External forces are creating an urgent need for change in rewards approach. See how sector organizations are responding.

Ongoing challenges around talent attraction and retention, rising costs, inflationary pressures, aggressive M&A activity, supply chain disruptions and an increased focus on environmental, social and governance (ESG) initiatives are creating an urgent need for change in biopharmaceutical and life sciences (BPLS) organizations. Each of these factors are reshaping the rewards landscape and, as a result, industry organizations are adapting their pay strategies and increasing their emphasis on the overall employee experience.

The current state of rewards

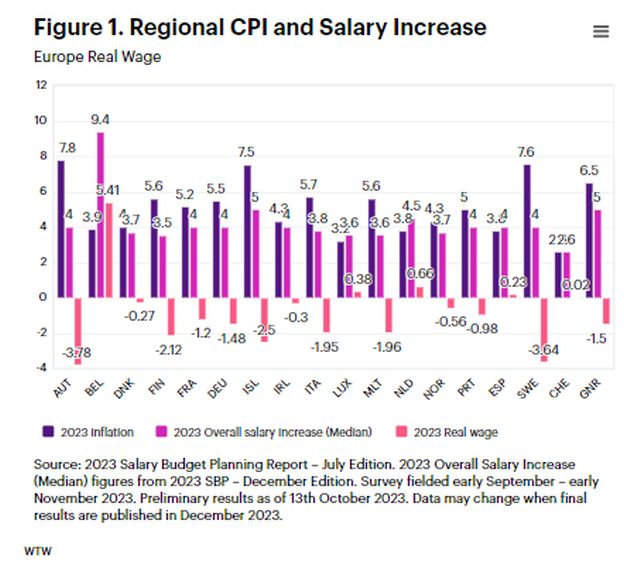

As inflation contributed to declines in real wages across Europe, improving the employee experience became a priority for organizations seeking to balance rising compensation costs with attraction and retention imperatives. As the economic outlook began stabilizing later in 2023, organizations realized the need to rethink their value propositions to differentiate themselves in the talent market.

In most Western European markets, salary budgets were high in 2023, with 65% of organizations allocating more toward increases as compared to 2022. Though projections indicate slight moderation in 2024, salary budgets are projected to still be notably higher than historical levels (see Figure 1). This spend is being driven by inflation, tight labor supply in critical segments, and evolving employee expectations.

Apart from our Salary Budget Planning Report, our 2023 BPLS compensation survey collected data from more than 350 organizations and reflects 795,000 incumbents across Western Europe. Following are key insights we uncovered from that data:

- Manufacturing roles comprise 15% of the dataset, with technical specialist and supply chain positions also highly prevalent. Sales job are less common in Switzerland.

- Information technology, data science and sales incumbents saw the highest reported pay increases across most Western European countries. Areas like clinical development and sales also saw above-average adjustments.

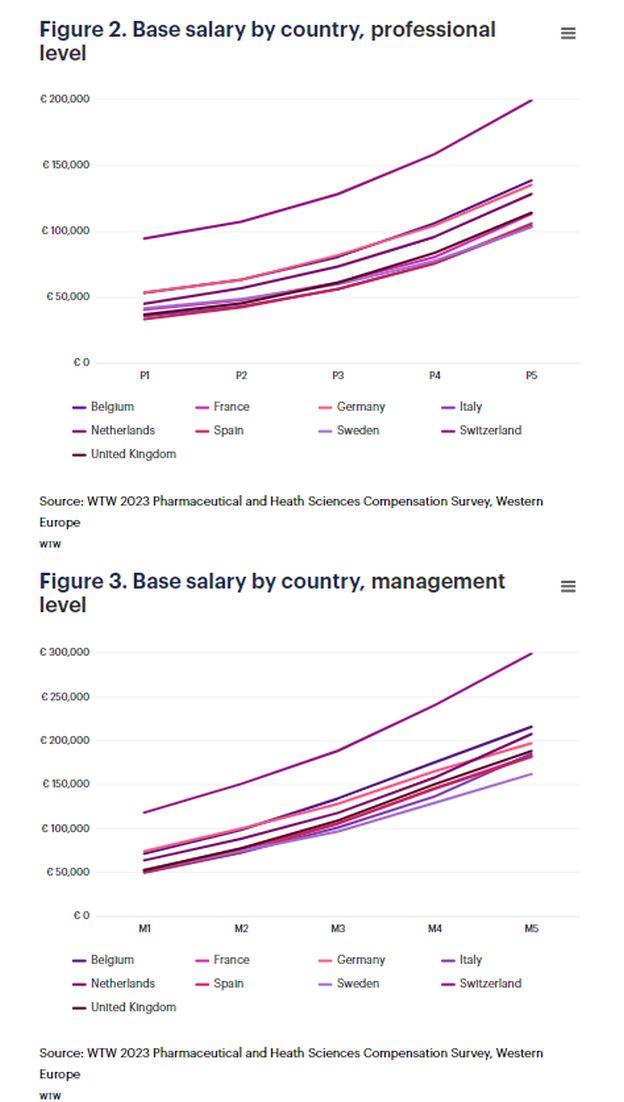

- Among professional roles, Swiss pay rates came in at the highest, with Belgium and Germany also positioning considerably above median market rates thanks to indexation and tax normalization policies (see Figures 2). Significant pay premiums exist for manager transitions into strategy-setting positions (see Figure 3).

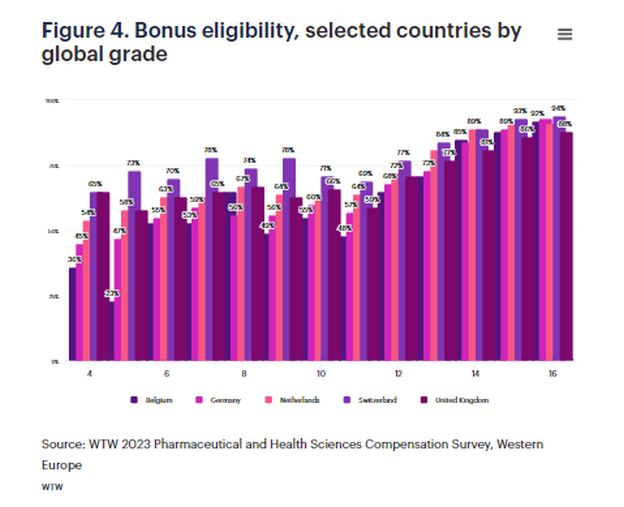

- Bonus eligibility is high, especially among middle managers and above, enabling pay-at-risk tied closely with performance targets like revenue, pipeline growth, access improvement and sustainability. Eligibility hovers around 80% for directors and strategic leadership. Long-term incentive coverage typically lags bonus eligibility, but still sees more than 50% adoption rates for senior management grades (see Figure 4).

As innovation, regulation, activism and economic uncertainty continue disrupting the BPLS sector, tailored reward strategies will help attract, motivate and retain specialized talent that is essential for driving pipeline growth, profitability and access.

Adapting to changing expectations

With remote and hybrid work cementing itself as a permanent option, employee priorities have fundamentally shifted. Younger employees especially tend to emphasis purpose, growth and flexibility at the same level as – if not more than – compensation.

Even amid inflation and supply chain uncertainties, more than 80% of companies have invested in non-financial rewards, including inclusion, sustainability and career development opportunities. Some levels of flexibility also have graduated from sought-after perks to basic table stakes in most industries.

While cost sensitivities remain, early adopters of these initiatives realize they cannot cost-cut their way out of the talent conundrum. Organizations are incorporating new approaches into their strategic priorities, including monitoring employee sentiment closely via stay interviews and engagement surveys. This informs more responsive benefits packages that support physical, financial and mental wellbeing.

The communications needle also is moving from the basics like pay and job security toward purpose, achievement and flexibility. Subtle moves include increased personalization and localized messaging across regions and demographic cohorts.

Tracking digital talent dynamics

As the proliferation of technology accelerates across sectors, organizations are doubling down on digitalization efforts while facing persistent talent gaps. WTW research affirms that more than 90% of companies globally face challenges attracting and retaining critical digital skills.

To prepare for increased automation and AI-led transformation, one-third of organizations aim to advance their digital talent pipelines. And demand remains robust for roles like software engineers, developers, data scientists, AI experts and cloud architects.

Cash compensation is retaining its dominance as the key attraction and retention lever, with 65% of respondents enhancing pay for digital talent. However, non-monetary motivators also rank high:

- Autonomy and purpose, such as having a real impact in the workplace and being offered varied/challenging work

- Growth, including clear promotion pathways as well as learning programs and career models tailored for digital profiles

- Security, including job stability assurances

Across sectors, employers recognize the expanded need for digital literacy even within traditional functions like finance, HR and customer service. As exponential technologies like AI and automation become more mainstream, the race to reskill and attract digital natives will intensify.

For BPLS companies, the implications of this span R&D productivity, clinical trial efficiency, manufacturing analytics and customer experience enhancement. Success hinges on workforce planning that reflects change, skills strategies that proactively close gaps, and change management to shepherd broad adoption.

Additional talent demands in the sector

Manufacturing operations and technical specialist skills have seen heavy demand in BPLS companies, comprising more than 20% of benchmarked roles in Western Europe. Clinical research and sales capabilities also feature prominently given high R&D activity and commercial intensity in therapeutic areas like oncology, immunology and rare diseases.

Commercial and medical roles also saw above-average pay adjustments, indicating robust business growth and regulatory complexities amid pricing reforms that are sweeping key European markets. Despite moderating from peak crisis mode, hiring challenges have endured for niche technical and sales competencies.

Focus for 2024

As economic headwinds persist, BPLS organizations need to be prepared to balance attraction and retention imperatives without compromising cost efficiencies. Salary budgets will focus on non-monetary elements shaped by regular employee listening. With niche skills under perennial shortage, analytics-based workforce planning to identify adjacent talent sources and pragmatically pace upskilling are priorities. Finally, streamlined processes enabling managers to make sound compensation decisions faster will counter regrettable attrition. Progressive organizations will differentiate themselves by grounding their rewards strategy on being adaptable rather than leaning on traditional approaches.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.