South Africans are no strangers to fraud and corruption, but it is a global issue at both corporate and government levels. According to the Occupational Fraud 2022: A Report to the Nations, it is estimated that organisations lose 5% of revenue to fraud annually. Furthermore, internal or occupational fraud, which generally entails an employee, manager or executive of an organization deceiving the organization itself; is considered to be the most costly and most common form of financial crime in the world. 12 -18 November is International Fraud Week, so it is fitting that we underscore the significance of internal corporate investigations. These investigations play a pivotal role in safeguarding companies against unethical practices and fraudulent behaviour.

What triggers an internal investigation?

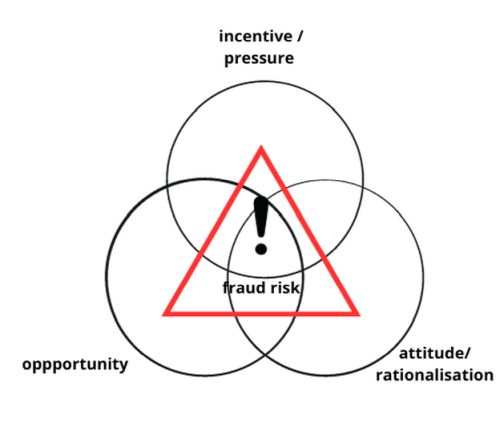

It is important to note that fraud takes place when employees under pressure identify the opportunity to commit fraud - coupled with a perceived low risk of detection. The fraud triangle is an excellent representation of this:

A specific event relating to allegations of misconduct, unethical behaviour, policy violations, fraud or any other related matter that may threaten an organisation's integrity or reputation may trigger an internal investigation.

This includes but is not limited to:

- The belief that company data has been stolen by a current or former employee

- Receipt of a tip-off or whistle-blower allegations

- External data breaches

- Unfavourable media attention

- Increased regulatory scrutiny within the industry or jurisdictions in which a company operates

- Any red flags or malfeasance identified through routine audits

When should an internal investigation be conducted?

An effective internal corporate investigation will ensure that an organisation is presented with relevant and accurate facts, which will allow for informed decision-making. The type of investigation, and the resources you allocate to resolving the issues identified, depend on the seriousness of the conduct being investigated and its potential impact on the organisation. The benefits of conducting an internal investigation are far-reaching:

- Investigations can uncover potential wrongdoing by management, employees or third parties and the malfeasance can be stopped before can cause any further harm.

- It promotes a culture of accountability within an organisation and promotes awareness of potential risks.

- Investigations can uncover potential financial losses or claims that the organisation might have against third parties.

- Investigations serve to demonstrate to employees, counterparties, shareholders, regulators, financiers, insurers and investors, that an organisation is serious about ethical conduct and "doing the right thing".

- The outcome or conclusion of an investigation can also potentially lead to a reduction in civil liability or pecuniary sanctions. Moreover, a company that self-reports to law enforcement, regulators and agencies, is likely to obtain recognition for doing so.

Planning an internal investigation

An effective internal corporate investigation will ensure that an organisation is presented with relevant and accurate facts, which will allow for informed decision-making. The type of investigation, and the resources you allocate to resolving the issues identified, depend on the seriousness of the conduct being investigated and its potential impact on the organisation. Collaboration is key, and an effective internal investigation will include all stakeholders. In certain instances, it may even be necessary to appoint an external investigations team to lead the investigation to ensure independence and impartiality.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.