Introduction

Pursuant to the Regulations1 adopted by the Cayman Islands to implement the AEOI regimes, each Cayman Islands entity that is a Reporting Financial Institution (a "FI") is required to:

- register with the United States Internal Revenue Service (the "IRS") to obtain a Global Intermediary Identification Number (a "GIIN") (US Regulations only);

- notify the Cayman Islands Department for International Tax Cooperation (the "DITC") that the FI will be subject to reporting obligations under one or more sets of the Regulations;

- implement a due diligence programme to facilitate the identification of any reportable account holders; and

- report on any such accounts identified by the requisite reporting deadline.

The purpose of this guide is to outline the practical steps which a FI should take to facilitate (1) to (4) above.

Getting Started

The first step for any Cayman Islands entity, whether a company, partnership or trust, is to establish whether it is classified as a 'Financial Institution' (ie a Custodial Institution, a Depositary Institution, an Investment Entity or a Specified Insurance Company) for the purposes of the Regulations. The CRS Regulations are intended to apply more broadly than the US Regulations and the UK Regulations, with the scope of exemptions available under the CRS being much narrower. Accordingly, certain entities that are classified as non-reporting Financial Institutions under FATCA may be classified as reporting FIs for the purposes of the CRS Regulations and will therefore need to implement a suitable compliance programme.

Once an entity has verified that it is a Financial Institution, it needs to determine whether it is a FI, as Non-Reporting Financial Institutions generally have no or reduced registration and/or reporting obligations. Walkers' attorneys can assist with this classification exercise as there are often many variables to be considered. This guide focuses on steps to be taken once a Cayman Islands entity has been identified as a FI under any of the Regulations. This guide does not address FIs who utilise the sponsoring entity or trustee documented trust approach.

If a Cayman entity is not classified as a FI, it will be a non-financial foreign entity ("NFFE" or "NFE") for the purposes of the AEOI regimes, in which case it will not have any registration or reporting requirements, although it may be requested to certify its status as a NFFE when opening a new account with another FI (such as a bank or brokerage account).

Documentation

In order to commence the registration and notification processes outlined in (1) and (2) above, the operator of the FI is required to appoint a "Responsible Officer" or "Point of Contact" (the "Contact") to act as the principal liaison with the IRS and the DITC. The Contact should be a physical individual and will typically be a compliance officer or equivalent within the relevant organisation or group. Alternatively a director (or equivalent) will often perform this role and will ordinarily act as the Contact for the purposes of the registration and notification.2

The Contact is required to submit the applicable forms and documentation to each of the IRS (pursuant to the US Regulations) and the DITC (pursuant to the Regulations generally). Other than notification to the DITC, there is no additional registration or notification requirement pursuant to the UK Regulations or the CRS Regulations.

The Contact should be formally appointed by way of a resolution of the operator of the FI. Template resolutions to facilitate such appointments by company boards, general partners and trustees are available from Walkers.

Registration with the IRS

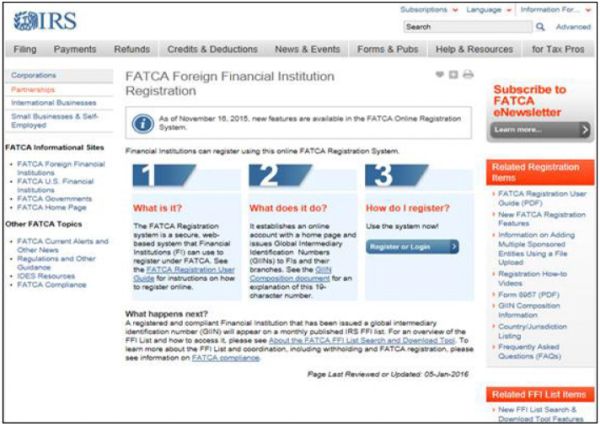

Once the Contact has been properly appointed, the Contact should proceed to register the FI with the IRS to obtain a GIIN.

The registration process should be completed on-line through the IRS portal at www.irs.gov/fatca-registration. Although paper application forms are available, the IRS has discouraged the use of these forms. A comprehensive registration guide is also available at the same web address.

The registration process, in brief, requires to the FI to supply:

- FI registration category;

- Legal name;

- Mailing address;

- Country of tax residence;

- Confirmation of overseas branches (if any);

- Contact's legal name and contact information; and

- Designation of names of up to five secondary persons to act as additional points of contact.

Once the application form has been completed, the Contact must approve the certification that, to the best of their knowledge and belief, the information in the application is accurate and complete, and that the FI will comply with its FATCA obligations under the Cayman legislative framework. Once the certification is completed, the Contact can submit the application to the IRS.

The IRS will process the application and, assuming it is complete and approved, will notify the Contact via email of the GIIN assigned to the FI.

Notification to the DITC

Once a FI has obtained its GIIN (where required pursuant to the US Regulations), it can apply to register with the DITC via the Automatic Exchange of Information Portal (the "AEOI Portal"), a process referred to as 'notification'. Entities that are not required to obtain a GIIN may proceed to the notification stage, following appointment of their designated Contact. Under the notification process, each FI must register with the DITC in preparation for the commencement of reporting. Entities which have already completed the notification process for FATCA purposes will also need to 'refresh' their notification in preparation for CRS reporting which commences in 2017. FIs that have been newly captured under the CRS will need to undertake the full notification process once the AEOI portal has been updated to facilitate the CRS (expected during the course of 2016).

To complete the notification, FIs should access the AEOI Portal at https://caymanaeoiportal.gov.ky. Alternatively this can be accessed via the main DITC website at To complete the notification, FIs should access the AEOI Portal at https://caymanaeoiportal.gov.ky. Alternatively this can be accessed via the main DITC website at www.tia.gov.ky, and then via the tab headed 'Automatic Exchange of Information (AEOI)' on the left hand side of the home page, followed by 'Cayman AEOI Portal Initial Setup (Notification)'.

The AEOI Portal is designed to be user friendly and the DITC has issued a comprehensive user guide which can be accessed at http://tia.gov.ky/pdf/User_Guide.pdf.

In summary, each FI will need to populate the notification template with the following information:

- Name of FI;

- Confirmation of whether the FI will be subject to the UK Regulations, the US Regulations and/or (in due course) the CRS Regulations;

- GIIN number (where obtained);

- FI registration category;

- FI email address; and

- Contact name, email address, telephone number and full office address.

In addition, the FI must submit a PDF document evidencing the authority of the Contact to act on behalf of the FI. This authority should be a signed letter from the FI (on its own letterhead and confirming the GIIN (where an entity is subject to the US Regulations) of the FI) or a copy of the operator resolution giving authorisation to the Contact and containing the same Contact information outlined above. If a letter is used to evidence authority, it should be signed by an operator of the FI or the Contact where such signing authority has been conferred on the Contact in the authorising resolutions referred to under 'Documentation' above. A template letter appropriate for this purpose is available from Walkers.

Once the notification has been made to, and processed by, the DITC, the Contact will receive an email from the DITC containing a username and temporary password which will allow access to the reporting section of the AEOI Portal.

Due Diligence

In preparation for reporting, each FI must collate the necessary due diligence information from financial account holders in order to properly identify any 'Reportable Accounts' - in brief, a custodial/bank account (for a Custodial Institution or a Depositary Institution) or holdings of equity or debt interests (for an Investment Entity) held by US entities, citizens or residents (for the purposes of the US Regulations) or tax payers in other AEOI regime jurisdictions (for the purposes of the UK Regulations or the CRS Regulations)3. In addition, Investment Entities in non-participating CRS jurisdictions (which includes the United States) that are managed by another FI will be classified as Passive NFEs and will be subject to Controlling Person verification (see below under 'Reporting').

To assist with collecting due diligence, at a minimum, the FI should request that each account holder completes either (i) the applicable W-8 or W-9 IRS form and a Cayman UK/CRS Regulations self-certification form or (ii) a combined Regulations self-certification form. Please refer to your usual Walkers contact who will be able to provide the relevant Cayman Islands forms.

This will allow the FI to analyse each account holder to see whether any relevant indicia are present and ascertain whether an account is a Reportable Account for the purposes of any of the AEOI regimes. Identification of accounts should be completed by the FI as soon as practicable after the account has been opened or in any event within 90 days.

In addition, where an account was opened pre 1 July 2014 in respect of FATCA and 1 January 2016 in respect of the CRS, the FI must commence a remedial exercise to classify the account. A phased timetable is applicable to the remedial due diligence process (also known as 'account scrubbing') with a view to all relevant accounts being classified for the purposes of all the AEOI regimes no later than 31 December 2017. There are important qualifications to the deadline above depending on the account type, inception date, balance and relevant AEOI regime. Further clarification is provided in the Guidance Notes and Regulations and Walkers is able to advise in relation to such qualifications.

In practice, professional service providers such as fund administrators will ordinarily take a lead role in completing the necessary due diligence required to analyse and classify pre-existing financial accounts. If you are the operator of a FI which is an investment fund, it would be prudent to speak with your fund administrator to determine which AEOI services are provided, and whether there are any gaps in your AEOI compliance program, particularly in respect of extending services to cover the CRS, which need to be addressed.

Reporting

All reports pursuant to the AEOI regimes should be submitted to the DITC through the AEOI portal, which will then on-report, on behalf of all Cayman FIs, to the relevant tax authorities in the appropriate jurisdictions.

Preliminary reporting pursuant to the US Regulations commenced in June 2015. Additional reporting pursuant to the US Regulations and the first reports pursuant to the UK Regulations are due in August 2016, with reporting for the CRS to commence in May 20174. The filing deadline for reports will generally be 31 May in each year, although FIs should seek to submit reports in advance of this date wherever possible.

Additional reporting under the Regulations is due to be phased in through 2018, with each subsequent annual round of reporting expanding to cover additional information on specified accounts.

Reporting for the purposes of the UK Regulations commences in 2016 and will need to cover (i) all new accounts opened by either individuals or entities since 1 July 2014 which have been identified as UK Reportable Accounts (including where applicable reporting on any controlling person of an entity account who is a 'Specified UK Person'), and (ii) all accounts opened pre 1 July 2014 by individuals which had a value exceeding $1,000,000 as at 30 June 2014 or at 31 December of any subsequent year.

Similar reporting applies for the purposes of the US Regulations in respect of US Reportable Accounts (including, where applicable, reporting on any Controlling Person of an entity account who is a 'Specified US Person'), save that entity accounts opened between 1 July 2014 and 31 December 2015 need not be reported until 2017 if such accounts have not been classified as US Reportable Accounts by 31 December 2015. For US FATCA, in addition to the basic information below a FI must also report certain payments made to Non-Participating Financial Institutions.

The first reports due for the purposes of the CRS (due May 2017) should cover all identified Reportable Accounts (including, where applicable, 'Controlling Persons' which may extend to senior management officials or directors of entities where there are no natural persons owning a controlling stake of 25 percent or more) opened on or after 1 January 2016, as well as all accounts opened pre 1 January 2016 by individuals which had a value exceeding $1,000,000 as at either 31 December 2015 or 31 December 2016. Reporting on all entity accounts opened pre 1 January 2016 will commence in May 2018.

Where a FI does not have any Reportable Accounts, a 'nil report' may be filed with the DITC. Although this is not mandatory, this is industry best practice to demonstrate that the FI has a compliance regime in place to address the requirements of the AEOI regimes.

The reporting format is consistent with currently published Schema by the IRS and the format developed by the OECD for the CRS.

Reports should include the following basic information in respect of each Reportable Account:

- Name;

- Address;

- Tax Identification Number (TIN) (US Regulations), National Insurance Number (UK Regulations) or functional equivalent (CRS Regulations);

- Date of birth (UK Regulations and CRS Regulations);

- Jurisdiction(s) of residence and place of birth (CRS Regulations);

- Account number or functional equivalent;

- FI name and GIIN (if any); and

- Account balance or value (in US$ or currency in which account is denominated) as of 31 December of the year immediately prior to the reporting date or immediately prior to closure if the account was closed during such prior year.

Certain additional information (for example, gross interest paid, gross dividends paid, aggregate redemption payments) may also need to be reported dependent upon the type of Reportable Account ie a Custodial Account, Depositary Account or other Financial Account, and is being phased in commencing in 2015.

FIs may submit reports to the DITC individually, by entering information manually on the AEOI Portal, or via bulk submission by uploading a XML file(s). The DITC encourages FIs to submit reports electronically using the XML format. Full instructions on how to submit reports are set out in the DITC's user guide.

FATCA/CRS compliance

Walkers Professional Services can assist clients in fulfilling their FATCA/CRS compliance obligations by offering the following services:

- Registration - both with the IRS for the purposes of obtaining a GIIN and with the DITC via the AEOI Portal for the purposes of making the necessary 'notification'; and

- Reporting - to the DITC pursuant to the US Regulations, the UK Regulations and the CRS Regulations.

Future developments

New regulations covering the offences and penalties which will be imposed for breach of the CRS Regulations are expected to be enacted during 2016. Whilst details of the proposed offences and penalties have not yet been published, these are expected to be broadly similar to those under FATCA ie financial penalties for operators and entities that do not comply with their obligations under the CRS and/or potential imprisonment for operators and senior managers.

The Cayman Islands Ministry of Financial Services has confirmed that the UK Regulations will be phased out by 2017 as the UK transitions to the CRS for reporting purposes. As both the UK Regulations and the CRS Regulations will be operational during 2016, FIs under both regimes will need to file returns under the CRS with supplementary information on pre-existing low-value individual accounts and pre-existing entity accounts to satisfy the UK Regulations.

Footnotes

[1] On 29 November 2013, the Cayman Islands government entered into a Model 1B inter-governmental agreement with the United States (the "US IGA") in connection with the implementation of sections 1471 to 1474 of the United States Internal Revenue Code of 1986, commonly referred to as the US Foreign Account Tax Compliance Act or "FATCA". A similar agreement was entered into with the United Kingdom (the "UK IGA" and together with the US IGA, the "IGAs"). On 29 October 2014, the Cayman Islands along with 50 other jurisdictions signed a Multilateral Competent Authority Agreement (the "MCAA") to demonstrate its commitment to implement the Common Reporting Standard or "CRS", a global automatic exchange of information initiative developed by the Organization for Economic Cooperation and Development (the "OECD"), CRS together with FATCA being referenced herein as the "AEOI regimes".

On 4 July 2014, the Cayman Islands government issued The Tax Information Authority (International Tax Compliance) (United States of America) Regulations, 2014 (as amended) (the "US Regulations") and The Tax Information Authority (International Tax Compliance) (United Kingdom) Regulations, 2014 (as amended) (the "UK Regulations") and on 16 October 2015 the Cayman Islands government issued The Tax Information Authority (International Tax Compliance) (Common Reporting Standard) Regulations, 2015 (the "CRS Regulations", and together with the US Regulations and the UK Regulations, the "Regulations"), in each case to provide the framework for registration and reporting pursuant to the IGAs and MCAA, with a view to facilitating the automatic exchange of tax information between the Cayman Islands and overseas taxation authorities. The Regulations are supplemented by guidance notes (the "Guidance Notes") which have been issued by the Cayman Islands Tax Information Authority (the "TIA") and which can be viewed at http://tia.gov.ky/pdf/FATCA_Guidance_Notes.pdf and http://tia.gov.ky/pdf/CRS/CRS_Guidance_Notes.pdf. The CRS Regulations are further supplemented by the OECD Commentaries (http://www.oecd-ilibrary.org.docserver.download/2314131ec007.pdf) and the OECD Implementation Handbook which can be viewed at: http://www.oecd.org/ctp/exchnage-of-tax-infromation/implementation-handbook-for-automatic-exchange-of-financial-infomration-in-taxmaters.pdf.

[2] The Contact will not generally be regarded as an 'officer' of a company for the purposes of the Companies Law (2016 Revision) and there is no requirement for the company to update its Register of Directors and Officers or make any filings with the Cayman Islands Registrar of Companies. However, a company may wish to appoint the Contact as an officer to extend indemnity protections that are often afforded to officers under a company's articles of association. Where a formal officer appointment is made, an updated Register of Directors and Officers should be filed with the Registrar within 30 days - entities should also remember to monitor and report any changes to the Register involving the Contact on an ongoing basis in accordance with usual Cayman law requirements.

[3] Over 100 countries have now agreed to implement to the CRS. A list of all participating jurisdictions for the purposes of the regulations can be found at: http://tia.gov.ky/pdf/CRS/CRS_PJ_List_Gazette_Notice.pdf.

[4] It is expected that FIs will only need to file reports in respect of 'Reportable Jurisdictions' for the purposes of the CRS. The DITC has not yet released the list of Reportable Jurisdictions, but this is expected before the first reports for the CRS are due to be filed in May 2017.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.