A modern legal framework for entrepreneurs and industry players

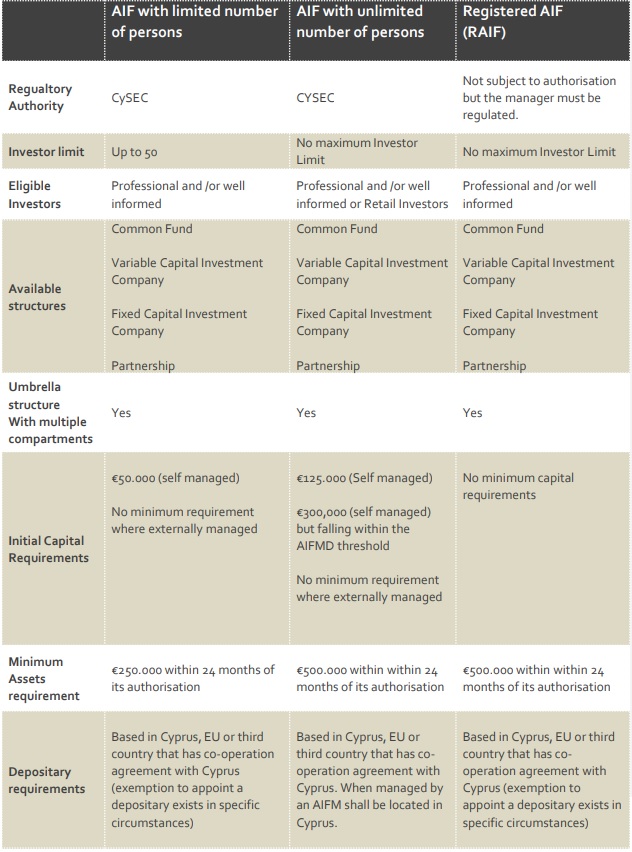

With the introduction of the new Alternative Investment Funds Law (L.124(I)/2018) Cyprus' legal framework has been duly modernized and provides a competitive alternative to other popular European Fund Hubs. More specifically, there are 3 types of available funds.

|AIFLNP

|AIFUNP

| RAIF

Fund structures at a glance

Taxation

Cyprus tax regime provides numerous tax incentives for the set up and operation of funds. These include the following:

AT FUND LEVEL

- Gains from trading in securities are tax exempt,

- It can benefit from the 12.5% tax on annual net profits earned worldwide,

- Notional Interest Deduction (NID) for new equity may reduce taxable base for interest received by up to 80% (applicable to companies) reducing the effective tax on interest to 2.5%,

- Dividends, capital gains arising from the sale of property abroad, capital gains from the sale of shares of foreign property companies are exempt,

- No subscription tax on the net assets of the fund,

- Each compartment of an umbrella structure (although legally is not treated as a separate entity, for tax purposes each compartment is treated as a separate person,

- Fund management services provided to funds are not subject to VAT.

AT INVESTOR LEVEL

- Foreign investors:

- no withholding tax on dividends,

- no taxation on redemption of units,

- no deemed distribution restrictions.

- Resident investors:

- a withholding tax on dividends of 17% if the investor is an individual who is both tax resident and domiciled in Cyprus,

- no taxation on redemption of units,

- on withholding tax if investor is a company.

- Resident Investors – Non Domiciled:

- exemption from 17% withholding tax on dividends,

- no taxation on redemption of units,

- no withholding tax if investor is a company.

Where the AIF investor is a non-Cypriot resident, and the AIF is in the form of a common fund or partnership, investors are generally exempt from any withholding tax on distributions and from any tax on the redemption of their units in an AIF, under Cyprus law since the AIF in such a form is not considered to have a permanent establishment in Cyprus. National tax legislation will instead apply.

To view the Brochure in full click here

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.