Overview

The Indian Media and entertainment industry is a sunrise sector with a rapid growth curve. In 2015, the industry grew at 11.76% with a market size of USD 19 billion (INR 1,281 billion1 ). Overall, the industry is expected to grow at CAGR of 13.98% till 2018. By 2025, the industry is expected to attain a market size of USD 100 billion (INR 6,743 billion). India is globally the fifth largest Media and entertainment market.

The global Media and entertainment industry is expected to touch a market size of USD 2.14 trillion in 2020. The United States of America's Media and entertainment industry is the world's largest and is expected to be valued at USD 723 billion by 2018.

Media and entertainment is one of the sectors identified by the Indian Government under "Make in India" initiative.

The key sub-sectors of the Media and entertainment industry are outlined below:

Television, print, and films are the three largest sub-sectors in India. Key demographics of the Indian Media and entertainment industry are outlined below:

- India is the world's second largest television market with 168 million television households and 890 television channels approximately (including 400 news and current affairs channels approximately).

- India has the world's largest film industry in terms of tickets sold and number of films produced (more than 1,250 films are produced yearly in more than 20 languages).

- Globally, India has the biggest newspaper market with more than 100 million copies sold daily and more than 100,000 registered newspapers.

The Ministry of Information and Broadcasting is the apex body for formulation and administration of the rules, regulations and laws relating to information, broadcasting, press, and films in India.

Foreign direct Investment

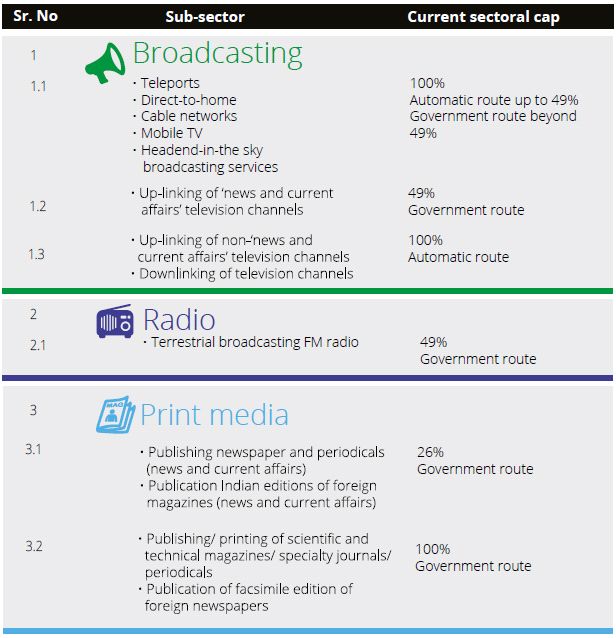

The foreign direct investment (FDI) inflows in the information and broadcasting sector for the period April 2000 to December 2015 stands at USD 4.55 billion. In India, FDI can be made under two routes — the automatic route (i.e. no approval of Government is required) and under the Government route (i.e. approval of the Government is required). Under the Government route, it is necessary to obtain a prior approval of the Foreign Investment Promotion Board. Recently, the Indian Government has further liberalized the FDI policy for the Media and entertainment industry. The current FDI sectoral limits for the Media and entertainment industry are tabulated as follows:

FDI in above sectors is also subject to compliance with the policy, guidelines, regulations of the Ministry of Information and Broadcasting. With respect to the sub-sectors not listed above, FDI is permissible up to 100% under the automatic route, e.g. films.

The Government has, on 20 June 2016, announced several amendments in the FDI Policy including changes in broadcasting sector. It is proposed to permit 100% FDI under automatic route in broadcasting carriage services (for activities mentioned in point 1.1 above) as against present limit of 49% under automatic route and beyond 49% under Government route. Formal amendments to the FDI Policy and Regulations under Foreign Exchange Management Act giving effect to the said announcement is awaited.

Tax

The key direct tax and indirect tax issues in respect of the Indian Media and entertainment industry have been outlined as follows:

Broadcast

Advertising on television channels

- Typically, three parties are involved for advertising arrangements on television channels, namely – broadcaster, advertising agency, and advertiser. Payments are made by the advertiser to the advertising agency and by the advertising agency to the broadcaster.

- The Central Board of Direct Taxes (CBDT) has clarified that withholding tax as contractual payments (i.e. 2%) would be applicable for the first payment (i.e. by advertiser) and there would be no withholding tax on the second payment (i.e. by advertising agency).

- Recently, the CBDT has clarified regarding the withholding tax applicability on "the fees/charges taken or retained by the advertising agency" i.e. whether the same is in the nature of discount or commission. If this amounts to commission, withholding tax at 10% is applicable. It has been clarified that withholding tax would not be attracted on above payments made by the broadcaster to the advertising agency or on amounts retained by the advertising agency for booking, procuring, and canvassing advertisements.

- The above clarifications are also applicable for the print segment advertisement arrangements.

Withholding tax on band placement Fees

- Broadcasters pay channel/band placement fees to multi-system operators/cable operators for placing their channels on a preferred frequency/band to enhance viewership of the channel.

- The Revenue authorities have adopted a position that band placement fees are in the nature of royalty. Accordingly, it is necessary to deduct withholding tax at 10%.

- The Tribunal has upheld the taxpayer's contention of withholding tax at 2% as contractual payments but still this issue continues to be subject matter of litigation.

Service tax on band placement fees

- Services provided by cable operators or multi-system operators to broadcasters for placing their channels on a preferred frequency are not covered in the negative list or exemption notifications and are accordingly subject to service tax.

Production of content

- Broadcasters make payments to production houses for production of content which is telecast on their channels.

- Recently, the CBDT has clarified that in case such content is produced as per specifications of the broadcaster, the same is considered as works contract and withholding tax at 2% would be applicable.

- I n case the broadcaster acquires only the broadcasting rights for the content already produced by the production house, the same is not considered as works contract and other provisions of withholding tax would have to be evaluated such as royalty, fees for technical services (withholding tax rate for royalty and fees for technical services is 10%).

Content cost

- A major cost for the broadcasters is in respect of content (commissioned or licensed). The taxpayers claim such cost as a revenue expenditure deductible in the first year or over the license period. In a few cases, however, the Revenue authorities treated such content cost as an intangible asset entitled to depreciation at 25%.

- The taxpayer's method of accounting and tax treatment adopted has been upheld by the Tribunals and the Revenue authorities' position for grant of depreciation instead has been rejected in the said cases.

Dual taxation on copyright Transactions

- The declared list of services, inter alia, includes 'temporary transfer or permitting the use or enjoyment of any intellectual property right' (IPR), thus being liable to service tax.

- Almost all State Governments across India have classified "copyright" as goods and levied value added tax (VAT) on such transfer or licensing of copyright.

- Levy of dual tax being service tax and VAT on the IPR transaction unduly increases the cost of doing business, especially if they are not available as credit to the buyer.

- One could argue that the definition of 'declared service' under the service tax law is amply clear, but there is protracted litigation on what could be construed as 'transfer of right to use'. This could result in accelerating the dispute on dual taxation; the industry would end up paying both the taxes on conservative basis to mitigate interest and penal consequences. Goods and Services Tax (GST) could amicably address this issue of dual taxation.

Withholding tax on transponder fees

- Broadcasters make payments for transponder fees to satellite companies for transmission of television signals.

- The royalty definition under the domestic tax laws was amended in the year 2012 retrospectively to include transmission by satellite. Subsequently, the High Court held that payments for transponder fees are royalty under the domestic tax laws in view of the above retrospective amendment.

- In case such payments are made to nonresidents, the Revenue authorities are adopting a position that the amended definition of royalty is applicable even to the tax treaty and, accordingly, transponder fees received by nonresidents are taxable in India under the tax treaty.

- The Tribunal held that the payments for transponder fees are taxable as royalty even under the tax treaty while recently another High Court has ruled in favour of the taxpayer holding that the Parliament cannot amend international treaty unilaterally. The High Court has further ruled that payment for digital broadcasting services through a transponder should not be considered as royalty. Accordingly, one needs to wait and watch the developments in this space.

Indirect tax on transponder fees

- Satellite companies located in India pay service tax on transponder fees received from broadcasting companies. However, in cases where such satellite companies are situated outside India, the taxability of the transaction needs to be analyzed from the perspective of Place of Provision of Services Rules, 2012 (POPS Rules).

- Interestingly, a question was raised before the Court as regards VAT applicability on such transponder fees.

The High Court held that since the agreement was entered into within Karnataka, there was a 'transfer of right to use goods', namely 'space segment capacity of the transponder' in a satellite, thereby, qualifying as 'deemed sale' and liable to VAT. Thus, the issue again boils down to applicability of VAT vis-à-vis service tax on transponder fees.

Foreign telecasting companies

- A foreign broadcaster telecasting its channel in India is mandatorily required to appoint an Indian company as its representative in view of the guidelines issued by the Ministry of Information and Broadcasting.

- Such foreign broadcasters earn advertisement and subscription revenues from India. The Tribunal held the broadcaster (USA company) to have a dependent agent permanent establishment in India and, accordingly, considered its advertisement revenues taxable in India. Additionally, the matter was sent back to the Revenue authorities to examine whether subscription revenues are taxable as royalty.

- Taxability of foreign broadcasters has been a matter of litigation between the Revenue authorities and taxpayers in several cases. The decision mentioned above is the most recent development on this front.

- In such cases, another issue arises regarding the profits attributable to India in case the foreign broadcaster has a permanent establishment in India.

Earlier based on a Circular issued by the CBDT, 10% of advertisement revenues of the foreign broadcaster (after reducing commission payments) were considered as taxable income in case such foreign broadcaster did not have a permanent establishment in India. This Circular was subsequently withdrawn in the year 2001.

Direct-to-home service

- Direct-to-home (DTH) service has two aspects – service aspect and entertainment aspect. There are two separate and distinct taxable events in respect of each of the two aspects.

- Service tax is payable on service aspect. Since DTH provides performances, films or programmes to viewers, the State Government also levies entertainment tax on such service. Thus, DTH service provider is also subject to dual taxation being service tax and entertainment tax leading to a dual tax burden upon the industry.

Set-top boxes

- Sale of set-top boxes has been a litigative matter as to whether consideration should be included in the service portion of DTH service or only VAT should be applicable as sale of goods.

- In some of the judicial decisions, the High Courts held that sale of set-top boxes should attract VAT and not service tax. There are also disputes with regard to inclusion of set-top box value for the purpose of entertainment tax levy.

- In the recent Union Budget 2016-17, customs duty on digital head-ends and set-top boxes is reduced to 10%. This is a positive development for DTH and cable operators and could lead to reduction in prices of set-top boxes.

Entertainment tax

- In most of the States in India, cable operators are liable to pay entertainment tax and questions were raised as to whether such tax paid is to be included in the value of taxable service for the purpose of discharging service tax liability.

- The Central Board of Excise and Customs (CBEC) has clarified that entertainment tax collected and paid to the Government would not be included in the value of taxable service, provided the cable operator indicates the entertainment tax element on the bill raised upon the customer.

Foreign news agencies/newspapers

- Foreign news agency or newspaper/ magazine/journal houses typically have a presence in India to facilitate collection of news from India.

- Income of such foreign news agency or newspaper/magazine/journal houses should not be taxable in India with respect to activities confined to collection of news and views in India for transmission out of India based on an exemption under the domestic tax laws.

- From a tax risk management perspective, it is of outmost importance that the activities in India of such foreign news agency or newspaper/magazine/journal houses are limited to collection of news or views.

Service tax on news agencies/ Journalist

- Mega exemption notification, under service tax, provides an exemption to any service provided, by way of collecting news, or any service provided, by way of providing news to any person, by a specified person. Such services are exempt from payment of service tax.

- The said specified service providers are independent journalists, Press Trust of India, and United News of India. The above entry makes it clear that the service provided by stringers, both Indian as well as foreigners would be outside the purview of service tax.

Additional depreciation

- Additional depreciation of 20% is allowable to taxpayers engaged, inter alia, in the business of manufacture or production of an article or thing. An issue arises whether additional depreciation is allowable to taxpayers in the business of publishing newspapers.

- The Tribunal held in favour of the taxpayer and concluded that newspapers/periodicals are distinct commodity than paper, printing ink and other ingredients used. Since a new commercial product comes into existence, the process involved for such transformation amounts to production and manufacture and accordingly, additional depreciation should be allowed.

Service tax on print media

- Sale of advertisement space in print media is not liable to service tax. 'Print media' is defined to mean newspaper and book (not including business directories, yellow pages, trade catalogues for commercial purposes). Thus, print media houses do not pay service tax on majority of advertising revenue earned.

- However, corresponding service tax exemption is not extended to the service providers (except a few) who provide services to such print media houses. This results in additional (service tax) cost to print media houses on services availed.

Newsprint

- Print media houses typically use newsprint for printing newspaper and currently import nearly 25%-30% of the newsprint into India. The Government has exempted basic customs duty on newsprint (from existing 5% to 0%), thereby reducing raw material cost for manufacture of paper, paperboard and newsprint.

- While this could marginally reduce the cost, it could also result in newsprint being dumped into India by overseas suppliers and adversely impact the domestic newsprint manufacturers. The registered newsprint manufacturers may not be able to sell their product competitively and there could be large quantum of imports adding to the burning foreign exchange outgo issue and revenue loss to the country.

Advertising in print

- As discussed earlier under broadcast section.

Download >> Media And Entertainment Industry - India Tax Landscape

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.