Each country has its own tax and accounting requirements. Understanding accounting in Mexico will be an advantage when doing business. Below is a summary of the different legal requirements for doing business in Mexico.

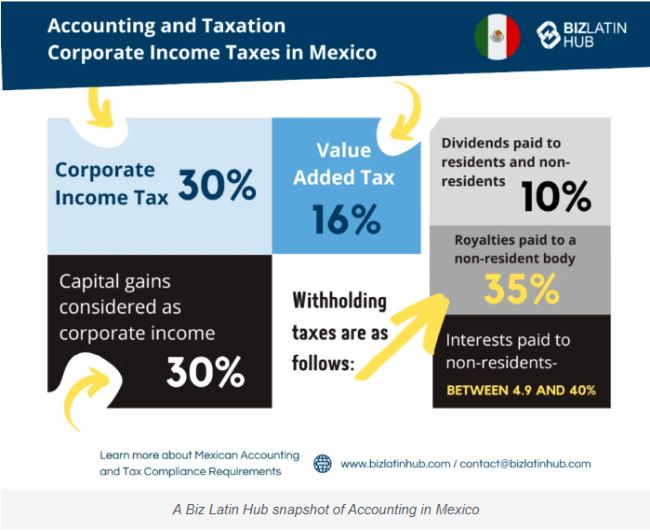

1. Accounting and Taxation – Corporate Income Taxes in Mexico

Corporations are subject to different tax rates than other business models, families, or individuals are. They are listed by per cent here:

- Corporate Income Tax- 30%

- Capital gains considered as corporate income- 30%

- Value Added Tax- 16%

Withholding taxes are as follows:

- Dividends paid to residents and non-residents- 10%

- 5% royalties from railway rentals

- 25% royalties for technical assistance

- 30% royalties for patent rental

- Interests paid to non-residents- between 4.9 and 40%

2. Tax Incentives in Mexico

- Dividends received from a resident company do not have to pay withholding tax.

- Businesses can freely send funds back to their country due to Mexico's lack of exchange controls.

- Companies registered in Export Processing Zones are exempt from corporate income tax.

3. Tax Administration in Mexico – Servicio de Administración Tributaria (SAT)

The Tax Administration is somewhat similar to the IRS in the USA and has its own regulations and timelines. It is required for all companies to file annual tax returns in Mexico with the Tax Administration within 3 months of the end of the upcoming fiscal year. Later than the 17th of each month, the Value Added Tax must be filed. Digital invoices are also required for every transaction that a trading company in Mexico makes.

4. Additional Tax and Accounting Considerations

- Employers must pay 15-25% of each employee's monthly salary to the Mexican Social Security Institute (IMSS).

- Mexico has signed double tax treaties (avoids or mitigates double taxation) with 61 countries, including the U.S., Canada, and many European countries.

- Mexico is a member of the NAFTA and EFTA free trade agreements, along with nearly 20 others.

5. Mexican Company – Accounting Compliance Requirements

The Mexican General Law of Corporations outlines the general legalities that all companies must follow. A few of its rules are:

- All resident companies must keep records of the company's shareholders' contact information, amount of time in each shareholder meeting, and any changes in the share capital.

- A local registered address is required for all Mexican resident companies.

- All companies listed publicly must file financial reports with the Mexican Securities and National Banking Commission.

- Up to 10% of the annual income must be shared with the company's employees.

6. Entity Requirements – Employer Considerations

Employers should be aware of the general regulations for workers in Mexico and payments that they are entitled to. A few considerations below:

- A workweek in Mexico is a maximum of 48 hours, with a maximum of 3 hours of overtime per day and three times a week.

- Workers are permitted to engage and be members of a union.

- Minimum wage per day in Mexico is USD$12.26.

- 2% of payroll must go to workers' retirement funds and 5% must go to their housing funds.

Navigating Mexico's Tax and Legal Compliance Standards

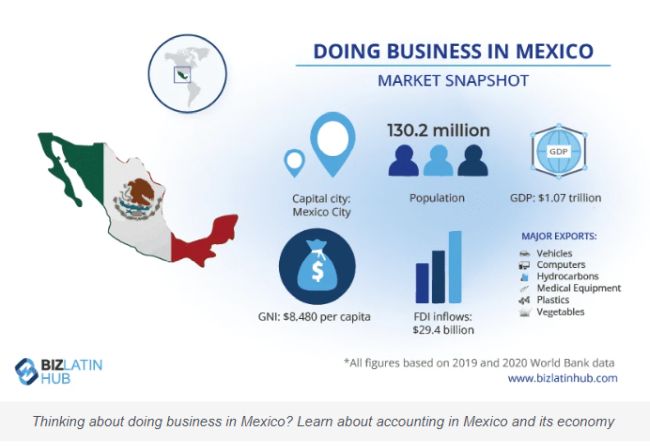

Mexico is a country full of opportunity and is very open to the prospect of foreign business and trade. Understanding the legalities prior to designing your business plan will create the foundation for a smoother market entry.

Watch the following video for more information!

Originally Published by 2 July 2018

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.