The Vietnamese market remains an attractive destination for foreign investors. In addition to some popular business sectors that Vietnam has opened its market such as Management Consulting, Computer Services, restaurants, etc., there are still other business sectors that Vietnam has not fully opened or reserves the final decision to the licensing authority of Vietnam. Therefore, from the perspective of foreign investors, before conducting business in Vietnam, investors can check the commitments and regulations of Vietnamese law on that business sector themselves. The following article will provide a comprehensive guide to searching for business sectors, with the hope that foreign investors can perform the search themselves to evaluate the effectiveness of the business plan.

- Why should we look up business sectors?

The business sector is one of the most important factors that investors need to determine before proceeding with a business investment. Foreign investors must determine whether Vietnam has committed to opening up to the prospective business sector and what the specific conditions are (market access conditions). Additionally, they must determine whether there is a requirement for a separate license (business conditions) as a fundamental step to proceed with an investment in Vietnam.

Market access conditions for foreign investors include:

- The proportion of charter capital ownership of foreign investors in economic organizations;

- Form of investment;

- Scope of investment activity;

- Capacity of the investor and partners participating in investment activities;

- Other conditions as specifically prescribed by Vietnamese law. For example, if the investor intends to do business in tourism services, in addition to considering Vietnam's commitments according to the WTO commitment schedule, the investor also needs to consider the detailed regulations in the Tourism Law and accompanying guidance documents.

Thus, not all sectors are open to foreign investors for capital investment, share purchases, or project implementation. Foreign investors must adhere to the regulations of the Vietnamese Investment Law. Accordingly, the Government issues a list of business sectors with restricted market access, requiring foreign investors to meet market access conditions to operate in those sectors.

The list of sectors not yet opened to the market is stipulated in Section A of Appendix I of Decree 31/2021/ND-CP. The list of sectors accessible to the market with conditions is stipulated in Section B of Appendix I of Decree 31/2021/ND-CP (please refer to the details in the attached file at the end of the article).

- Principle of Applying Limitations on market access

Except for the business sectors in the List of business sectors with restricted market access, foreign investors are allowed to access the market under the same regulations as domestic investors. Foreign investors are not allowed to invest in business sectors that have not yet been opened to the market. For business sectors with conditional market access, investors must meet the market access conditions before doing business in Vietnam.

The market access conditions for business sectors that Vietnam has not yet committed to market access for foreign investors are applied as follows:

- If Vietnamese law does not have restrictive regulations, foreign investors are allowed to access the market under the same regulations as domestic investors;

- If Vietnamese law already has regulations, those regulations will be applied.

- Concept of CPC Code and Commercial Presence in the WTO Commitment Schedule

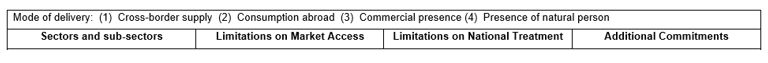

The Commitment Schedule on Trade in Services is one of the important documents for foreign investors investing in Vietnam, which is the result of negotiations between Vietnam and other WTO members to open up the service market when joining the WTO. Vietnam's Commitment Schedule when joining the WTO includes 3 parts: general commitments, specific commitments, and a list of measures exempting most-favored-nation treatment (MFN).

Concept of CPC Code

- The CPC code is a code that identifies sectors and sub-sectors of services in the Commitment Schedule of member countries when joining the WTO. Each sector and sub-sector in the Commitment Schedule on Trade in Services corresponds to a CPC code. For example: CPC 841: Computer and related services

- When carrying out investment activities in Vietnam, investors must understand the regulations on market access restrictions for foreign investors. The CPC code is the basis for comparing business sectors in Vietnam's Commitment Schedule when joining the WTO;

- Choosing the appropriate CPC code will help foreign investors consider the feasibility of investing in Vietnam.

- Each CPC code stipulates separate commitments about opening the market;

- Foreign investors can be allowed to invest in Vietnam when the investment sector has been committed. Vietnam is not obliged to accept investment sectors that have not yet been committed.

Concept of Commercial Presence Commercial presence includes economic organizations with foreign investment capital; representative offices, branches of foreign traders in Vietnam; and the head office of foreign investors in the business cooperation contract (Clause 7 Article 3 Decree 152/2020/ND-CP). To look up sectors according to the WTO Commitment Schedule, it is necessary to understand the restrictions on market access and the form of commercial presence allowed for foreign investors when doing business in that sector in Vietnam.

- How to look up sectors by CPC code

Investors will need to refer to the Handbook of Vietnam's Service Trade Commitments in the WTO; Part II - Specific Commitment Schedule on Services List of exemptions from Most-Favored-Nation treatment according to Article II in Vietnam's Commitment Schedule on Trade and Services when joining the WTO (hereinafter referred to as "Specific Commitment Schedule on Services");

In the two documents above, investors can look up sectors by sector content and determine related conditions, the overall lookup process includes:

Step 1: Access the Specific Commitment Schedule on Services (https://bom.so/tdIU6Y) and look up the keyword of the prospective business sector

Step 2: Consider section (3) Commercial Presence and the column "Limitations on market access" to determine the specific conditions that foreign investors must meet (if any) when investing in a specific sector in Vietnam.

Step 3: Cross-reference this sector description in the Handbook of Vietnam's Service Trade Commitments in the WTO to clarify the scope that investors are allowed to do business by looking up the CPC code or sector keyword.

Step 4: Look up Appendix I of Decree 31/2021/ND-CP to determine whether the sector is a sector that has not yet accessed the market (Section A) or has conditional market access (Section B) and cross-reference the market access conditions posted at the National Investment Information Portal (https://bom.so/qOW6hd).

Step 5: Look up the prospective sector chosen by the investor in the List of conditional business sectors (Appendix IV of the 2020 Investment Law)

Step 6: Look up the specific conditions of each conditional business sector as prescribed by specialized laws.

FOR EXAMPLE: Looking up computer services

Access the Specific Commitment Schedule on Services (https://bom.so/tdIU6Y) and look up the keyword "computer". Accordingly, computer services fall under CPC 84-845, CPC 849 - Computer and related services.

Looking at section (3) Commercial Presence and the column "Limitations on market access", it can be seen that the conditions for this service have expired; now foreign investors are allowed to establish 100% foreign-owned enterprises in Vietnam to do this service.

Cross-reference this sector description in the Handbook of Vietnam's Service Trade Commitments in the WTO to clarify the scope that investors are allowed to do business by looking up the CPC code 841 or the keyword "computer".

Based on the lookup results, we can see that computer services currently have no restrictions on market access; foreign investors are allowed to establish 100% foreign-owned enterprises.

Article written on: 30/08/2023

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.