As reported in our prior bulletin, "Four Trends in Indigenous Equity Participation in Canada", we have been monitoring reports of Indigenous equity participation in energy and related infrastructure projects to see how these investments and projects are evolving. We know that Indigenous equity investments in energy and related infrastructure projects are key towards advancing economic reconciliation with Indigenous Peoples in whose treaty and traditional territories such projects are located. They are also key for managing project risk by helping to align the interests of the parties and facilitating Indigenous support and consent for a project.

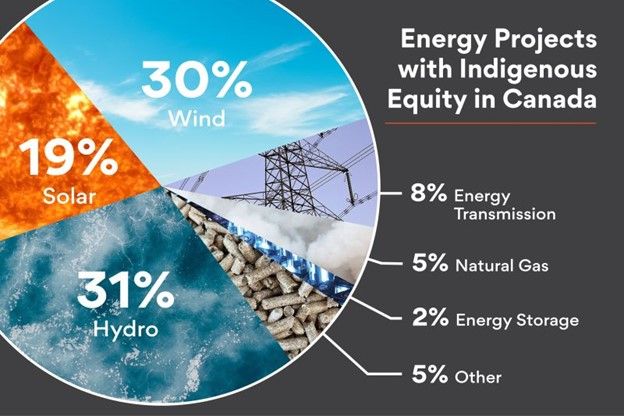

Based upon our data compiled to date [1], we note that the most Indigenous equity investments in this sector are in hydroelectric (31%) and wind (30%) energy generation projects, followed by solar energy generation projects (19%) and energy transmission projects (8%), including electricity transmission lines and pipelines. Investments in natural gas (5%) and energy storage (2%) projects are much less common, while about 5% of investments are in other energy or related infrastructure projects.

We are watching to see how these numbers will develop. Over the next few years, we expect to see increasing numbers in energy storage and green or renewable energy and hydrogen projects.

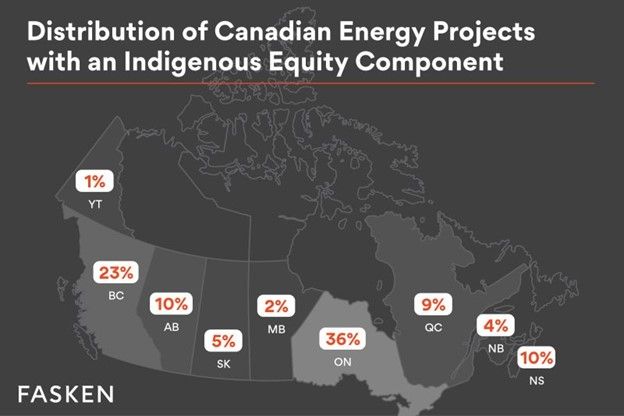

We also note that the most Indigenous equity investments in this sector are in Ontario (36%) and British Columbia (23%), followed by Alberta and Nova Scotia (each with 10%) and Quebec (9%). Only four provinces accounted for almost 80% of the aggregate number of energy and infrastructure projects with Indigenous equity participation. Each of Saskatchewan (5%), New Brunswick (4%), Manitoba (2%), and Yukon (1%) were 5% or less and just over 12% in the aggregate.

Over the next few years, we would expect Alberta to gain some ground as a result of its loan guarantee program that enables Indigenous communities to access capital, which has proven to be quite successful in facilitating such transactions to date. If (or when) programs become available in other jurisdictions that include loan guarantees or other financing solutions to enable Indigenous communities to access capital at reasonable rates, we would expect to see increasing numbers in those jurisdictions as well, while an effective federal program might help to distribute such projects more evenly across the country. It is also important to note that we have not considered the size of the project or amount of investment in these figures, which at upper levels we expect would also be highly dependent on programs facilitating access to capital.

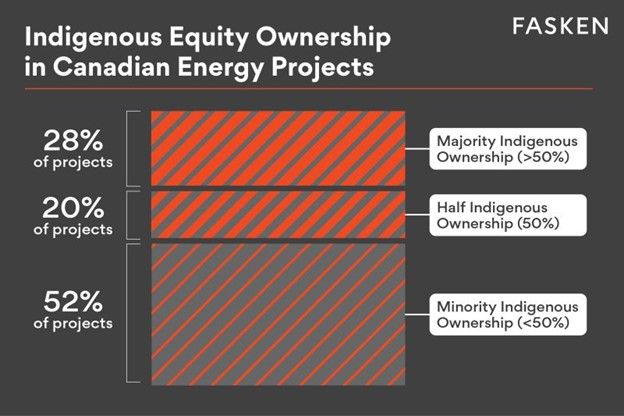

Finally, our analysis indicates that over half (52%) of the projects have a minority (or less than 50%) Indigenous equity interest in the project. The number of projects with a majority (over 50%) Indigenous equity interest in the project (including projects that are 100% Indigenous owned) is 28%, while 20% have an equal (or 50%) Indigenous equity interest in the project. Almost half (48%) of the projects where such figures are reported have at least equal, if not majority, Indigenous equity ownership.

We think it will be interesting to see how these numbers develop over the next few years, with the expectation that the number of reported projects with equal or majority Indigenous equity ownership will become more common than those with a minority Indigenous equity interest.

Refer to Fasken's Energy in Transition page for more thought leadership content.

Footnotes

1. Our analysis is based solely on publicly available information that we have reviewed regarding transactions involving Indigenous ownership in energy and related infrastructure projects, and does not necessarily reflect an exhaustive analysis of all such transactions. Given the limited information available, it is likely that some of these observations are not statistically significant.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.