INTRODUCTION:

The Ministry of Corporate Affairs ("MCA") vide Notification1 dated 26.12.2016 notified Section 248 to 252 of the Companies Act, 2013 ("Act") and revised the process of striking off the name of the company from the register of companies maintained by the Registrar of Companies ("ROC"). The procedure of strike off the name of company through the Fast Track Exit ("FTE") mode under the provisions of section 560 of the Companies Act, 1956 stands revised and accordingly, the "Strike Off" mode was introduced by the MCA vide said notification. The provisions relating to Strike Off provide an opportunity to the defunct companies to get their names struck off from the records of the ROC. In addition to the provisions of the Act relating to Strike Off, MCA has also issued the Companies (Removal of Names of Companies from the Register of Companies) Rules2, 2016 ("Rules") to be effective from the same date i.e. 26.12.2016 in order to provide procedural aspect of Strike Off under the Act.

MODES OF STRIKE OFF:

There are two modes of strike off under the provisions of the Act and Rules made therein as below: 1. By ROC itself under Section 248(1) of the Act; and 2. By way of filing application by the Company under Section 248(2):

1. STRIKE OFF BY ROC SUO MOTO UNDER SECTION 248(1) OF THE ACT:

The various aspects of strike off by the ROC suo-moto may be summarized in the following manner:

Power of removal of name by ROC

In pursuance of section 248(1) read sub rule (1) of Rule 3 of these rules, the ROC may remove the name of a company from the register of companies in terms of sub-section (1) of section 248 of the Act.

Section 248(1) of the Act provides that, "where the ROC has reasonable cause to believe that:

(a) a company has failed to commence its business within one year of its incorporation; [or]

(b) a company is not carrying on any business or operation for a period of two immediately preceding financial years and has not made any application within such period for obtaining the status of a dormant company under section 455,

he shall send a notice to the company and all the directors of the company, of his intention to remove the name of the company from the register of companies and requesting them to send their representations." Accordingly, the ROC may initiate the process of Strike Off if the company has failed to commence its business within one year of its incorporation or had not been doing business or operation for last two financial years and has not applied with the ROC for the status of dormant company.

1.2 Companies Excluded from Applicability of the provisions of Strike off:

Rule 3 of the Companies (Removal of Names of Companies from the Register of Companies) Rules, 2016 provides that the ROC may remove the name of a company from the register of companies in terms of sub-section (1) of section 248 of the Act, Provided that following categories of companies shall not be removed from the register of companies under this rule and rule 4, namely:-

(i)listed companies;

(ii) companies that have been delisted due to non-com pliance of listing regulations or listing agreement or any other statutory laws;

(iii)vanishing companies;

(iv) companies where inspection or investigation is ordered and being carried out or ac tions on such order are yet to be taken up or were completed but prosecutions arising out of such inspection or investigation are pending in the Court;

(v) companies where notices under section 234 of the Companies Act, 1956 (1 of 1956) or section 206 or section 207 of the Act have been issued by the Registrar or Inspector and reply thereto is pending or report under section 208 has not yet been submitted or follow up of instructions on report under section 208 is pending or where any prosecution arising out of such inquiry or scrutiny, if any, is pending with the Court;

(vi) companies against which any prosecution for an offence is pending in any court; (vii) companies whose application for compounding is pending before the competent authority for compounding the offences committed by the company or any of its officers in default;

(viii) companies, which have accepted public deposits which are either outstanding or the company is in default in repayment of the same;

(ix) companies having charges which are pending for satisfaction; and

(x) companies registered under section 25 of the Companies Act, 1956 or section 8 of the Act.

1.3 Procedure to be followed by ROC for strike off by its own motion

The ROC has to follow the following procedures for strike off by its own motion:

a) Serving of Notice: ROC shall sent a notice in writing in Form STK - 1 to all the directors of the company at the addresses available on record, by registered post with acknowledgement due or by speed post. The notice shall:

- contain the reasons on which the name of the company is to be removed; and

- seek representations, if any, against the proposed action from the company and its Directors along with the copies of relevant documents, if any, within a period of thirty days from the date of the notice.

b) Representation of Company: The ROC shall consider the representation of the Company if it has received the same. If the ROC is not satisfied with the representation made by the company and its directors, it may proceed further for the strike off the name of company.

c) Publication of notice: the notice for removal of name under sub-section (1) of section 248 shall be in Form STK 5 and the same be –

- placed on the official website of the MCA on a separate link established on such website in this regard;

- published in the Official Gazette;

- published in english language in a leading english newspaper and at least once in vernacular language in a leading vernacular language newspaper, both having wide circulation in the State in which the registered office of the company is situated.

d) Intimation to regulatory authorities: The ROC shall simultaneously intimate the concerned regulatory authorities regulating the company, viz, the Income-tax authorities, central excise authorities and service-tax authorities having jurisdiction over the company, about the proposed action of removal or striking off the names of such companies and seek objections, if any, to be furnished within 30 days of notice.

e) Strike off the name and publish notice of dissolution of the company: in accordance with sub – section (5) of section 248, the ROC may, at the expiry of the time mentioned in the notice, unless cause to the contrary is shown by the company, strike off its name from the register of companies, and publish notice thereof in the Official Gazette. The company shall stand dissolved on the publication of this notice in the Official Gazette.

f) Sufficient provision has been made for realization of all amounts due: ROC, before striking off, shall satisfy itself that sufficient provision has been made for realization of all amounts due to the company and for the payment or discharging of its liabilities.

1.4 Effect of company notified as dissolved

As per Section 250 of the Act, if a company stands dissolved under section 248, it shall on and from the date mentioned in the notice of dissolution, cease to operate as a company and the Certificate of Incorporation issued to it shall be deemed to have been cancelled from such date except for the purpose of realizing the amount due to the company and for the payment or discharge of the liabilities or obligations of the company.

1.5 Liabilities of directors, managers, officers and members to be continue: The liability, if any, of every director, manager or other officer who was exercising any power of management, and of every member of the company dissolved under this section, shall continue and may be enforced as if the company had not been dissolved.

1. Strike off by way of filing application by the Company under Section 248(2):

The various aspects of strike off by the ROC on the application filed by company may be summarized in the following manner:

Grounds for filing application:

Section 248(2) of the Act provides that, "without prejudice to the provisions of sub-section (1), a company may, after extinguishing all its liabilities, by a special resolution or consent of seventy-five per cent. members in terms of paid-up share capital, file an application in the prescribed manner to the Registrar for removing the name of the company from the register of companies on all or any of the grounds specified in sub-section (1) and the Registrar shall, on receipt of such application, cause a public notice to be issued in the prescribed manner:

Provided that in the case of a company regulated under a special Act, approval of the regulatory body constituted or established under that Act shall also be obtained and enclosed with the application."

Accordingly, a Company can file an application for Striking off its name with the ROC. The application may be filed on all or any of the grounds as mentioned under sub section 1 of section 248 of the Act.

Restriction on making application:

In additions to the companies which are excluded from applicability of provisions of strike off in accordance with sub – rule (1) of rule 3 of the Rules and listed at point no. 1.2 herein above, a company, in pursuance of provisions of section 249 of the Act, is not eligible to make an application for strike off under section 248(2) of the Act if, at any time in the previous three months

a) the name of the company changed or registered office has been shifted from one state to another by the company;

b) the company has made a disposal for value of property or rights held by it, immediately before cesser of trade or otherwise carrying on of business, for the purpose of disposal of gain in the normal course of trading or otherwise carrying on of business;

c) the company has engaged in any other activity except the for one which is mandatory or expedient for the purpose of making an application under that section, or deciding whether to do so or concluding the affairs of the company or complying with any statutory requirement;

d) an application has been made by the company to the National Company Law Tribunal ("Tribunal") for the sanctioning of a compromise or arrangement and the matter has not been finally concluded; or

e) the company is being wound up under Chapter XX by the Tribunal.

1.3 Process to followed for strike off on application of the company:

a) Holding a Board Meeting: to hold a Board meeting to pass Board Resolution for strike off the company subject to approval of the shareholders and authorizing the filing of this application with the ROC;

b) Holding a General meeting: to hold a general meeting of members of the company to obtain Shareholder's approval by way of Special Resolution;

c) Approval of concern authorities: In the case of a company regulated by any other authority, approval of such authority shall also be required.

d) Filing of Form STK-2: Application in Form STK- 2 to be filed by the Company along with following documents:

(i) Indemnity Bond duly notarized by every director in Form STK 3;

(ii) An affidavit in Form STK 4 by every director of the company;

(iii) a statement of accounts containing assets and liabilities of the company made up to a day, not more than thirty days before the date of application and certified by a Chartered Accountant;

(iv) a copy of the special resolution duly certified by each of the directors of the company or consent of seventy five per cent of the members of the company in terms of paid up share capital as on the date of application;

(v) a statement regarding pending litigations, if any, involving the company.

e) Public notice by ROC: after filing application for strike off by the company , the ROC shall publish a public notice in Form STK-6 inviting objections to the proposed Strike off, if any. The objections are to be sent to the respective ROC within thirty days from the date of publication. The notice shall be placed on the website of Ministry of Corporate Affairs, published in the Official Gazette and published in a leading English newspaper and at least in one vernacular newspaper where the registered office of the company is situated.

f) Intimation to regulatory authorities: The ROC shall simultaneously intimate the concerned regulatory authorities regulating the company, viz, the Income-tax authorities, central excise authorities and service-tax authorities having jurisdiction over the company, about the proposed action of removal or striking off the names of such companies and seek objections, if any.

g) Publication of notice of dissolution: ROC, after having followed and dealt with the above steps, shall strike off the name and dissolve the Company and a Notice of striking off and its dissolution to be published in the Official Gazette in Form STK 7. On the publication in the Official Gazette of this notice, the company shall stand dissolved with effect from the date mentioned therein. The same shall also be placed on the official website of the MCA.

Penalties:

a) In case application is filed in violation of section 248(1):

In pursuance of Section 249(2) that if a company files an application in violation of Section 248(1) it shall be punishable with fine which may extend to Rs. 1 lakh.

b) In case application is filed with the intention to defraud:

Section 251(1) provides that where it is found that an application by a company has been made with the object of evading the liabilities of the company or with the intention to deceive the creditors or to defraud any other persons, the persons in charge of the management of the company shall, notwithstanding that the company has been notified as dissolved, be jointly and severally liable to any person or persons who had incurred loss or damage as a result of the company being notified as dissolved; and be punishable for fraud in the manner as provided in Section 247. Furthermore, ROC may also recommend prosecution of the persons responsible for the filing of an application under Section 248(2).

2. Restoration order:

Section 252 of the Act empowers the Tribunal, to pass an order for the restoration of company which has been struck off by the ROC, in the following manner:

2.1 on appeal filed by any person:

Any person aggrieved by the order of the ROC may file an appeal before the Tribunal within 3 years of the order passed by ROC and if the Tribunal is of the opinion that the removal of name of company is not justified in view of the absence of any of the grounds on which the order was passed by the ROC, it may pass an order for restoration of the name of the company in the register of companies after giving a reasonable opportunity of making representations and of being heard to the ROC, the company and all the persons concerned.

2.2 On application filed by ROC:

The ROC may, within a period of three years from the date of passing of the order dissolving the company under section 248, file an application before the Tribunal seeking restoration of name of such company if it is satisfied that the name of the company has been struck off from the register of companies either inadvertently or on the basis of incorrect information furnished by the company or its directors.

2.3 On application filed by Company or any member or creditor or workmen:

The Tribunal, on an application made by the company, member, creditor or workman before the expiry of 20 years from the publication in the Official Gazette of the notice of dissolution of the company, if satisfied that:

a) the company was, at the time of its name being struck off, carrying on business or in operation; or

b) otherwise it is just that the name of the company be restored to the register of companies,

may order the name of the company to be restored to the register of companies. Further, the Tribunal may also pass an order and give such other directions and make such provisions as deemed just for placing the company and all other persons in the same position as nearly as may be as if the name of the company had not been struck off from the register of companies.

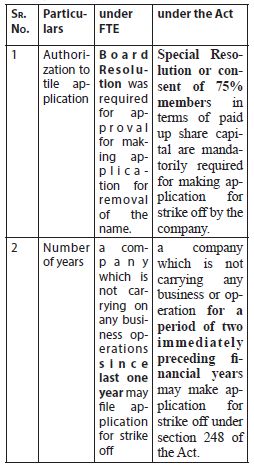

3. Key changes from the earlier FTE:

The difference between FTE under Section 560 of Companies Act, 1956 and under Section 448-252 of Companies Act, 2013 are as below:

CONCLUSION:

The section 248 to 252 of the Act corresponding to the earlier provisions under the Companies Act 1956 seems more controlling in terms of authorizations and procedures. It is undoubtedly the most speedy way to shut down a company as compare to other modes of winding up under the Companies Act. Even though the company can easily dissolve through this mode and its name removed from the ROC's registers the liabilities continues on every director, officer and members of the company and may be enforced in the same manner as if the company had not been dissolved. In addition, by providing restoration provisions, the company which has been struck off may get a chance to restore its name in the register and get active with the permission of Tribunal even within 20 years of being struck off. Since the notification of the strike off provisions under the Act, the ROC became very active in sending notices to the companies which seems eligible for strike off under section 248(1) of the Act and such notices are also being posted at the website of MCA recently. The companies are required to take due care while making reply to such notices to the ROC and it should be kept in mind that strike off does not relieve the directors and members from their liabilities, if any, under the law.

Footnotes

1 http://www.mca.gov.in/Ministry/pdf/Notificatiion28122016.pdf

2 http://www.mca.gov.in/Ministry/pdf/Rules_28122016.pdf

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.