Buy-to-let property

With extra stamp duty land tax on the purchase of additional residential properties and the new restriction on relief for finance costs, landlords need to take action to minimise the impact of these changes.

Extra stamp duty

Since 1 April 2016, anyone buying a second or subsequent UK residential property has been subject to a 3% stamp duty land tax (SDLT) surcharge. This can add substantial cost to a buy-to-let property purchase, as shown in the following example.

Restriction on finance costs

As a residential landlord, you're currently able to claim various costs of financing your buy-to-let property as an expense against rental income. This includes interest on servicing debt used to fund the rental business and any incidental costs of obtaining or repaying finance. Income tax relief is available at your marginal rate of 20%, 40% or 45%. In some cases, this can produce a rental loss for the tax year, which can be carried forward and offset against further rental profits from the same property business.

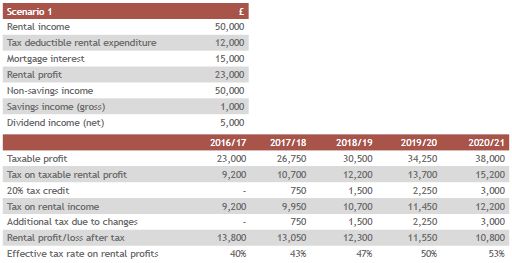

From April 2017 however, if you're subject to income tax, you will have a restriction applied to the relief you receive on the finance costs of running your rental business. This will apply to interest paid on any debt, as well as the costs of obtaining or paying off finance. Partnerships and trustees are included, although there is a specific exclusion for non-UK resident companies subject to UK income tax and for furnished holiday lets. The restriction will completely remove any finance costs from the tax calculation and introduce a basic rate tax credit, equal to 20% of the related finance costs. To further complicate matters, this tax credit will be restricted where the property profits are less than the finance costs, ensuring that the finance tax credit is not given against tax on other sources of income. If the finance tax credit is restricted, the excess can be carried forward and used in future tax years.

This restriction will be phased in from 6 April 2017 and fully implemented from 6 April 2020. From 6 April 2017, 25% of finance costs will be disallowed and subject to the basic rate tax credit. This will increase by 25% each tax year until the restriction applies to the total finance costs. Some landlords may see their tax bill increase by more than the difference between their marginal tax rate and the 20% tax credit.

Impact of the restriction

An increase in rental income may have the following consequences.

- Your income may be pushed above £100,000, resulting in a reduction in your personal allowance.

- Your income may be pushed into the additional rate band (above £150,000), with the associated decrease in your annual pension relief allowance.

- Other income, such as dividends and savings, may be taxed at a higher marginal income tax rate.

Minimising the impact

You can take action to minimise the impact of these changes. These actions are likely to be suitable if you have a high loan-to-value rental business and pay a high proportion of finance interest. Suitability will, of course, depend on your circumstances and intentions.

One option is to incorporate your property business, as the income tax provisions restricting the deduction of interest costs related to residential property will not apply to companies. We can advise on all tax and accounting aspects (including potential liabilities) of the process, including the availability of incorporation relief and the impact of SDLT. There will be non-tax issues to consider in changing any structure and these could include whether your lender would still keep the same terms. You might consider incorporation if you have a large property portfolio.

Other ways to reduce the impact of the tax changes may be to involve your spouse or children in the business or to cut business debt. We can advise on the tax implications of these alternatives too.

We have taken great care to ensure the accuracy of this publication. However, the publication is written in general terms and you are strongly recommended to seek specific advice before taking any action based on the information it contains. No responsibility can be taken for any loss arising from action taken or refrained from on the basis of this publication. © Smith & Williamson Holdings Limited 2016. Code: 16/431 Exp: 13/11/2016