- within Corporate/Commercial Law topic(s)

- within Corporate/Commercial Law topic(s)

- in United Kingdom

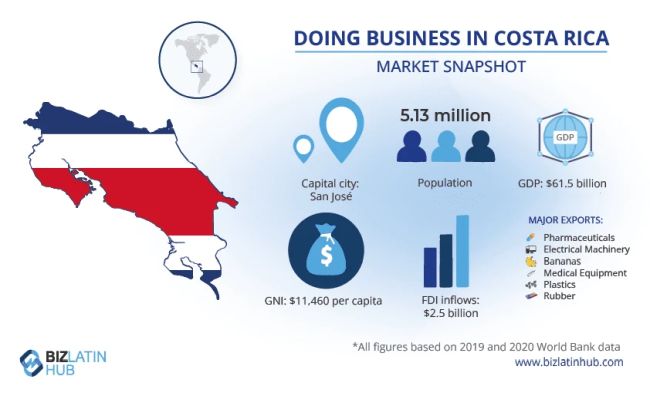

Despite its small size, Costa Rica is a good option for registering a company as it is known as one of the most developed, and safest countries in Latin America. Economically growing, its gross domestic product (GDP) reached 2021 $64.28 billion in (all figures in USD), and in the last twenty years, it tripled the gross national income (GNI) reaching $12,500 per capita in 2021.

There are so many reasons to consider business formation in Costa Rica. Entrepreneurs that incorporate a company in Costa Rica's economy might choose to operate in several thriving industries, including technology, tourism, agriculture, manufacturing, and renewable energy. There are many business opportunities in these sectors but sustainable and green innovation is arguably the most interesting opportunity for company formation in Costa Rica.

Its focus on innovation and sustainability makes it an attractive destination for investment. Successful examples of green tech include dosmil50, whilst the eco-tourism industry alone contributes almost USD$1.5 billion a year to the economy! Costa Rica is undoubtedly a world leader in this area.

This has meant FDI (Foreign Direct Investment) has soared in the last decade, reaching $3.56 billion when last measured by the World Bank in 2021. It has strong FTAs (Free Trade Agreements) with the likes of Chile, Panama and Mexico and is an influential member of the Central American Common Market (CACM), along with El Salvador, Guatemala, Honduras, and Nicaragua.

If you're considering doing business in Costa Rica, read on for 10 simple steps to register a company in Costa Rica. You can also contact us now for more information.

10 simple steps to register / form a company in Costa Rica

Registering a company in Costa Rica is a fairly short process. It's simpler than in many countries and as with a Power of Attorney and an incorporation agent, you can act remotely.

1. Pay Agency Fees when forming your Costa Rican company

If you're using a firm to help you with the incorporation process, the firm may ask for upfront payment on services to obtain the necessary due diligence documents.

2. Choose the Company Structure

You will need to choose the right company structure for your company's needs and activities. Following this, you'll need a project plan draft detailing the timeline and tasks for each week of the incorporation process.

3. Search for homonyms of the company name

A firm will help search for homonyms of your proposed company name and file an application to reserve your company name with the Costa Rica Registrar of Companies.

4. Sign Off on Proper Documentation

The agency will ask you to sign, notarize, and legalize documents from your country of residence. You'll then return them to the agency for timely documentation registration in Costa Rica.

5. Register an Incorporation Charter

A company incorporation charter also called an M&AA, is filed at the mercantile section of the public registry in Costa Rica. The firm can then legalize the company's bookkeeping.

6. Open a Corporate Bank Account in Costa Rica

Once you've successfully incorporated your company, the law firm will open a corporate bank account for the company and deposit the capital to start the business. Additionally, depending on the firm, they might pay incorporation fees to the bank on behalf of your company.

7. Register as a Taxpayer in Costa Rica

The agency files a D-140 form to the government to register your company as a legal taxpayer in Costa Rica. The company may let you use their office address for tax purposes until you get an office address in the country for your company.

8. Apply for Insurance

After your company hires staff in Costa Rica, the company will be registered for labour risk insurance with the National Insurance Institute.

9. Register with Costa Rican Social Security

Post-incorporation, the firm will register your company as an employer with the Caja Costarricense de Seguro Social (CCSS).

10. Receive your Costa Rica Company Kit

Ideally, your contracted firm will send you all of the documentation for your company that has been filed throughout the incorporation process.

Common FAQs when forming a company in Costa Rica

In our experience, these are the common questions and doubtful points of our Clients.

1 . Can a foreigner own a business in Costa Rica?

Yes, a business can be 100% foreign owned by either legal persons ("legal entities") or natural persons ("individuals")

2. How long does it take to register a company in Costa Rica?

It takes 6 weeks to register an operating company in Costa Rica.

3. What does an S.A. company name mean in Costa Rica?

The S.A. in a company name in Costa Rica refers to a "Sociedad Anónima," which translates to a "Joint Stock Company." This legal framework establishes the company as a separate entity from its shareholders, with each shareholder possessing shares that represent their ownership stake. Importantly, the financial responsibility of shareholders is confined solely to the value of their shares, crafting a safeguarded boundary. The S.A. structure holds substantial prominence in Costa Rica due to its exceptional adaptability and flexibility, rendering it the favored option for a diverse range of business ventures.

4 . What does SRL company name mean in Costa Rica?

SRL in Costa Rica, stands for "Sociedad de Responsabilidad Limitada," which translates to Limited Liability Company in English. This legal entity operates independently from its shareholders, offering them limited liability. SRL companies are prevalent due to their simplified requirements, making them a popular choice for business structures.

5. What entity types offer Limited Liability in Costa Rica?

In Costa Rica, both "S.A" (Sociedad Anónima) and "S.R.L" (Sociedad de Responsabilidad Limitada) are limited liability entity types.

6. Main differences between SA and S.R.L in

Costa Rica

1. Shareholders: An S.R.L. can have one to unlimited shareholders, while an S.A. must have at least two shareholders, three board members, and a comptroller who is not part of the board, but is nevertheless a statutory requirement.

2. Administration: An S.R.L. has no board of directors, only appointed administrators; an S.A. requires a board with at least three members.

3. Liability: In both entities, shareholders are jointly liable for debts up to their contributions.

4. Transfer of shares: S.R.L. share transfers require approval from other shareholders, while S.A. shares can be transferred through endorsement without approval.

5. Company Size: S.R.L. is ideal for smaller companies or those with shareholders outside Costa Rica, while S.A. suits larger companies.

6. Regulatory requirements: S.R.L. faces easier regulations compared to S.A., with fewer formalization requirements.

Register your company in Costa Rica with the help of Biz Latin Hub

Forming a company in Costa Rica can be a difficult process when you are unsure of the steps to take. Using an incorporation firm to aid you in starting your business can save you time, stress, and money in the long run.

Originally Published by 1 July 2018

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.