On 11 December 2012 the British government published draft legislation, which is due to come into force in April 2013. Further drafts were published on 31 January 2013.

These draft publications reaffirm the government's announcement in March of 2012 to stop perceived Stamp Duty Land Tax (SDLT) avoidance through the use of companies and other corporate entities.

To discourage these types of arrangements, the following changes have been put in place:

- A higher rate of SDLT will be charged when properties are purchased by corporate entities;

- A new annual charge which will apply from April 2013; and

- A charge to Capital Gains Tax (CGT) on the disposal of property sold by a corporate entity.

SDLT

The rate of SDLT payable on the purchase of a property acquired for more than £2m has been increased since March 2012. An individuals or trustee who will purchase such a property will pay 7% SDLT, whereas a company or other corporate entity will pay 15% SDLT.

Annual Residential Property Tax

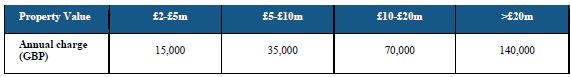

A new annual charge known as the "Annual Residential Property Tax" will apply from 1 April 2013 to corporate entities owning a residential property worth over £2m.

The proposed rates for the Annual Residential Property Tax are set out below:

The new Capital Gains Tax charge

Capital Gains Tax (CGT), at a rate of 28%, will apply to a corporate entity which disposes of a residential property worth over £2m,

There will be a statutory re-basing, so that the CGT charge will only apply to future gains arising from April 2013. That is welcome relief for those who were worried that CGT would be payable on historic gains.

Exemptions

A number of exemptions have been introduced. The following will be exempt from the 15% SDLT rate, Annual Residential Property Tax and the new CGT:

- Genuine commercial landlords (provided that the property will not be occupied by certain "non-qualifying persons");

- Genuine property traders and developers;

- Certain properties which are open to the public;

- Certain dwellings to be occupied by employees, provided the employee has and interest of less than 5% in the company; and

- Farmhouses.

Each of these exemptions contains detailed conditions and should be examined carefully. There are also complex clawback provisions which may reinstate the liability to tax if certain events occur.

How can we help?

The holding structures of all £2m+ residential properties should be considered now, before April 2013.

We will be happy to assist in analysing your property holding structure and consider what will be the best solution going forward.

It should be noted that a compliance return will need to be submitted to HMRC in order to claim the available exemptions, Where the various exemptions noted above do not apply, it may be worth exploring the options available prior to April 2013, and we will be able to assist in providing alternative arrangements.

There is a limited amount of time for those affected by the changes to take action before April 2013. It is important to balance the pros and cons of winding down the existing structure, with the benefits of retaining it.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.