Foreward

Welcome to the third edition of the Deloitte European CFO Survey. This Survey presents the insights from nearly 1,500 CFOs based across 17 European countries on critical business concerns including capital markets and funding, business risk appetite and overall market sentiment.

The European CFO Survey is conducted as part of the Deloitte EMEA CFO Programme, an initiative that brings together multidisciplinary teams of senior Deloitte professionals to help CFOs effectively address the challenges and demands they experience in their role. Other key offerings of the Deloitte CFO Programme include the Next Generation CFO Academy, CFO Transition Labs and the CFO Lens application. If you would like further information on the programme please contact one of my colleagues based in your country.

We would like to thank all CFOs who took the time to participate in our Survey and invite you to participate in our next European CFO Survey to be conducted in the third quarter. We welcome your thoughts and feedback.

Key Findings

Chief Financial Officers across Europe have begun 2016 in a cautiously optimistic mood, but are acutely aware of a number of headwinds ahead.

Nearly 1,500 CFOs in 17 countries participated in Deloitte's Q1 2016 European CFO Survey and, on a GDP-weighted basis, a net balance of +2% say they have a more positive view about growth in their businesses than they did six months ago. Since our previous European CFO Survey in the third quarter of 2015, the eurozone economy has continued its modest recovery. Reflecting this, CFOs in eurozone countries are once again more optimistic (+4% net balance) about the financial prospects for their companies than their non-eurozone peers (-1%).

The jobs market has been a particular source of optimism in the eurozone recently, and this improvement is mirrored by CFOs' positivity about employment in their businesses. While the employment outlook over the next 12 months has fallen (-3pp since Q3 2015) overall, it has improved for eurozone countries (+6pp since Q3 2015). The outlook for hiring is particularly strong in Italy and Ireland – two countries that saw among the sharpest rise in unemployment following the financial crisis of 2008-09.

Monetary policy has also continued to spur growth across Europe, with central banks incentivising bank lending to stimulate activity. CFOs as a whole report that the outlook for bank borrowing has improved again from six months ago, and remains positive. The improvement has been strongest for eurozone firms, where a net balance of +56% of CFOs now view bank borrowing as an attractive source of funding, up +5pp from Q3 2015.

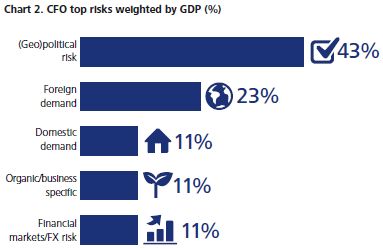

However, this quarter's survey also highlights a growing number of headwinds. Levels of financial and economic uncertainty remain elevated, and have risen once again. 68% of CFOs report levels of external uncertainty to be above normal, up from 66% in Q3 2015 leading to a net balance of +64% (see Chart 1). In particular, politics and geopolitics seem to be weighing heavily on sentiment in a number of countries and are the most commonly cited risks to future growth (see Chart 2).

Europe entered 2016 facing a number of political and geopolitical challenges, which could now threaten growth and confidence, as well as the political unity of the region as a whole. Perhaps the biggest of these events has been the 'migrant crisis', which has had a destabilising effect on confidence in a number of countries along the most popular migrant routes – from Turkey through southern and central Europe – causing political tensions between EU members over the period between our surveys. Outside the eurozone, the UK's forthcoming referendum on EU membership has now eclipsed longstanding concerns about emerging markets and eurozone growth as a key concern for European businesses. The result of the referendum is far from certain, and a vote to leave the EU could have far-reaching implications for the UK and the rest of Europe.

Internal politics has also been a destabilising influence in Spain, Ireland and Portugal, where closely contested elections led to a political stalemate in recent months. To the east, Russia continues to suffer the effects of prolonged low oil prices and economic sanctions.

Given all these external and internal challenges it is unsurprising that CFOs are no more than cautiously optimistic. Rising perceptions of external uncertainty have been accompanied by risk appetite falling sharply and CFOs reporting increased pressures on operating margins. When uncertainty is high, firms prioritise cost control over expansionary strategies. A net balance of just 16% of CFOs now think investment in capital expenditure (capex) will rise over the next 12 months – a 10 percentage point fall since Q3 2015. In terms of strategic priorities, cost control or cost reduction are the top two priorities in 14 countries.

Europe's economy has benefitted from some continued improvement in domestic conditions over the last six months, including loose monetary policy and a rapidly improving labour market.

The hope must be that political and geopolitical headwinds do not set the recovery back in the coming six months.

This quarter's 'special question' related to TTIP (Transatlantic Trade and Investment Partnership). We asked CFOs what they believe the impact on their business would be by the proposed trade agreement between the US and the EU. CFOs report limited enthusiasm for the proposals, with 73% of the cohort reporting that there would be no discernible impact to their businesses from the deal. CFOs in Sweden are most enthusiastic, with 42% saying they would stand to benefit from TTIP, followed by those in Belgium (37%), Portugal (36%) and Germany (33%). The biggest disadvantages are seen in Russia (14%) and Turkey (11%) – countries that lie outside the EU and would therefore not be part of the agreement.

Since our previous European CFO Survey, uncertainty has risen and risk appetite has fallen. Geopolitical factors are now the main risk for European CFOs for 2016.

To read this Report in full, please click here.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.