Those retailers that are doing one or two are being left behind. It is the scale and acceleration in the pace of change that will determine the winners that breakout of the recession and breakaway to be successful in the world of flat spend trend.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.