Final Report And Draft Legislation Released

In February 2008, the Government of Canada established a third-party Expert Panel on Securities Regulation charged with providing the federal Minister of Finance and the provincial and territorial ministers responsible for securities regulation with advice and recommendations on the best way forward to improve securities regulation in Canada. The Expert Panel released its Final Report and Recommendations on January 12, 2009; along with a draft national Securities Act.

The central theme of the Expert Panel's report is that Canada needs a single securities regulatory authority with a strong, decentralized structure that would promote the strengths of the current system while addressing its shortcomings. The Expert Panel recommends adoption of a comprehensive national securities act and a national regulatory system administered by a new Canadian Securities Commission (CSC). The report and draft Securities Act are accompanied by legislative commentary and background technical papers. These documents, as well as previously published written submissions and a Stakeholder Report, can be accessed at www.expertpanel.ca.

A National Securities Act

The draft Securities Act, proposed to be adopted federally, largely reflects a harmonization of existing provincial and territorial securities legislation, in order to minimize transitional disruptions. The Alberta Securities Act was used as a starting point. Consideration was also given to the proposed Uniform Securities Act, British Columbia Securities Act of 2004, and the current Ontario Securities Act and relevant federal and international legislation. Core, fundamental provisions are included in the statute while more detailed and technical requirements are to be promulgated through rules.

A National Regulator

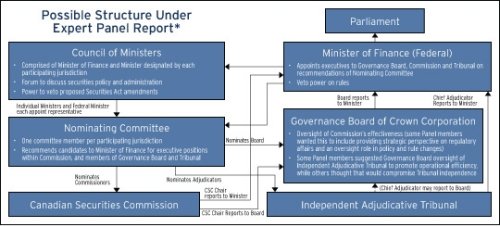

The CSC would be a federal institution with an independent Governance Board, accountable to parliament through the federal Finance Minister. The CSC would be responsible for policymaking and rulemaking activities as well as regulatory offence investigation and prosecution. An independent adjudicative tribunal, possibly subject to some Governance Board oversight, would be established to adjudicate securities matters. The federal Minister of Finance, based solely on the slate of candidates put forward by the Nominating Committee, would appoint members to the Governance Board, CSC (including Chair and Vice-Chairs) and adjudicators. The structure recommended by the Expert Panel (including a non-unanimous proposal for tribunal oversight) is illustrated below.

"Willing" Provincial Participation

The national regulatory system would be based on the willing participation of provinces and territories (for purposes in this summary, the term provinces includes territories). Each province could voluntarily participate in the national securities regime. The intent is that the Securities Act would be federal legislation accepted by the voluntarily participating provinces and only applying to such provinces during the transition period to a comprehensive national regime. All existing instruments and rules could continue in effect as instruments and rules under the Securities Act until such time as they could be harmonized under an appropriate rules review process. While not stated in the Report, this author is of the opinion (not necessarily reflecting the views of other Panel members) the near term result would likely be that jurisdictions choosing not to participate could continue under the Passport system, accepting decisions of the CSC in the same manner as the Ontario Securities Commission currently accepts decisions under the Passport system. Like the Ontario Securities Commission, the CSC would not be a Passport regulator.

The Expert Panel report emphasized the importance of an effective, decentralized regulatory structure with CSC offices, both regional and local, located across Canada. It can be expected that initial staff would be drawn from existing employees of participating jurisdictions. The Expert Panel envisages the CSC head office to be located in a province with significant capital market activity, specifically British Columbia, Alberta, Ontario or Québec. The various offices could specialize in specific areas of regulation (e.g., oil & gas policy or financial services), as well as providing local responsiveness. The head office of the adjudicative tribunal could be separate and could potentially be in a different city than the head office of the CSC.

Transition To A National Securities Regime

A staged transition is contemplated by the Expert Panel report, taking place over what would likely be a two to three-year period. The federal government, supported by a transition and planning team, would negotiate a memorandum of understanding with participating provinces. The transition team would also plan for establishment of the CSC and independent adjudicative tribunal and oversee preparation of the official federal legislation. Following passage of the federal Securities Act, the Council of Ministers would be constituted and the Nominating Committee, Governance Board members, Commission Chair, Chief Adjudicator and some other senior staff would be appointed. Arrangements would be made for offices, technology, employee transfers and rule transition.

Market Participant Opt-In

If a sufficient number of provinces do not agree to participate within a reasonable period of time, the Expert Panel report says the federal government should facilitate transition by allowing market participants in non-participating jurisdictions to individually opt-in to the federal regime to the exclusion of provincial legislation. This Market Participant Opt-In feature would work such that a reporting issuer with a head office in a non-participating province could elect to be governed by the CSC and, as a result, could distribute securities under a prospectus in all provinces without having to comply with any provincial securities laws. Similarly, a dealer registrant with a head office in a non-participating province could elect to be governed by the CSC with the effect that it and all of its registered sales people across the country would be governed by the CSC federal regime to the exclusion of provincial securities regulatory requirements. It is hoped that the Market Participant Opt-in feature would expedite the transition to a comprehensive national securities regulatory regime. See decision chart below.

Expert Panel Recommendations

The Expert Panel's key recommendations are summarized as follows.

Objectives, Outcomes and Performance Measurement

1. Adopt a uniform set of core objectives of securities regulation and guiding principles of regulatory conduct for Canada.

2. Adopt a guiding principle of regulatory conduct as being to facilitate the reduction of systemic risk.

3. Prescribe appropriate interim powers in legislation to allow securities regulators to quickly respond to market events that might pose systemic risks to Canada's capital markets (emergency powers).

4. Adopt a guiding principle of regulatory conduct as being the need for regulation to be cost-effective.

5. Reflect the need to facilitate innovation and maintain Canada's capital markets' competitiveness.

6. Develop a single, uniform performance measurement system for securities regulation in Canada that includes timely reporting to the public on the advancement of statutory objectives, service efficiency, enforcement outcomes, and the costs and benefits of regulation.

7. Establish a governance board to provide oversight of the performance measurement system. (Some Panel Members recommended broader oversight including providing strategic perspective on regulatory affairs and oversight on policy and rule changes.)

Advancing Proportionate, More Principles-Based Securities Regulation

8. Continue adopting a more principles-based approach to securities regulation with due regard to reducing regulatory uncertainty, rethinking enforcement, addressing the distinct needs of small public companies, and properly engaging investors.

9. Establish an independent, small reporting issuers' panel.

10. Examine opportunities to use more proportionate-based securities regulation.

11. Pursue a risk-based approach to securities regulation and consider expanding existing Canadian use of that approach.

Independent Adjudicative Tribunal

12. Establish an independent adjudicative tribunal. The securities regulator should retain jurisdiction over certain decisions, such as discretionary exemptions from securities regulations and rules, and matters regarding contested takeover bids. (Some Panel members recommended Governance Board oversight to promote operational efficiency.)

Better Serving Investors

13. Establish a dedicated service to address the lack of information, guidance, and support for investors in the domain of complaint-handling and redress. This service, which would disseminate comprehensive information, could be provided by a securities regulator or another regulatory entity.

14. Improve investor complaint-handling and redress mechanisms:

- Give securities regulator the power to order compensation in the case of a violation of securities law so that the investor would not be required to resort to the courts;

- Establish an investor compensation fund, funded by industry, to allow the securities regulator to directly compensate investors for a securities law violation; and

- Mandate registrant participation in the dispute resolution process through a legislatively designated dispute resolution body.

15. Establish an independent investor panel.

16. Establish a dedicated investor issues group.

Recommended Regulatory Structure For Canada

17. Establish the Canadian Securities Commission to administer a single securities act for Canada. Include an Investor Panel, a Smaller Reporting Issuer Panel, a Governance Board, a Federal-Provincial Nominating Committee, a Council of Ministers, and an Independent Adjudicative Tribunal.

18. Immediately establish a Capital Markets Oversight Office reporting to the federal Minister of Finance.

Opportunities to Further Strengthen Securities Enforcement

19. Conduct a full examination of larger structural reforms to strengthen enforcement in Canada, including a complete assessment of the merits of a National Enforcement Branch that consolidates administrative and criminal enforcement functions.

Improving the Regulation of Derivatives in Canada

20. Regulate exchange-traded derivatives in securities legislation.

21. For OTC derivatives, ensure the Canadian Securities Commission has sufficient policy depth and resources to determine the best path for the regulation of OTC derivatives in the future.

Where Do We Go From Here?

The report was provided on January 12 to the federal Minister of Finance and provincial and territorial ministers responsible for securities regulation. We can hope that the positive momentum generated from the release of the final report and draft Securities Act will bring together a sufficient number of provinces to begin work to establish the CSC.

In his January 27, 2009 Budget Speech, the federal Minister of Finance indicated that the Government would proceed to establish an office to manage the transition to a Canadian Securities Regulator. Later this year, it will table a Federal Securities Act for Canada and the transition office will deliver an administrative plan within 12 months.

The time has come for a national securities regulatory system.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.