Two years ago, Turkey introduced a 25 percent annual limit on housing rent hikes1. This popular regulation was introduced when inflation was increasing, the economy was not going well, and real estate investments stagnated. Moreover, during the last two years, supply and demand shocks have occurred subsequently. Demand for housing has increased due to irregular immigrants, and an earthquake disaster destroyed thousands of residences. Thus, the regulation quickly becomes a problem rather than a solution. In this short article, first, we elaborate on the economics of rent controls. Then, we discuss the regulation in Turkey and some of its unintended consequences. Finally, we put our recommendations.

Basic economics of rent control

The goal of setting price limitations is often to protect consumers from high costs while also ensuring that necessary goods and services remain affordable. However, price controls can have various effects on market outcomes, and their impact in the short run would be different than in the long run. When the subject matter is rent control things can be worse, as one economist called rent control "The best way to destroy a city, other than bombing" 2.

Under normal circumstances, in the short run, the supply of housing units is fixed, and the demand (number of people searching for housing) is stable. Therefore, when the government imposes a rent control regulation, due to the inelasticity of both the demand and supply side, the initial adverse effect remains limited. However, the long-run story is very different. Both supply and demand become responsive. Especially, landlords respond to low rents by not building new housing and directing their money to more fertile investments. Thus, the supply cannot meet the demand, and this results in a large shortage of housing in the long run.

As depicted above, the adverse effects of rent control are less apparent to the general population because these effects occur over many years. However, things have moved fast motion in Turkey.

Rent control regulation in Turkey and its effects

In 2022, when inflation increased rapidly (more than 60 percent), the parliament introduced a regulation that put a 25 percent annual limit on housing rent hikes. The regulation aimed to get the rental prices under control. Even though the lawmakers were aware of the difficulty of carrying out this objective according to economic factors during the inflationary time, they did not hesitate to enact a very protective legislation.

Before the regulation, the rent increase rate in Turkey was determined according to the twelve-month average of the consumer price index. When the regulation was enacted, the 25 percent increase began to serve as a binding price ceiling which provided immediate relief to existing tenants by protecting them from sudden and significant hikes in rental prices. Therefore, this can make housing affordable for existing tenants. The regulation, which initially entered into force for one year, was extended for another year in 2023. However, the legal disputes have increased significantly with the extension of the regulation.

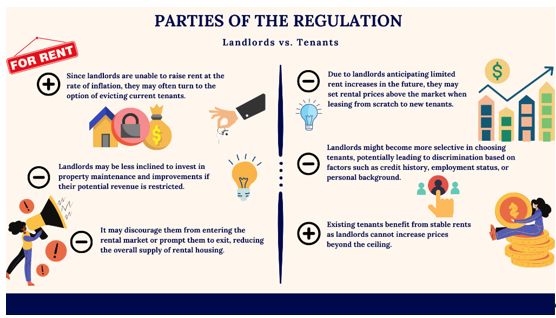

The reason for this is the conflict of interest between the landlords and the tenants. Due to the regulation, landlords resort to the option of evicting existing tenants as soon as they cannot realize a rent hike at the rate of inflation. Despite the mandatory nature of the regulation, many landlords calculate the hike in the rental price by taking well above 25 percent. For these reasons, "eviction" and "rent determination" cases have increased significantly in the courts. In response to this explosion in the number of disputes, mandatory mediation has been introduced in rental disputes as of September 20233. As a result, the regulation has caused a serious burden on the courts in terms of its consequences and has adversely affected the tenant-landlord relationship within the society.

However, there are at least two additional factors that should be considered for the Turkish case that made things worse and moved the adverse effects fast motion. First, due to the political instability in the region (Syria, Iraq, Afghanistan), Turkey has attracted millions of irregular refugees who have increased the housing demand significantly. Second, on February 6th, 2023, the eastern part of Turkey experienced a destructive earthquake that affected ten cities. Besides thousands of lives lost, the earthquake increased the demand for housing in other cities and decreased the supply of rental housing stock. Those two shocks have brought forward adverse effects.

Is the regulation a solution?

Limiting the rate of rent hikes has not brought a solution as seen fast motion in the Turkish case. In contrast, the regulation has increased the social and economic burden of the problem. However, when rent control is eliminated and the housing market is left to the forces of competition, there is hope to find a solution. In other words, the solution can be achieved by market forces: supply and demand. If the government wants to direct the market forces, it can only be achieved by designing the right incentive schemes rather than directly regulating rents.

On the demand side, directing the demand with comprehensive macro-level policies could be effective. For instance, a policy that aims to deal with the purchase of a house in a way that directly meets the need for shelter rather than being an investment tool should be effective. Thus, the funds could be used effectively and demand for rental houses would decrease.

On the supply side, the amount of rental housing should be increased by arranging a tax policy to incentivize the landlords to increase the supply of rental housing. In that sense, implementing even higher tax rates for properties that are vacant or not fully utilized could be effective. This encourages property owners to put their properties into productive use, such as making them available for rent. As an example of the implementation of progressive tax rates with higher rates for vacant or underutilized properties, Canada introduced the Empty Homes Tax (EHT) for Vancouver in 2018. The EHT was introduced as a measure to address housing affordability and encourage the use of vacant or underutilized properties for rental purposes. The outcome of the policy is deemed positive. 52 percent of properties declared deemed or determined vacant in 2021 were converted to occupied in 20224.

As seen, policymakers should reach the desired goal by protecting the balances in the rental house market with carefully designed incentive mechanisms rather than directly controlling the price.

Footnotes

1. Entered into force in the Official Gazette dated 11 June 2022 by being added as a provisional article to the Turkish Code of Obligations.

2. Mankiw, N., & Taylor, M. (2014). Economics (3rd ed.). Cengage Learning EMEA, p.189.

3. According to law on Amendments to the law of Bankruptcy and Enforcement and Some Other Laws published in the Official Gazette dated 05.04.2023.

4. 2022 Empty Homes Tax Annual Report. Accessed on 27.02.2023, https://vancouver.ca/files/cov/vancouver-2022-empty-homes-tax-annual-report.pdf.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.