1. Summary

On December 21, 2018, the Financial Services Agency of Japan (the "FSA") released the final report of the "Study Group on the Virtual Currency Exchange Services," which proposed major reforms to the regulatory framework for virtual currencies and security tokens, and such reforms are expected to be realized through legislative measures led by the FSA.

2. Background

In May 2016, Japan passed a law introducing new regulations on "virtual currency exchange service providers" ("VCESPs"), such as crypto exchange operators, under the Payment Services Act (the "PSA"), for the purpose of user protection (including a registration requirement), and under the Act on Prevention of Transfer of Criminal Proceeds (the "APTCP"), for the purpose of AML/CFT (anti-money laundering and countering the financing of terrorism), which came into force in April 2017. Subsequently, there were incidents of virtual currency theft from VCESPs, and many VCESPs were found to have problems such as insufficient internal controls amid the rapid expansion of their business. In addition, it has been pointed out that virtual currencies are targets of speculation due to their prices being highly volatile. Furthermore, new types of transactions have emerged, such as leveraged trading and so-called initial coin offerings ("ICOs": electronic issuance of tokens for the purpose of fundraising from the public). Responding to these situations, the Study Group was set up by the FSA in March 2018 and had discussed reforms to the current regulatory framework.

3. Outline of the Report

(1) VCESPs

In relation to the existing VCESP regulations, the report proposes:

(a) to oblige a VCESP to (i) establish and publish its policy on incidents of virtual currency theft and (ii) maintain (x) net assets of not less than the value of the customers' virtual currencies in hot wallets (if any) and (y) the same amount or more of such virtual currencies as assets;

(b) to oblige a VCESP to publicly disclose its financial statements;

(c) to give customers the right to receive a preferential return of the virtual currencies deposited with a VCESP upon its insolvency;

(d) to oblige a VCESP to place the customers' cash in trust for the purpose of preventing misappropriation and ensuring bankruptcy remoteness;

(e) to oblige a VCESP to publish, when it conducts OTC deals with customers, (i) its bid and ask prices and bid-ask spread for such OTC deals or the contract price/quotation on a trade matching platform operated thereby and the differences between its bid and ask prices for such OTC deals and such contract price on a trade matching platform and (ii) a reference price calculated by an association certified as a self-regulatory organization (a "certified SRO")1 and the differences between its bid and ask prices for OTC deals and such reference price;

(f) to oblige a VCESP who provides multiple trading channels, such as dealing, provision of a trade matching platform, and brokerage, to establish and publish its policy on conflicts of interest and best execution;

(g) to oblige a VCESP, if it fills an order made through a trade matching platform operated by itself without matching such order with another order, to explain to the customer to that effect and the reason why it is the best execution;

(h) to oblige a VCESP, if it participates in trading on a trade matching platform operated by itself for the purpose of providing liquidity thereto or otherwise, to explain to customers to that effect and the reason for doing so;

(i) to prohibit a VCESP from making exaggerated advertisements, misrepresentations, conclusive assessments, cold calls, inadequate solicitations in light of the customer's knowledge, etc., and advertisements and solicitations to induce speculative trading;

(j) to refuse, or enable rescission of, a VCESP registration if the applicant or registered VCESP who is not a member of a certified SRO (i) does not have internal rules that are equivalent to the SRO's self-regulatory rules or (ii) has not established a sufficient internal system to comply with such internal rules; and

(k) to replace the current ex post notification requirement of any change in tradable virtual currencies with a prior notification requirement thereof in order to exclude problematic virtual currencies.

(2) Unfair Spot Trading

In order to deal with unfair spot trading, the report proposes:

(a) to impose unfair trading regulations on every person, such as prohibition of fraudulent acts, spreading of rumors, and market manipulation but excluding insider trading; and

(b) to oblige a VCESP to monitor customers' trades, to appropriately manage non-public information related to any tradable virtual currencies, and not to trade based on such information for the benefit of itself or any third party.

(3) Virtual Currency Custodians

In relation to virtual currency custodians,2 the report proposesto adoptsome of the rules that will be applicable to VCESPs, such as:

(a) the requirements of (i) registration, (ii) establishment of an appropriate internal control system, (iii) segregation of customers' virtual currencies, and (iv) external audit of customer asset segregation and financial statements;

(b) such rules as mentioned in (1) (a), (c), and (k) above; and

(c) the know-your-customer (KYC) and suspicious activity reporting requirements under the APTCP.

(4) Leveraged Trading

In relation to virtual currency-based derivatives,3 the report proposes:

(a) to regulate virtual currency-based derivatives dealers/brokers like OTC forex derivatives dealers, which are regulated as "financial instrument business operators" that conduct "type I financial instruments business" ("Type I FIBOs") under the Financial Instruments and Exchange Act (the "FIEA"), including the maximum permissible leverage ratio;

(b) to regulate them under rules equivalent to those applicable to VCESPs, reflecting the characteristics of virtual currencies; and

(c) to require them to (i) establish minimum margin amounts, (ii) take measures to avoid dealing with inappropriate customers in light of their means or other factors, and (iii) provide alerts to customers.

The report also proposes to regulate virtual currency margin trading under rules equivalent to those that will apply to virtual-currency based derivatives.

(5) ICOs

The report proposes to regulate investment-type ICO tokens, where the issuers are supposed to owe an obligation to distribute business revenue, etc.,4 under the regulatory framework for investment services. More specifically, in relation to the rights represented by such ICO tokens, the report proposes:

(a) to introduce initial and ongoing disclosure requirements that are equivalent to those for "paragraph 1 securities," such as shares and bonds, under the FIEA, regardless of whether the contribution is made in a fiat or virtual currency;5

(b) to introduce regulations for dealers/brokers that are equivalent to those for securities firms, which are regulated as Type I FIBOs under the FIEA, and have them examine the business and financial conditions of issuers;

(c) to introduce regulations for offering activities conducted by issuers in the same manner as offering activities conducted by the issuers of so-called "collective investment scheme interests" (which are regulated as "financial instruments business operators" that conduct "Type II financial instruments business" ("Type II FIBOs")), such as a registration requirement, advertisement and solicitation regulations, and the duty to explain the details of tokenized tokens;

(d) to introduce unfair trading regulations that are equivalent to those for "securities" under the FIEA, except for insider trading regulations; and

(e) as like unlisted shares, to restrict offerings of such tokenized rights to non-professional investors unless measures for user protection, such as appropriate examination by a third party, are taken.

The report proposes to regulate other ICO tokens under the regulatory framework for payment services. In relation to ICO tokens that are "virtual currencies" under the PSA and other virtual currencies that have their respective issuers, the report proposes to oblige a VCESP to provide information on such virtual currencies, such as:

(a) the details of the issuer, whether the issuer owes any obligation to the holders (and, if yes, the details thereof), and the calculation basis of the offering price; and

(b) in the case of an ICO, the project plan prepared by the issuer, the feasibility of the project, and the progress of the project.

(6) Grandfathering

If grandfathering for existing service providers (in relation to, for example, derivatives regulations) will be provided, the report proposes, before registration:

(a) prohibiting them from adding any service or tradable virtual currency;

(b) prohibiting them from acquiring new customers (or, at least, from making advertisements/solicitations for customer acquisition); and

(c) requiring them to indicate on their websites, etc. (i) that they are not registered service providers and will cease their service if a registration is rejected and (ii) nothing in relation to the expectation of registration.

The report further proposes to limit the time period where they can continue their services without being registered.

(7) Renaming

The report proposes to rename "virtual currencies" (kaso-tsuka) under the PSA to "crypto-assets" (ango-shisan).

4. Notes

The FSA is expected to seek legislative measures to realize the new regulatory framework proposed in the report. It is probable that a bill to amend the FIEA, the PSA, and the APTCP will be submitted to the National Diet, Japan's parliament, in the next ordinary session (from January 2019), and after the enactment, the relevant secondary legislation will be made through the process of public consultation, and then they will come into force. Available exemptions to the contemplated regulations will be further considered.

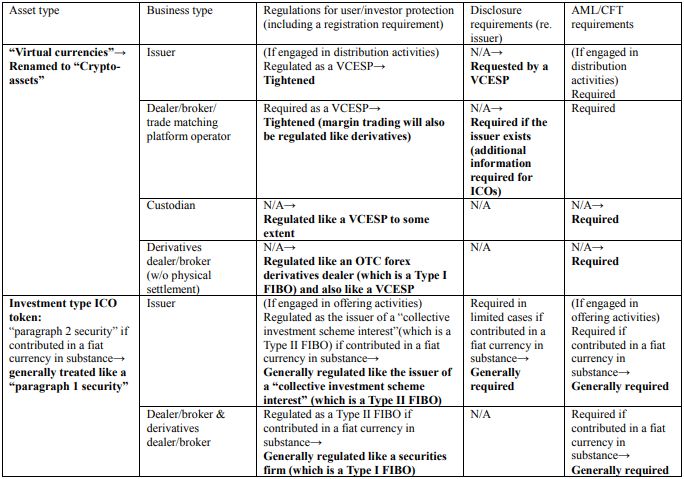

These reforms will cause a drastic change in the regulatory framework for "virtual currencies" (or "crypto-assets" after the renaming) and security tokens in Japan. Please see the following chart for a summary of the expected reforms contemplated in the report (except for the unfair trading regulations).

(Overview of the Proposed Reforms in the Report)

Footnotes

1. Currently, the Japan Virtual Currency Exchange Association is a certified SRO for VCESPs.

2. Virtual currency custody services are currently not regulated unless such services are provided as a part of "virtual currency exchange services" under the PSA.

3. Virtual currency-based derivatives are currently not regulated unless a physical settlement is made by which fiat and virtual currencies or two virtual currencies are exchanged, in which case the dealer would need to be registered as a VCESP.

4. Currently, according to the FSA's view, if the contribution is made in a fiat currency in substance, the rights represented by such tokens are regulated as so-called "collective investment scheme interests," a type of "paragraph 2 securities," under the FIEA; thus, the issuer (if engaged in offering activities), dealers and brokers are required to be registered as a Type II FIBO.

5. The report also proposes similarly expanding the definition of so-called "collective investment scheme interests," a type of "paragraph 2 securities" under the FIEA. Thus, offering activities of investment fund interests will generally be regulated under the FIEA regardless of whether the contribution is made in a fiat or virtual currency.

Originally published January 2019

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.