There has been a great deal of comment about potential increases in capital gains tax. However, much of it highlights how little we actually know about the tax and those who pay it.

This chart shows how many people paid capital gains tax and how much tax was raised. The tax peaked in 2007-08, with over 270,000 taxpayers, paying over £7 billion. These totals were swelled by people selling assets taxed at an effective rate of 10%, just before the rate moved up to the current 18% rate.

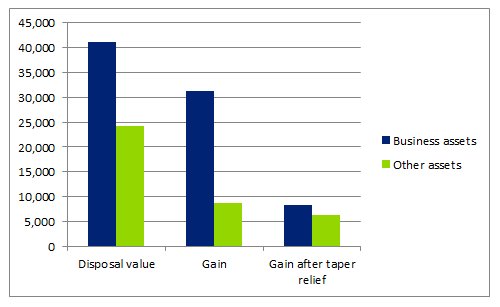

The second chart shows what types of assets were sold in 2006-07, which was the last year unaffected by tax changes, or indeed recession. Business assets were (broadly) shares in unquoted trading companies; shares owned by employees and assets used by a business in which the owner was engaged. It's interesting to see that business assets formed more than three-quarters of all assets sold. Taper relief, which cut the effective rate to 10% for business assets owned for more than 2 years, was very important.

A different HMRC table shows that two-thirds of disposals were of financial assets i.e. shares. Interestingly, 30% of shares had been owned for 10 years or more - and 51% of non-financial assets.

A different table showes that there were nearly 1 million disposals, by 261,000 individuals and trustees. 80% of those disposals were of investment assets, rather than business assets. However, 20% of the number of disposals - the business sssets - produced 73% of the gains.

What we still don't understand, though, is how many people actually pay the tax over, say, a ten year period. Is it just the same 200-250,000 people every year? It is much more likely that there are many who make very occasional gains, thus making it a more important tax than the basic numbers of taxpayers suggest.

The other important unknown is how many people don't pay the tax at all, thanks to the exempt allowance (currently £10,100). We think that removing the exempt allowance could easily quadruple the number of people who pay CGT - including a significant number of basic rate taxpayers

We would all benefit from more information, so that we could debate sensibly potential changes to the structure of capital gains tax. Let's hope that the Chancellor follows the Coalition Government's openness in revealing spending with a lot more data about taxation

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.