In 2023, pensions policy became a political hot topic and a wave of risk transfer transactions changed the focus and pace of the industry. This year promises to be another busy one in pensions, with new legislation, regulatory guidance, policy developments and record-breaking risk transfer deals. This overview highlights the key developments that will dominate trustee, employer and pensions industry agendas.

Pensions policy – the year of the economic growth agenda

In 2023, the Chancellor's Mansion House speech and Autumn Budget Statement set out and developed ambitious policies for pensions to support the Government's economic growth agenda. Policies for both defined benefit (DB) and defined contribution (DC) schemes shared a common thread of how to encourage investment in UK-based 'productive finance' (i.e. private equity, start-up finance and infrastructure). In 2024, we are likely to see how these policy ideas are distilled into draft legislation and guidance.

Pensions and the economic growth agenda

The focus on pensions and the economic growth agenda looks set to continue in 2024. The Government and regulatory bodies have promised to release consultations in the first half of the year. In addition, March's Spring Budget Statement is likely to see the Chancellor continue the themes he started and developed in his Mansion House speech and Autumn Budget Statement.

For DB schemes, this is likely to focus on policies aimed at encouraging DB consolidation (via superfunds and a public sector consolidator) and surpluses (identified by the Government as being a barrier to investment in productive finance). New guidance on productive finance is also expected to be issued in the first half of 2024.

The Government is also likely to press ahead with plans to encourage (or force) the consolidation of Local Government Pension Scheme (LGPS) pooled funds and to set goals for exposure of LGPS investments to private equity and/or other UK-based productive finance investments.

Developments in DC

DC pensions will continue to be a focus for policy development and implementation in 2024. As part of the Government's economic growth agenda, we expect to see further announcements on the:

- consolidation of occupational DC pension schemes;

- value for money framework;

- lifetime provider model (also known as 'pot follows member'); and

- development of collective DC (CDC).

In addition, there will be follow up on the policy to require schemes to offer DC decumulation options.

Finally, the Government may push forward with changes to make automatic enrolment available to more people (by lowering the threshold age from 21 to 18) and increasing savings by removing the lower qualifying earnings threshold.

Pensions legislation and guidance – tying up loose ends

In 1785, Robert Burns wrote one of his best-known poems: To a Mouse. In it, he noted that "The best laid schemes o' Mice an' Men gang aft agley" - even the most carefully planned projects can go wrong). In the world of pensions policy, however, the risk seems to be more one of repeated delays rather than things going completely agley.

DB scheme funding

The new DB scheme funding regime is likely to come into force in Q3 2024 (with 1 October 2024 being the most likely effective date).

To achieve this, regulations will be laid before parliament in Q1 2024 and are likely to become law on 6 April 2024. The Pensions Regulator's (TPR's) revised code of practice on DB scheme funding is expected to go into force in Q2 2024. All of this is, however, subject to available parliamentary time being available.

Corporate transaction notifiable events

The Pension Schemes Act 2021 introduced two new notifiable events relating to corporate transactions. Under the new regime, sponsors will have to notify The Pensions Regulator when a 'decision in principle' is made in relation to certain transactions. Neither have yet been brought into force by regulations. This may happen in April 2024, but November 2023's Regulatory Initiatives Grid does, however, state that there remains "significant uncertainty around delivery".

TPR's General Code

The General Code will consolidate 10 of The Pensions Regulator 15 Codes of Practice into a single code of practice. The remaining freestanding Codes of Practice are then expected to be incorporated into the General Code in due course.

On 10 January 2024, The Pensions Regulator laid the final version of the General Code before parliament ('New code of practice consultation – final response'). November 2023's update of the Regulatory Initiatives Grid gives April 2024 as the expected date for The Pensions Regulator General Code to be in force. With the General Code now laid before parliament, it is possible that it could be in force as early as March 2024.

Abolition of the lifetime allowance

In the Spring Budget 2023, the Chancellor announced the abolition of the lifetime allowance regime. Following this, the Government published draft legislation to repeal the provisions of the Finance Act 2004 relating to the lifetime allowance. This will come into force on 6 April 2024.

As well as abolishing the lifetime allowance, two new lump sum allowances will be introduced. Scheme rules will need to be reviewed and may need to be amended to bring them up to date with HMRC's revised authorised payments regime.Pensions industry – the year of the mega deals?

Insured risk transfer market

2023 may turn out to have been a record-breaking year for the total value of insurance-based risk transfer deals. Even if the year falls short of the record, it has been a notably busy period for the pensions risk transfer industry.

2024 is likely to remain busy, but perhaps not as frenetic as 2023. Some key developments to watch out for are the first transaction worth over £10 billion, a slew of multi-billion deals and new entrants to the insurer market.

Other trends in pensions risk transfer

In addition to greater insurance capacity, we predict that the risk transfer market as a whole will overcome its capacity constraints in 2024.

Continuing a trend from previous years, 2024 will see new technological solutions deployed to help manage the sheer volume of scheme data.

There will also be an increased focus on the role of superfunds and other alternatives to buy-ins.

Pensions disputes – an appealing time for litigation

In 2024, the Court of Appeal will hear appeals in two key pensions cases:

- BBC v BBC Pension Trust Ltd; and

- Virgin Media Ltd v NTI Pensions Trustees II Ltd.

In the BBC case, the Court of Appeal will hear the BBC's appeal against last year's High Court ruling focused on the interpretation of the amendment power contained in the BBC pension scheme's trust deed and rules. The Court of Appeal is due to hear the appeal in June 2024. For more on this case, read our insight - High Court rules against BBC on its pension plans.

In the Virgin Media case, the High Court handed down a judgment that focused on the effect on scheme amendments of the absence of an actuarial confirmation under section 37 of the Pension Schemes Act 1993. Virgin Media has lodged an appeal, which is also listed to be heard in June 2024. We explore this case further in our article - High Court rules on validity of alterations to contracted-out pension schemes.

Possible trends in pensions litigation in 2024

In addition to the two cases outlined above, we may see judgments handed down that focus on some key trends:

- resolving issues that relate to possible failures to comply with formalities in amending schemes (e.g. execution and other risks);

- potential LDI-related claims following the mini-budget of September 2022; and cases involving issues arising from surpluses in schemes (whether 'trapped' or otherwise).

Key dates for the pensions diary

There is no doubt that 2024 will be a busy year for pensions, with new legislation, regulatory guidance, policy developments and record-breaking risk transfer deals.

Our calendar provides the key dates for the pensions diary in 2024 to keep you one step ahead of the pensions landscape.

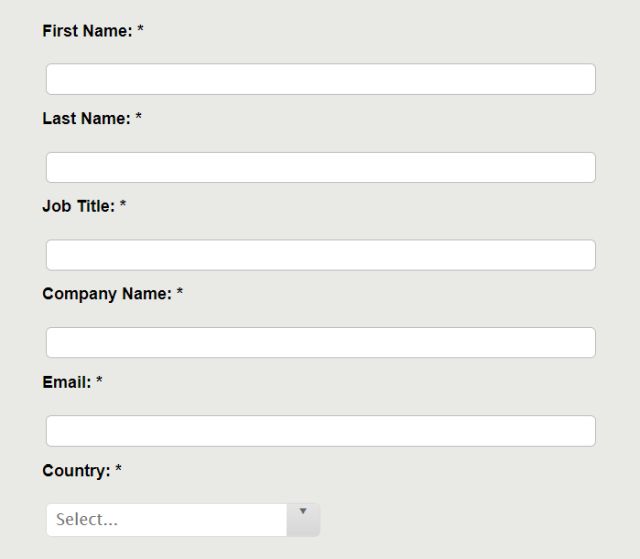

Download the calendar by filling in the form.

Read the original article on GowlingWLG.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.