Copyright 2008, Blake, Cassels & Graydon LLP

Originally published in Blakes Bulletin on Income Trusts, July 2008

On July 14, 2008, the Minister of Finance released draft amendments to the Canadian Income Tax Act to facilitate the conversion of specified investment flow-through (SIFT) entities, commonly known as income trusts, and real estate investment trusts into corporations.

The Canadian Income Tax Act generally permits trusts and partnerships to avoid tax at the trust or partnership level by flowing their income out to their unitholders. This flow-through treatment is not available to publicly listed or traded SIFT trusts or partnerships, subject to a grandfathering provision for SIFTs that were in existence on October 31, 2006 and which do not exceed the Department of Finance "normal-growth guidelines." Grandfathered SIFTs will continue to be entitled to flow-through tax treatment until 2011. Once a SIFT becomes subject to the SIFT tax, it will pay tax at the applicable corporate tax rates on the taxable distributions by the SIFT. In effect, the SIFT will be subject to tax as if it were a corporation.

Even though there were tax benefits of using a trust or partnership structure, it was also clear that they were cumbersome from a non-tax perspective. Once the tax advantages of being a flow-through entity were proposed to be eliminated, many, if not most, SIFTs started to contemplate conversion to corporate form. When the SIFT rules were enacted, the legislation did not include specific rules that easily facilitated the conversion to corporate form. Although some SIFTs have already converted, the structures that were used were somewhat cumbersome and the final conversion structures are somewhat unwieldy.

The July 14, 2008 draft legislation implements the Canadian Minister of Finance's promise to introduce tax measures to facilitate SIFT conversions. Most SIFTs have been waiting to see these rules before charting a course of action.

Two Forms Of SIFT Conversions

The proposed rules contemplate two ways of converting an income trust into corporate form:

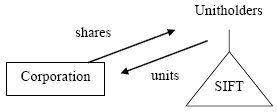

- Direct Exchange Of Units For Shares

– All income trust unitholders transfer their units

to a Canadian corporation in exchange for shares of the

corporation. As a result, the unitholders become shareholders

of the corporation and the corporation becomes the sole

unitholder of the income trust.

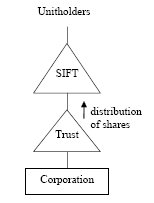

- Distribution Of Shares On The Redemption Of Trust

Units - The income trust reorganizes so that its

only assets are shares of a Canadian corporation. The trust

then distributes those shares to its unitholders on the

redemption of the unitholders' units. As a result,

the unitholders become shareholders of the corporation and

the income trust is wound up.

The following is a general overview of the proposed amendments and how they are expected to apply to income trust conversions. The draft legislation is highly complex and contains a number of pitfalls and limitations. It will be important for income trusts to review their own circumstances to see how the proposals will apply to them under the two forms of conversion.

THREE NEW ROLLOVERS

In order to provide for the two methods of conversion described above and the elimination of internal trusts, the draft legislation proposes three new rollover provisions to be added to the Income Tax Act:

Subsection 85.1(8) Unit-For-Share Exchange

This provision facilitates a conversion by way of a direct exchange of units for shares of a Canadian corporation. Subsection 85.1(8) of the Income Tax Act will provide an automatic tax-deferred rollover where a unitholder transfers a unit of an income trust to a Canadian corporation solely in exchange for shares of the corporation equal in value to the exchanged units.

This rollover will apply on an exchange of units by a unitholder where the exchange occurs as part of an overall transaction whereby:

- all of the units of the income trust are either acquired

by the corporation or redeemed by the income trust within a

60-day period;

- all of the unitholder's interests in the income

trust are disposed of during the 60-day period; and

- all unitholders participating in the automatic rollover

receive only one class (or series) of shares.

This rollover provides flexibility to permit a unitholder to transfer some units on a rollover basis and other units on a taxable basis (e.g., for cash).

Following this acquisition, the corporation would hold all of the units of the acquired SIFT trust. This trust (and any underlying trust in a two-tier trust structure) can be eliminated under the new section 88.1 rollover discussed below.

Subsection 107(3.1) SIFT Trust Wind-Up Rollover

This provision facilitates a conversion by way of a redemption of income trust units. Subsection 107(3.1) provides that there will be no gain or loss to an income trust or its unitholders if the trust transfers shares of a Canadian corporation to its unitholders on the redemption of their units. In order for this rollover to apply, there must be a distribution of all of the trust's property to its unitholders and, correspondingly, all of the unitholders dispose of all of their interests in the trust.

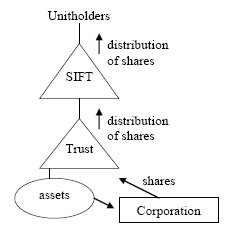

The subsection 107(3.1) rollover will also apply where a SIFT trust holds all of the equity interests in an internal trust (second-tier trust) and the second-tier trust distributes shares of a Canadian corporation to the SIFT trust on the winding-up of the second-tier trust.

Where this rollover is used to first distribute shares from a second-tier trust to a SIFT trust and then from the SIFT trust to its unitholders, the second distribution must occur within 60 days of the first distribution.

The only property that can be distributed on a winding-up of a SIFT trust and redemption of units under subsection 107(3.1) is shares of a Canadian corporation. Where the income trust holds other property, such as operating assets, the existing rollover provision in section 85 of the Income Tax Act may permit the property to be transferred to a Canadian corporation in exchange for shares of the corporation, which are then distributed to unitholders of the SIFT trust on the conversion.

One potential pitfall in the use of this form of conversion is tax under Part XIII.2 of the Income Tax Act. This tax can apply on a payment by an income trust to non-resident unitholders if units of the trust are listed on a designated stock exchange and more than 50% of the fair market value of the units is attributable to real property in Canada, Canadian resource property or a timber resource property. Where the tax applies, it is at a rate of 15% of the amount paid to non-resident unitholders, which is not otherwise subject to Canadian tax.

Section 88.1 SIFT Trust Wind-Up Rollover

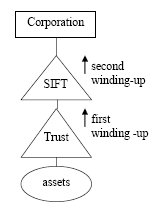

This provision facilitates the winding-up of a SIFT trust following the first step in a conversion by way of the direct acquisition of trust units. It will apply where a single Canadian corporation holds all of the interests in a SIFT trust. If the trust is then wound up into the corporation, the tax values of the trust's assets and the trust's tax accounts can generally be flowed up to the corporation much in the same manner as on a winding-up of a wholly owned corporate subsidiary into its parent.

Section 88.1 and subsection 107(3.1) both require a winding-up of a SIFT trust. The differences between the two provisions are that only subsection 107(3.1) can be used where the SIFT trust distributes assets to multiple unitholders and the only assets that can be distributed are shares of a Canadian corporation. Subsection 107(3.1) provides that there is no gain or loss on the wind-up, but the trust's other tax attributes do not flow through to the unitholders. Section 88.1 can apply where the trust distributes any form of property and provides for the flow-through of tax attributes, but only where all of the interests in a SIFT trust are held by a single Canadian corporation.

Section 88.1 will also apply on the winding-up of a second-tier trust into a SIFT trust that is wholly owned by a single Canadian corporation. In this case, the second-tier trust must be wound up into the SIFT trust first before the SIFT trust is wound up into the corporation, and the second wind-up must occur within 60 days of the first wind-up.

It appears that a potential pitfall in the use of section 88.1 is that a capital gain may be triggered on the winding-up of the trust into its sole beneficiary, if the beneficiary's cost of the trust interest is less than both the trust capital and the tax value of the trust's assets net of its liabilities. The same consequence would not apply on a winding-up of a trust under subsection 107(3.1).

Neither section 88.1 nor subsection 107(3.1) permits the winding-up of internal trusts unless they are wholly owned by a SIFT trust throughout the period from July 14, 2008 to the time of conversion. Therefore, third- or lower-tier trusts will not qualify and a second-tier trust will not qualify if, at any time after July 13, 2008, any of its equity is held by an intervening corporation or partnership.

ADDITIONAL PROVISIONS

In addition to the rollovers described above, the draft legislation includes other provisions that are intended to facilitate conversions.

Employee Options

The draft legislation includes an amendment to provide for a tax deferral when existing employee options for units of a SIFT trust are exchanged for options for shares of a public corporation resulting from either form of conversion.

Internal Debt

Many income trust structures involve internal debt, either between tiers of trusts or between a trust and an underlying operating corporation. Where the value of such debt has declined since it was incurred, the elimination of the debt can give rise to concerns under the "debt forgiveness" rules in the Income Tax Act.

The proposed amendments include a new rule that can be used to avoid a debt forgiveness on debt owing between a SIFT trust and a wholly owned second-tier trust. There is no provision to deal with debt owing by a corporation or partnership to a SIFT trust or second-tier trust. Where debt forgiveness is a concern in these cases, it may be preferable to carry out an income trust conversion by having a corporation acquire all the units of the trust using the subsection 85.1(8) unit-for-share exchange rollover, followed by the winding-up of the trust using the section 88.1 SIFT wind-up rollover. Since section 88.1 provides for the flow-through of the cost of the trust's assets (including debt of a corporate subsidiary), it may be possible to eliminate the debt without adverse tax consequences on a subsequent merger of the operating corporation with its new corporate parent.

Acquisition Of Control

There are a number of tax consequences when a corporation undergoes an acquisition of control, including a year-end of the corporation, a write-down of its assets to fair market value and a limitation or expiry of its ability to carry forward tax losses.

The draft legislation includes a new provision that deems there to be no acquisition of control when shares of a corporation are transferred from a second-tier trust to a SIFT trust on the winding-up of the second-tier trust. This provision does not deal with a transfer of shares from a trust to a corporation. Accordingly, depending on the structure of the income trust and the form of the transaction, a conversion may give rise to an acquisition of control of underlying corporations.

For the purposes of section 88.1, a trust is deemed to be a corporation and a majority-interest beneficiary of a trust is deemed to have acquired control of the trust and each corporation controlled by it. These rules may affect the flow-through of losses where the trust's units have been acquired by a corporation – for example, in the first step of a unit-for-share exchange conversion. It appears that section 88.1 does not cause the rules in the Income Tax Act that require a write-down of assets to apply on an acquisition of control of a trust.

DEALING WITH EXCHANGEABLE INTERESTS

Many income trusts have a subsidiary corporation or limited partnership that has issued shares or limited partnership units that are exchangeable for units of the income trust. In many cases, these exchangeable securities are accompanied by special voting units of the income trust. It is expected that these exchangeable interests would also be exchanged for shares of the new public corporation in an income trust conversion.

There is no provision in the new rules dealing with securities that are exchangeable for units of a SIFT trust. Accordingly, if holders of exchangeable interests convert or exchange their interests as part of an income trust conversion, they would have to do so under existing section 85 of the Income Tax Act, which provides for an elective rollover on a transfer of securities to a corporation in exchange for shares of the corporation.

In some cases, holders of exchangeable securities have other contractual rights under a securityholders' agreement, such as the right to appoint directors and approval rights with respect to certain transactions by the income trust's operating subsidiaries. Conversion of the income trust to a corporation may give rise to commercial issues regarding how or whether to continue these types of rights in the new corporate structure.

DEALING WITH TRUST DEBT

Many SIFTs have issued debt at the trust level. An example of this is convertible debentures. There are a number of tax and non-tax issues relating to such debt that will have to be dealt with in the context of a conversion. The terms of the debt could limit the SIFT's flexibility on which a conversion method is used. A conversion by way of an acquisition of all of the units of the income trust may trigger an acquisition of control of the trust and a mandatory repayment of the debt. This could be particularly problematic if the debt must be redeemed at a premium or, in the case of convertible debt, where it is trading at a discount from the face amount. One way to avoid a mandatory repayment may be for the trust to transfer all of its assets to a subsidiary corporation of the trust that assumes the debt pursuant to a reorganization provision under the terms of the debt, followed by a distribution of the shares of the subsidiary corporation to the unitholders on redemption of their units using the subsection 107(3.1) rollover.

ISSUES AFFECTING NON-RESIDENT UNITHOLDERS

As discussed above, there may be 15% Part XIII.2 tax on the redemption of units held by non-residents where more than 50% of the SIFT's fair market value is derived from real property in Canada, Canadian resource property or timber resource property. This may be of particular concern to royalty trusts. Leaving aside the Canadian tax considerations applicable to a conversion, it will also be necessary to consider foreign law considerations. For example, an acquisition of units by a corporation for shares of the corporation followed by a wind-up of the SIFT should generally be a tax-free event for U.S. tax purposes. On the other hand, a distribution of shares on a redemption of units may be a U.S. taxable event.

PROCESS FOR CONVERSION

If a conversion proceeds by way of a direct acquisition of income trust units by a corporation, it will be necessary for the corporation to acquire all of the outstanding units of the income trust. This can be accomplished using a court-approved plan of arrangement.

A plan of arrangement is a procedure provided for under corporations legislation for completing an "arrangement" (which can include a wide range of reorganization transactions) in respect of a corporation. Although an income trust is not subject to corporations legislation, other corporations involved in an income trust conversion, such as the corporation created to become the publicly held corporation following conversion, can use the provisions provided that one or more of the steps in the conversion process falls within the statutory definition of an arrangement.

The principal steps involved in completing a plan of arrangement involve obtaining interim court approval of the plan, holding a meeting of unitholders to approve the plan and obtaining final court approval of the plan. Plans of arrangement are routinely used in public company acquisitions and the process for obtaining court and securityholder approvals for them are well established. While the time required to complete a plan of arrangement will depend on various factors, income trust conversions by way of arrangement are typically completed within 60 days following announcement.

An income trust conversion by way of redemption of units can be carried out either with or without the use of the plan of arrangement provisions. A redemption conversion without a plan of arrangement would require a meeting of unitholders and, therefore, would likely entail a similar level of cost and take about the same time to complete as a conversion by way of arrangement. An important benefit of proceeding by way of plan of arrangement – being an exemption applicable to court-approved arrangements under U.S. securities laws for the distribution of shares to U.S. unitholders – is not available where the conversion procedure does not entail court approval.

TIMING CONSIDERATIONS

The new rules will generally apply after July 14, 2008, the date the amendments were announced. One exception is that the subsection 85.1(8) unit-for-share exchange rollover can be applied to exchanges occurring after December 20, 2007 if the appropriate elections are filed.

The rules will apply to a trust that was a SIFT trust at any time between October 31, 2006 and July 14, 2008. Accordingly, the wind-up rollovers can be used to eliminate trusts that were acquired by a corporation in a SIFT conversion that occurred (on either a taxable or non-taxable basis) any time after the SIFT tax proposals were first announced on October 31, 2006.

The new rules will only apply to an exchange of units or winding-up of a trust that occurs before 2013. On the other hand, grandfathered income trusts will become subject to SIFT tax commencing in 2011. While it may be expected that many income trusts will delay converting until the end of 2010, some income trusts may find it desirable to convert earlier. This may be the case, for example, if there is a concern that the trust will lose its grandfathered status under the "normal-growth guidelines" or if there is a concern that the trust will exceed the non-resident ownership restrictions in the Income Tax Act. Income trusts that are able to make significant non-taxable capital distributions to unitholders after 2010 may choose to delay conversion until up to the end of 2012. This is because capital distributions by a public corporation are generally taxed in the same manner as dividends.

The draft legislation is highly complex and contains a number of pitfalls and limitations, some of which may not have been intended. It is quite possible there will be changes to the provisions before they are enacted.

According to the press release that accompanied the draft legislation, interested parties are invited to provide comments on the proposals by September 15, 2008. This suggests the enacting legislation will not be tabled until the fall at the earliest.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.