On October 27, 2015, Alberta Finance Minister Joe Ceci tabled the province's first budget since the NDP won the provincial election on May 5, 2015. Alberta's first 2015-16 budget was tabled on March 26, 2015, but was not passed into law before the NDP won the election.

The effect of lower oil prices on Alberta's economy and provincial government revenue is significant, with estimated 2015-16 resource revenue down over $6 billion from last year. Based on current forecasts, the recovery will take longer than was anticipated during the spring election campaign.

An estimated surplus of $1.1 billion is forecast for the current fiscal year (2014-15), with projected deficits for the next four years, before showing a surplus again in 2019-20.

The 2015-16 budget lays out a plan for $34 billion in capital spending over the next five years to create jobs and build schools, roads and hospitals (a 15% increase from the March budget). There is also to be more money for health, education and social services, as well as a new Job Creation Incentive program that will give employers $5,000 for each new job they create. Also, starting next year, Alberta will have to borrow money to pay for day-to-day operations—something that hasn't been done in 20 years.

The following is a summary of the key tax measures included in the budget:

Business tax measures

Corporate tax rates

As previously announced and included in Alberta Bill 2 (enacted in June), the general corporate income tax rate increased from 10% to 12%, effective July 1, 2015. The rate increase is pro-rated for taxation years that straddle this date. No changes have been made to the small business tax rate or to the $500,000 small business limit.

Alberta's corporate tax rates for 2015 and 2016, assuming a December 31 year-end, are summarized in Table A below:

Personal tax measures

Personal tax rates

As previously announced, and also included in Alberta Bill 2, a new system of progressive 2personal income taxes was introduced to replace the 10% flat personal income tax rate. Transitional provisions apply for 2015, such that one-quarter of the rate increases apply. Corresponding tax rate changes will be made to the taxation of trusts, so that the 15% highest personal income tax rate will apply to all trusts beginning in 2016, with the exception of graduated rate estates (for up to 36 months) and qualified disability trusts. For 2015, the top rate of 11.25% also applies to inter-vivos trusts. This new progressive system affects taxpayers earning more than $125,000 a year. The new income tax brackets will be indexed starting in 2017.

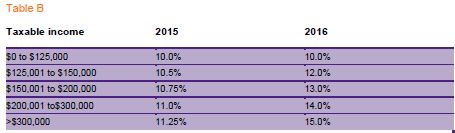

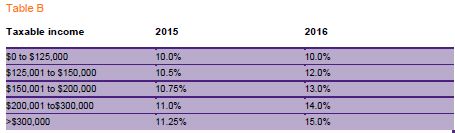

Table B illustrates the provincial rates for 2015 and 2016.

Table C illustrates the top marginal rate of tax (federal and provincial combined) on various types of income for 2015 and 2016:

Alberta family employment tax credit

The previous government proposed enhancements to this refundable tax credit applicable to lower income-earning families, effective July 1, 2015. The NDP government is proposing to implement the same enhancements, but with an effective date of July 1, 2016. The rate at which benefits are phased in will be increased from 8% to 11% on working income over $2,760 and the phase-out threshold will be increased from a family net income of $36,778 to $41,250 (at a rate of 4% of family net income greater than $41,250). For the 2016 benefit year starting on July 1, payments will increase to a maximum of $754 for one child, $1,439 for two children, $1,850 for three children and $1,987 for four or more children.2

Alberta child benefit

The new Alberta Child Benefit mirrors the new Alberta Working Family Supplement proposed by the previous government.3 The Alberta Child Benefit is a new refundable tax credit applicable to working families earning up to $41,220 per year, effective July 1, 2016. Families with net income of up to $25,500 will receive the maximum benefit. Benefit amounts will then be reduced, and phased out completely once family net income reaches $41,220 per year. Effective July 1, 2016, families with one child will be eligible for a maximum annual benefit of $1,100. An additional annual benefit of $550 will be provided for each of the next three children. Therefore, families with four or more children will be eligible to receive a maximum annual benefit of $2,750. Benefits will be paid four times per year. Families currently eligible for the Alberta family employment tax credit will automatically be enrolled for this new credit. Otherwise, an Alberta income tax return will have to be filed in order to be eligible.

Charitable donations tax credit (CDTC)

The previous government announced that the CDTC applied to total donations over $200 would be reduced from 21% to 12.75%4 beginning in 2016. The NDP government has announced that it will retain the current rate of 21%.

Dividend tax credit

In response to the federal government's upcoming changes to the factors used in the calculation of its dividend tax credit for non-eligible dividends,5

Other measures

Tobacco tax

Effective at 12:01 a.m., October 28, 2015, the following tobacco taxes are being increased:

- The tax per carton of 200 cigarettes will increase by $5 (from $45 to $50).

- The tax on loose tobacco will rise by 3.75 cents per gram (from 33.75 cents to 37.50 cents per gram).

- The tax rate applied to a cigar's taxable price will rise from 116% to 129%. The minimum and maximum tax per cigar will rise from 22.5 cents to 25 cents, and from $ $7.05 to $7.83, respectively.

Insurance premiums tax

As announced by the previous government, effective April 1, 2016, the tax rate on premiums receivable in respect of contracts of life, accident and sickness insurance will increase from 2% to 3%, and the rate for any other contract of insurance will increase from 3% to 4%.

Locomotive fuel tax

The tax on locomotive fuel will increase by 4 cents to 5.5 cents per litre, effective November 1, 2015.

Footnotes

1 These rates do not include a possible 4% increase in the top federal tax rate for taxable income over $200,000, proposed by the new federal Liberal government

2 Amounts subject to change for 2016 indexing

3 The previous government's proposal was never included in a Bill

4 The rate which applied prior to 2007

5 Beginning in 2016

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.