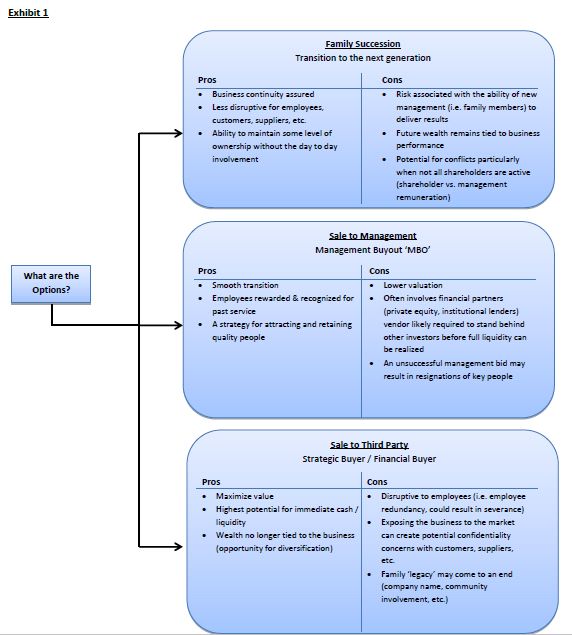

Business owners know that they are going to leave their business at some point in the future and it's never too early to consider an exit strategy. After all, the owner will be dealing with what is likely their most important asset. That said, every owner has options when it comes to their succession and who will ultimately own their business. In every case, the process can be complex, time consuming, fraught with anxiety and has the potential for animosity. The three basic alternatives are family succession, management buyout and sale to a third party. Each of these alternatives has its positive and negative considerations. (See Exhibit 1)

Family Succession

When multiple family members are involved it is critical to maintain transparency, fairness and to establish governance and control measures over the business and personal affairs. Forming a family council, i.e. an organized forum, can allow for open communication between family members and can include both those involved in management and those not directly involved in the day-to-day operations of the business. This can also be a vehicle to deal with the differing risk profiles, liquidity needs and expectations amongst family members. In our experience, for shareholders looking to transition out of the business the creation of a liquidity event can prove the biggest challenge when transitioning the business to the next generation. Sometimes financial leverage is available through traditional lenders as the business is capable of taking on additional debt to satisfy the needs of the existing shareholders. However, often the transition takes place over an extended timeframe and the shareholders remain exposed to the risk profile of the business.

Management Buyout ('MBO')

An MBO refers to the process of management acquiring a minority or majority stake in a company as a means of ownership succession. MBOs can provide a viable exit strategy for owners and an attractive opportunity for management, particularly when the business is positioned for continued growth and financing is available. In our experience, private equity firms have played a growing role in the marketplace as they are attracted to strong management teams with a willingness to form a working partnership and who are willing to have a vested interest in the business. The private equity firm often looks to management for an investment which is meaningful in terms of each individual's financial wherewithal. Management's financial contribution may or may not be significant in the context of the overall value of the business but nevertheless aligns all stakeholders' interests and demonstrates the team's commitment to future success.

Sale to Third Party

Whether selling to a corporate buyer (i.e. competitor) or financial buyer (i.e. private equity firm), value can be maximized when the target acquisition is viewed as being strategic in nature. In the case of a financial buyer it may represent a platform investment that forms the basis for a roll up or consolidation strategy or perhaps an add-on acquisition for an existing portfolio investment which means they may be willing to pay a strategic value. Strategic buyers typically want to pay for a value based on historical performance and not value that they believe they will create through a roll up strategy (economies of scale) or realizing synergies (cost reductions, cross selling opportunities). However, in our experience, when a competitive auction process is undertaken that is backed by a strong negotiating team, a strategic buyer can be persuaded to share in some of the prospective upside despite the risk associated with realizing any synergistic component.

Other trade-offs that should be considered include the flexibility of deal structuring, tax efficiency opportunities, time requirements, risk of deal failure and professional costs (lawyer, tax advisor, investment banker, etc.) associated with execution. These factors influence the value to the owner which is made up of, not only the stated purchase price, but also the economic terms of the deal and the intangible aspects of the deal. Understanding that every situation is unique an owner should consider each alternative and carefully weigh the pros and cons while managing the process in such a way that allows them to reach their personal and business goals.

The content of this article is intended to provide a general guide to the subject matter. Specialist advice should be sought about your specific circumstances.