1. INTRODUCTION

India is one of the most thriving markets for retailing in the world currently, making it a magnet for leading retail entities all around the world. Indian consumers now have vast shopping avenues across all channels, including physical stores, e-commerce websites, mobile apps, etc. The retail industry is being revolutionized by internet of things (IoT) technology, which is bringing new opportunities for customer service, supply chain management, and physical stores, as well as promising new platforms like home-based connected devices. The retail market in India has undergone significant growth and transformation in the last decade and is projected to reach $2 trillion by 2032,1 owing to the socio-demographic and economic factors like urbanization, income growth, and the rise of nuclear families.

This growth acceleration has also been supported by the Indian government ("Government") by introducing various reforms and initiatives. These include raising the sectoral cap for foreign investment in the retail sector to allow even up to 100% foreign investment in certain retail sub-sectors, lifting certain sector-specific restrictions and allowing operational relaxations. We have dealt with the foreign investment regime in India in detail in this paper.

An interesting aspect of the Indian regulatory framework is the unique way in which it classifies the Indian retail sector. The Indian retail industry is vast and varied, encompassing a range of different players and segments that span from small, independently owned shops to large, global corporations. Due to this, the regulatory system in India has created a specialized classification system that acknowledges the unique features and qualities of each format. Therefore, retailers including e-commerce companies who are interested in investing in this sector will need to familiarize themselves with the specific regulations that are in place.

In this paper, we have discussed in detail the regulatory framework surrounding the retail industry in India which include sector-specific conditions applicable to various sub-types of retailing such as single and multi-brand retail trading, wholesale cash and carry, and e-commerce. While exploring the different business models and foreign investment conditionalities present in such retailing sub-types, we have also analysed the implications of such conditions with appropriate examples, wherever applicable. Further, we have also described certain ancillary laws apart from the primary foreign investment regulatory structure of the retailing sub-types in this paper.

2. TYPES OF RETAIL TRADING

Before delving deeper on the aspects of retail trading sectors in India and the applicable investment conditions as per the extant foreign exchange regime, it is important to understand how the terms 'retail', 'retail trading', 'retailing', 'retailer', 'wholesaler' etc. are construed in India.

The term 'retail' has been defined by the Indian courts as a sale for final consumption in contrast to a sale for further sale or processing (i.e., wholesale)2.

Further, it is pertinent to distinguish between the terms 'retailing' and 'retail trading' which are often used interchangeably. In common parlance, 'retail trading' means the sale of goods to end users, for use and consumption by such user, and not for resale. In contrast, the term 'retailing' is wider term which is used to denote the whole activity of undertaking manufacturing/contract manufacturing or under franchise and license agreements and further selling the manufactured goods/ procured goods to the customers on businesses to business ("B2B") and business to consumer ("B2C") basis. Clearly, the term 'retailing' has a wider scope, and the 'retail trading' is a subset of the retailing. Examples of entities engaged in retailing in India include Hindustan Unilever Limited, which undertakes manufacturing of popular Indian dental products under the brand-names like 'Close Up' and 'Pepsodent' and further sells to its consumers through its distribution channels. The extant foreign exchange regime in India contains conditions on foreign investment in retail trading in India (as discussed in this paper) and not retailing per se. However, to the extent that an entity engaged in retailing business also undertakes manufacturing of the goods it retails (whether self or contract manufacturing), the foreign investment in such an entity would fall under the 'manufacturing' sector under the foreign exchange regulations. We have provided a broad overview of the investment conditions in this sector and the interplay between the manufacturing and retail trading sector in paragraph 6 below.

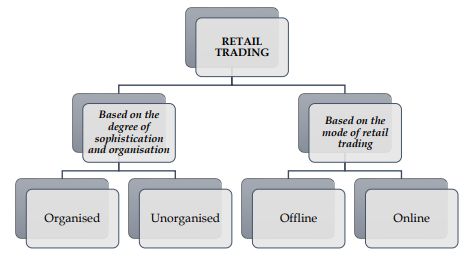

We can categorise the retail trading sector in India into two broad categories:

2.1. Unorganized v/s organized retail

The unorganized sector (generally synonymous with 'informal sector') consists of unincorporated businesses that are owned and run by individuals or households.3 These businesses are not legally distinct from their owners and have limited access to capital.4 In the context of retail sector, it could therefore be said to cover those forms of trade which sell a range of products and services ranging from fruits and vegetables to shoe repair. Thus, the traditional formats of low-cost retail trading, for example, the local mom and pop stores or corner stores (also known as kirana or general stores), flea markets, hand cart and pavement vendors, vegetable, food vendors, general electronic shop, etc., would fall under the 'unorganized sector'.

On the other hand, organized retail refers to trading activities undertaken by licensed retailers, that is, those who are registered for tax purposes, etc. These include the corporate-backed hypermarkets and retail chains, departmental store, discount stores, drug stores, factory outlets, and also the privately owned large retail businesses. The organized retail stores are characterized by professionally managed stores or large chain of stores, providing goods and services that appeal to customers, in an ambience that is encouraging for shopping and agreeable to customers. For example: Smart Bazaar, Vishal Mega Mart, Shoppers Stop, Reliance Trends, Reebok, Nike, McDonald's, Pizza Hut, Titan, etc. The organized retail sector has seen a robust growth which has propelled the share of India's organized retail to 18.5% of the total $836 billion annual retail market in the year 2022.5

The organized retail sector owes its steady growth performance to its ability to offer wider products at competitive prices, procure goods and services from lowest-costs supplier, maintain standard of goods by implementing product safety norms, better incentives to the farmers and producers and maintaining low distribution and logistics cost. As compared to the unorganized retail sector, the organized sector (due to its formal set-up) may face greater scrutiny and liability risks, however it will continue to offer higher standard products at competitive prices along with prospects of better-paid jobs to its employees than unorganized retailers. 6

2.2. Offline v/s online retail

The traditional understanding of 'retail' took into consideration a retail shop or physical business premises where goods are sold or services are provided to the public, or to which the public is invited to negotiate for the supply of services. However, due to the emergence of e-commerce (including m-commerce), the physical/territorial component of the definition no longer holds true. Since the retailers have now managed to surpass the barrier of direct personal contact and reach out to the public via alternative media, the customers can place orders online and the delivery takes place elsewhere, most likely at their doorsteps. Nonetheless, the emphasis on the business-to-consumer format remains, which must be differentiated from the business-to-business dealings.

The extant foreign exchange regulations distinguish this sector in terms of modes of retail trading and regulates the investment regime under the following sub-sectors:

2.2.1. Offline

- Cash and Carry Wholesale Trading/ Wholesale

Trading

The extant foreign exchange regulations in India define cash and carry wholesale trading ("CNC") /wholesale trading as the sale of goods/ merchandise to retailers, industrial, commercial, other professional business users or to other wholesalers and related subordinated service providers.7 Therefore, wholesale trading implies that the sale of goods is made for the purpose of trade, business and profession but not for personal consumption. The yardstick to determine whether the sale is wholesale or not shall be the type of customers to whom the sale is made and not the size and volume of sales. Wholesale trading shall include resale, processing and thereafter sale, bulk imports with export/ex-bonded warehouse business sales and B2B e-commerce. As stated in paragraph 2.2 above, CNC / wholesale trading is different from the retail trading which means sale of goods/merchandise to end consumers. A detailed analysis of investment in this sector is covered under paragraph 4.1 of this paper. - Single-brand retail trading

While the extant foreign exchange regulations do not prescribe the definition of 'single-brand retail trading' ("SBRT"), we note that as per the conditionalities provided therein, the entities engaged in selling products of a 'single brand' to retail customers for their personal consumption fall under the ambit of SBRT in India. A detailed analysis of investment in this sector is covered under paragraph 4.2 of this paper. - Multi-brand retail trading

Similar to SBRT, multi-brand retail trading ("MBRT") as a concept does not find a definition under the extant foreign exchange regulations, however, it generally refers to sale of goods/products of multiple brands by a single entity to retail consumers for final consumption. Due to this reason, there exists an ambiguity on what constitutes as 'multi-brand' and what falls under the ambit of 'single brands' or 'sub brands'. A detailed analysis of investment in this sector is covered under paragraph 4.3 of this paper.

Click here to continue reading . . .

Footnotes

1. Invest India, "Retail & E-Commerce", March 2023 (accessed from https://www.investindia.gov.in/sector/retail-e-commerce).

2. Association of Traders of Maharashtra v. Union of India, 2005 (79) DRJ 426.

3. Organized Retailing in India: Issues and Outlook; Rajeev Kohli, Columbia Business School Research Paper No. 12/25; Columbia University 2011. Available at https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2049901

4. Id.

5. Available at https://www.indiaretailing.com/2022/08/16/online-share-in-indias-retailing-jumps-to-6-5-while-organized-players-account-18-5-of-indias-annual-retail-market, last accessed: February 21, 2023.

6. Supra note 3.

7. Entry 15 of the Table, Schedule I, Foreign Exchange Management (Non-debt Instruments) Rules, 2019

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.