Supply chain executives at large companies have been consistently confronted with supply chain disruption, rushing to keep up as problem after problem emerged—from pandemic-induced shutdowns to container scarcity, semiconductor shortages, and trade disruption. Companies have reordered priorities as a result, with efforts now aimed at diversifying supply bases and employing near- or onshoring strategies.

This reassessment happened as the nature of supply-chain disruption shifted. Once confined to certain industries or regions, disruptions in recent years have become more common and their impact has become much larger. Supply interruptions are only part of the equation. The cost of advantages of a buy-centric and/or offshore-focused supply chain is decreasing due to several additional factors, including:

- Labor costs: It is no longer a given that China is the lowest-cost source as Mexico and Eastern Europe are often equally or even more cost-competitive. While Serbia or Bulgaria, for example, are 10%-20% cheaper on direct manufacturing labor, Romania is offering similar wage ranges as China. Poland and Hungary are ~30% more expensive on unskilled labor, but offer competitive wages for skilled and managerial employees compared to China1)

- Protectionism: Customs and duties – especially related to China imports – are on the rise

- Financing: Working capital costs are increasing amid high interest rates

- ESG: Costs related to the forthcoming energy transition, including taxes, are increasingly considered

- Knock-on costs: Expenses related to production halts, and other kinks make nearshoring attractive

- Automation: As automation increases, labor arbitrage is becoming less relevant in highly automated production – the required labor resources and the share of labor in overall costs declines

Our recent end-to-end supply chain survey, fielded among 115 Europe-based executives performing relevant roles in five industries (automotive, consumer products, industrials and building, medical device, and oil & gas) shows how prevalent China is in decision-makers' minds. The results show that while there is no one-size-fits-all solution for addressing cost concerns while building agility and resiliency, there are several shared priorities.

CHINA DEPENDENCY REDUCTION UNDERWAY

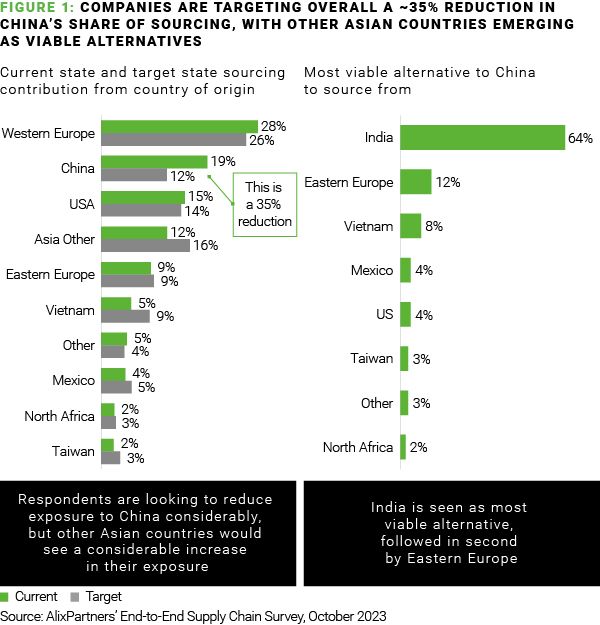

Nearly all respondents—55% of whom work for companies reporting at least $5 billion in sales—have developed actions to reduce dependency on China. Roughly a quarter have already reduced exposure by 10%; an additional one-third of respondents will hit that threshold within the next year. Companies are targeting an overall 35% reduction in China's sourcing share—India, Eastern Europe, and Vietnam are among the supply bases that could benefit the most as a result (Figure 1).

This presents a list of challenges. Topping the list is difficulty finding alternative suppliers with sufficient capacity. Other issues include developing an understanding of cost implications, finding alternative suppliers with required capabilities, and selecting which countries to move to.

Specific questions to be considered include:

Where do I want to produce instead of China? There are several factors to consider, including the best way to conduct a search and the merits of locating offshore vs. onshore. Survey respondents see India as a top destination, followed by Vietnam. These locations do not fit the definition of nearshore, reflecting the fact many companies still see merit in the traditional model of weighing cost, scale, and capabilities over proximity. That said, a substantial number are considering nearshoring in Eastern Europe, e.g., Romania, Poland, or Hungary.

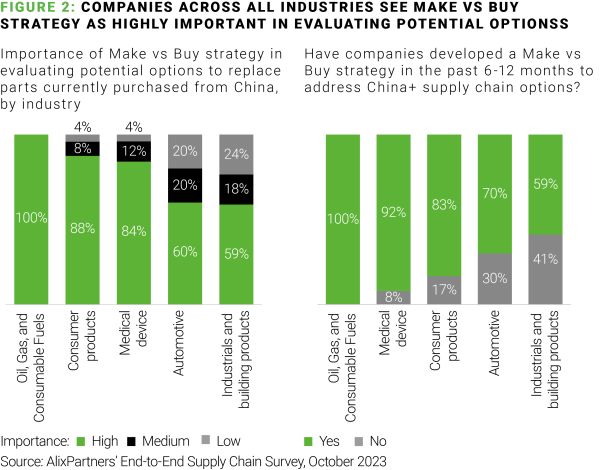

What is my strategy for a change in configuration? Developing a "make vs. buy" strategy is seen as critical (Figure 2), regardless of industry. Among those polled, however, as many as 41% in certain sectors have not yet developed a strategy for execution.

What are the new capabilities needed? There is a litany of needs to consider in this environment. For instance, when we listed six big challenges, executives could rank in terms of importance when nearshoring, supplier capacity and supplier capability ranked as among the most difficult.

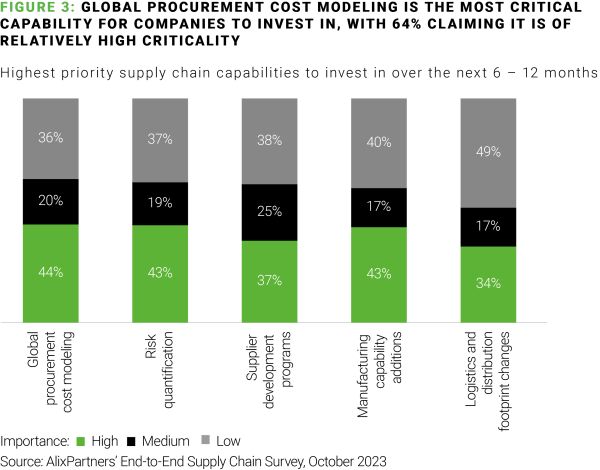

What are the overall cost implications? Labor, materials, freight and logistics, tariffs, and other factors need to be analyzed. Some 44% of respondents told us procurement cost modeling is of high importance (Figure 3), followed closely by risk quantification and manufacturing capability additions.

What are the incentives? Companies do feel government and local incentives are the most developed lever they can pull in a China+ diversification strategy (compared to supplier capacity, capability, cost considerations, etc.). The readiness to utilize them varies based on geography and industry. Companies have deep knowledge of European Union government incentives, and 80% have a plan to use them. The situation is not as clear in the U.S.

JUGGLING A WIDE RANGE OF CONCERNS

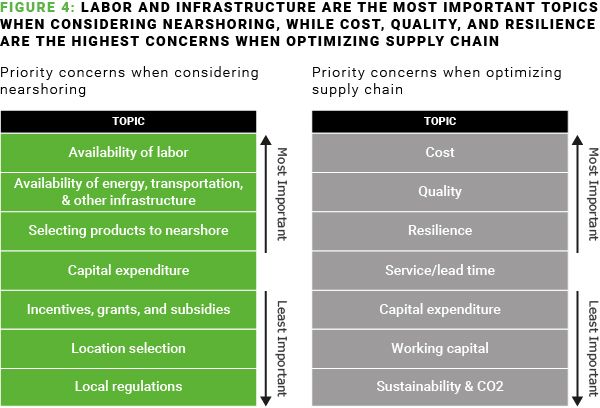

Nearshoring comes with its own unique list of challenges. Labor availability, the readiness of energy, transportation, and other infrastructure, and CapEx top the list (figure 4). The past few years, however, have taught us that the priority list can change due to unforeseen events that sometimes crop up seemingly overnight.

When it comes to optimizing supply chains, our survey indicates companies see cost, quality, resilience, and service/lead time as the most significant priority concerns for supply chain executives trying to optimize the supply chain. These are closely followed by concerns related to working capital, CapEx, and sustainability concerns (including decarbonization).

Optimizing from End to End

Reducing China exposure remains highly important, but this priority is increasingly shaped by a need to improve cost and deliver long-term solutions to supply constraints. This requires a broad view that seeks to optimize the entire value chain spanning inbound to outbound logistics while applying scrutiny of procurement, manufacturing, and distribution tactics and strategies. Companies will need to enhance global supply visibility, cost forecasting, and risk modeling, as well as harness generative AI simulation capabilities.

AlixPartners has extensive experience helping clients optimize and restructure end-to-end supply chains to drive bottom-line impact. Our proprietary GTO (Global Trade Optimizer) digital platform is a differentiated capability that allows rapid mapping of the entire global supply base, enabling the total cost of ownership modeling and implementing alternative supply chains. Our senior consultants have real-world operations experience optimizing each stage of the E2E supply chain, from supplier identification to final assembly and customer delivery.

Please reach out to discuss ways that AlixPartners can help you navigate the road ahead.

Source: Mercer Global Pay. Entry para-professional level considered. China wages fluctuating by region, average of major industrial regions applied.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.