Taxpayers that have implemented cross-border tower financing structures and that have claimed a Canadian tax deduction for any U.S. taxes paid should revisit their structures carefully in light of the Tax Court of Canada's recent decision in FLSMIDTH Ltd., v. The Queen (2012 TCC 3), which is the Court's first decision concerning tower structures.

Tower structures – of which several variations have evolved over the years – have been used routinely by Canadian corporations to finance U.S. operations and by U.S. corporations to finance Canadian operations. Regardless of the variation, the principal tax benefit of a tower structure is the potential generation of two interest expenses within the cross-border corporate group with generally only one corresponding income inclusion. The ability to "double dip" is achieved through a series of intercompany transactions involving "hybrid" entities that are characterized differently under the tax laws of Canada and the United States. Income earned, and paid, through these hybrid entities generally attracts different tax treatment in Canada and the U.S., which presents the opportunity in certain circumstances to use the same deduction for both Canadian and U.S. tax purposes. Certain tower structures have effectively been shut down by recent changes to the Canada – US Tax Convention (the "Treaty"); however, other variations continue to be used.

Interestingly, the viability of the double interest deductions was not at issue in FLSMIDTH Ltd; rather, the issue was whether an additional deduction under subsection 20(12) of the Income Tax Act (Canada) (the "Act") was available in Canada with respect to U.S. income tax that was paid on income generated through the tower structure.

Facts

The relevant facts in this case are typical of many cross-border tower financing structures that are still in use by Canadian corporations seeking to finance the operations of U.S. subsidiaries:

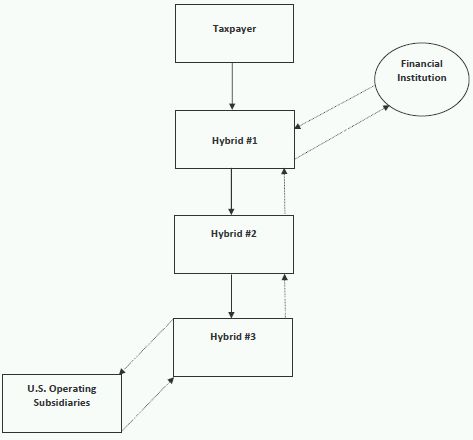

- The taxpayer (through a predecessor Canadian corporation) established a U.S. entity ("Hybrid#1") that was treated as a partnership for Canadian tax purposes but as a corporation for U.S. tax purposes. The taxpayer held a significant majority interest in Hybrid#1.

- Hybrid#1 borrowed money on an interest-bearing basis (presumably from an arm's length financial institution) and used such funds to subscribe for shares of a Nova Scotia unlimited liability company ("Hybrid#2"). Hybrid#2 was treated as a non-resident corporation for Canadian tax purposes but as a disregarded entity for U.S. tax purposes. As described below, the interest paid by Hybrid#1 to the financial institution is the interest that generated the double deductions that are at the core of this tower structure, since this interest expense was deductible by Hybrid#1 in computing both its Canadian and U.S. federal income tax.

- Hybrid#2 used the proceeds of the share subscription from Hybrid#1 to subscribe for shares of a U.S. limited liability company ("Hybrid#3"), which was treated as a corporation for Canadian tax purposes but as a disregarded entity for U.S. tax purposes. Hybrid#3 was a "foreign affiliate" of Hybrid#2 and the taxpayer for Canadian federal income tax purposes.

- Hybrid#3 loaned money to U.S. operating subsidiaries of the taxpayer's corporate group and earned interest income in respect of such loans.

- Hybrid#3 paid dividends to Hybrid#2 equal to the amount of interest it had received from the operating subsidiaries.

- Hybrid#2 paid equivalent dividends to Hybrid#1.

A simplified organizational chart is attached below.

These transactions gave rise to different tax consequences in Canada and in the U.S.

For U.S. tax purposes, (i) the interest income received by Hybrid#3 was considered to have been received directly by Hybrid#1; (ii) the interest paid by Hybrid#1 to the financial institution was deducted by Hybrid#1; and (iii) the intercompany dividends paid by Hybrid#1 and Hybrid#2 were disregarded. Accordingly, only the spread between the interest received and the interest paid by Hybrid#1 was subject to U.S. federal income tax.

For Canadian tax purposes, Hybrid#1 computed its income by including the dividends that it received from Hybrid#2 and by deducting (i) the interest that Hybrid#1 paid to the financial institution; and (ii) the amount of U.S. federal income tax paid by Hybrid#1 on its net interest income described above. The dividends received by Hybrid#2 from Hybrid#3 were exempt from Canadian income tax under Canada's foreign affiliate regime. Accordingly, the only amount of income that was subject to tax in Canada was the taxpayer's share of the net income earned by Hybrid#1.

Issue

The issue before the Court had nothing to do with the "double dip" – i.e., the deduction by Hybrid#1 of the interest paid to the financial institution for both Canadian and U.S. tax purposes; rather, the sole issue was whether the taxpayer was entitled to a deduction pursuant to subsection 20(12) of the Act with respect to its share of the U.S. tax that was paid on the net interest income earned by Hybrid#1.

Generally, the taxpayer would be entitled to the deduction under subsection 20(12) of the Act if two conditions were met:

- Hybrid#1 must have paid the U.S. tax in respect of a source of income under the Act; and

- the U.S. tax must not reasonably be regarded as having been paid in respect of income from the share of a capital stock of a foreign affiliate of the taxpayer.

In Respect of a Source of Income under the Act

On the first question, the Court reiterated the general legal principal that the words "in respect of" are words of the widest possible scope. In the context of subsection 20(12), this requires that there be some relationship or connection between the foreign tax and the income being computed under the Act.

There was no dispute that Hybrid#1 paid U.S. tax in respect of the net interest income that it was considered to have received for U.S. tax purposes. However, there was also no dispute that Hybrid#1's only source of income for purposes of the Act was its shares of Hybrid#2, on which it only received dividend income. On this basis, the Crown argued that for purposes of the Act dividend income was not the same source upon which the U.S. tax had been paid. The Court felt this interpretation was too narrow and held in favour of the taxpayer, noting the following at paragraph 46 of the decision:

...the payment of the U.S. tax was related to or connected with the dividend income received by [Hybrid#1] from [Hybrid#2] because the indirect source of the dividend income received by [Hybrid#1] was the interest income received by [Hybrid#3] from [the U.S. operating subsidiaries] and the payment of the tax reduced the amount available to [Hybrid#2] that could be paid out to [Hybrid#1] as dividends.

In other words, the U.S. tax was paid by Hybrid#1 "in respect of" the dividend income received by Hybrid#1 from Hybrid#2, even though it was not paid "on" that income.

In Respect of Income from the Share of a Capital Stock of a Foreign Affiliate of the Taxpayer.

While the Court's broad interpretation of the phrase "in respect of" assisted the taxpayer in satisfying the first question, it proved to be the demise of the taxpayer on the second.

Recall the following facts: (i) the only source of income of Hybrid#1 was the shares it held in Hybrid#2; (ii) Hybrid#2 – a Canadian corporation – was not a foreign affiliate of the taxpayer; and (iii) the only income of Hybrid#1 was dividends received on the shares of Hybrid#2. Despite these facts, the Court was of the view that the U.S. tax paid by Hybrid#1 was connected with or related to the dividend income paid by Hybrid#3 to Hybrid#2 because it was paid on income that funded the payment of the dividends. Since Hybrid#3 was a foreign affiliate of the taxpayer, it was therefore reasonable to conclude that the U.S. tax paid by Hybrid#1 was "in respect of" income from the share of a capital stock of a foreign affiliate of the taxpayer.

Treaty Relief

The taxpayer also argued that the Treaty also provided a basis for the deduction; however, the Court concluded that no Treaty relief was required in the present circumstances. While Article XXIV(2) of the Treaty provides specific forms of relief from double taxation in certain circumstances, the Court noted that it does not require that Canada allow a deduction for all U.S. tax paid on income arising in the U.S. and that Canada's obligation does not go beyond providing relief from double taxation (i.e., the deduction is limited to Canadian tax payable in respect of that income). The Court stated the following at paragraph 81 of the decision:

In the present case, neither the U.S. source income of [Hybrid#1] that was taxed in the U.S. (and which is not recognized as income of the limited partnership under Canadian law) nor the dividend income which was received by [Hybrid#1] from [Hybrid#2], and which flowed through to the partners including [the taxpayer], was taxed in Canada. Furthermore, the [Hybrid#3] dividends received by [Hybrid#2] (which were the source of the dividends paid by [Hybrid#2] to [Hybrid#1] were not taxed in Canada because they were paid out of the exempt surplus of [Hybrid#3]. On this basis, it seems clear that no Canadian tax was payable "in respect of" the dividends received by [Hybrid#1] from [Hybrid#2].

Conclusion

This decision provides a good review of the parameters concerning the availability of foreign tax credits and deductions for foreign tax, central to which is the broad interpretation that must be given to the phrase "in respect of".

Taxpayers that have implemented tower structures and that have claimed a subsection 20(12) deduction on any U.S. tax paid should revisit their structures and contact a tax advisor to discuss the potential implications of this case in their particular circumstances.

At this time it is unclear whether the taxpayer will appeal this decision to the Federal Court of Appeal.

About Fraser Milner Casgrain LLP (FMC)

FMC is one of Canada's leading business and litigation law firms with more than 500 lawyers in six full-service offices located in the country's key business centres. We focus on providing outstanding service and value to our clients, and we strive to excel as a workplace of choice for our people. Regardless of where you choose to do business in Canada, our strong team of professionals possess knowledge and expertise on regional, national and cross-border matters. FMC's well-earned reputation for consistently delivering the highest quality legal services and counsel to our clients is complemented by an ongoing commitment to diversity and inclusion to broaden our insight and perspective on our clients' needs. Visit: www.fmc-law.com

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.