Minister of Finance Carlos Leitão gave an update on Québec's economic and financial situation. The following is a summary of the tax related highlights.

MEASURES PERTAINING TO BUSINESSES

Reduction of the Health Services Fund contribution rate for SMEs in the primary and manufacturing sectors

The Health Services Fund contribution rate for SMEs in the primary and manufacturing sectors will be reduced as of 2015.

Briefly, eligible employers whose total payroll is equal to or less than $1 million will see the applicable rate decrease from 2.7% to 1.6%. Eligible employers whose total payroll is between $1 million and $5 million will be subject to a rate ranging from 1.6% to 4.26%.

Depending on the size of the business' payroll, the lower contribution rate will reduce its HSF contributions by up to around $17 000.

Illustration of the impact of the reduction of the HSF contribution rate for SMEs in the primary and manufacturing sectors:

The new rate scale will apply to an employer that, for a particular year, is a specified employer (essentially employers other than State or governments) whose total payroll for the year is less than $5 million, where over 50% of the employer's total payroll for the year is attributable to activities in the agriculture, forestry, fishing and hunting sector, the mining, quarrying and oil and gas extraction sector or the manufacturing sector that are grouped under codes 11, 21 or 31 to 33 of the North American Industry Classification System (NAICS).

Increase in the additional deduction for transportation costs of remote manufacturing SMEs

Determination of the rate of the additional deduction: increase in the rates applicable by region and addition of a fourth zone

Currently, additional deduction rates of 2%, 4% and 6% apply to the "intermediate zone", the "remote zone" and the "special remote zone" respectively.

These rates will be raised by one percentage point, with the result that rates of 3%, 5% and 7% will apply to the "intermediate zone" (including Laurentides and Lanaudière), the "remote zone" and the "special remote zone" respectively, and a rate of 1% will apply to "major urban centres" which are the Montreal, Quebec and Gatineau census metropolitan areas.

Determination of the additional deduction cap

Limit based on gross income and on the regional cap

The additional deduction is limited to a percentage (see rates above) of the manufacturing SME's gross income for the taxation year. It is however subject to a regional cap.

SMEs with a base deduction rate of 5%, 3% and 1% will be subject to new regional caps which will be of $350,000, $150,000 and $50,000 respectively.

When the taxation year has fewer than 365 days, the new caps will be reduced in proportion to the number of days of the taxation year compared to 365.

Sharing of regional caps between associated corporations

Under the existing rules, only the size of a group of associated corporations has an impact on the additional deduction a corporation may claim.

An additional rule will provide that corporations that are members of a group of associated corporations must share the use of the regional cap on a percentage basis.

Application date

These changes will apply to a manufacturing SME's taxation year that begins after December 31, 2014.

Temporary increase of the refundable tax credit for Québec film and television production

Qualified corporations preparing a film or television production generally receive interim funding from the Société de développement des entreprises culturelles (SODEC) or a financial institution, occasioning additional financing costs for them.

To mitigate these additional costs, the basic tax credit, at the rate of 36% or 28%, will be calculated on an "increased expenditure" equal to the aggregate of the amount of the qualified labour expenditure and an amount equal to 2% of the amount of the qualified labour expenditure.

These changes will apply regarding a film or television production for which an application for an advance ruling, or an application for a certificate, if an application for an advance ruling was not filed earlier, is submitted to SODEC after December 2, 2014 and before January 1, 2017.

Increase in the temporary contribution relative to the compensation tax for financial institutions

The temporary contribution rates will be increased for the period from December 3, 2014 to March 31, 2017

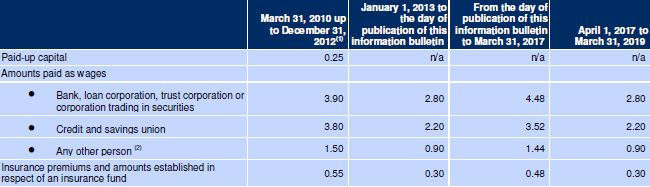

The following table shows the various rates of the compensation tax for financial institutions applicable according to the period concerned; the compensation tax has consisted solely of the temporary contribution since January 1, 2013.

Rates of the compensation tax for financial institutions (per cent):

(1) The tax payable on paid-up capital consisted solely of a base rate, while, in other cases, the temporary contribution rates of 1.9%, 1.3%, 0.5% and 0.2% were combined with the base rates of 2%, 2.5%, 1$ and 0.35%.

(2) Excluding an insurance corporation and a professional association that has set up an insurance fund under section 86.1 of the Professional Code. In addition, a financial corporation that has not made the joint election provided for in section 150 of the Excise Tax Act is no longer subject to the temporary contribution, as of January 1, 2013.

Introduction of minimum eligible expenditure thresholds for R&D tax credits and the tax credit for investments relating to manufacturing and processing equipment

The government is announcing the introduction of minimum eligible expenditure thresholds for R&D tax credits and the tax credit for investments relating to manufacturing and processing equipment. Accordingly, as of December 3, 2014, businesses will be able to claim from these tax credits for their eligible expenditures exceeding a certain threshold.

Thresholds applicable to R&D tax credits

The minimum eligible expenditure thresholds for R&D tax credits as a whole will be:

- $50,000 for corporations with assets of less than or equal to $50 million;

- $225,000 for corporations with assets of $75 million or more;

- an amount that increases linearly between $50,000 and $225,000 for corporations with assets between $50 million and $75 million.

Threshold applicable to the tax credit for investments relating to manufacturing and processing equipment

Businesses that claim the tax credit for investments relating to manufacturing and processing equipment will be subject to a threshold of $12,500 for eligible manufacturing and processing equipment expenditures.

Standardization of the rate of the refundable R&D tax credits

Québec offers corporations that carry out R&D activities an assistance regime consisting of four refundable tax credits:

- one tax credit for researchers' salaries;

- three enhanced tax credits for specific activities:

-

- the tax credit for a research contract entered into with a university, an eligible public research centre or a research consortium;

- the tax credit for private partnership research;

- the tax credit for fees and dues paid to a research consortium.

The rates of the three enhanced tax credits will be standardized with those of the R&D tax credit paid on researchers' salaries.

Accordingly, as of December 3, 2014, the applicable rates will go from:

- 28% to 30% for SMEs, which represents a two-percentage-point increase in tax assistance;

- 28% to 14% for large businesses.

MEASURES PERTAINING TO INDIVIDUALS

Increase from $800,000 to $1 million in the limited capital gains exemption on farm property and fishing property

The $800,000 lifetime capital gains exemption applicable to gains on the disposition of qualified farm property or qualified fishing property or a combination of the two will be raised to $1 million.

The exemption's indexation to inflation, which will be applied for taxation years subsequent to 2014, will be temporarily suspended in regard to farm and fishing property.

The increase will apply to dispositions made subsequent to December 31, 2014. It will also apply to the inclusion, in a

taxation year subsequent to 2014, of a capital gains reserve attributable to the disposition of farming and fishing property after December 2, 2014.

Adjustment of childcare funding

A new rate that takes into account parents' income

The December 2014 update follows up on the announcement made on November 20 that an additional rate based on parents' income will be introduced. This rate, which is payable when parents file their income tax returns, is in addition to the rate of $7.30 a day paid for childcare services.

As of April 1, 2015, the new daily rate will be:

- $7.30, up to a net family income of $50,000;

- $8, up to a net family income of $75,000;

- $20, reached on a net family income of $155,000.

As of 2016, the parental contribution will be indexed.

To accommodate families with three or more children registered at the same time for subsidized childcare services, no additional rate will be charged for the third child and any additional children.

Childcare at school

The December 2014 update provides for the following two changes:

- as of April 1, 2015, the reduced contribution charged for childcare at school will be raised to $8 a day;

- as of January 1, 2016 and January 1 of each subsequent year, the parental contribution will be determined so as to keep parents' share in the total funding of childcare services at a minimum level.

Change to the tax assistance to support assisted procreation

Refundable tax credit for the treatment of infertility

This refundable tax credit corresponds to 50% of expenses paid by a household for assisted in vitro fertilization (IVF) activities. Eligible expenses for the tax credit are capped at $20,000. Accordingly, an individual who opts for assisted procreation to become a parent may claim a tax credit of up to $10,000 a year.

The December 2014 update reiterates that the refundable tax credit for the treatment of infertility will be adjusted, as of January 1, 2015, to provide tax assistance respecting expenses incurred for medical IVF treatments that will no longer be covered by the Québec Health Insurance Plan.

This credit will correspond to a maximum of 80% of eligible IVF expenses. It will be reduced on the basis of income.

Thus, the maximum 80% rate of the tax credit will be maintained up to a net family income of $50,000, after which it will be gradually decreased, to a minimum of 20% for a net family income of $120,000 or more. For persons living alone, the 80% will apply up to a net income of $25 000, while the minimum rate will apply as of a net income of $60 000.

New eligibility conditions for the tax credit

New eligibility conditions have been established for the refundable tax credit for the treatment of infertility.

For example, it is provided that:

- only households without children will be eligible for the tax credit;

- the number of eligible treatments will be one for women under 37 years of age and two for women 37 years of age or over.

New provisions for the tax credits for medical expenses

To take into account the changes to be made to the refundable tax credit for the treatment of infertility, new provisions will also be introduced respecting eligible expenses for the tax credits for medical expenses.

Eligible expenses to the medical tax credit will no longer include expenses:

- for which the refundable tax credit for the treatment of infertility was granted;

- attributable to an in vitro fertilization (IVF) activity carried out respecting a woman under the age of 18 or over the age of 42;

- attributable to an IVF activity during which more than one embryo was transferred, in the case of a woman 36 years of age or under, or more than two embryos, in the case of a woman 37 year of age or over;

- attributable to an IVF activity, carried out at a centre for assisted procreation, that does not meet the requirements of the Act respecting clinical and research activities relating to assisted procreation.

Reduction of the rate of the tax credits for union, professional or other dues

The Quebec income tax credit rate for an eligible contribution to a recognized professional association, a union or a similar group will be reduced from 20% to 10% as of the 2015 taxation year.

Tightening of the eligibility conditions for refundable tax credits to increase the incentive to work

The Québec tax legislation will be amended to provide that an individual who is a full-time student for a particular taxation year will no longer be considered an eligible individual for the purposes of the refundable tax credits to increase the incentive to work, unless, on December 31 of that year or, as applicable, on the date of the individual's death, the individual is the father or the mother of a child with whom he or she lives.

These changes will apply as of the 2015 taxation year.

MEASURE PERTAINING TO COMMODITY TAX

Application of the general tax rate for insurance premiums to all automobile insurance premiums

The tax on insurance premiums is generally levied at a rate of 9%. The rate of tax on insurance premiums is reduced to 5% for premiums payable under an automobile insurance policy covering essentially material damage. This reduction will be abolished as of January 1, 2015. Accordingly, the 9% general rate will apply to all insurance premiums (including automobile insurance policy) paid after December 31, 2014.

As always, readers are reminded that while tax proposals are customarily given the effect of law immediately, the amending legislation, when ultimately adopted by National Assembly, may be altered to some degree.The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.