Act No. 497/2022 Coll. on Screening of Foreign Direct Investments (the "FDI Act"), published on 23 December 2022, will have a significant impact on foreign investments in Slovakia, at least in terms of the time needed to complete transactions. The FDI Act takes effect on 1 March 2023. The new rules do not apply to investments completed prior to such date.

01 When must an investment be subject to approval?

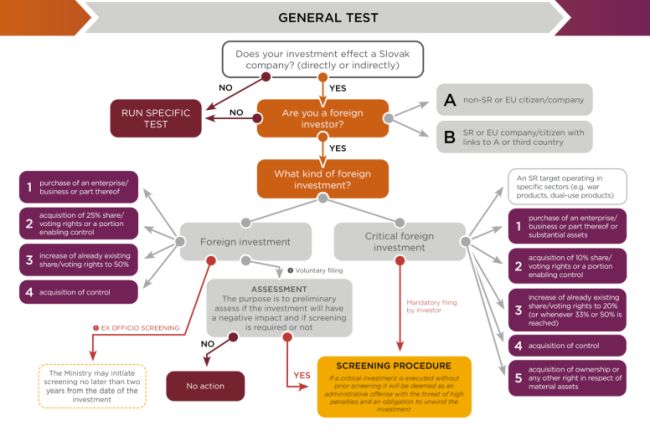

Screening under the FDI Act concerns foreign investments made by foreign investors as defined in the FDI Act.

Foreign investments made by foreign investors falling under the category of critical foreign investments can be made only after approval by the Slovak Ministry of Economy ("MoE"). Critical foreign investments are to be determined by the Slovak government in a separate decree.

According to the FDI Act, an investment is made when an agreement covering the investment takes effect. In practice, transactional parties will frequently not be able to avoid the situation where certain clauses in foreign investment contracts take effect before obtaining such approval. In view of the high fines contemplated for the breach of the FDI Act, parties to such transactions should tread cautiously to avoid clauses that could be considered as an early implementation of the contract (similar to "gunjumping" in merger control).

No prior approval is required for foreign investments made by foreign investors that are not deemed to be "critical." However, the MoE can also screen such investments within two years after the date they were made. Such screening may result in a ban on investment, with an obligation to revert it. As a consequence of the risk of having an investment banned, in several cases and for legal certainty investors can choose an optional notification of their investment. This will delay completion of the transaction at least until it is clear that the MoE has not identified any risk of negative effect of their foreign investment and that, as a result, there is no risk that such investment will be banned or approved only conditionally.

02 Definition of "foreign investments made by foreign 02 investors"

The definitions of "foreign investors" and "foreign investments" in the FDI Act go beyond what is contemplated under EU Regulation 2019/452 establishing a framework for the screening of foreign direct investments into the Union. "Foreign investors" thus include not only natural persons that are not nationals of an EU Member State and legal persons without a seat or place of business in the European Union, but also any other person (for example, Slovak legal persons) if linked, in a manner defined in the FDI Act, to any person of a third country defined in the FDI Act. Such a "person of a third country" includes, for example, a legal person or other entity in whose management a public authority of a third country participates (i.e., an entity with capital participation of a third country).

A qualified link with a person of a third country exists, for instance, where the person of a third country is the ultimate beneficial owner of the foreign investor, or where such person provides for financing of the foreign investment. Foreign investors include also various types of trusts that are qualified in the FDI Act as a legal arrangement of assets with a foreign element, where a person of a third country holds a position defined in the FDI Act

A foreign investment is linked (directly or indirectly) to its target. A target is any person with a seat in the Slovak Republic. A foreign investment under the FDI Act is an investment that will allow a foreign investor, directly or indirectly, to

- acquire a target or a part of a target;

- exercise an effective interest in a target. Effective interest is at least 25% interest in the registered capital or voting rights of a target and, in the event of a critical foreign investment, at least 10% interest

- increase an effective interest in a target. Increase of effective interest means an increase of an already existing foreign investor's effective interest in the registered capital or voting rights of a target to at least 50%, in the event of a critical foreign investment to at least 20%, and always when at least a 33% or 50% threshold is achieved. It is to be noted that a speculative distribution of a foreign investment into multiple investments—such that each of them separately does not meet the criteria set in the definition of a foreign investment or critical investment, but where all of them taken together meet these criteria—is considered to be in circumvention of law; exercise control of a target, where the definition of control is that used in the Slovak Act on the Protection of Competition;

- exercise control of a target, where the definition of control is that used in the Slovak Act on the Protection of Competition;

- receive ownership title or other right to material assets of a target in the case of a critical foreign investment. "Other right" means any right to use or make disposition of the material assets of a target. "Material assets" are such assets of a target that were or are strictly necessary to conduct the business of a target that is vital for a foreign investment being classified as a critical foreign investment.

03 What factors are considered in screening?

In the procedure regarding foreign investment under the FDI Act, investments are screened for their effect on the security and public order of the Slovak Republic and the EU. The FDI Act contains a list of factors considered in such screening. These include circumstances concerning a target; circumstances concerning the foreign investor; the persons controlled by or controlling the foreign investor; and the wider context and circumstances around the planning or making of such a foreign investment. Screening involves consultations with a number of consulting bodies, including the Slovak Police Force and Slovak Intelligence Service. The Ministry of Finance also plays an important role when it gives its view if, in connection with the screening, any conflict arises with the obligations binding the Slovak Republic under international treaties on the promotion and protection of foreign investments.

04 What does the foreign investment screening 04 process look like?

The foreign investment screening process is initiated upon a screening application filed by an investor or by virtue of official authority, and consists in principle of the following two stages:

- at the first stage, the foreign investment is reviewed for the risk of its negative effect. If, within 45 days of receipt of an investor's screening application, the MoE does not send to the investor a notification to open the second stage of the procedure (investment screening stage), it is assumed that no risk of negative effect of the foreign investment was identified;

- the second stage (investment screening stage) is taken where a risk of a negative effect was identified in the first stage. In certain cases (for example, where critical foreign investments are screened), the first stage is not run, and the procedure starts with the screening itself.

The screening process can be terminated with a decision to approve the foreign investment, a decision to conditionally approve the foreign investment, or a decision to ban the foreign investment. If the investment is approved conditionally, the investor is ordered to take certain mitigating measures, for example to waive or preserve certain rights or assets. A mitigating measure might be an obligation to determine or appoint an independent manager to supervise the implementation of the mitigating measures. The FDI Act grants the MoE the authority to change the decision on conditional approval of an investment if the mitigating measures prove to be insufficient. The MoE's power to reopen a decision on investment approval gives rise to legal uncertainty. The MoE may ban an investment only subject to the relevant opinion given by the Slovak government. If the MoE, within 130 days of the date it started the foreign investment screening (opened the second stage), neither issues a decision to conditionally approve the investment nor presents an opinion to the government that the investment has a negative effect, the MoE is presumed to have issued a decision to approve the investment. However, the FDI Act foresees an extension of this time limit, for example where consultations are opened further to the investor's opinion on the draft decision drawn up by the MoE.

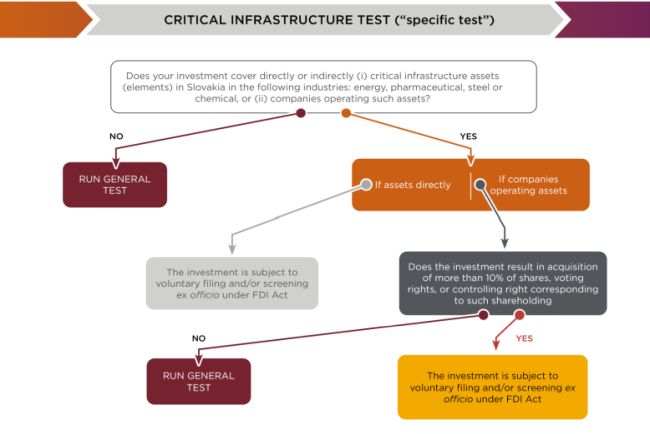

05 Special regime for transactions involving critical 05 infrastructure elements

Under the FDI Act, the MoE has the right to screen certain transactions that involve (directly or indirectly) elements of critical infrastructure in the energy, pharmaceutical, metallurgical or chemical sectors as per Act No. 45/2011 Coll. on Critical Infrastructure. Such screening can also take place where the transaction is not a foreign investment made by a foreign investor as defined in the FDI Act. It can be triggered by the transfer or assignment of an element of critical infrastructure, or achieving a direct or indirect interest in the operator of such an element of more than 10% in such operator's registered capital or voting rights, or achieving an interest that gives rise to the possibility to exert an influence over the management of such operator that is comparable with an influence corresponding to such interest. This is also the case if the transfer occurs as part of an enforcement procedure, enforcement of pledge or mortgage, or other similar procedure. The MoE informs the relevant operator that its element has been registered on the list of critical infrastructure. The list is not public.

06 Fines

The amount of the fine depends on the nature of the obligation that was breached and ranges from 1% to 2% of the aggregate total net turnover of the foreign investor, the person controlling the foreign investor, and the person controlled by the foreign investor, generated in the previous financial year (in the case of a foreign investor who is a legal person) or from EUR 100,000 to EUR 1 million (in the case of a foreign investor who is a natural person). If the investment value is higher than 2% of the investor's aggregate total net turnover, the value of the investment is used as the upper limit of the fine. Fines may be imposed also repeatedly and are imposed not only for serious breaches (such as, making a critical foreign investment without approval), but also for those deemed less serious (such as, breach of the obligation to notify the completion of an investment or to register in the register of public sector partners).

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.