Although the legislation for the new Ontario Retirement Pension Plan (ORPP) received Royal Assent in May of last year,1 there was some indication that the federal Liberal majority win last October could put a hold on the plan's rollout.2 Recently, however, Ontario Premier Wynne announced that, notwithstanding the new federal government's desire to expand the Canada Pension Plan (CPP), Ontario still intends to go ahead with the ORPP as scheduled.

Background on the ORPP

The ORPP is a mandatory pension plan for residents of Ontario who are employees, but who don't have "comparable" workplace pension plans. A "comparable plan" is defined as a registered pension plan, subject to federal and provincial regulation, that meets the following minimum thresholds:

- provides people with a predictable stream of income in retirement for life

- provides people with security (they won't outlive their savings)

- requires contributions by employers to ensure fairness

- aims to replace up to 15 percent of a person's pre-retirement income

Workplace defined benefit or defined contribution pension plans will meet the comparability test, provided that certain specific conditions are first met.3 Group Registered Retirement Savings Plans and Deferred Profit Sharing Plans will not be considered comparable plans for this purpose.

Employers that offer a registered workplace plan that doesn't meet the above minimum thresholds will have until 2020 to decide if they want to adjust their plans or enrol their employees in the ORPP.

How will it work?

The ORPP will be a supplement, and very similar in design, to the existing CPP. When fully phased in, it will require equal contributions from employees and employers (not exceeding 1.9 percent each, or 3.8 percent in total). This compares to the current CPP regime which requires employer and employee contributions of 4.95 percent each (9.9 percent total). The biggest difference between the ORPP and the CPP is that CPP contributions currently max out at an income level of $54,900 (in 2016), whereas the ORPP will max out at an income level of $90,000, subject to indexation for inflation.

For both the CPP and ORPP, the basic exemption amount is set at $3,500 (this is the amount a plan member can earn before they begin making contributions).

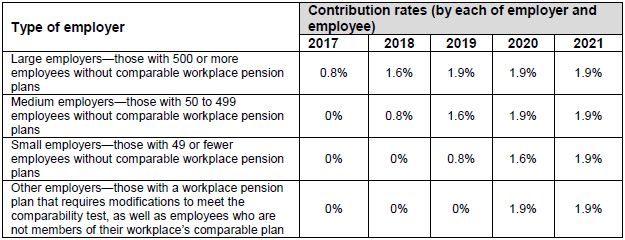

ORPP contributions will be phased in. For large employers with 500 or more employees, contributions will start January 1, 2017, and will be increased each year until 2019. For medium-sized employers, contributions will begin January 1, 2018, with contributions phased in to their maximum by 2020. Small employers with fewer than 50 workers will start contributing on January 1, 2019, with contributions phased in to their maximum by 2021. Others employers will start to make contributions on January 1, 2020. These phase-in rules are summarized in the table below.

Table A

Phase in of contribution rate by type of employer

Benefits will be indexed to increases in wages and the cost of living, and will start to be paid in 2022. Benefits will generally start at age 65; however, similar to the CPP, individuals will have the option to receive adjusted retirement income as early as 60 or as late as 70.

Note: The ORPP cannot cover self-employed workers because the federal Income Tax Act does not allow self-employed people to participate in a registered pension plan. Ontario has asked the federal government to consider changing the Act to allow self-employed workers to join the ORPP.

Administration of the plan

The Ontario Retirement Pension Plan Administration Corporation (ORPP AC) will begin contacting Ontario employers in early 2016 to verify their existing pension plans and assess the coverage offered to employees.

Footnotes

1 Ontario Bill 56, Ontario Retirement Pension Plan Act, received Royal Assent on May 5, 2015.

2 As part of its federal election platform, the Liberals had noted that the government intended to work with the provinces to "enhance" the CPP.

3 Such that benefits equal or exceed the benefits being offered under the ORPP.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.