March 29, 2012

INTRODUCTION

On March 29, 2012, Finance Minister Jim Flaherty delivered his 2012-2013 budget titled "Jobs Growth and Long-term Prosperity," in the House of Commons.

With modest new revenue measures and program spending cuts (only 2% of government spending), the government is counting on expected economic growth to balance the budget. Flaherty announced a projected deficit for the 2011-2012 fiscal year of $24.9 billion. The deficit is projected to fall to $21.1 billion in 2012-2013 and continue to decline until 2015-2016 when budgetary surpluses are predicted to start.

In this budget there were no changes in personal or corporate income tax rates.

Flaherty anticipates modest economic growth in Canada in the near-term. The budget predicts growth rates of 2.1% for 2012 and 2.4% in 2013. Average annual growth over the next five years is projected to be just 2.4%.

Unemployment is expected to continue to decline over the next five years from 7.5% in 2012 to 6.6% in 2016. Inflation is expected to remain around 2% over the next five years with 2012 projected to be at 2.1%. The value of the Canadian dollar is projected to be just above par compared to the U.S. dollar for the next five years. Short-term and long-term interest rates are projected to slowly increase over the next five years with the biggest increases occuring in 2014 and 2015.

Notable features of the budget include a three-year plan to cut 19,200 public-sector jobs, a mandate to the Royal Canadian Mint to cease production of the penny, effective this fall, and a proposal to raise the age of eligibility under the Old Age Security (OAS) pension plan from 65 to 67 years in 2023.

We have provided an overview of the major proposals of the budget.

BUSINESS TAX MEASURES

As expected, the budget proposes significant changes to the way the Federal government supports innovation in Canada. The government intends to reduce the amount of support delivered through the Scientific Research and Experimental Development (SR&ED) Investment Tax Credit (ITC) system and provide other more direct support.

The budget proposes $1.1 billion over five years to directly support business-led and industry-relevant research and development. The budget also proposes $400 million to help increase private sector investment in early stage risk capital although details of this form of support have not been provided yet. In addition, the budget proposes to add funding to a number of existing (and some new) programs which are intended to support business R&D.

The support delivered through the SR&ED investment tax credit systems is reduced through the following changes to the SR&ED rules:

General SR&ED ITC Rate Reduction

The general SR&ED ITC rate is currently 20% and there is an enhanced 35% rate for eligible Canadian-controlled private corporations (CCPCs). CCPCs are eligible to claim the 35% rate on up to $3 million of qualified SR&ED expenditures incurred annually and for CCPCs the ITCs are refundable. The budget proposes to reduce the general 20% SR&ED ITC rate to 15% for taxation years that end after 2013, except that for a taxation year that includes January 1, 2014, the 5 % reduction in the ITC rate will be prorated. The 35% rate for eligible CCPCs will remain unchanged. After 2013, SR&ED expenditures above the $3 million limit will attract ITCs at the 15% rate.

SR&ED Capital Expenditures Eliminated

Currently, capital expenditures in respect of SR&ED are fully deductible in the year incurred and are eligible for ITCs. The budget proposes to exclude capital expenditures from being eligible for full deduction and also from ITCs. This change also excludes payments for the use or the right to use property that would, if it were acquired by the taxpayer, be capital property of the taxpayer. Essentially, equipment lease costs will no longer be eligible for ITCs. This change will apply to property acquired on or after January 1, 2014, and to amounts paid or payable in respect of the use of, or the right to use, property during a period after 2013.

Overhead Proxy Rate Reduced

Itemized overhead expenditures directly attributable to SR&ED are eligible for SR&ED tax incentives. Alternatively, taxpayer's can elect to use the simplified proxy method to claim as SR&ED overhead expenditures, amount equal to 65% of the total salary and wages of employees engaged directly in SR&ED. The budget proposes to reduce the 65% proxy rate to 60% for 2013 and to 55% after 2013. For taxation years that include days in 2012, 2013, or 2014, the proxy rate will be prorated based on the number of days in the taxation year that are in each of those calendar years. As a result of these changes, taxpayers should not automatically continue to use the proxy method if they have in the past as the traditional method may prove to be more beneficial.

SR&ED Contract Payments Reduced

A taxpayer (the payer) who contracts an arm's length party (the performer) to perform SR&ED work is entitled to deduct the contract payment and claim an ITC. The budget proposes to disallow from the expenditure base, for ITC purposes, 20% of the cost of arm's length SR&ED contracts. The 20% is a "proxy" for the profit earned by the arm's length SR&ED performer. Taxpayers will now be able to claim only 80% of the SR&ED contract amount paid to an arm's length contractor. This change will apply to expenditures incurred on or after January 1, 2013.

Furthermore, consistent with the proposed change (described above) concerning SR&ED capital expenditures, arm's length contract payments eligible for SR&ED tax incentives must also be reduced for any amount paid in respect of a capital expenditure incurred by the performer in fulfilling the contract. The performer will be required to inform the payer of these amounts.

The capital expenditures incurred by a performer will reduce the contract amount before the 80% eligibility ratio is applied. In addition, the amount that the performer is required to net against its qualifying SR&ED expenditures because of the contract payment will be reduced by the amount the performer received that is in respect of the capital expenditure.

Enhancing Predictability

The budget announced $6 million for the Canada Revenue Agency (CRA) to implement changes to the administration of the SR&ED program. The CRA will:

- conduct a pilot project to determine feasibility of a formal pre-approval process;

- enhance the existing online self-assessment eligibility tool;

- work collaboratively with industry representatives to address emerging issues;

- make more frequent and effective use of "tax alerts"; and

- improve the Notice of Objection process to allow for a second review of scientific eligibility determinations.

Eligible Dividend Designations

Under existing rules, if a corporation wishes to pay taxable dividends and only a portion of those dividends could be eligible dividends (i.e., eligible for an enhanced dividend tax credit), that portion must be paid as a separate dividend so that investors are eligible to claim the enhanced dividend tax credit. The budget proposes that a corporation can designate, at the time it pays a taxable dividend, any portion of a dividend to be an eligible dividend.

Also under existing rules a dividend is only an eligible dividend if, at the time the dividend is paid, the corporation notifies each shareholder in writing that the dividend is designated as an eligible dividend. If a corporation fails to designate a taxable dividend as an eligible dividend, even if the corporation could have done so, the corporation cannot file a late eligible dividend designation.

The budget also proposes to allow the Minister of National Revenue to accept a corporation's late designation of a taxable dividend as an eligible dividend. The Minister will be allowed to accept the late designation as long as it is made within three years after the day the designation was first required to be made. In addition, the Minister must be of the opinion that accepting the late eligible dividend designation would be just and equitable in the circumstances.

Both proposals apply only to taxable dividends paid after March 28, 2012.

Tax Compliance Burden

The budget proposes to reduce the tax compliance burden for small businesses and announces several administrative improvements by the CRA:

- Written Responses to Business Enquiries - As of April 16, 2012, businesses will be able to submit questions and receive answers to specific enquiries electronically using the CRA's My Business Account portal.

- CRA Web Forms - CRA's Web Forms electronic filing application for information returns now accepts 11 additional types of returns, and the limit on the number of each type of form that can be issued using this approach has increased.

- CRA's Secure My Business Account portal - As of April 16, 2012, business owners can input an address change online and balances such as non-capital loss and refundable dividend tax on hand from the last five tax year-ends will be automatically displayed.

- Business section on the CRA's website – Modifications are intended to provide a "one-stop shop" for businesses and a clear path to available electronic services with a new task-based web page.

- Penalties – The CRA has instituted a new administrative policy intended to ensure that penalties for late-filed information returns are charged in a fair and reasonable manner.

- Tax fairness – The CRA website has been revised to provide easier access to information on complaints and disputes. The CRA will also add information on recourse mechanisms to notices of assessment and reassessment. The CRA is also updating publications related to tax fairness and developing new content and new types of content on this topic.

Clean Energy Generation Equipment (Classes 43.1 And 43.2)

Currently, the capital cost allowance (CCA) system provides accelerated CCA deductions (50% per annum on a declining balance basis) for investment in specified clean energy generation and conservation equipment, and certain eligible equipment that generates or conserves energy. The budget proposes to expand Class 43.2 as follows with respect to assets acquired after March 28, 2012:

- the restriction that heat energy generated from waste-fuel thermal energy equipment must be used in an industrial process or a greenhouse has been removed;

- district energy system equipment is expanded to include those that distribute thermal energy primarily generated by waste-fuelled thermal energy equipment; and

- the residue of plants is added to the list of eligible waste fuels used in waste-fuelled thermal energy equipment or a cogeneration system.

In addition, equipment, that was not used or acquired for use before March 28, 2012, that uses eligible waste fuels will not be eligible under Class 43.1 or Class 43.2 if the applicable environmental laws and regulations of Canada or of a province, territory, municipality, or a public or regulatory body are not complied with at the time the equipment first becomes available for use.

Corporate Mineral Exploration And Development Tax Credit

The budget proposes to phase out the 10% corporate tax credit for pre-production mining and development expenses, as follows:

- 10% credit will remain for mining exploration expenses incurred in 2012, but will decline to 5% in 2013 and be eliminated after 2013; and

- 10% credit will remain for development expenses incurred before 2014, but will decline to 7% in 2014, 4% in 2015 and be eliminated after 2015.

Additional transitional relief will apply at a 10% rate for pre-production development expenses incurred before 2016 in certain cases where a written agreement was entered into before March 29, 2012.

Exploration and pre-production development expenses will continue to qualify as Canadian exploration expenses and as such will be fully deductible in the year incurred.

INTERNATIONAL TAXATION

Transfer Pricing Secondary Adjustments

The tax term "transfer prices" is known internationally as referring to the prices at which goods, services and intangibles are traded across international borders, between persons who do not deal with each other at arm's length. Where the terms or conditions of a transaction or series of transactions do not reflect arm's length terms and conditions, the CRA may adjust for tax purposes amounts related to the transaction or series to reflect arm's length terms and conditions. This is commonly referred to as a "primary adjustment."

Once a primary adjustment has been made, a "secondary adjustment" is generally required to account for the benefit conferred on non-residents participating in the transaction or series of transactions. For example, if a Canadian corporation buys goods from its non-resident parent corporation for $100 but parties dealing at arm's length would have charged $80, the primary adjustment would reduce by $20 the cost of the goods to the Canadian taxpayer. A secondary adjustment should also arise to reflect the $20 benefit that was conferred on the non-resident parent (i.e., the amount by which the non-resident parent was overpaid for the goods).

The secondary adjustment can be subject to Canadian withholding tax since it is considered a dividend. The budget proposes to legislatively enact the tax treatment of a secondary adjustment and confirm the CRA administrative practices of not assessing withholding tax on the dividend, in cases where the primary adjustment is repaid back to the Canadian corporation. No deemed dividend will arise in similar transactions with controlled foreign affiliates in certain situations.

The proposed changes will apply to transactions (including transactions that are part of a series of transactions) that occur on or after March 29, 2012.

Thin Capitalization Rules

The thin capitalization rules limit the deductibility of interest expense of a Canadian-resident corporation in circumstances where the amount of debt owing to certain non-residents exceeds a 2-to-1 debt-to-equity ratio. The thin capitalization rules protect the Canadian tax base from erosion through excessive interest deductions in respect of debt owing to these non-residents.

The budget proposes to revise the thin capitalization rules by:

- reducing the debt-to-equity ratio from 2-to-1 to 1.5-to-1, effective for taxation years that begin after 2012;

- extending the scope of the thin capitalization rules to debts of partnerships of which a Canadian-resident corporation is a member, effective for taxation years that begin on or after March 29, 2012;

- treating disallowed interest expense under the thin capitalization rules as dividends for Part XIII withholding tax purposes, effective for taxation years that end on or after March 29, 2012; and

- preventing double taxation in certain circumstances where a Canadian-resident corporation borrows money from its controlled foreign affiliate, effective for taxation years of Canadian-resident corporations that end on or after March 29, 2012.

Foreign Affiliate Dumping

Foreign affiliate dumping transactions often involve a Canadian subsidiary using borrowed funds to acquire shares of a foreign affiliate from its foreign parent corporation. These transactions are carried out in the expectation that interest paid by the Canadian subsidiary on such borrowed money is deductible in computing income for tax purposes. Meanwhile, most dividends received by the Canadian subsidiary on the shares of the foreign affiliate are exempt from taxation, resulting in the erosion of the Canadian corporate tax base. The government has now introduced measures that will curtail certain transactions where a business purpose is not met.

The budget proposes that a dividend will be deemed to be paid by a Canadian subsidiary to its foreign parent, to the extent of any non-share consideration given by the Canadian subsidiary for the acquisition of the shares of a foreign affiliate. Any deemed dividend will be subject to non-resident withholding tax, as reduced by any applicable tax treaty. It further proposes to disregard the paid-up capital of any shares of the Canadian subsidiary that are given as consideration.

The proposed changes will apply to transactions that occur on or after March 29, 2012.

Overseas Employment Tax Credit (OETC)

Employees who are residents of Canada and who qualify for the OETC are entitled to a tax credit equal to the federal income tax otherwise payable (calculated using the employee's average tax rate) on 80% of their qualifying foreign employment income and up to a maximum foreign employment income of $100,000. The budget proposes to phase out the OETC over four taxation years, beginning with the 2013 taxation year.

During the phase-out period, the factor (currently 80%) applied to an employee's qualifying foreign employment income, in determining the employee's OETC, will be reduced to 60% for 2013, 40% for 2014 and 20% for 2015. The OETC will be eliminated by 2016 and subsequent years. This phase-out will not apply with respect to qualifying foreign employment income earned by an employee in connection with a project or activity to which the employee's employer had committed in writing before March 29, 2012.

PERSONAL TAX MEASURES

Old Age Security (OAS)

Starting in April 2023, the age of eligibility for OAS and Guaranteed Income Supplements (GIS) will gradually increase from age 65 to 67 years. The phase-in will be fully implemented by January 2029. This proposed change will not affect any individual who is 54 years or older as of March 31, 2012.

Starting on July 1, 2013, individuals will also be able to voluntarily defer receipt of their OAS for up to five years to receive a higher, actuarially adjusted amount.

Group Sickness Or Accident Insurance Plans

Employer contributions to certain group sickness or accident insurance plans will now become a taxable benefit to the extent these contributions are not paid in respect of a wage-loss replacement benefit payable on a periodic basis. This change will not affect the current tax treatment of private health service premiums or other similar plans, and will apply in respect of employer contributions made after March 28, 2012 relating to coverage after 2012.

Medical Expense Tax Credit

The list of expenses eligible for the 15% medical expense credit has expanded to include expenses incurred by individuals who require anti-coagulation therapy. Eligible expenses now include blood coagulation monitors and associated disposable peripherals such as prickling devices, lancets and test strips. All expenses must be prescribed by a medical practitioner in order to qualify.

Mineral Exploration Tax Credit (Metc) For Flow-Through Share Investors

The eligibility for the METC will be extended by one year for flow through agreements entered into on or before March 31, 2013.

Retirement Compensation Arrangements (RCA)

The CRA has identified a number of arrangements that abuse various features of the RCA rules to obtain unintended tax benefits. The government is challenging these arrangements as they are not consistent with the policy intent of the rules. Therefore, the budget proposes new prohibited investment and advantage legislation to prevent the use of similar schemes in the future. These new rules will impose significant penalties when RCAs engage in non-arm's length transactions and will closely resemble existing rules for TFSAs, RRSP's and RRIF's. These new rules will apply to investments acquired and advantages received after March 28, 2012.

Employee Profit Sharing Plans (EPSP)

The CRA has identified EPSPs as a means for some business owners to direct profits to family members in order to reduce or defer the payment of tax. To ensure that EPSPs are used for their intended purpose, the budget aims to target excessive employer contributions by introducing a special tax to be applied to specified employees (non-arm's length employees or employees who have at least a 10% interest in the employer).

This tax will apply to EPSP contributions that exceed 20% of the specified employee's salary received in the year. These new rules will apply in respect of employer contributions made on or after March 29, 2012.

Registered Disability Savings Plan (RDSP)

A number of changes to the rules governing RDSP have been proposed.

- On a temporary basis, certain family members will be allowed to become the plan holder of the RDSP for an adult individual who might not be contractually competent. This will apply from the date of Royal Assent until the end of 2016.

- The "10-year repayment rule" that applies to government repayments will be replaced by the "proportional repayment rule" when a withdrawal is made from an RDSP. This will apply to withdrawals made from an RDSP after 2013.

- To provide greater flexibility in making withdrawals from an RDSP, changes to the rules for maximum and minimum withdrawals have been proposed. These rules will apply after 2013.

- After 2013, Registered Education Savings Plan (RESP) investment income made can be transferred on a tax-free basis to an RDSP if the plans have the same beneficiary.

- When a beneficiary of an RDSP becomes ineligible for the disability tax credit (DTC), the period in which the RDSP can continue to exist has been extended for a longer period. The RDSP may remain open for four additional years if an election is made. This election can be made after 2013.

- Certain administrative changes were also proposed to reduce the compliance burden on RDSP issuers.

SALES AND EXCISE TAX MEASURES

GST/HST Health Measures

The budget proposes a number of changes to zero-rate or exempt certain health care services, drugs and medical devices from GST/HST to reflect the evolving nature of the health care sector:

- Pharmacists' services – Non-dispensing health care services that pharmacists are authorized to provide in the course of their professional practice under provincial legislation will be exempt. In addition, diagnostic health care services ordered by pharmacists when the pharmacists are authorized to issue such orders under provincial legislation will also be exempt.

- Corrective eyewear – Corrective eyeglasses or contact lenses supplied under a vision assessment record, produced by an optician authorized under the provincial legislation, will be zero-rated.

- Medical and assistive devices – Blood coagulation monitoring or metering devices and associated test strips and reagents will be zero-rated. Medical and assistive devices which qualify for zero-rating, when supplied on the written order of a medical practitioner, will also now qualify when supplied on the written order of a registered nurse, occupational therapist or physiotherapist. The drug – Isosorbide-5-mononitrate will be added to the list of zero-rated non-prescription drugs.

GST/HST Streamlined Accounting Thresholds

Small businesses and most public service bodies (PSBs) can elect to use the Quick or Special Quick Method of accounting, respectively to determine the amount of GST/HST to remit. In addition, such entities can also elect to use the Streamlined Input Tax Credit Method to determine input tax credits (ITCs). To simplify GST/HST compliance for such entities, the budget proposes to double the existing streamlined accounting thresholds. Specifically:

- The annual taxable sales threshold at or below which eligible businesses can elect to use the Quick Method will increase to $400,000 (from $200,000) of GST/HST-included taxable sales; and

- The annual taxable sales and taxable purchases thresholds at or below which eligible businesses or PSBs can elect to use the Streamlined Input Tax Credit Method and eligible PSBs can elect to use the Prescribed Method for Calculating Rebates will increase to $1 million (from $500,000) of taxable sales and to $4 million (from $2 million) of taxable purchases.

OTHER TAX MEASURES

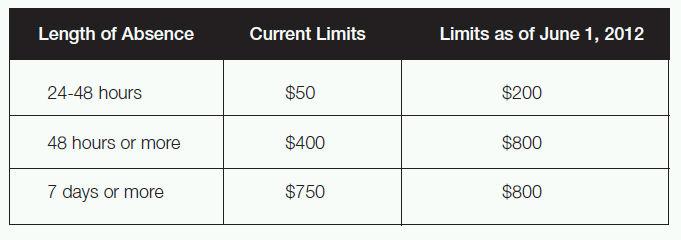

Travellers' Exemptions

The budget proposes to increase the value of goods that may be imported duty-and tax-free by Canadian residents returning from abroad as follows:

To view the budget in its entirety, please click here to be redirected to the Ministry of Finance website.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.